In Brief

An attacker exploited an arbitration bot to siphon off $2.3 million by manipulating the Curve finance pool with a flash loan.

In a recent sophisticated cyberattack, an exploiter drained $2.3 million from an arbitration bot. The attack involved a flash loan and subsequent price manipulation within the Curve finance pool.

The incident unfolded when the attacker identified an exposed function within the bot’s code that allowed the conversion of Ethereum to Bitcoin. By taking out a massive flash loan of 27,255 WETH, valued at approximately $51.36 million, the attacker was able to significantly skew the WETH/WBTC price ratio in the Curve pool.

The attacker’s manipulation of the price ratios in the Curve pool deliberately led to a distorted market. Consequently, this forced the arbitrage bot into an unfavorable trade, exchanging 1339.8 WETH for just 6.95 WBTC, inflicting a significant financial blow to the bot’s operators.

The cyberattack transaction clearing the funds from the arbitration bot can be tracked on Etherscan, revealing the specifics of the strategy that led to the bot’s downfall. The affected bot’s address is publicly viewable, providing a transparent ledger of the financial activity leading up to the exploit.

Looks like an arb bot contract got rekt for $2m

Had an open function to sell weth for wbtc and blackhat found it and moved the price of the pool to drain the arb bot contract. pic.twitter.com/BNRJUHrmAX

— Spreek (@spreekaway) November 7, 2023

Twitter user spreekaway actively highlighted the event, summarizing the significant exploit that impacted the arbitration bot. The social media post shed light on a critical vulnerability within the bot’s code. An attacker exploited this flaw, showcasing the persistent dangers in automated cryptocurrency trading strategies.

This incident sharply highlights the inherent risks in the DeFi space. The complexity of smart contracts can occasionally open up unforeseen opportunities for exploitation. The persistence of these exploits underscores the critical necessity for thorough smart contract audits. It also calls for robust security implementations across the decentralized finance ecosystem.

Disclaimer

Any data, text, or other content on this page is provided as general market information and not as investment advice. Past performance is not necessarily an indicator of future results.

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master’s degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

Nik Asti

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master’s degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

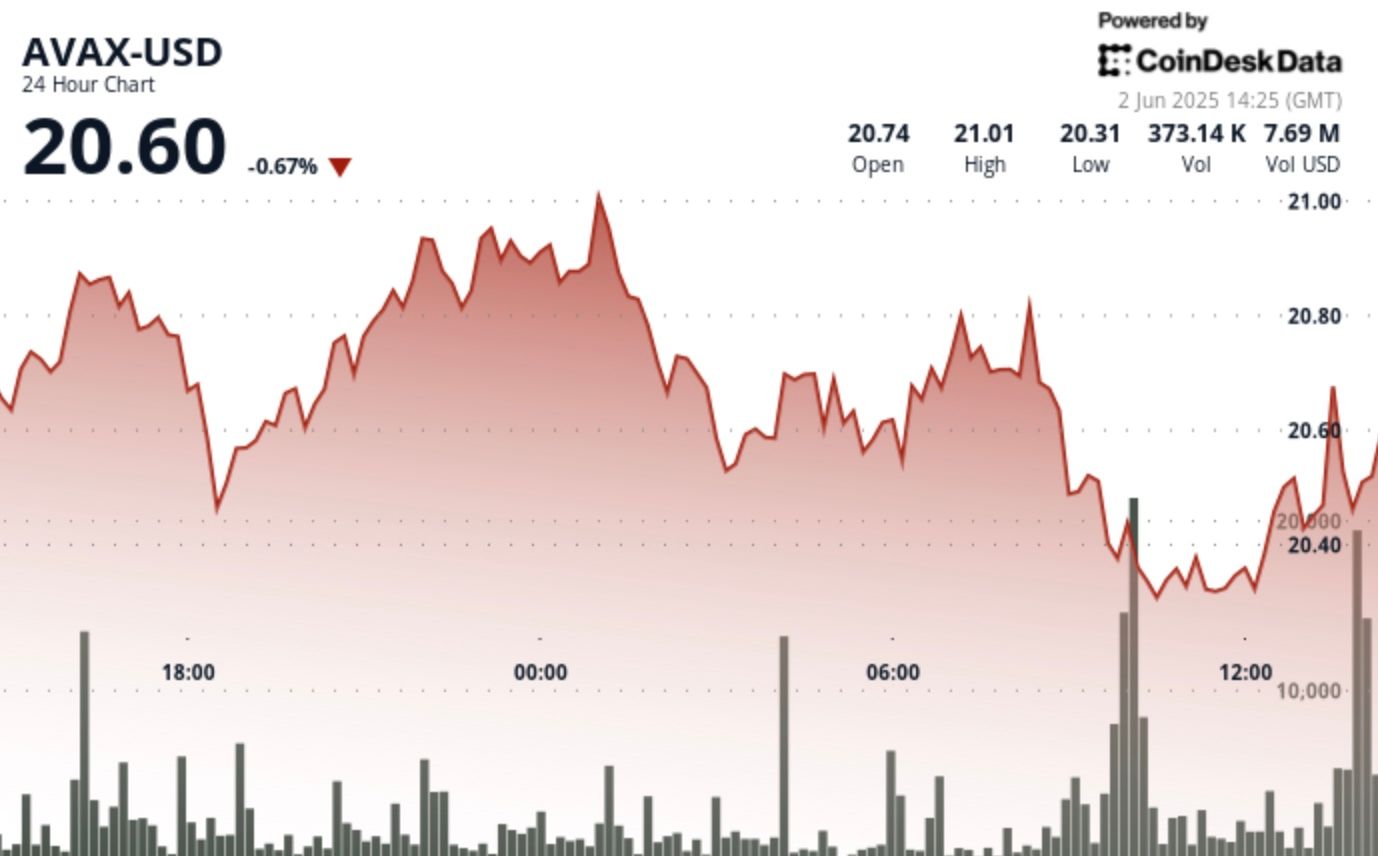

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  OKB

OKB  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic