Consumer and media brands are set to tap extended reality (XR) for tracking attention amid the rise of the Metaverse, CORTEXR explained in a recent post.

According to the Brighton, UK-based firm, attention has become a leading metric for advertisers seeking to deepen engagement with potential customers.

The news comes as companies such as Tobii and Varjo Technologies have begun exploring eye-tracking tools capable of deeper immersion and analytics. CORTEXR’s latest solutions have offered global headset providers a world-first solution for tracking headsets, no matter the device or medium.

Getting ‘On Track’: History and Study

Research agency Gorilla in the Room published a study in September, which showed attention data and metrics were scalable with headsets and their technologies and crucial to the immersive economy. It involved 65 XR experience firms and noted metrics were a high priority for the industry.

Sectors such as education, training, automotive, manufacturing, healthcare, and others needed to monitor attention and gaze to pilot immersive solutions, the company explained.

User attention for training tasks, product prototypes, and medical procedures provided crucial insights. They also revealed to trainers that visual attention indicated strong metrics for cognitive processing and comprehension in AR and VR, allowing firms to optimise their user experiences (UX).

Herbert A Simon was the first to take on the attention economy in 1971, following the rise of Web2 algorithms and AI-backed engines that powered multiple social media platforms.

Speaking on the need for an attention economy, he said,

“In an information-rich world, the wealth of information means a dearth of something else: a scarcity of whatever it is that information consumes. What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention.”

Vying for Attention

The complexities of human behaviour in XR and the Metaverse are significantly greater in 3D experiences. To resolve this, companies use eye-tracking tools to monitor attention across sectors. These solutions will measure time spent watching content, how it is viewed, and user actions while doing so.

Despite this, issues limit eye-tracking integration for some head-mounted displays. Several major brands require limited permissions or require additional steps to set up third-party solutions.

Despite this, issues limit eye-tracking integration for some head-mounted displays. Several major brands require limited permissions or require additional steps to set up third-party solutions.

HTC VIVE requires expertise in specialist data analytics, while Microsoft’s HoloLens calibrates its software according to each user. Meta’s latest device, the Quest Pro, hosts a software development kit (SDK) that does not readily produce metrics for attention, the company explained.

Scalable Tracking Solutions

According to CORTEXR, essential scalable solutions could accommodate over one billion AR-capable smartphones and 70 million HMDs.

These hardware-agnostic solutions could work with numerous devices, namely those with six degrees of freedom (6DoF). CORTEXR’s analytics tracking tools, including cognitive science and intelligence engines, convert biometric data as metrics for its platform.

One of the company’s earliest clients, Mondelēz International, claimed CORTEXR’s attention metrics tools were on par with dedicated eye-tracking equipment, the latter said.

According to the firm, mobile AR was one of the top mediums for measuring and monetising attention. Additional insights from Dentsu’s Attention Economy Research showed that optimising content for attention created 3.7 years in just one month, compared to optimising for reach and frequency.

Read More: www.xrtoday.com

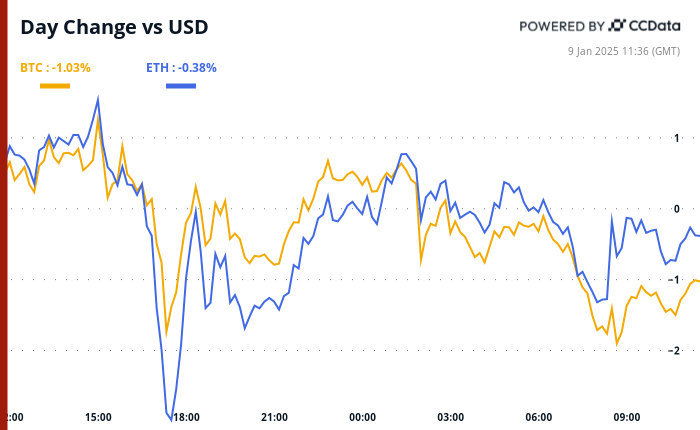

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Sui

Sui  Toncoin

Toncoin  Chainlink

Chainlink  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Render

Render  Bittensor

Bittensor  MANTRA

MANTRA  Monero

Monero  Tokenize Xchange

Tokenize Xchange  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum