[ad_1]

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ADA encountered a bearish order block at $0.2654.

- Although bullish on the 12-hour chart, the bulls may have trouble getting above $0.2671.

Since its steep drop last December, Cardano [ADA] has lost about 20% of its value and hit a new low at $0.2415 until press time. The $0.2415 support was strong enough for the bulls to initiate a rally.

ADA has recovered about half of its value since mid-December. At press time, the asset was trading at $0.2641, up 4% in the last 24 hours. Although the price has been bullish on the 12-hour chart, this bullish order block may undermine the momentum.

The bearish order block at $0.2654: can bulls bypass it?

ADA was trading between $0.2415 – $0.2671 since mid-December 2022. At the time of writing, ADA threatened to break out above this range. However, the obstacle around the bearish order block at $0.2654 remained.

The Relative Strength Index (RSI) moved well above the midpoint, indicating increased buying pressure. Accordingly, the Directional Movement Index (DMI) showed that buyers (green line) had more influence on the market at 27.

The On-Balance Volume (OBV) also showed an increase, indicating that trading volumes were increasing and adding to the buying pressure.

So, Cardano bulls may try to break the bearish order block at $0.2654. If they succeeded, they would also have to overcome the immediate hurdle of $0.2671. However, this would require the OBV breaking above the 29.3 volume mark.

The bears could take the lead if the bulls fail to overcome the $0.2654 level. Such a downward movement would invalidate the bias. Nevertheless, such a downtrend could settle around the $0.2595 level or drop below to the $0.2530 level if the selling pressure increased.

How many ADAs can you get for $1?

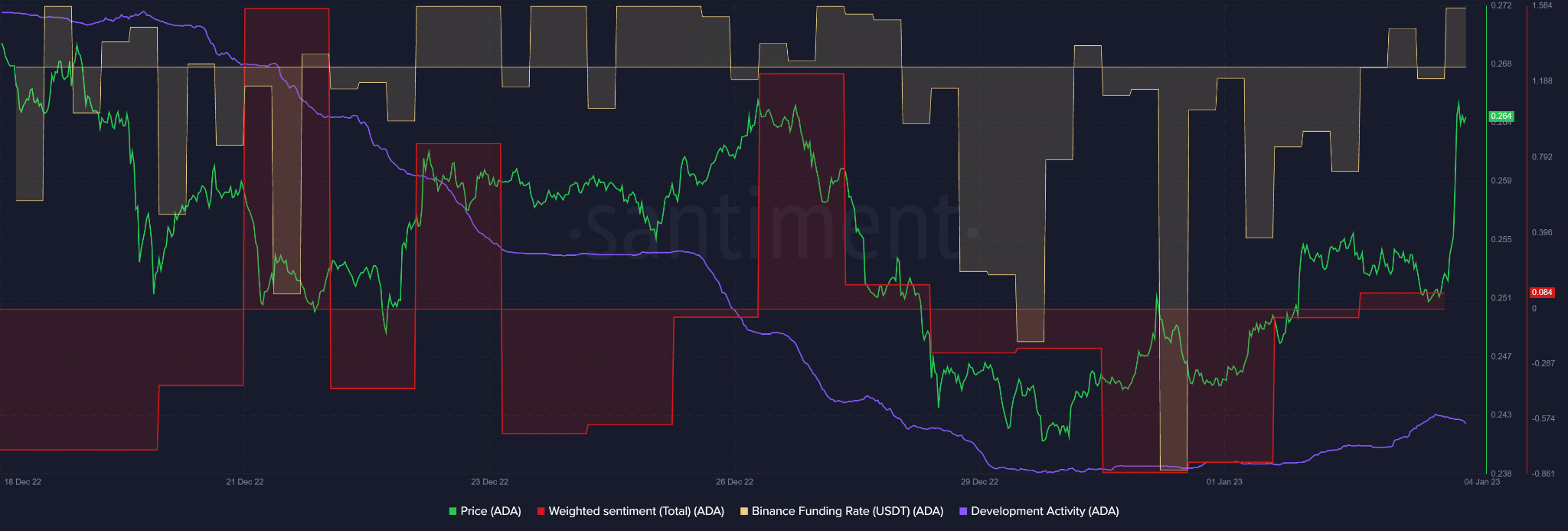

Cardano development activity and ADA price have steadily declined since mid-December

ADA prices fell with declining development activity on the blockchain since mid-December, as shown by Santiment.

Read Cardano’s [ADA] Price Prediction 2023-24

However, there was a slight increase at press time, followed by a downward trend. The slight increase in development activity may have influenced the recent prices to rise and improved investor confidence, as shown by the improved weighted sentiment.

ADA also saw an increase in demand in the derivatives market, as shown by the Binance Funding Rate, which moved to the positive side. But could the slight decline in development activity derail the continued upward trend?

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Wrapped eETH

Wrapped eETH  WETH

WETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic