Believe_In_Me/iStock Editorial via Getty Images

The biggest risk to tech stocks in 2022 are business normalizations from COVID-19 pull forwards. The chip sector faces a normalization of PC sales this year, but Advanced Micro Devices (NASDAQ:AMD) won’t be impacted to any great extent due to supply constraints holding back prior year sales. My investment thesis remains very Bullish on the stock after this sell-off to $120.

PC Cycle Fears

Analyst Harsh Kumar downgraded AMD last week on fears of a slowing PC market. Piper Sandler placed a $130 target on the stock after AMD had topped $160 a few months ago.

If the chip company was just a cyclical play on PC demand, the call would be concerning. The whole story on AMD is a secular shift in demand to their higher performance chips with market share taken from industry giant Intel (INTC). AMD has been supply constrained for years, so any sales issues at the margin will hit the chip giant with AMD selling all the chips the company can get TSM (TSM) to produce.

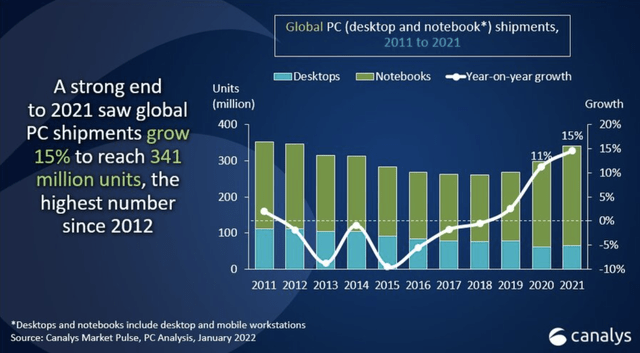

My investment thesis is definitely in agreement with the call on slowing PC demand. According to Canalys, the PC sector saw strong sales in 2020 and 2021, leading to sales growth of 27% above the 2019 levels to reach 341 million units.

The sector hadn’t seen growth in years, so one shouldn’t assume these levels of sales should persist going forward. Enterprises and individuals buying extra PCs for WFH environments won’t be in the need of new computers for years.

AMD Computing Focus

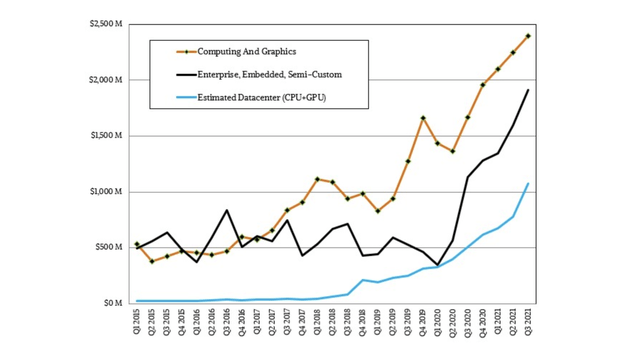

AMD obtains a large portion of sales from CPUs sold into the PC sector. The company just highlighted a massive amount of deals in the laptop division to support growth this year. A combination of CPU/GPU sales amounted to Q3’21 sales of $2.4 billion with the majority of quarterly sales from CPUs for PCs.

Clearly, what happens in the desktop and laptop segments are very crucial to the success of AMD. The market expects AMD to continue growing datacenter chip sales from just over $1 billion this quarter to multi-billions per quarter in future periods.

While the PC sector could face a period of fewer units sold in 2022, AMD has been supply constrained for years. At the Credit Suisse conference back in late November, CEO Lisa Su highlighted how AMD was poised to maintain 20% growth targets and take more share in the high performance end of the PC segment:

And we said with Xilinx, we expect to continue that 20% CAGR. And from what we see, we see that that’s absolutely achievable. From a supply standpoint, from a demand standpoint, from a customer standpoint, I think there’s a lot of desire to expand where we are positioned in the market and we’re putting on all aspects of the supply chain to ensure we can do that.

There’s no question the last two years were very strong for PCs. I think as we go into 2022, we’ll see exactly how the supply chain — the total supply chain shapes up for the PC market. But overall, I mean, 350-plus-or-minus million units…

Read more:AMD Stock: Don’t Fear PC Cycle Weakness (NASDAQ:AMD)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Algorand

Algorand  Filecoin

Filecoin  Bonk

Bonk  Celestia

Celestia  Stacks

Stacks  Dai

Dai  Cosmos Hub

Cosmos Hub  WhiteBIT Coin

WhiteBIT Coin