Crypto market participants are hyped up like spider monkeys full of Skittles and Mountain Dew.

They’re bouncing off of the walls with the knowledge that spot ETF approvals for crypto’s largest assets (ETH and BTC) are imminent and on the hope that external investors are simply waiting in the wings to start deploying capital.

Indicative of the broader market’s bullish expectations for approval of spot crypto ETFs, analysts at legendary crypto investment firm Galaxy have predicted that approval of a spot BTC ETF will translate to $14.4B demand and should propel the price of BTC upwards by 74.1% within the first year alone!

Today, we’re tamping down some of those expectations, highlighting why the evidence fails to support the prevailing narrative that spot crypto ETF approvals will bring in those kinds of massive inflows.

Canadian Disappointment

Canadian Disappointment

Launching spot crypto ETFs in America will be far from a revolutionary feat; Canada has had them for over two years!

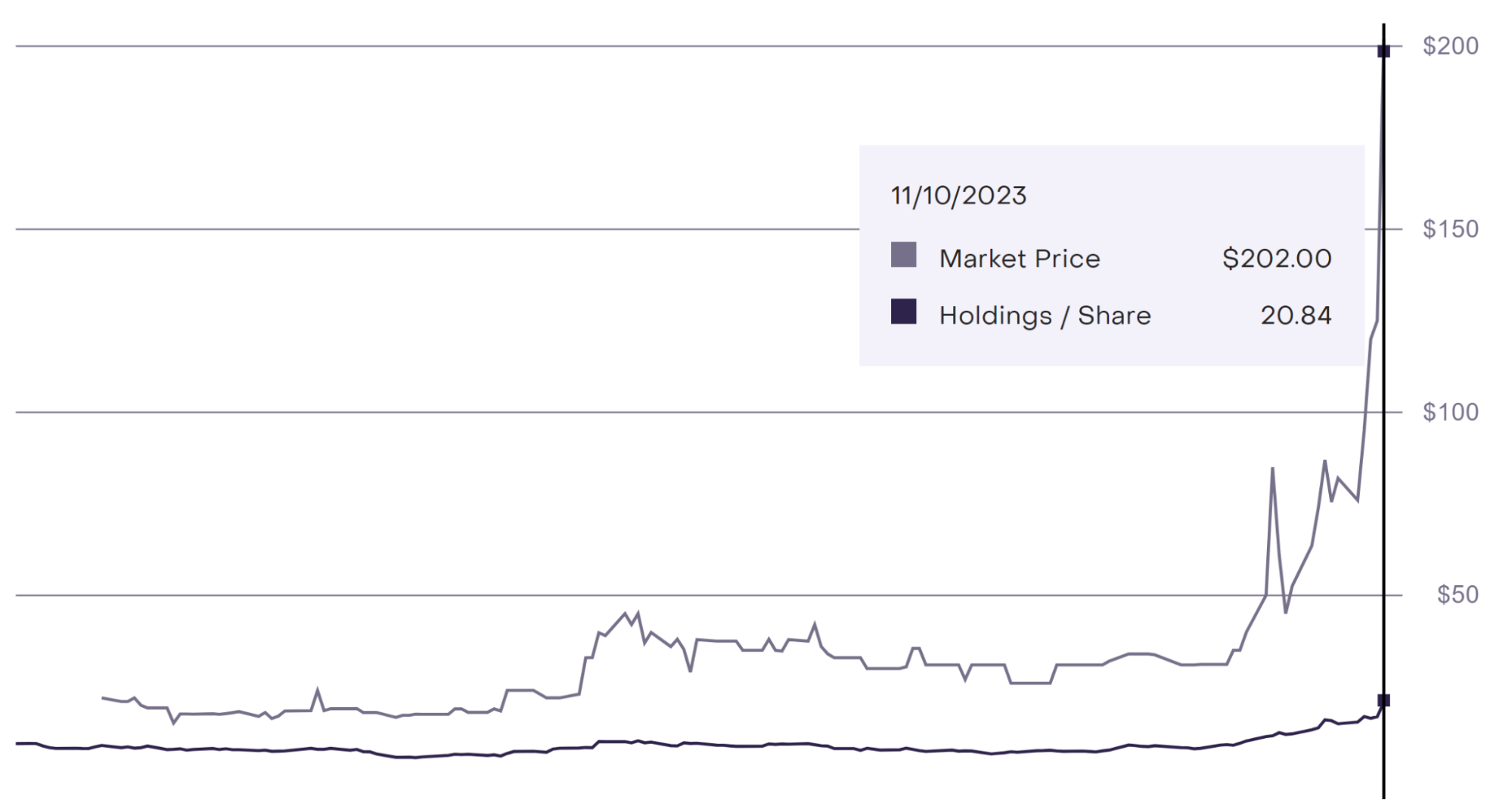

If unprecedented demand was set to be unleashed in the US upon spot crypto ETF approval, growth in holdings of Canadian spot Bitcoin instruments could be expected. Instead, they’ve remained virtually unchanged since July 2022.

Canada has had a spot ETF for over two years. Holdings have been essentially unchanged since July 2022.

If there was an urgency among the $2T Canadian pension market to get exposure to this asset, wouldn’t the value be climbing?

What am I missing? pic.twitter.com/lZRvuL0eWh

— 𝐓𝐗𝐌𝐂 (@TXMCtrades) October 28, 2023

Canadian investors are exposed to exactly the same investment narratives as Americans. Their lack of demand for spot BTC products is telling of potential US demand and indicative that Bitcoin’s narrative as a hedge against inflation and debasement is not potent enough to create inflows to the asset among non-crypto natives in the current market regime.

Format Doesn’t Matter

Format Doesn’t Matter

ETF experts may have bamboozled you into believing that the launch of marginally better investment instruments will lead to billions of dollars of inflows seeking to ape your bags, but the evidence to support this claim is lacking.

They claim that investors just don’t want crypto futures ETFs because they’re a suboptimal way to track the price of an asset in comparison to spot products – as rolling expiring futures contracts expose investors to contango and backwardation effects (i.e., that the price of the following month’s contract may be respectively higher or lower than that of the expiring contract).

The truth, however, is that investors simply DO NOT CARE about the format of the vehicle they are investing in if the narrative is powerful enough. Investment instruments offering exposure to a popular narrative will draw inflows, no matter how poor the product!

A case-in-point example demonstrating this truth is the explosive run experienced by the Grayscale Solana Trust (GSOL), which is now trading at a ludicrous 869% premium.

Grayscale’s Trust products, like GSOL and GBTC, are arguably much worse products than existing crypto futures ETFs, as there is no redemption mechanism, meaning that the market value of the asset you purchase can actually trade at a discount to the underlying trust holdings.

Despite GSOL’s drawbacks, investors have still managed to find the Solana narrative compelling enough to ape the instrument at a massive premium, leading to a further dislocation in the market price, as private placements (i.e., the route to create shares) are currently closed, meaning that supply cannot respond to the market’s demand.

Stagnant BTC Futures Demand

Stagnant BTC Futures Demand

If approval of spot crypto ETFs was actually going to result in massive inflows for the asset class, we would expect to see persistent inflows into futures products.

Instead, shares outstanding of BITO, the largest BTC futures ETF, have been largely unchanged since July of 2022, with deviations from the trend exhibited in June of 2023, the month BlackRock first filed for a spot BTC ETF, and early November of 2023, a week after crypto markets began to price in the imminence of spot BTC approval.

External capital is using BITO to front run the launch of a spot BTC ETF, and increases in shares outstanding can serve as a proxy for the market’s view on spot BTC ETF approval, but there does not appear to be actual external demand for Bitcoin futures products, especially when considering that shares outstanding was headed below the 60M mark prior to the most recent wave of spot ETF approval hype.

Takeaways

Takeaways

While the desire to front run the approval of spot crypto ETFs has commanded price throughout the second half of 2023, spot BTC ETFs are about to be listed, and the market’s theories on demand will be put into practice.

Traders who were caught off guard just weeks ago for failing to price in the potential impacts of a spot BTC ETF are at risk of being on the wrong side of the trade (yet again) when approval comes, and the resulting inflows are a disappointment.

Confronted with limited evidence that external capital wants to purchase crypto assets amid an uncertain macroeconomic climate, which forces potential buyers to focus on their financial stability amid growing debt concerns instead of chasing the next 100x moonshot, there’s no harm in holding off to observe if spot ETFs can truly fulfill expectations before increasing your crypto exposure.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  USDS

USDS  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Monero

Monero  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Cronos

Cronos  Internet Computer

Internet Computer  Ethena Staked USDe

Ethena Staked USDe