- Investors from Florida and California have sued Coinbase for deceiving investors into buying unregistered securities and alleged that the exchange’s business model is illegal.

- The lawsuit singles out tokens such as Stellar’s XLM, Solana’s SOL, Algorand’s ALGO, Polygon’s MATIC and Uniswap’s UNI as securities.

Coinbase just can’t seem to leave its legal trials behind. The exchange is facing yet another lawsuit alleging that it facilitates the sale of securities without proper licensing, not for the first time.

The latest lawsuit was filed in the District Court for the Northern District of California in San Francisco. The six plaintiffs—all Coinbase users—describe the exchange as “part of a shadowy crypto ecosystem operating just outside of the law since formed over ten years ago.”

The lawsuit states in part:

Its entire business model has been built upon a lie and a dream: the lie is that “we do not sell securities,” and the dream is that, knowing it would eventually be caught in the lie, “it is better to ask for forgiveness than permission.”

Coinbase repeatedly and intentionally violated state securities laws since its founding, the plaintiffs say. They specifically point out that the exchange’s User Agreement admits to securities involvement, allegedly claiming that the crypto it lists falls under securities. Apparently, the exchange repeated the same rhetoric in its filing with the SEC to become a public company.

And yet, Coinbase has never registered itself, its people, or the crypto securities it sells.

Coinbase Lawsuit Claims XLM, SOL, MATIC Are Securities

The lawsuit specifically cites eight cryptocurrencies the plaintiffs allege are securities. They are Solana (SOL), Algorand (ALGO), Polygon (MATIC), Decentraland (MANA), Near Protocol (NEAR), Uniswap (UNI) Tezos (XTZ) and Stellar Lumens (XLM).

They make the same arguments for all the cryptos: that the investors expected the value of the crypto to rise, and they expected it to happen “solely from the efforts of [any of the eight tokens]’s creator, developer and issuer.”

It’s unclear why the plaintiffs chose these eight cryptos despite acknowledging that as of January this year, Coinbase listed 235 crypto tokens.

The lawsuit further attacks the Coinbase Earn Accounts, which it alleges are “a Digital Asset Security that was offered and sold on the Coinbase Digital Asset Platforms during the Class Period.”

The plaintiffs are from Florida and California and allege that the exchange breached state securities laws in both states. Coinbase allegedly operated as an unregistered broker-dealer and “engaged in deceptive acts and practices under California law by taking advantage of the lack of knowledge, ability, experience, or capacity of Plaintiffs to a grossly unfair degree.”

This isn’t the first time Coinbase has been accused of securities violation, as CNF has reported. In its most recent one, the exchange defended its business model, and last month, a judge ruled in its favour. However, in that case, it won the lawsuit because of its user agreement; the judge ruled that the class-action lawsuit failed to meet the criteria as many plaintiffs had different user agreements as Coinbase had been updating the language used over time.

Read More: www.crypto-news-flash.com

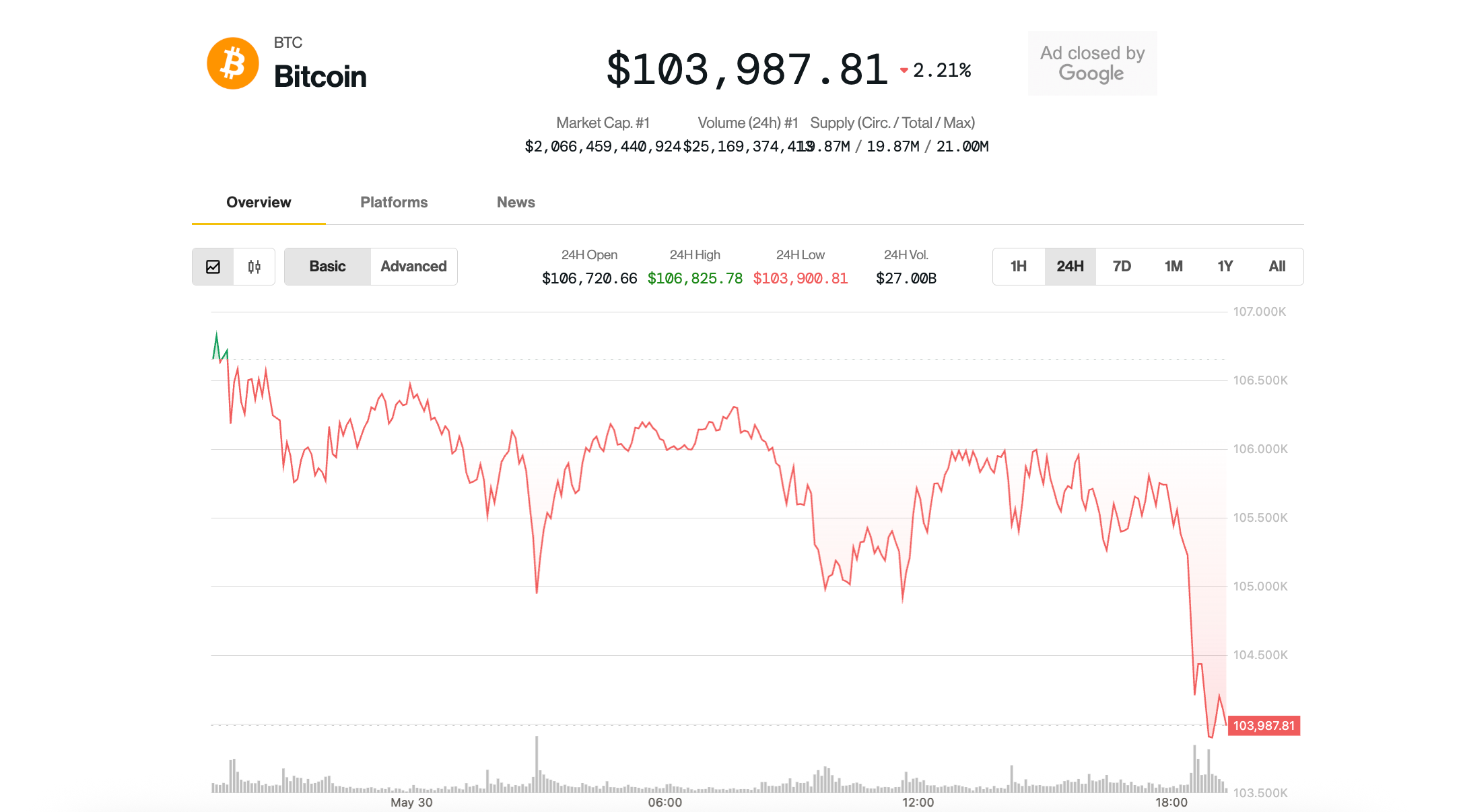

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer