Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved & Matías Andrade

-

Crypto markets face volatility influenced by a mix of macroeconomic factors and crypto-specific catalysts like sales of Jump Crypto’s portfolio.

-

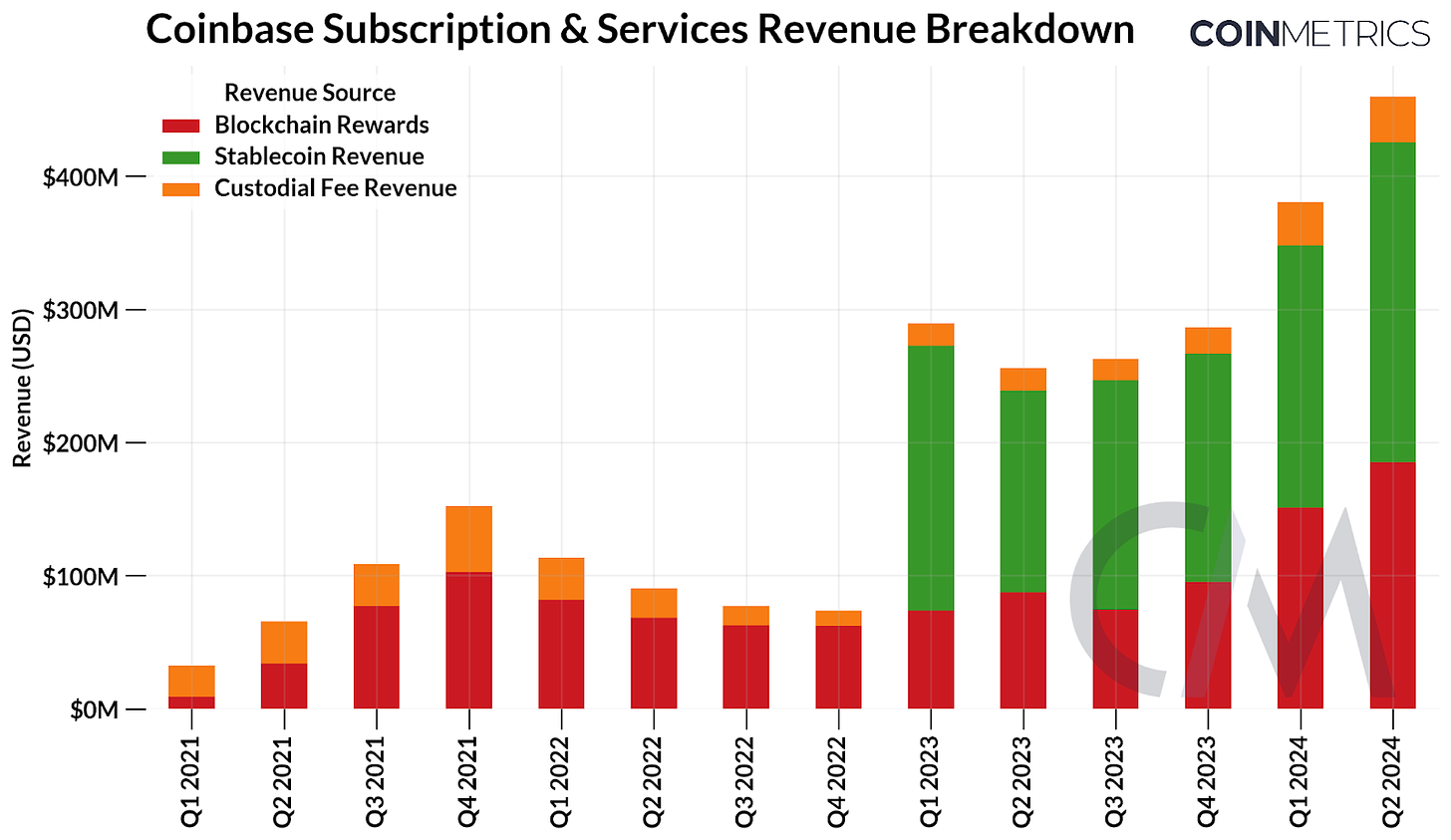

Coinbase’s Q2 2024 earnings show a shift in revenue sources, with transaction revenue down 27% Q/Q, but subscription and services revenue growing 17% Q/Q, with stablecoin revenue the largest source.

-

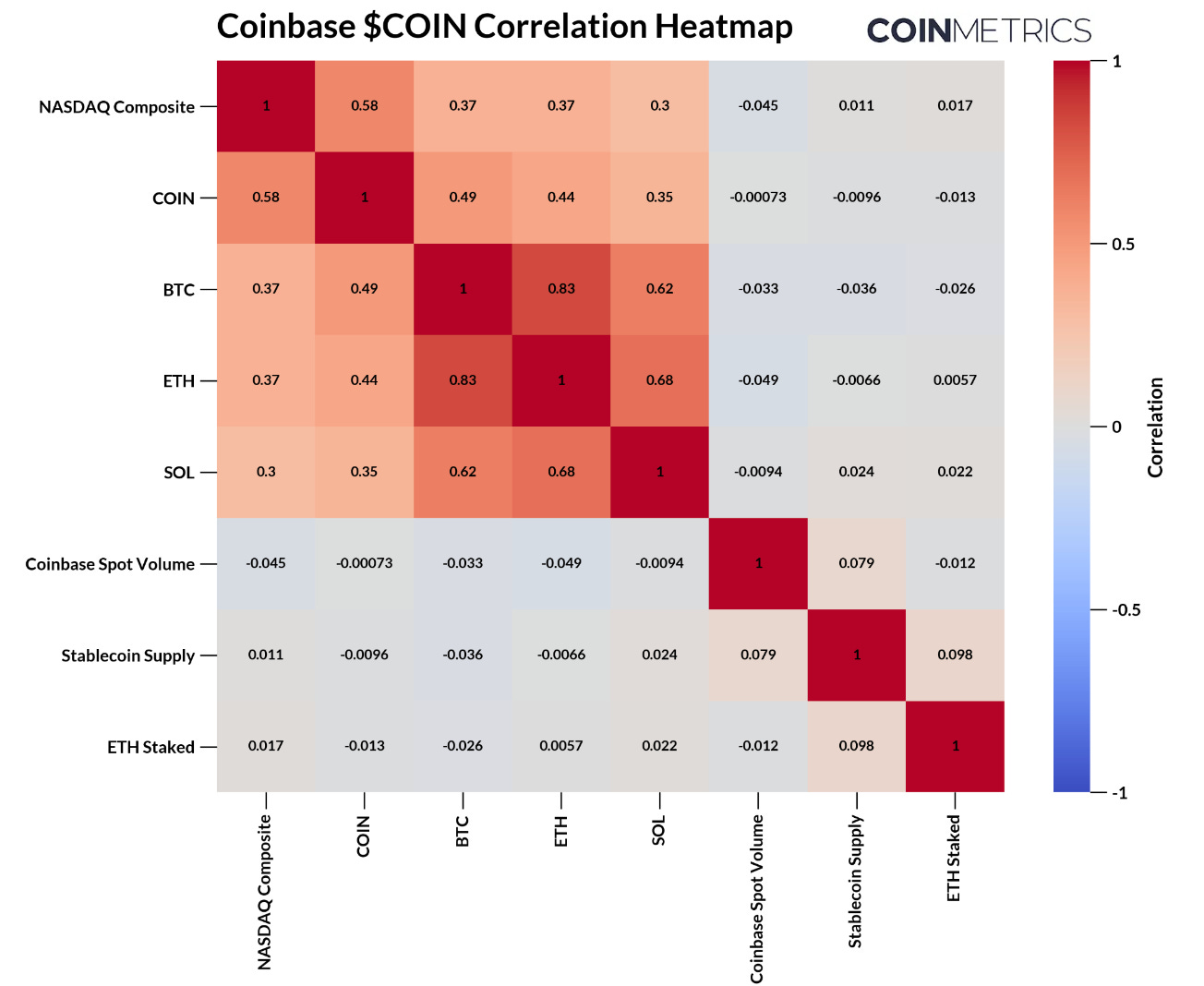

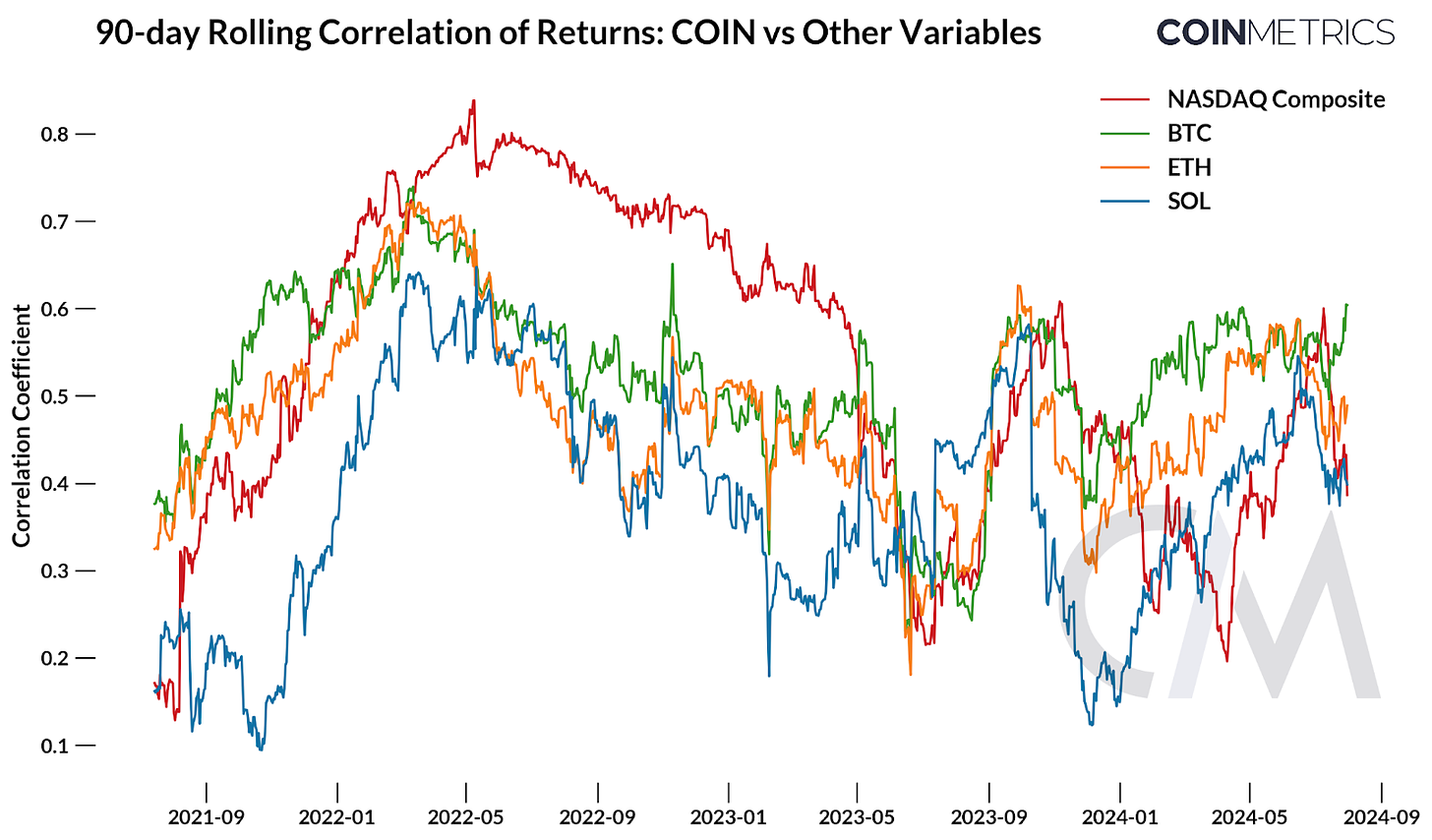

Coinbase stock ($COIN) displays strong positive correlations with both the NASDAQ Composite and major cryptocurrencies, highlighting its unique position bridging traditional and crypto markets.

In this issue of Coin Metrics’ State of the Network, we provide an update on crypto markets amidst the unfolding global market sell-off and break down Coinbase’s Q2 2024 earnings.

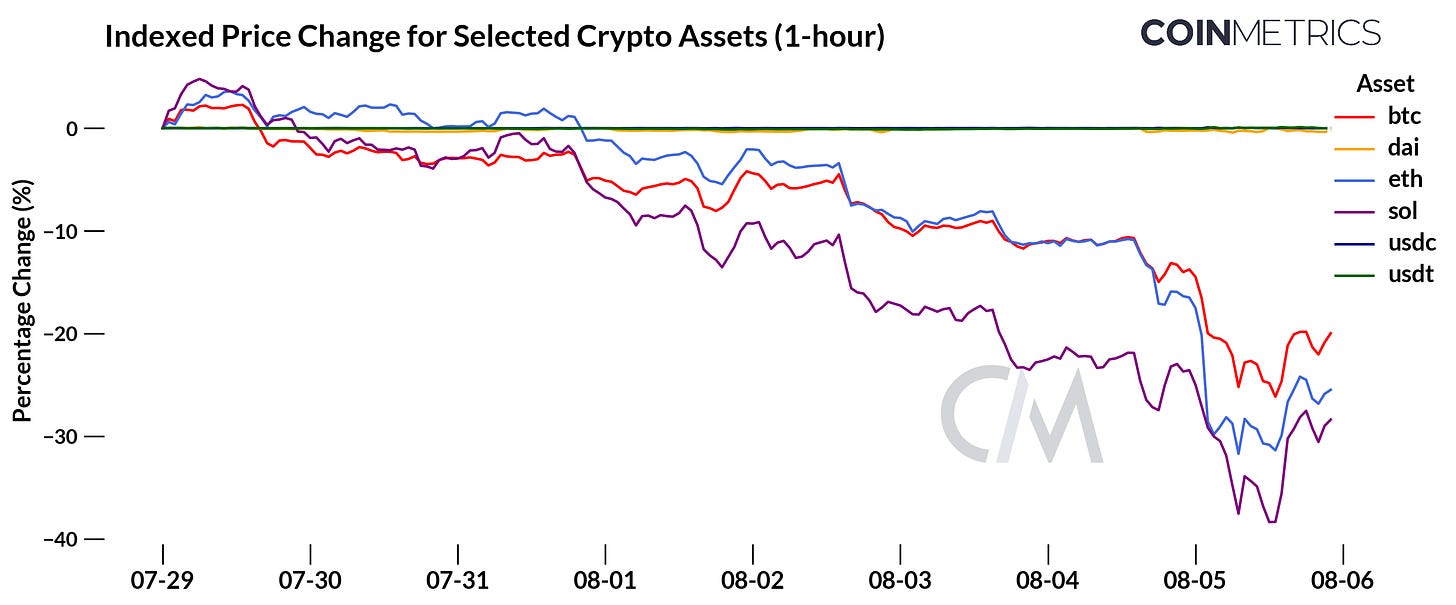

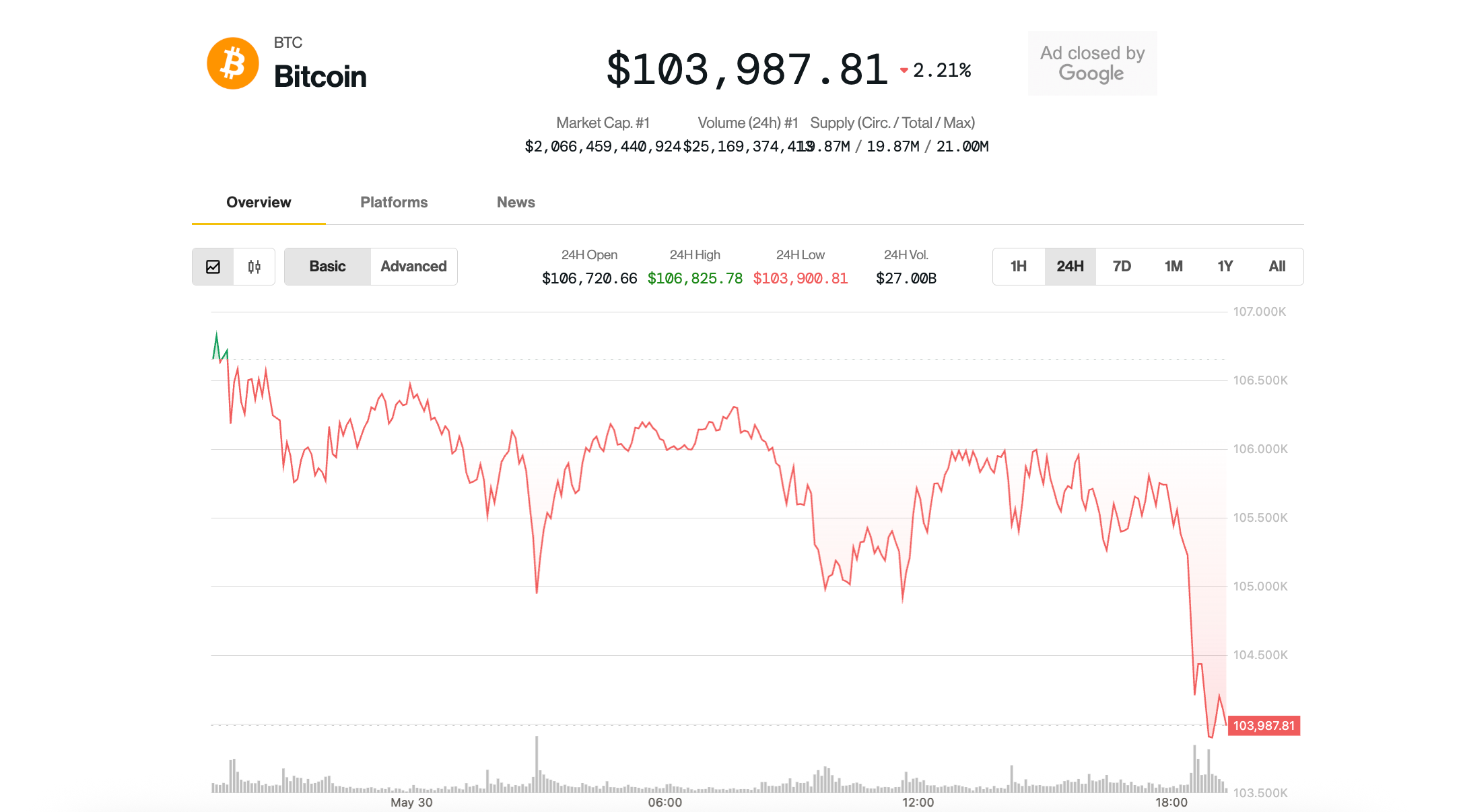

Over the past weekend, global markets and crypto-assets alike were jolted by a combination of macroeconomic developments and crypto-specific events. The Bank of Japan (BoJ) moved to raise its benchmark interest rate from 0-0.1% to 0.25%, in a shift towards monetary tightening. This prompted the largest decline in Japanese equity markets since 1987, with the Nikkei 225 index plunging over 12% on Monday while the Japanese yen (JPY) surged against the US Dollar. US equity markets—gripped by risks of recession and weaker than expected economic data—slid further, with the NASDAQ Composite leading losses.

Source: Coin Metrics Reference Rates

Of course, crypto-asset markets did not go undisturbed by these developments. The total crypto market capitalization declined by ~26% to ~$1.7T before rebounding on Monday, with BTC, ETH & SOL down between 18% to 28%. The selloff was exacerbated by crypto-specific catalysts, such as the unwinding of Jump Trading’s crypto portfolio following its CFTC probe, adding to the ongoing but subsiding supply overhangs from Mt.Gox creditor repayments and GBTC & ETHE outflows. Jump Crypto’s liquidations over the past two weeks stem predominantly from ETH, with deposits to exchanges rising to levels last seen during the FTX collapse.

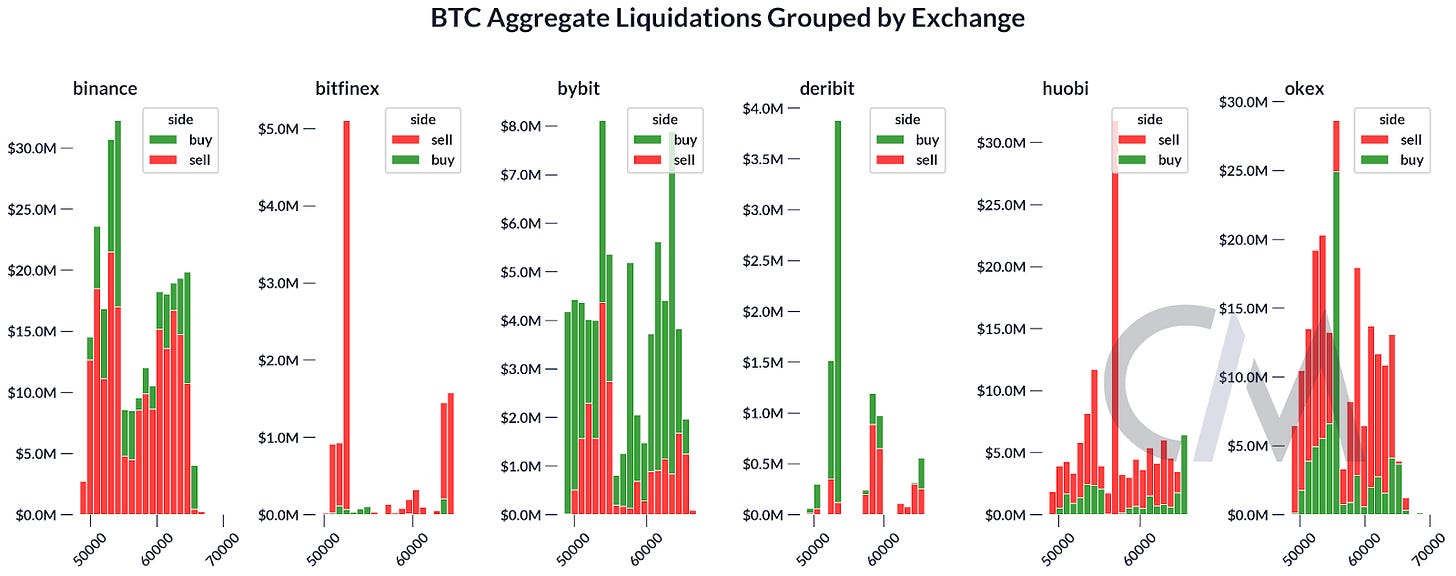

In culmination, these developments have resulted in heightened volatility in crypto-asset markets and triggered liquidations across exchanges at significant price levels.

Source: Coin Metrics Market Data Feed

Coinbase, one of the most widely recognized crypto businesses and the largest exchange in the United States, reported their earnings for Q2 2024 last week. Total revenue came in at $1.4B, 11% lower Q/Q, but 108% higher compared to last year, with revenue from transaction volumes, the core engine of their business, down by 27% Q/Q at $781M.

Nevertheless, in Q2 Coinbase made exciting progress in growing new product categories and reducing the frictions that come with interacting on-chain. This includes the launch of smart-wallets, lowering fees associated with their layer-2 Base, and integrating Base with Stripe to expand stablecoin adoption and global payment infrastructure. Significant strides were also made in achieving greater regulatory clarity, with the launch of spot Ether ETFs in the US and the implementation of MiCA regulations in Europe.

Source: Coin Metrics Market Data Feed

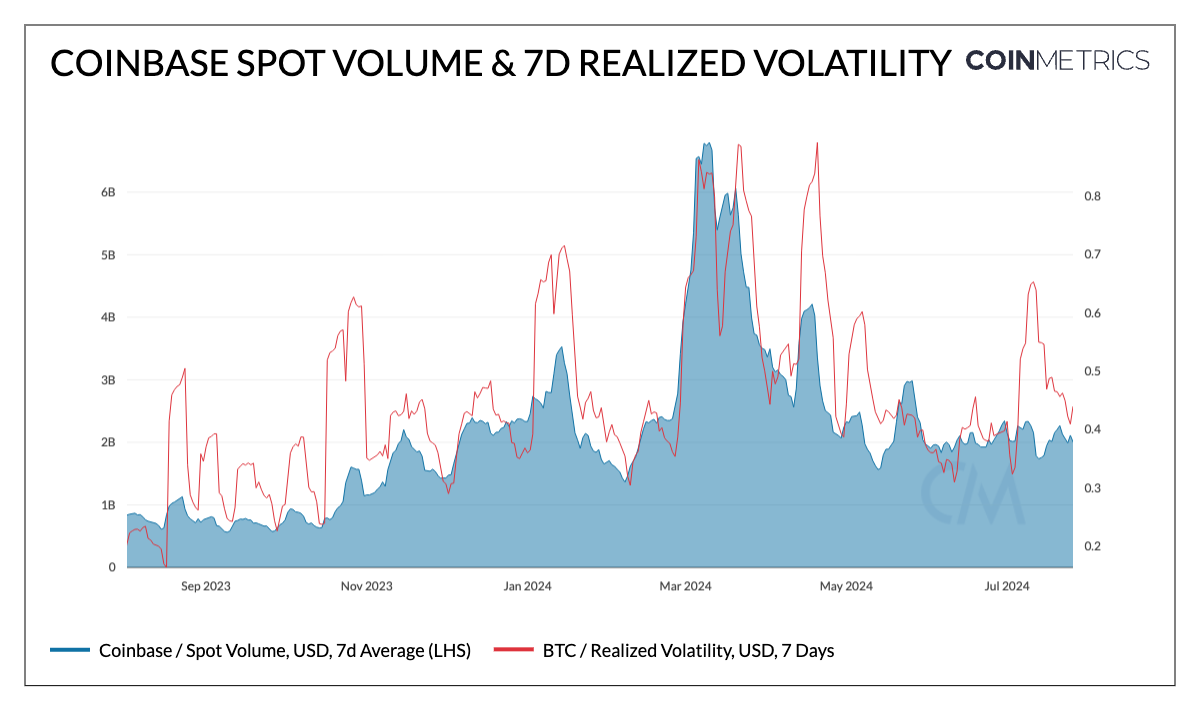

“Crypto asset volatility – a key driver of revenue – declined approximately 13% when comparing the Q2 average with the Q1 average, resulting in softer crypto spot market trading conditions in Q2”—Coinbase Q2 2024 Shareholder Letter.

Trading activity across the market declined from the peak seen in Q1, which benefited from a major rally in crypto-asset prices, driving volatility and volumes higher. In Q2, spot trading volumes on Coinbase stabilized around the $2B level on a 7-day average basis, of which 60% of spot volume came from BTC, ETH & USDT, while 40% came from other crypto-assets. This reflects the market’s preference for established, higher-cap assets in Q2 and may be explained by the larger presence of institutional trading volumes ($189B) relative to retail ($37B) at this point in the market cycle.

However, this did not prevent a strong quarter for its growing business. The recent history of Coinbase’s earnings have shown that revenue from non-trading activities, (“Subscriptions & services revenue”), has increasingly influenced Coinbase’s revenue mix and strategic direction. This segment, which includes revenue generated from Circle’s USDC agreement, blockchain rewards from PoS staking, and custodial fees from bitcoin spot ETFs, among others, grew 17% Q/Q to $599M.

Source: Coinbase Quarterly Earnings

The largest increase came from USDC held on the platform, stemming from their revenue sharing agreement with Circle. Coinbase and Circle equally share the interest income generated on the reserves backing USDC such as US Treasury bills and other dollar-equivalent assets, benefiting from the prevailing high interest-rate environment. Despite its growing prominence, the Federal Reserve’s decision to cut rates in the near future could present a headwind for the stablecoin revenue segment of Coinbase’s business.

With Coinbase expanding to numerous verticals beyond its core exchange business, it is likely to be influenced by the dynamic, interconnected nature of the crypto ecosystem and changes in broader markets. Understanding how various metrics and asset returns relate to Coinbase stock (COIN) returns can provide valuable insight into its potential drivers and risk factors.

Source: Coin Metrics Reference Rates, Network Data Pro & Google Finance

The chart above presents the Pearson correlation matrix of percentage changes in various metrics and asset returns with COIN returns, illustrating the strength and direction of linear relationships between these variables.

The percentage change in the NASDAQ Composite shows the highest positive correlation (0.58) with COIN returns. This suggests that COIN returns are significantly influenced by broader market trends and investor sentiment in traditional financial markets, particularly technology stocks. There is also a relatively high correlation with BTC returns (0.49) and ETH returns (0.44), indicating that a rise in the largest crypto-assets influence returns on COIN. Interestingly, metrics related to Coinbase’s business, such as spot trading volume, stablecoin supply and units of ETH staked display negligible correlations. However, looking at 90-day rolling correlations can provide a better view into how these variables have evolved over time.

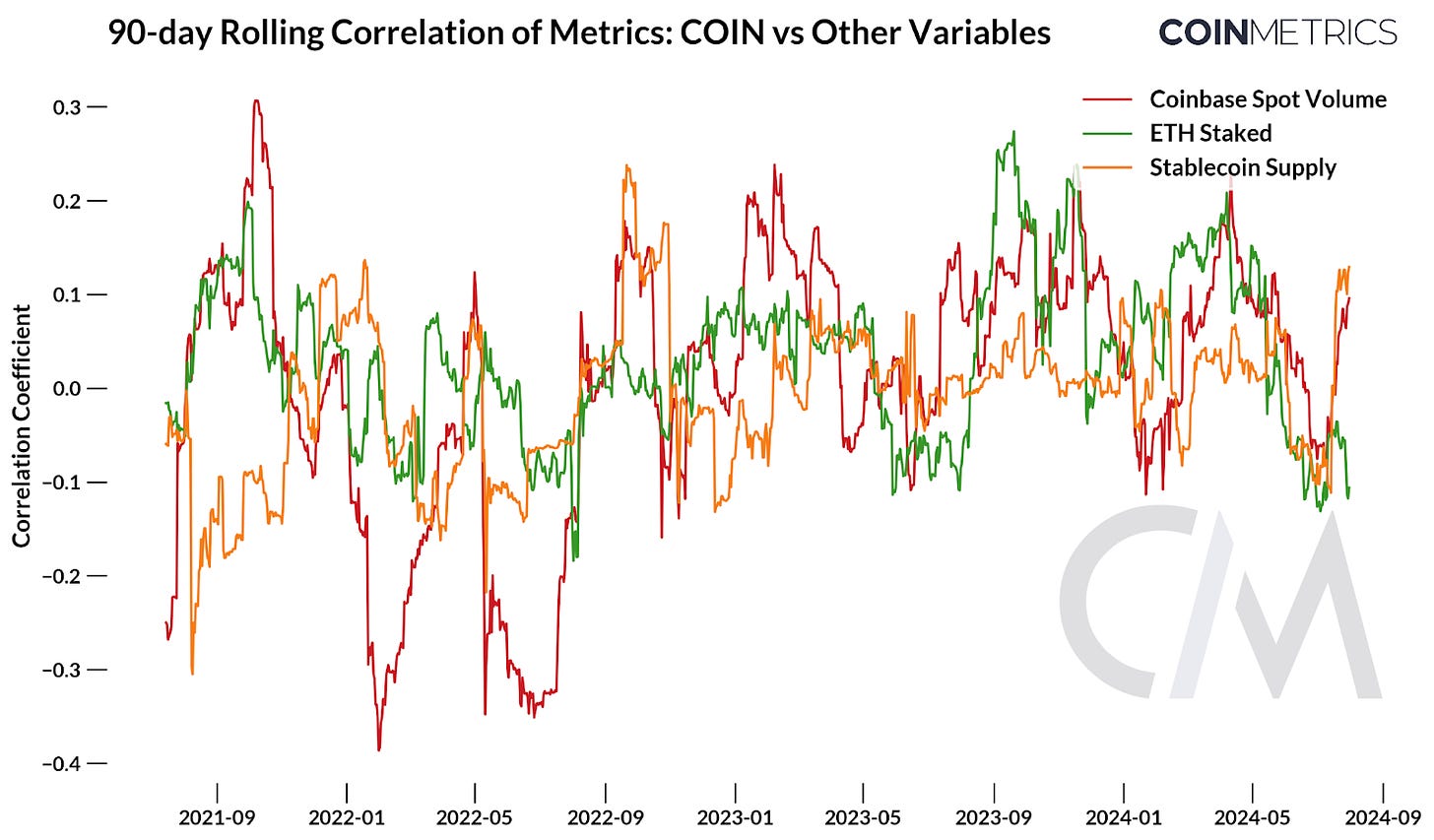

Source: Coin Metrics Network Data Pro, Market Data Feed

The 90-day rolling correlation between COIN returns and key metrics show significant variability, reflecting the dynamic nature of crypto markets and metrics tied to Coinbase’s business. During the early phases of Coinbase as a publicly listed company, COIN returns exhibited the highest magnitude of positive and negative correlations (+0.3 to -0.4) with spot volumes on the exchange, indicating its initial importance to investors. However, over time, its relationship with changes in stablecoin supply and ETH staked has also grown in prominence, albeit still weak, suggesting a gradual shift in investor focus towards newer revenue streams.

Source: Coin Metrics Reference Rates, Google Finance

As a Nasdaq-listed company, Coinbase provides a unique mix of exposure to both the crypto market and traditional financial markets. The rolling correlation with returns on the NASDAQ Composite has displayed a strong positive relationship up until 2023, a period when crypto markets declined, amplifying the influence of traditional markets. While returns on BTC, ETH, and SOL also display moderately positive correlations due to the interconnected nature of crypto, these relationships can diverge, especially during shifts in macroeconomic conditions, periods of market volatility, or in the presence of asset-specific catalysts.

Markets have seen near-term volatility and may continue to be risk-off due to a combination of macroeconomic and crypto-specific developments, testing the longer-term conviction of participants. Despite these challenges, on-chain infrastructure and applications have demonstrated resilience. In the short to medium term, subsiding supply overhangs from Mt. Gox creditor repayments, the eventual completion of Jump Crypto’s liquidations, and easing outflows from Grayscale’s GBTC & ETHE may present opportunities for both retail and institutional investors. Looking ahead, positive ETF flows will be crucial as they could signal sustained demand for crypto-assets, catalyzing a resumption in growth for crypto markets, potentially benefiting companies like Coinbase, and drive wider adoption of the on-chain ecosystem.

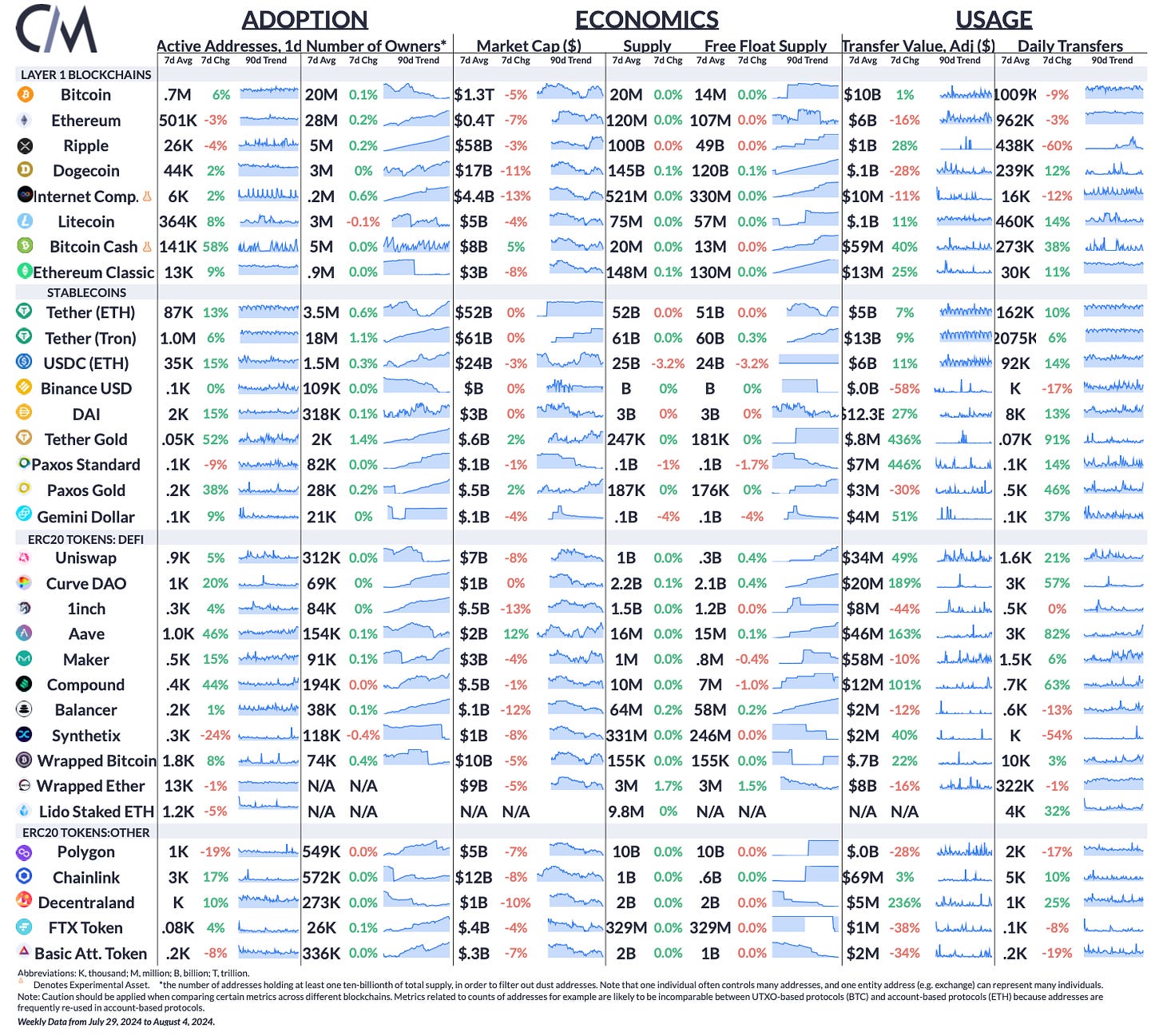

Source: Coin Metrics Network Data Pro

ERC-20 tokens for DeFi protocols like AAVE (+46%) and COMP (+44%) saw increases in daily active addresses and over a 100% rise in adjusted transfer values over the past week. This surge in activity was driven by market volatility and the processing of liquidations during the recent crypto market downturn.

This quarter’s updates from the Coin Metrics team:

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

-

We expanded our 1-hour network data metrics, now covering metrics for the Ethereum Beacon Chain (Consensus Layer) for granular insights into staking.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer