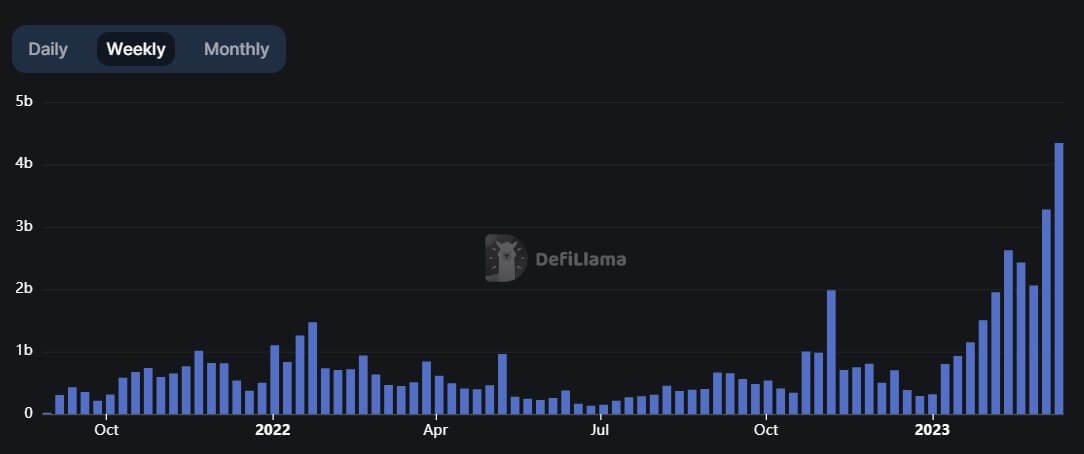

Arbitrum’s decentralized exchange (DEX) transactions volume rose to a new all-time high (ATH) in each of the last two weeks, according to DeFillama data.

Over the past seven days, DEX transactions increased 32.41% to $4.34 billion. For the week starting March 5, transaction volume on Arbitrum had surged to $3.28 billion.

Daily transaction volume stood at $535 million as of March 20 — second only to Ethereum (ETH) and almost twice that of Binance Smart Chain (BSC).

The top five DEXs on Arbitrum were Uniswap, SushiSwap, ZyberSwap, Camelot, and Balancer. In the last seven days, trading volume on these platforms grew by an average of over 40% — Camelot spiked the highest by 95% to $38.45 million, while ZyberSwap saw the most minor growth of 2.84% to $61,41 million.

Meanwhile, Uniswap remains the dominant DEX platform on Arbitrum, accounting for 48% of all trades on the layer2 (L2) network.

Arbitrum’s TVL and stablecoin inflow rises

The total value of assets locked on Arbitrum has risen by more than 20% in the last seven days to $3.85 billion, according to L2beats. In terms of ETH, 2.15 million tokens have been locked on the network.

The rising TVL also coincided with high-network activity on the L2 network. During the period, Arbitrum’s daily transaction per second rose 80.82% to 10.82.

DeFillama data shows that Arbitrum’s dominant DeFi protocol is GMX — the project controls 28.27% of Arbitrum’s total TVL.

Meanwhile, the L2 solution has continued to witness an increase in its stablecoin inflow. For context, Arbitrum’s USD inflow climbed 9% to $1.59 billion despite the recent issues plaguing the dominant stablecoin on its ecosystem, USD Coin (USDC).

During the period, there was more inflow of Tether’s USDT and algorithmic stablecoin DAI into the network as against USDC.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Toncoin

Toncoin  Monero

Monero  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Dai

Dai  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer