Join Our Telegram channel to stay up to date on breaking news coverage

Zcash (ZEC) is trading with a bearish bias on Wednesday. The Zcash price is down 4% to $44.56 over the past 24 hours. The total crypto market cap is down 1.63% on the day to $839.9 billion. The total crypto market volume is $38.11 billion, which makes a 1.82% increase over the last 24 hours, according to data from CoinMarketCap.

Major cryptocurrencies are also turning down with Bitcoin (BTC) trading at $16,776, down 1.37% on the day. The largest altcoin by market capitalization Ethereum (ETH) was exchanging hands at $1,226 after dropping 2.77% in the past 24 hours.

The biggest losers among the top cap cryptos were Aptos (APT) down 8.07% to $4.6, 96th placed Celo (CELO) which has lost 7.67% on the day to trade at $0.5977, and Fantom (FTM) which had plunged 7.4% to $0.2322.

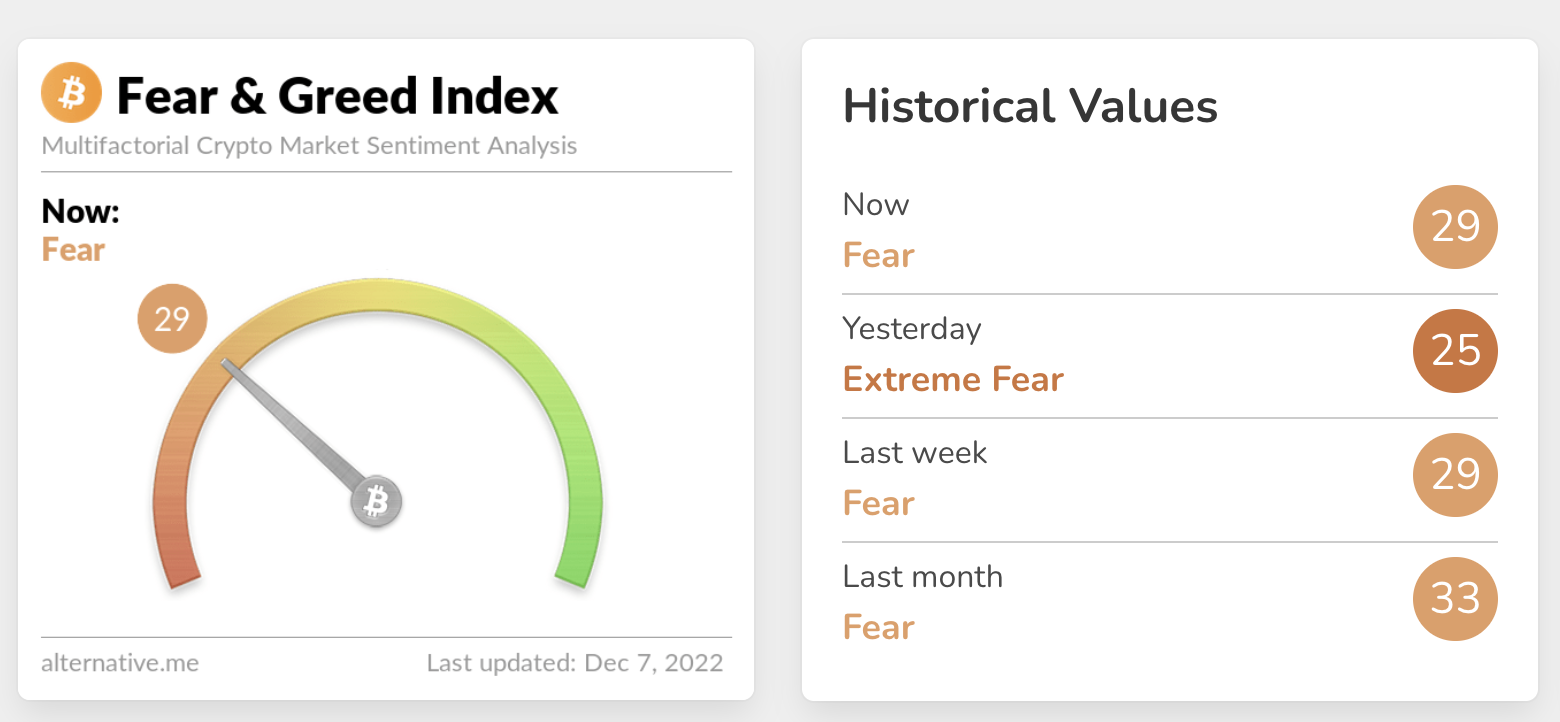

The plummeting crypto prices point to negative sentiments that still dominate the market. According to data from Alternative, the Crypto Greed and Fear Index is in the “Fear” zone at 29. Although this is a slight improvement from yesterday’s value at 25 which placed the index in the “Extreme Fear” zone, it shows that emotions and sentiments about the crypto market are largely negative even as the crypto winter rages.

Crypto Greed And Fear Index

According to Alternative, “Fear” can be a sign that traders are worried and they respond to market uncertainties by offloading risk-on assets like cryptocurrencies, minimizing the possibility of losing their investments. However, the sentiment and emotions analysis firm also points out that fear scenarios present “a buying opportunity” as strategic investors get in on the dip acquiring the assets at discounted rates.

The FTX Debacle Continues To Hurt Crypto Prices

While this may be true for ZEC, the price has been severally rejected by the $46.5 resistance level over the past six days. This level is the most likely explanation for the ongoing correction that has seen Zcash price trade in a second straight bearish session as shown on the daily chart.

On the one hand, market participants are relieved that ZEC is trading 34% above the $32.8 low hit on November 9, but it must be frustrating to be turned away by the same barrier the whole week. Adding to the price rejection, traders’ moods took a turn for the worse after U.S. senators reportedly requested Silvergate Bank to provide information regarding its relationship with the defunct FTX exchange.

Three lawmakers in the U.S. upper house raised concerns following reports that “ Silvergate facilitated the transfer of FTX customer funds to Alameda”. The bank has until December 19 to respond.

On December 5, reports from NBC News revealed that the Silvergate Bank had made claims that it was a victim of FTX and its corporate sibling Alameda Research’s apparent mismanagement and misuse of customer funds.

Investor sentiments remained negative; it was reported that the UK Treasury was making final touches on guidelines aimed at restricting foreign cryptocurrency sales. The regulations will give the Financial Conduct Authority (FCA) the ability to monitor operations in the region. The rules are being formulated as part of the financial services and markets bill.

From a technical outlook, it appears that ZEC is losing the $44.79 support, but as highlighted on the daily chart, the ascending channel is still key, making the altcoin bullish. Let’s analyze the Zcash price action to understand whether the bearish newsflow has negatively impacted the ZEC market’s sentiment.

Zcash Price Analysis: ZEC Faces Stiff Resistance Upward

After reaching a high of $56.8 on November 5, the Zcash crypto lost as much as 42% of its market value to hit lows of around $32.8, in the wake of the FTX/SBF/Alameda Research debacle. Since then, bulls have made several attempts at recovery with the last attempt that started on November 29 taking the altcoin toward the $46.5 resistance barrier.

This price action has seen ZEC record a series of higher highs and higher lows over the past month, leading to the appearance of an ascending parallel channel. As such, as long as the Zcash price remains within the confines of the ascending channel, it will continue to rise.

This is because an ascending parallel channel is considered a significantly bullish chart pattern that is formed when an asset forms a series of higher highs and higher lows as already seen on ZEC’s daily chart. A bullish breakout is confirmed when the asset’s price rises above the upper boundary of the prevailing chart pattern.

At the time of writing, the ZEC price traded at $44.56 and appeared to be fighting immediate resistance from the $44.5 level, embraced by the 50% Fibonacci retracement level. One of the stiffest roadblocks is found at the $45.80 level, where the 50-day simple moving average (SMA) and the middle boundary of the rising channel appeared to converge.

Zcash bulls would need support from the wider market to push the price past the said level first toward the 61.8% Fibonacci level at $47.6 and later to the upper boundary of the channel (which is also the optimistic target of the technical chart pattern) at $49.

As mentioned earlier, rising above this level would open the way for a bullish breakout with the bulls eyeing a return to the November 6 range high above $56. Such a move would represent a 28% uptick from the current levels.

However, before recording such gains ZEC would have to confront resistance from additional barriers in its path such as the $51.69 level, embraced by both the 100-SMA and the 78.6% extension level. Beyond that, traders may move to collect the liquidity between the $51.68 and the $56.8 levels, to complete the Fibonacci retracement.

ZEC/USD Daily Chart

From the analysis above, it is evident that there are several barriers that may stifle ZEC’s recovery journey. Apart from the downfacing moving averages, Wednesday’s long red candlestick on the daily indicates that the market favors the downside.

In addition, the relative strength index (RSI) was facing down and was just about to cross the midline into the negative region, suggesting that the bears had returned to the scene. Note that the Zcash price’s downward momentum will get more traction once the RSI crosses the middle line into the negative region.

As such, if the bears sustain the ongoing correction, ZEC may drop below the $44 psychological level to tag the 38.2% Fibonacci retracement level at $41.95. Later, the price may drop toward the $38.4 support floor, where the 23.6% extension level sits or lower to tag the $32.86 swing low.

Investors could expect Zcash to take a breather here. This will give late investors a chance to buy ZEC at a discounted price before another move upward is initiated.

Zcash is a blockchain network developed on the Bitcoin codebase and offers enhanced security and privacy for users. It is one of the leading privacy-centric crypto networks that have great potential to provide a better return in the long term.

Promising Tokens On Presale

From the Zcash price analysis above, it is evident that the bearish conditions in the market are likely to continue in the near term. The FTX contagion continues and the uncertainties in the macro environment are doing little to irk investor optimism. The headwinds continue to increase leaving crypto investors with less profitable projects to pump their capital into.

As such, there are some interesting tokens currently on pre-sale in the crypto space with the potential to increase investors’ returns once they are listed on exchanges. An example of such crypto with an optimistic outlook is the IMPT token, whose presale is ongoing.

The IMPT team has so far raised $14.5 million since its token sale began at impt.io on October 3 with $350,000 raised in the last 24 hours alone. There are only 4 days left to buy this “green” token at an early low price before its first crypto exchange listings on LBank, Changelly Pro, and Uniswap which are now scheduled for December 14.

🚨 ANOTHER MAJOR MILESTONE ACHIEVED 🚨

🔥 $14.5 MILLION RAISED 🔥

TAKE PART IN THE PRESALE NOW – YOU DON’T HAVE MUCH TIME LEFT! 🚀

🗓 THE PRESALE ENDS ON THE 11TH OF DECEMBER!

JOIN NOW ⬇️https://t.co/8KSvC4GHjF pic.twitter.com/cKa9q13jXu

— IMPT.io (@IMPT_token) December 7, 2022

As a bonus, the Impact Token team is running a giveaway promo of 100K. Hurry up and take part in this giveaway so that you don’t miss out on an exciting opportunity.

Similarly, Dash 2 Trade comes in as well among these promising tokens. It is a blockchain-based crypto trading platform that enables the creation and testing of trading strategies for traders and investors to make informed market decisions. Dash 2 Trade is designed to take your crypto trading to the next level by providing data-based crypto signals.

The team behind D2T has so far raised $8.85 million with over 99.79% of the tokens sold in stage 3 of the presale, with $400,000 raised in the past 24 hours. Don’t miss out on this opportunity to buy D2T at a discounted price as the price is set to increase to $0.0533 in stage 4 of the presale.

With a trading intelligence platform like Dash, looming disasters like the collapse of FTX can be spotted before they occur and help traders and investors to secure their assets and make market-beating returns.

Related News:

Dash 2 Trade – High Potential Presale

- Active Presale Live Now – dash2trade.com

- Native Token of Crypto Signals Ecosystem

- KYC Verified & Audited

Join Our Telegram channel to stay up to date on breaking news coverage

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Polkadot

Polkadot  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Sui

Sui  WETH

WETH  Uniswap

Uniswap  Litecoin

Litecoin  NEAR Protocol

NEAR Protocol  Pepe

Pepe  LEO Token

LEO Token  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  USDS

USDS  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Filecoin

Filecoin  Arbitrum

Arbitrum  Ethena USDe

Ethena USDe  Eigenlayer

Eigenlayer  Render

Render  Algorand

Algorand  Aave

Aave  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Celestia

Celestia  Hyperliquid

Hyperliquid