- ETH whales make AAVE one of the top 10 purchased coins of the week.

- AAVE might witness a bullish divergence this week.

Aave’s [AAVE] performance this week indicated a continuation of the bearish trend that started last week. So far, the coin has failed to secure enough buying pressure to recover November losses. But it is not all doom and gloom, now that ETH whales have increased their demand.

Read Aave’s [AAVE] Price Prediction 2023-24

WhaleStats revealed that AAVE was one of the top 10 most-purchased tokens among the 500 biggest ETH whales in the last 24 hours. Why is this an important observation?

Well, ETH whales have a massive impact on demand and prices in DeFi. The WhaleStats observation might thus signify that ETH whales find AAVE to be attractive at its current price point.

JUST IN: $AAVE @AaveAave now on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs

Peep the top 100 whales here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see data for the top 500!)#AAVE #whalestats #babywhale #BBW pic.twitter.com/3KASt8SJP7

— WhaleStats (tracking crypto whales) (@WhaleStats) December 13, 2022

Is AAVE on the path to a bullish breakout?

This new revelation about ETH whales meant AAVE was building up bullish demand at the time of writing. This made it one of the most interesting tokens to watch for towards mid-week, as this might trigger a resurgence of bullish demand and more volatility. But investors need to look at where AAVE was in terms of price activity to understand the potential impact.

AAVE’s $60.16 press time price represented a slight premium from its $58.25 low in the last 24 hours. This confirmed that there was indeed some bullish pressure coming into the market. But was it enough to support more upside?

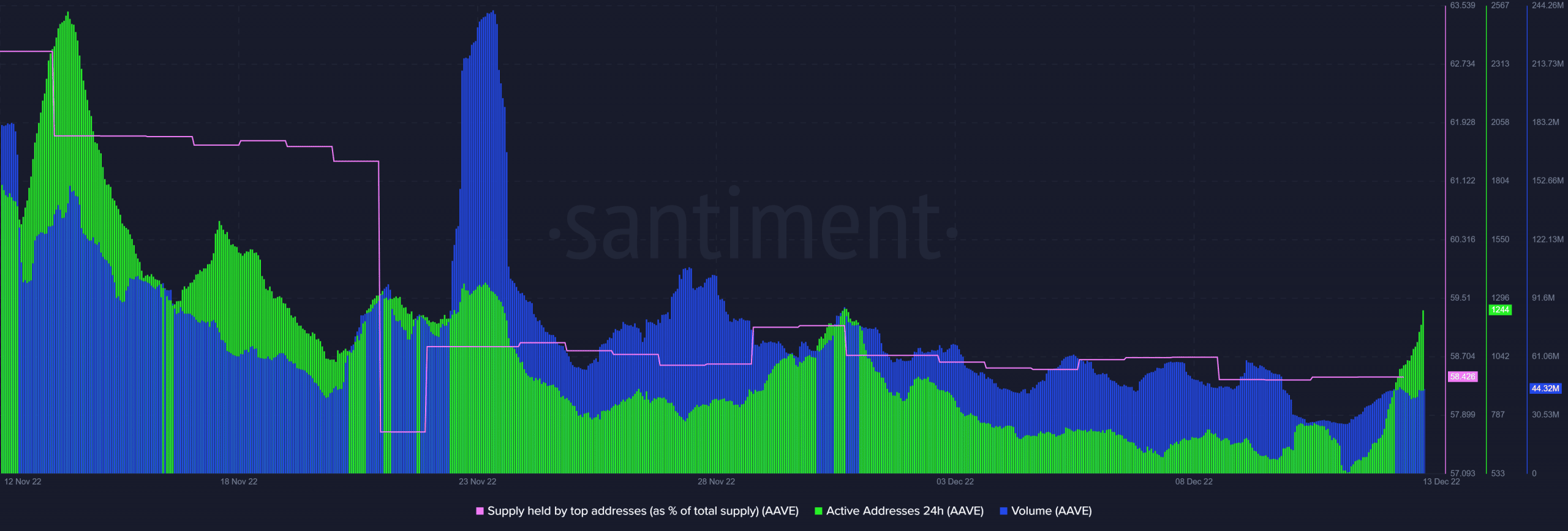

AAVE’s volume registered a slight uptick in the last 24 hours, confirming its increased trading activity. However, the uptick was relatively low, thus explaining why the price did not achieve a substantial bounce. Despite this, there was a sizable increase in the number of daily active addresses.

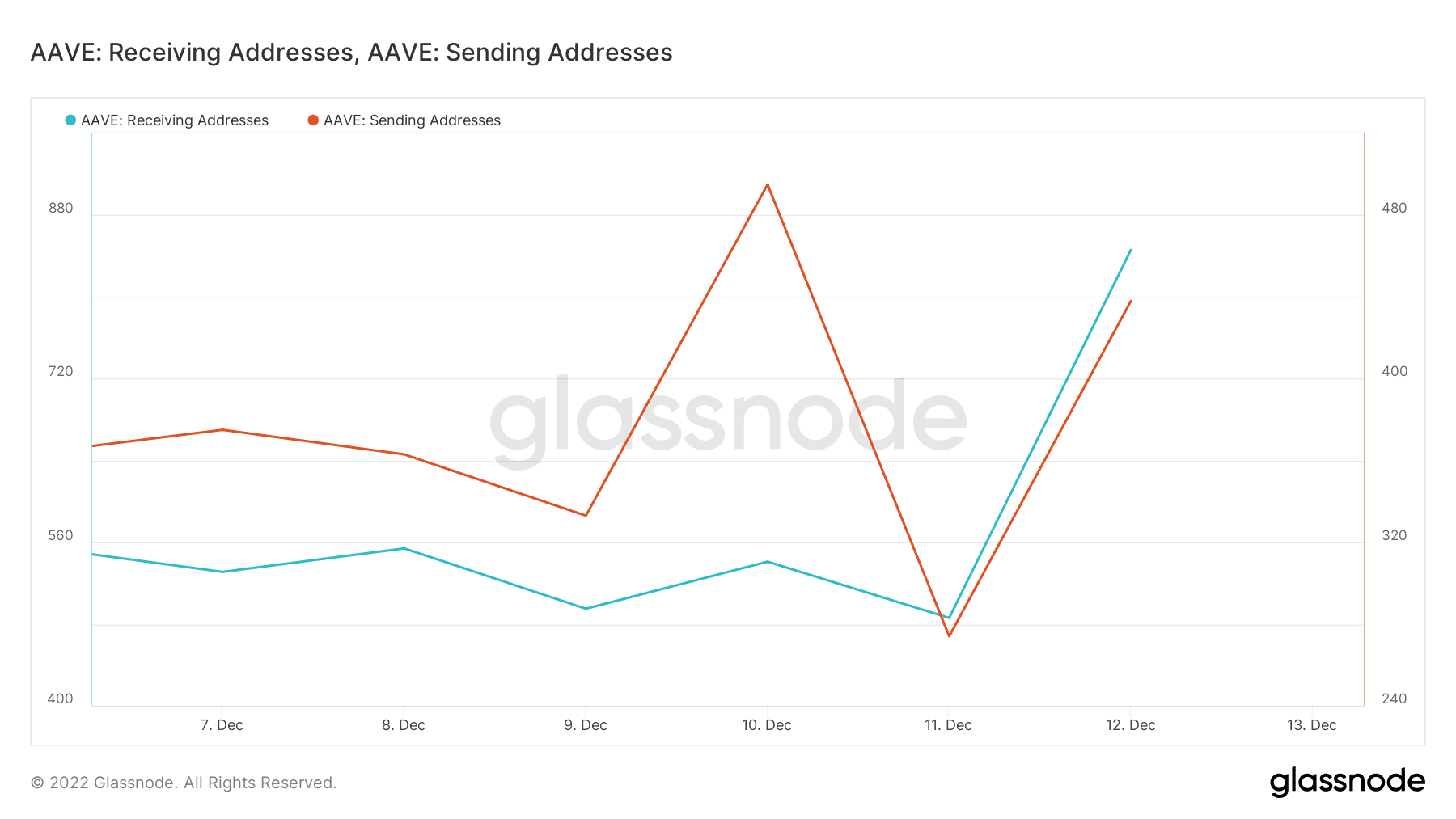

AAVE investors may find it interesting that the coin’s address flows increased in the last 24 hours until press time. Even more noteworthy is that receiving addresses outweighed the sending addresses by almost double. In other words, there is a net higher buy pressure than sell pressure in the market.

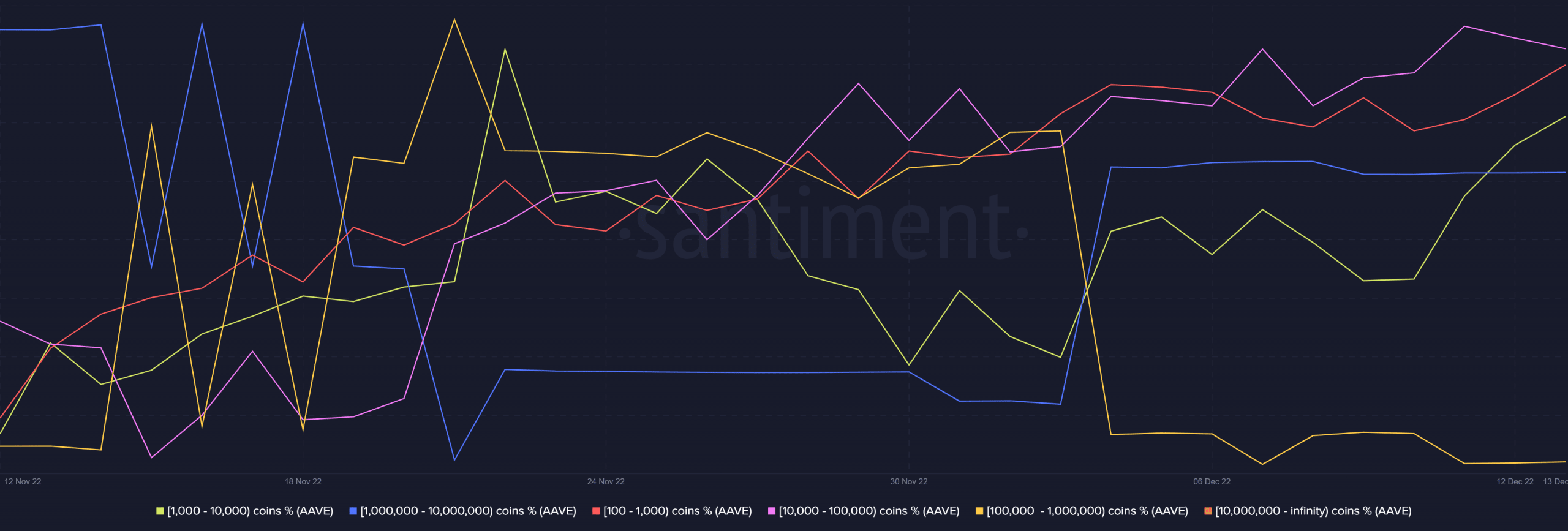

The supply distribution side of things revealed that most top addresses have not added or subtracted from their balances in the last 24 hours.

This is particularly the case for addresses holding 100,000 – 10 million AAVE. Nevertheless, there was some selling pressure from addresses in the 10,000 – 100,000 bracket.

Addresses in the 100 – 10,000 range have steadily accumulated in the last two days, thus canceling out most of the selling pressure.

What to expect moving forward

The above observations might indicate that investors were increasing their demand for AAVE as of 13 December. Thus, the coin may experience more volatility in the next few days if the same trend continues. The fact that the current demand is backed by ETH whales is already good news for AAVE bulls.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  NEAR Protocol

NEAR Protocol  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic