Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved

-

Flow is a Layer-1 blockchain designed for scalable and consumer-friendly applications, utilizing a multi-role architecture and the Cadence programming language.

-

The recent Crescendo upgrade brought full EVM compatibility to Flow, expanding its ecosystem to Ethereum-compatible smart contracts and leveraging existing EVM tooling and applications to complement its native capabilities.

-

Flow has gained adoption in the digital collectibles space, hosting applications like NBA Top Shot and NFL All Day, while maintaining extremely low transaction fees and fast block times.

As the foundational infrastructure of the on-chain ecosystem, Layer-1 blockchains—which serve as the settlement layer for scaling solutions and the execution environment for smart contracts and decentralized applications—continue to act as the linchpin of the crypto ecosystem. We’ve seen Layer-1s progressing on several fronts, with Ethereum pursuing a rollup-centric scaling roadmap, Solana enhancing throughput with new validator clients, Sui and Aptos leveraging Move-based virtual machines, and Monad combining EVM compatibility with parallel execution. In essence, Layer-1 projects aim is to strike a delicate balance between various tradeoffs, prioritizing on scalability, performance, application-specific use cases and developer-friendliness.

One such blockchain is Flow, a Layer-1 that’s focused on mass-market consumer applications and developer accessibility. Flow introduced Cadence, a resource-oriented programming language that powers a diverse ecosystem of applications—from digital collectibles to marketplaces. With its recent Crescendo upgrade, Flow has achieved EVM equivalence, allowing it to tap into the vast array of tooling and applications available within the Ethereum ecosystem.

In this issue of Coin Metrics’ State of the Network, we explore the Flow blockchain, examining its unique features, the implications of the Crescendo upgrade, and network data metrics to assess the adoption of its application ecosystem.

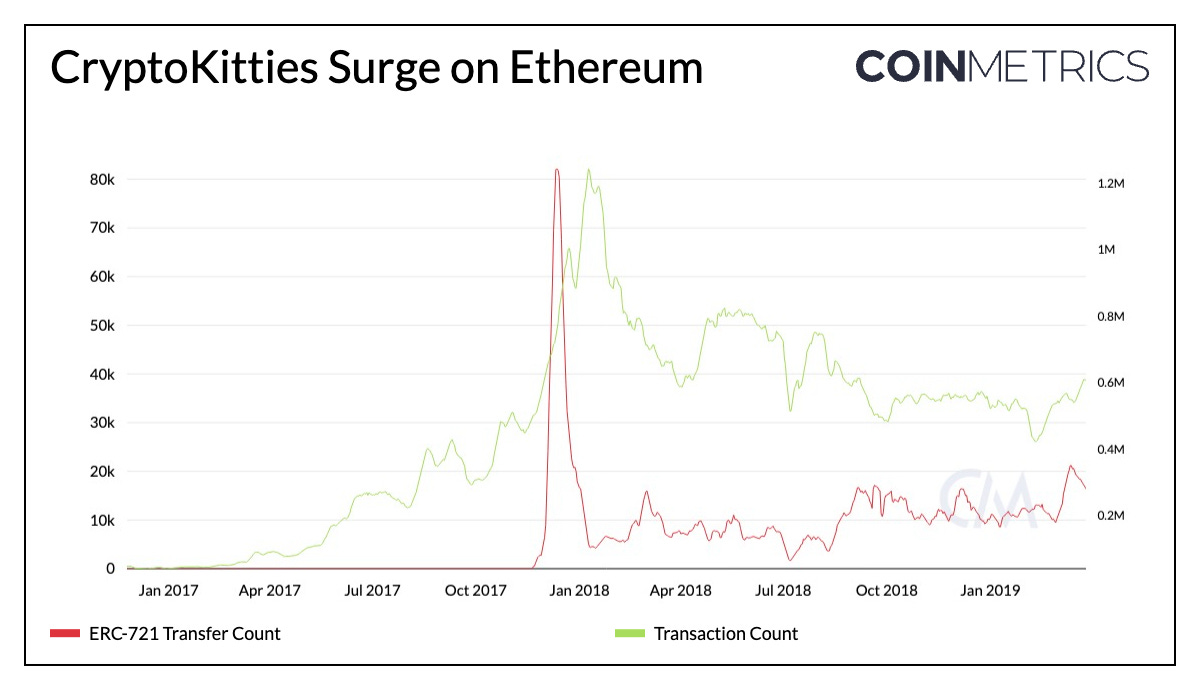

The origins of Flow interestingly begin on Ethereum. In 2017, Dapper Labs, the creator of the Flow blockchain, developed the then wildly popular “CryptoKitties” game. CryptoKitties was a platform that allowed users to buy, sell, collect and breed unique digital cats represented as non-fungible tokens (NFTs) on the Ethereum blockchain—following the ERC-721 token standard. However, the craze that followed led to a spike in ERC-721 associated transfers and transactions (up to 80K and 1.2M), alongside a congestion induced gas surge (back when the Ethereum network used a first-price auction model for transaction fees).

Source: Coin Metrics Network Data Pro

This brought Ethereum’s scalability challenges to the fore, leading Dapper Labs to conceptualize their own Layer-1 blockchain with cheap transaction fees and scalability under heavy usage.

The Flow blockchain mainnet launched in 2020, designed as the foundation for consumer-centric applications, and the digital assets that power them. Flow is a fast and developer friendly proof-of-stake (PoS) Layer-1 blockchain built for mass-scale decentralized applications based on a multi-role architecture for scalability as well as Cadence, a resource-oriented programming language designed specifically for smart contracts. The network uses Cadence as its main execution environment, which has served as the foundation for Flow’s ecosystem of applications—from digital collectibles and officially licensed platforms like NBA Top Shot to marketplaces, DeFi services and digital experiences in collaboration with Disney.

In September 2024, Flow underwent its largest change with the “Crescendo” upgrade, making the network fully EVM compatible. The network now supports two environments: a native Cadence-based chain (FLOW_NATIVE) and an EVM-compatible chain (FLOW_EVM).

With this upgrade, any smart contract or protocol running on Ethereum or an EVM Layer 2 can now be deployed on Flow, leveraging the flexibility of its account model. Flow introduces Cadence Owned Accounts (COAs), which, unlike traditional externally owned accounts (user wallets), function as smart contracts. This allows for native features like Account Abstraction, multi-signature authentication, and custom key management, enhancing both security and user experience. Flow can now leverage the network effects of EVM tooling, such as Metamask and integrate applications like Uniswap and Chainlink, further expanding its developer, application, and user ecosystem. Since the upgrade on September 4th, over 1000 new EVM contracts have been deployed on Flow.

Notably, this change will allow for composability across both environments, with the FLOW token as gas for transactions and a native VM token bridge allowing for fungible and nonfungible token transfers between environments.

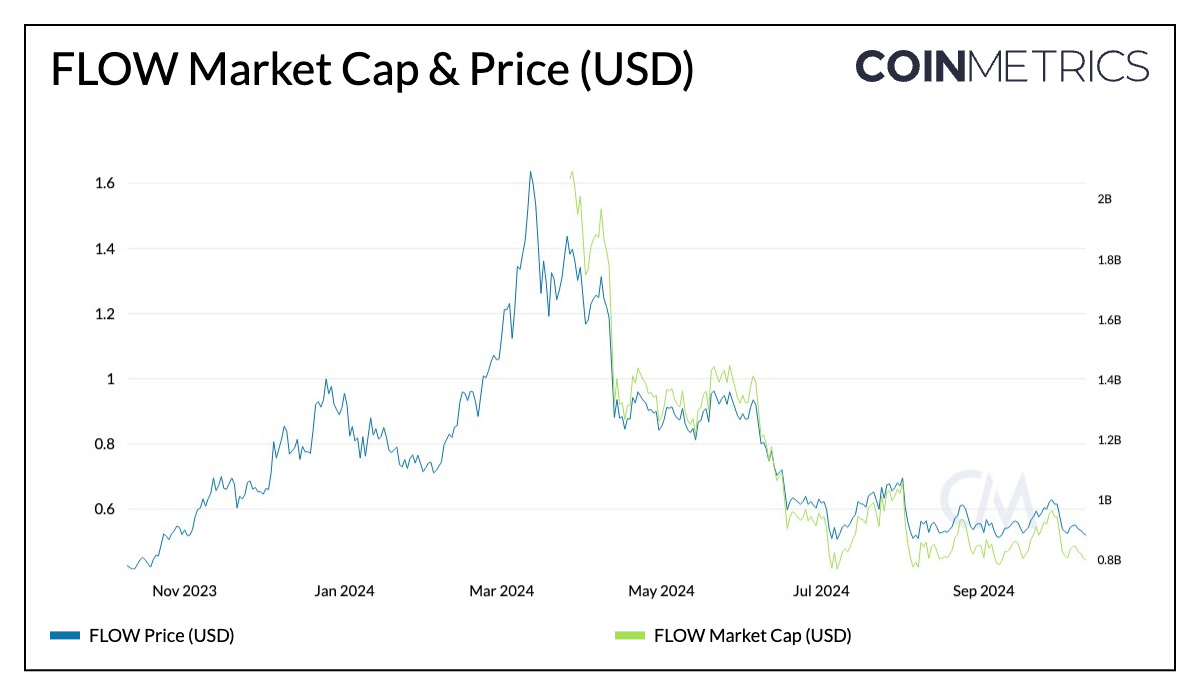

FLOW is the native token of the Flow blockchain. It serves as a means of rewarding staked participants of the network, as a medium of exchange within the Flow ecosystem, and to cover transaction fees. Furthermore, FLOW is also used as a form of collateral on lending applications like Increment Finance, as well as governance voting on future protocol and ecosystem development. At a current price of $0.53 per token, FLOW’s market capitalization sits near $800M.

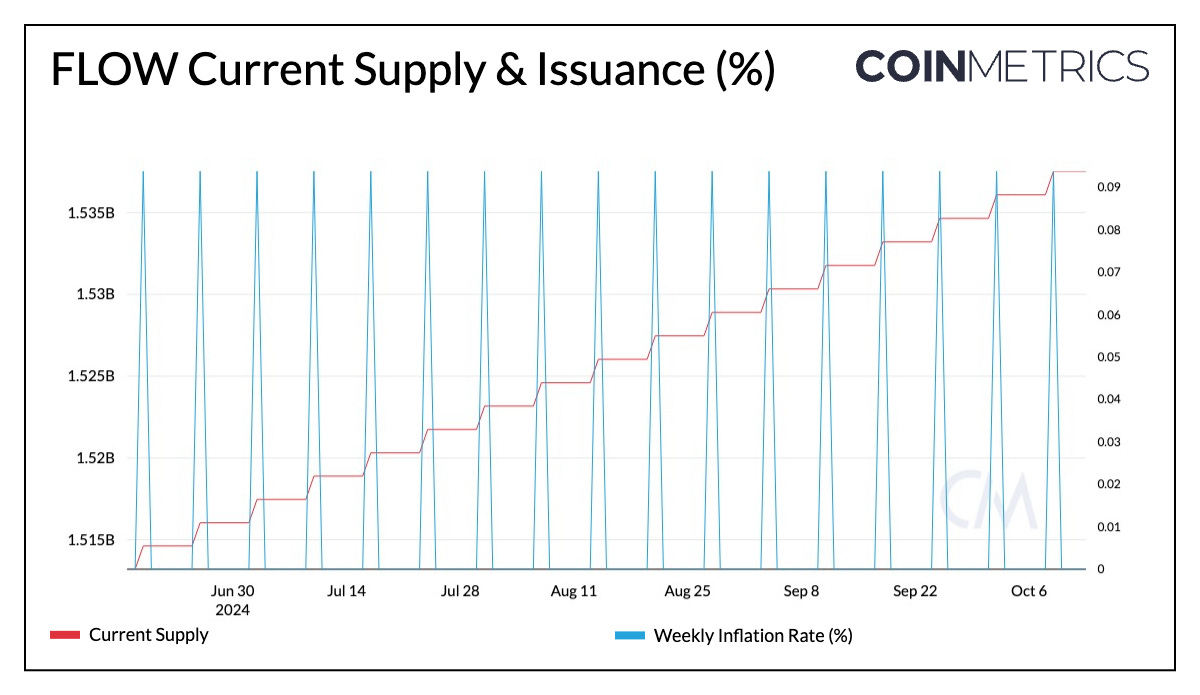

Source: Coin Metrics Network Data Pro

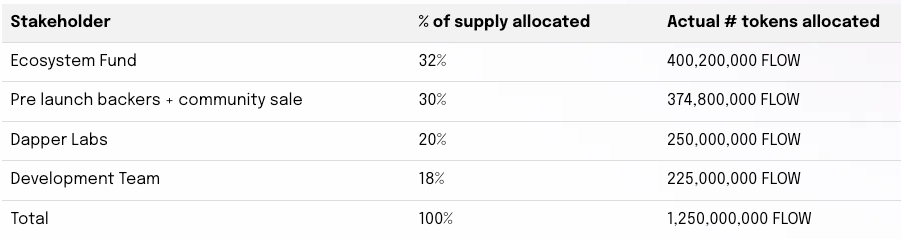

Flow’s genesis block was created in October 2020, with 1.25B FLOW, of which supply has been allocated across stakeholders in the ecosystem.

Since genesis, the supply of FLOW has increased by approximately 22% as a result of newly issued tokens for the distribution of validator rewards. The current total supply of FLOW tokens is 1.53B, with a weekly inflation rate of approximately 0.09% and an annual reward rate of ~5%.

Source: Coin Metrics Network Data Pro

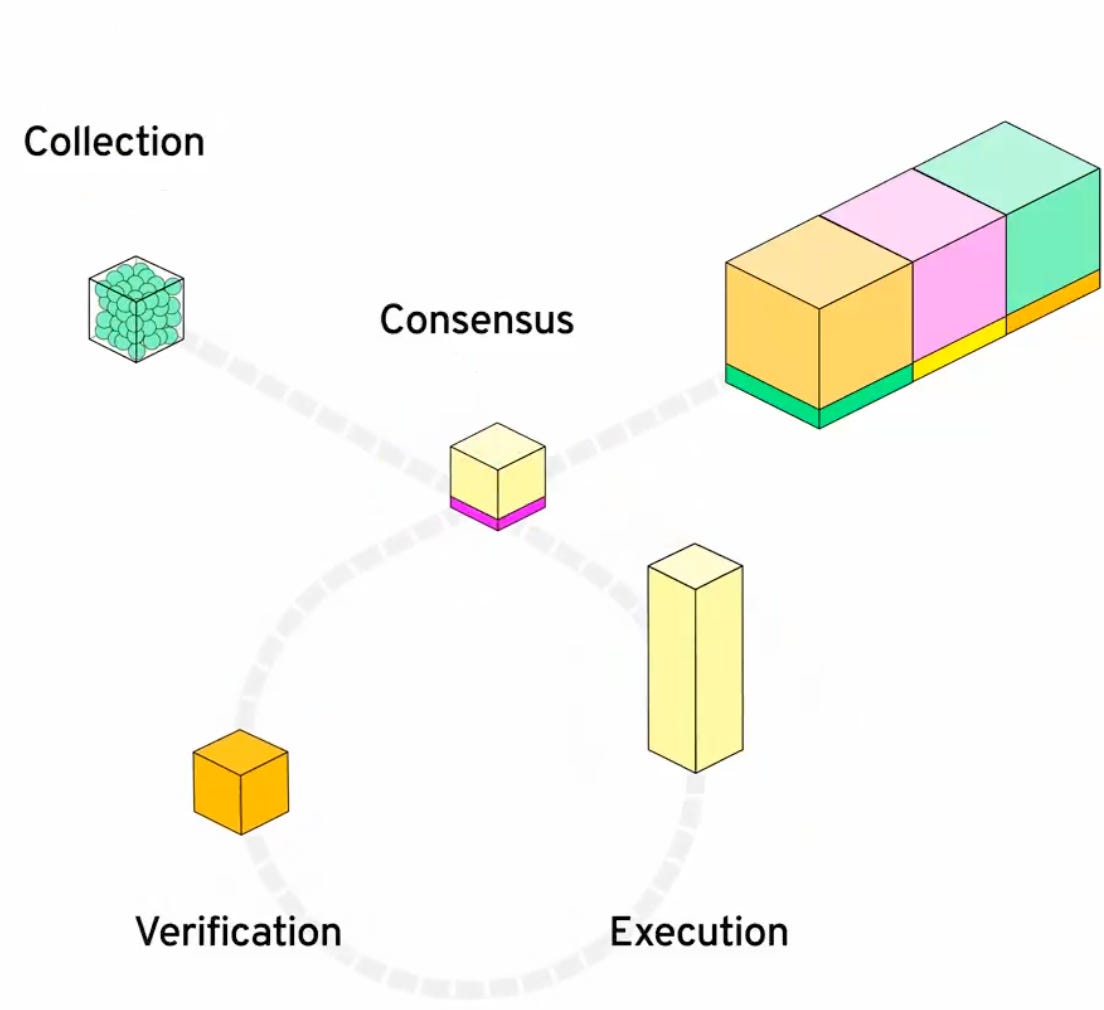

Achieving scalability for mass adoption has been the north-star for all blockchains. Several Layer-1s currently rely on sharding (splitting a blockchain network into smaller parts) or rollups (processing transactions off the main chain) for scalability. Flow applies pipelining to blockchains by specializing the jobs of a validator node into four different roles: Collection, Consensus, Execution, and Verification. This separation of duties (across different validation stages for each transaction) increases the efficiency of processing transactions.

-

Collection Nodes enhance network connectivity and data availability for dApps

-

Consensus Nodes decide the presence and order of transactions on the blockchain

-

Execution Nodes perform the computation associated with each transaction

-

Verification Nodes are responsible for keeping the Execution Nodes in check

Source: Flow Blockchain

The separation of block production across different node types provides strong maximal extractable value (MEV) resilience. Each node type has access only to the information it needs, without visibility into the state of block production, allowing for more predictable gas fees and improved user experience.

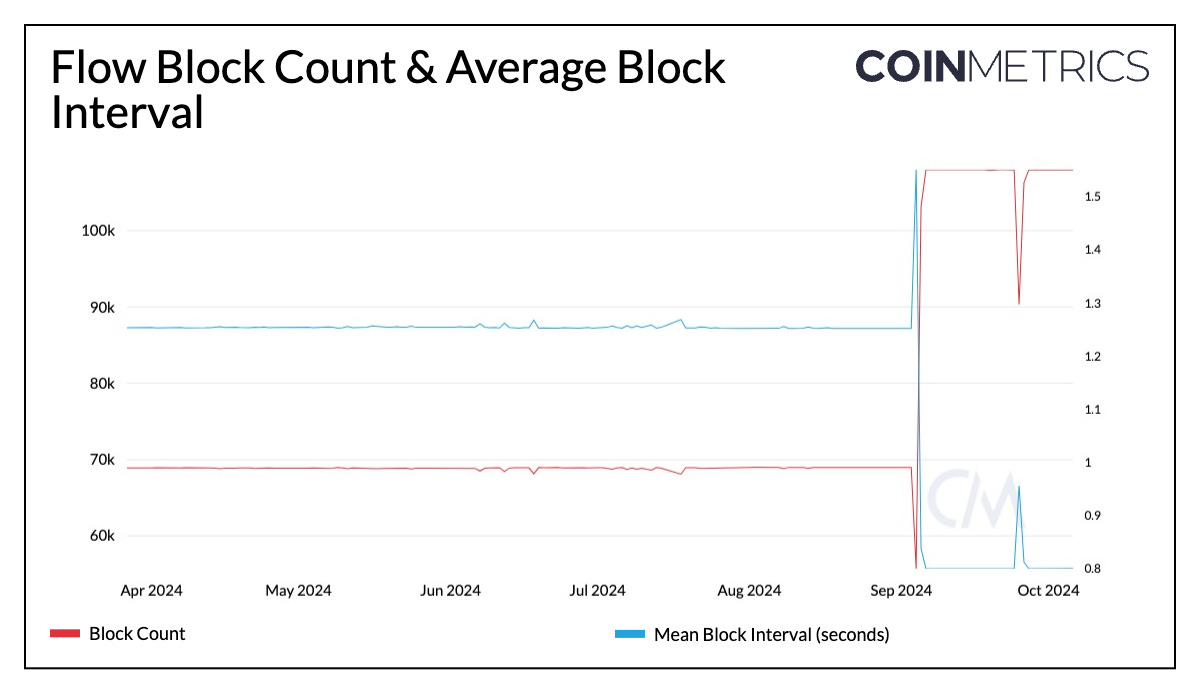

This architecture contributes to Flow’s ability to maintain block times as low as 1.3, decreasing to 0.8 seconds with its upgrade. This positions Flow as one of the lowest in average block time among other Layer-1’s. This fast finality creates a better user experience, making it well-suited for apps that require quick transaction processing and confirmation of user actions.

Source: Coin Metrics Network Data Pro

Coin Metrics recently onboarded network data metrics for Flow, including its Cadence and EVM chain. This allows us to understand the nature of usage of the network and gauge adoption of applications in the Flow ecosystem.

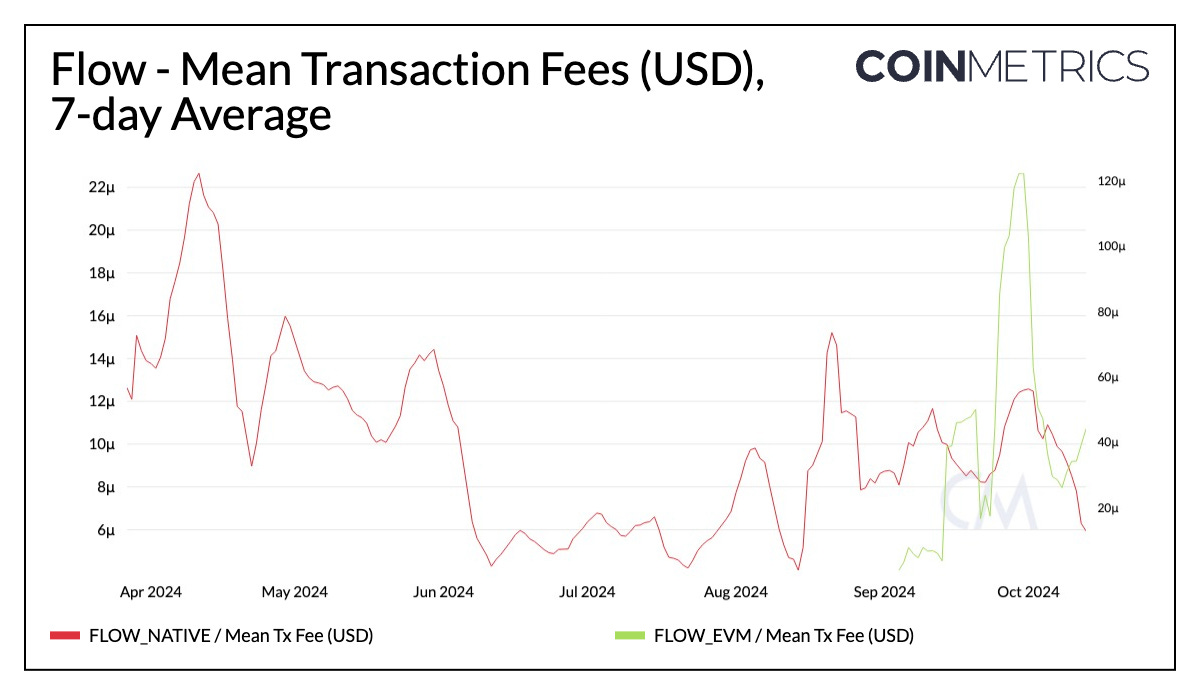

Source: Coin Metrics Network Data Pro

Flow imposes storage fees and transaction fees on the network, aiming to deter malicious actors and manage computational resources. As on other networks, users are required to pay transaction fees to execute actions on the blockchain. These are determined based on an inclusion fee that accounts for usage of resources, an execution fee and a surge factor based on market conditions. Average transaction fees on Flow (native) are as low as $0.000015 as a result of Cadence’s resource oriented design and $0.000070 on Flow (EVM), making it suitable for high-frequency, low-value transactions such as gaming or DeFi applications.

Source: Coin Metrics Network Data Pro

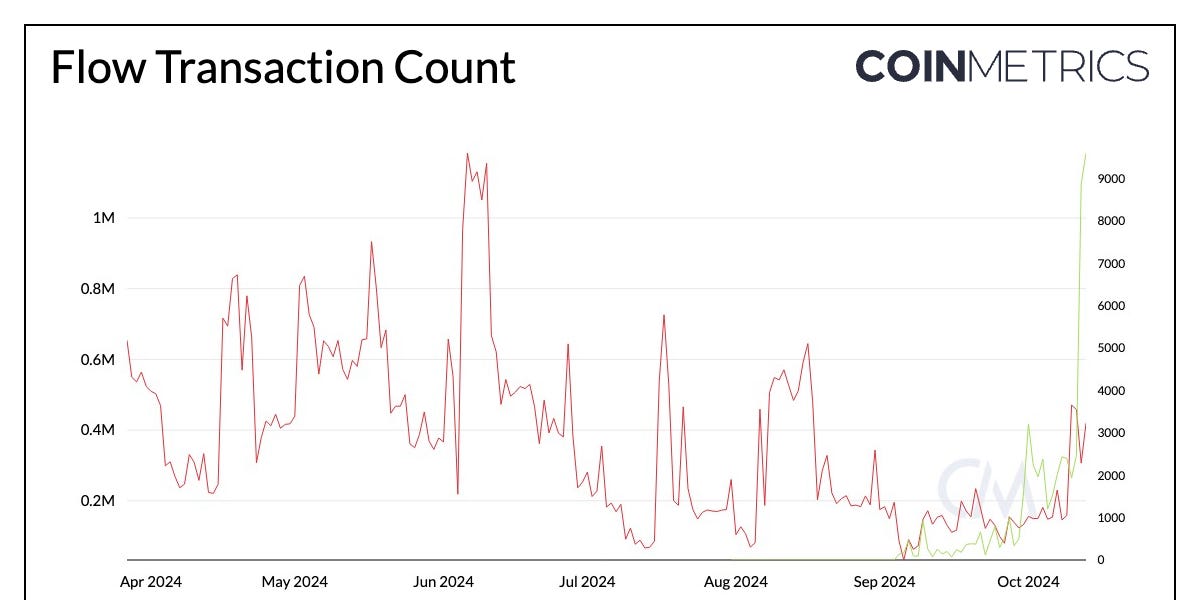

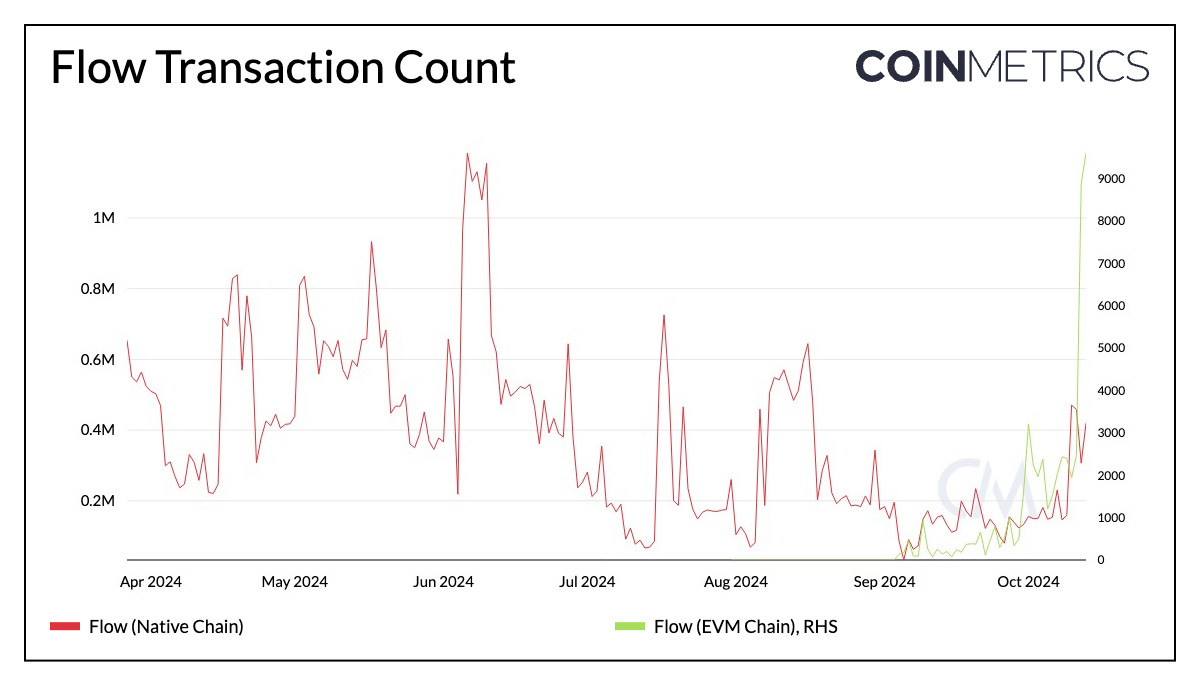

Transaction count peaked near ~1.2M in June, and has averaged around ~300K in daily transactions, with a recent spike to 470K. As the EVM implementation gains traction, it has seen up to 12K in daily transactions.

Source: Coin Metrics Network Data Pro

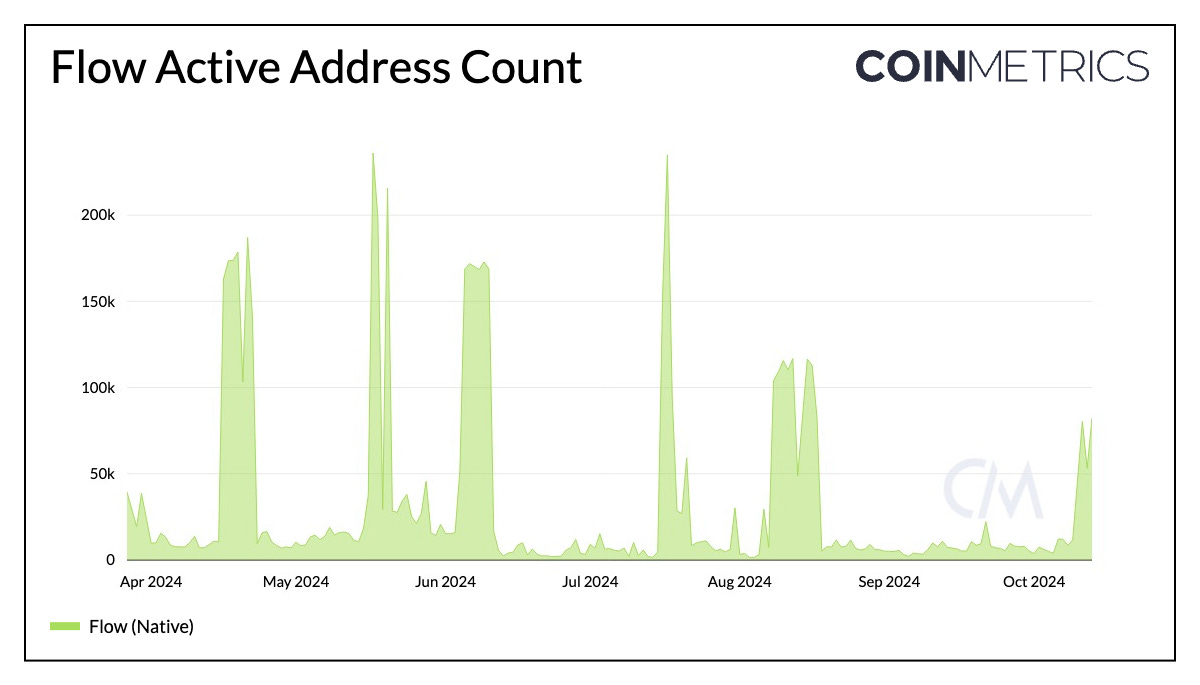

As measured through daily active addresses, activity on Flow (native chain) exhibits a cyclical pattern characterized by periodic spikes followed by periods of lower activity. There have been multiple short-lived spikes to over 170K active addresses, failing to sustain those levels. These coordinated boosts in activity could likely be influenced by Flow’s technical architecture, including batched execution of transactions and contract-based execution through Cadence Owned Accounts (COA’s).

Flow’s distinctive multi-role architecture, capabilities of the Cadence programming language and EVM compatibility position it uniquely within the layer-1 landscape, addressing the complex tradeoffs of scalability and interoperability. With the Crescendo upgrade bringing EVM equivalence to Flow, its existing features and ecosystem of applications can be complemented by the EVM ecosystem, growing developer flexibility, user-experience and ultimately, its user-base. The network data metrics highlighted in this report will continue to provide transparency into the usage, adoption and economics of the Flow blockchain.

This week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Monero

Monero  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic