- AVAX rallied to gain over 25% within 24 hours in a recent rally.

- The rally is tied to the recent Avalanche partnership with Amazon AWS.

Even though the market may be in a downturn, Avalanche [AVAX] has taken advantage of every chance to forge significant partnerships. With its most recent alliance, Avalanche is putting itself in a position to provide institutional services, which may mark the beginning of the next stage of blockchain use.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Avalanche teams up with Amazon AWS

On 11 January, Avalanche and Amazon Web Services announced their partnership, which would promote the widespread use of blockchain technology in businesses and government agencies.

It’s official! @Amazon #ChoseAvalanche to bring scalable blockchain solutions to enterprises and governments

#AWS fully supports Avalanche’s infrastructure and dApp ecosystem, including one-click node deployment, offering the best tooling for these high compliance use cases. pic.twitter.com/syInSrU9XD

— Avalanche

(@avalancheavax) January 11, 2023

To facilitate the partnership, AWS will provide one-click code deployment via the AWS marketplace. Use cases requiring adherence to FedRAMP standards can be carried out on AWS GovCloud by running Avalanche node operators.

In addition, Ava Labs will provide “Subnet deployment” as a service in the AWS Marketplace. This implies that any business or organization can hire Ava Labs to create a unique AWS Subnet.

AVAX surges in a daily timeframe, but…

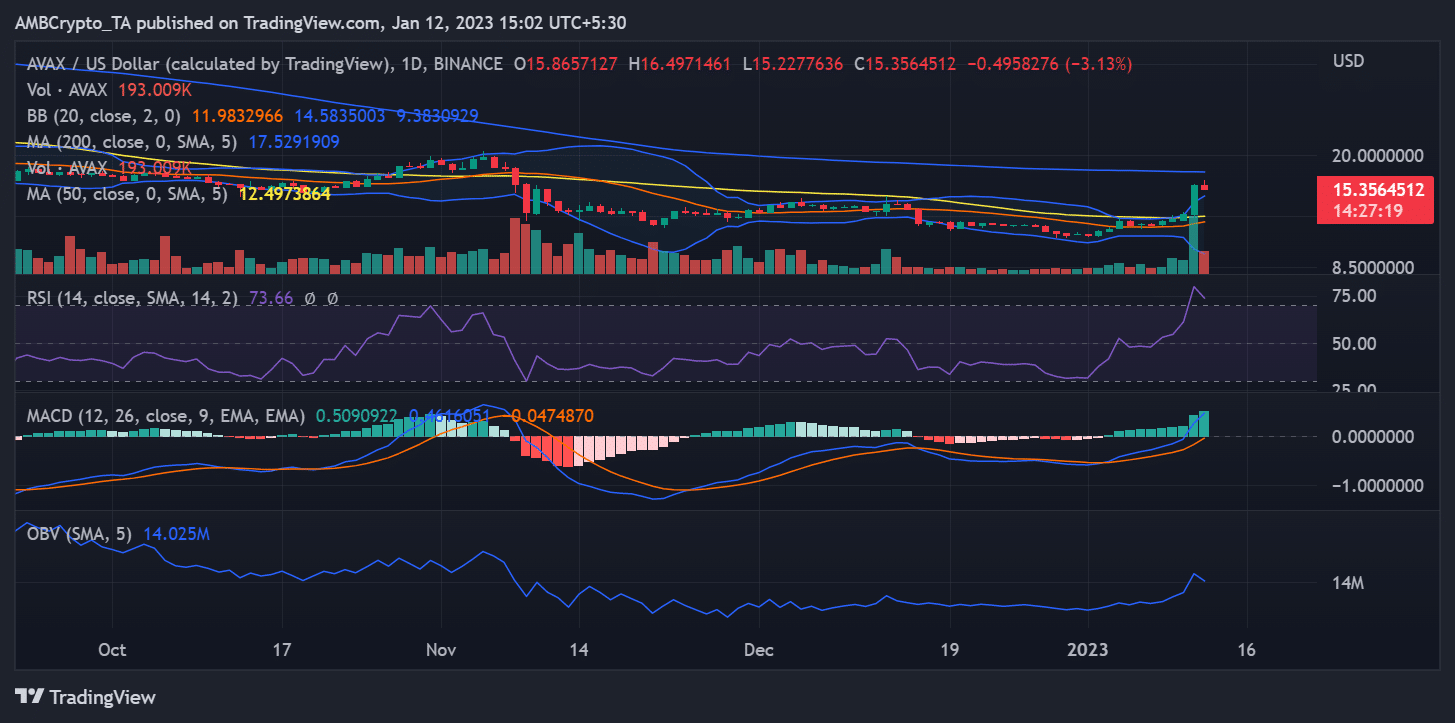

AVAX responded favorably to the AWS alliance, as evidenced by the asset’s daily timeframe chart. At the close of trade on 11 January, AVAX had increased in value by over 24%. The asset was trading at about $15 at the time of writing, despite losing about 3%. Its price before the almost 25% increase was roughly $12.

The latest price movements successfully overcame the resistance level created by the short Moving Average (yellow line). However, given where AVAX is, a price decline is likely.

AVAX had entered the overbought zone, as evidenced by the Relative Strength Index (RSI) line. The inference is that a price correction is approaching, which is likely to result, given the RSI’s current position.

Is your portfolio green? Check out the AVAX Profit Calculator

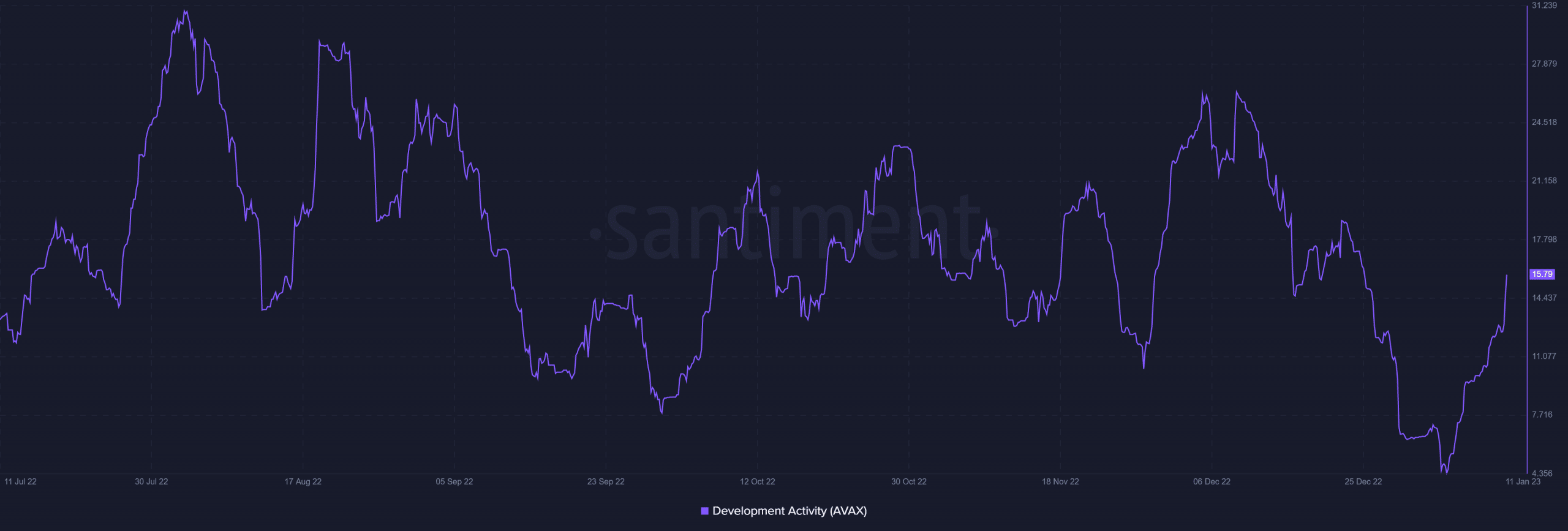

Dev activity witnesses an uptrend

The Development Activity indicator also showed an upward trend. According to the dev activity measure, network developers’ activities have scaled up. The dev activity chart at the time of this writing indicated that it had risen to approximately 15.79.

Read More: ambcrypto.com

![Avalanche [AVAX] gains 25% in a day, thanks to the Amazon AWS](https://ambcrypto.com/wp-content/uploads/2023/01/avax-1000x600.jpg)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Polkadot

Polkadot  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo