The U.S. Bureau of Labor Statistics (BLS) released nonfarm payroll data showing 263,000 jobs were added in November.

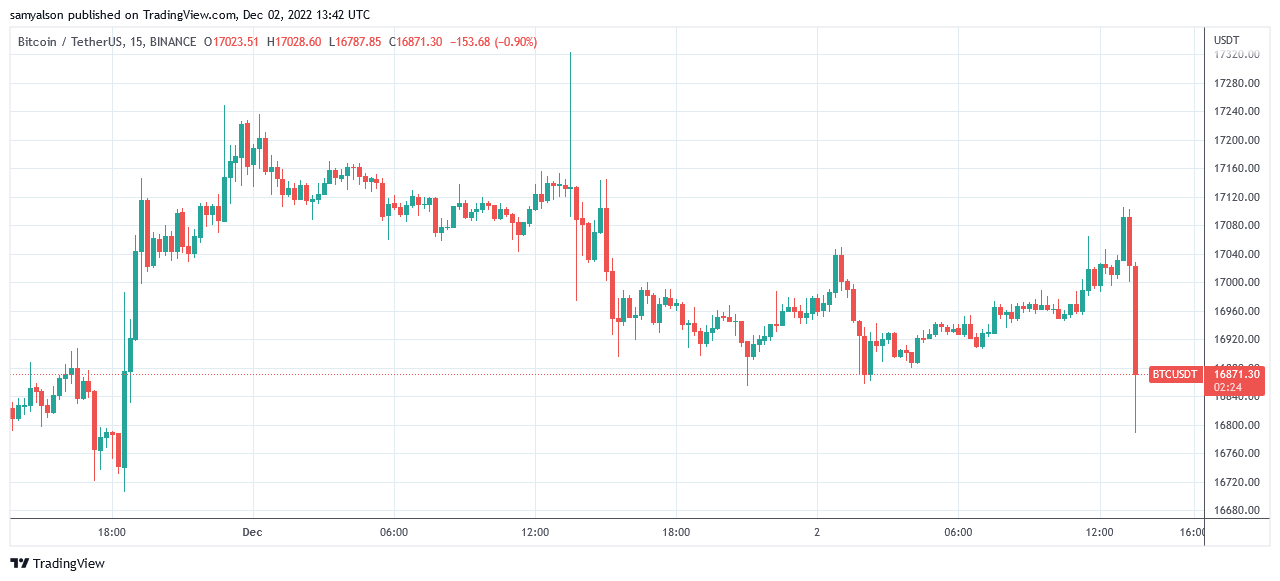

As an initial response, Bitcoin recorded a 1.4% swing to the downside, finding support at $16,780.

Jobs growth puts more pressure on the Fed

U.S. nonfarm payroll was forecast to rise by 200,000 for November. The prior month saw a better-than-expected 261,000 additional nonfarm jobs added.

On Nov. 2, the Fed enacted a fourth consecutive 75 basis point hike, in part, due to continued buoyancy in the U.S. labor market.

However, expectations of a slowdown in the labor market renewed hope that the pace of rate hikes may ease. Agron Nicaj, Economist at MUFG bank, echoed this view. However, he also pointed out that inflation is far from under control.

“The Fed might slow down the pace of rate hikes, but they are not at a point where they are going to completely stop.”

However, with November recording better-than-expected jobs figures again, hopes of an easing of rate hikes have faded.

Bitcoin drops

In the run-up to the release of BLS data, Bitcoin had been trending higher from a local bottom of $16,850. The uptrend topped out at $17,100 on the eve of the payroll announcement.

The ensuing 13:30 (UTC) candle saw bears drop the price of Bitcoin to $16,780 at the time of press.

Read More: cryptoslate.com

Vana

Vana  Polymesh

Polymesh  Ravencoin

Ravencoin  CoinEx

CoinEx  Toshi

Toshi  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Hamster Kombat

Hamster Kombat  DigiByte

DigiByte  Elixir deUSD

Elixir deUSD  yearn.finance

yearn.finance  Osmosis

Osmosis  aelf

aelf  Kadena

Kadena  Babylon

Babylon  Metaplex

Metaplex  Chia

Chia  Peanut the Squirrel

Peanut the Squirrel  GoMining Token

GoMining Token  ORDI

ORDI  Binance-Peg SOL

Binance-Peg SOL  RCGE

RCGE  Fluid

Fluid  Enjin Coin

Enjin Coin  Echelon Prime

Echelon Prime  Level USD

Level USD  Treehouse ETH

Treehouse ETH  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Kula

Kula  KOGE

KOGE  Bridged Ether (StarkGate)

Bridged Ether (StarkGate)  Drift Protocol

Drift Protocol  GMT

GMT  Orca

Orca  Maple Finance

Maple Finance  Euler

Euler  LCX

LCX  NEM

NEM  Horizen

Horizen  crvUSD

crvUSD  GMX

GMX  EthereumPoW

EthereumPoW  Falcon USD

Falcon USD  Kinesis Gold

Kinesis Gold  Constellation

Constellation  Alchemist AI

Alchemist AI  Conscious Token

Conscious Token  Freysa AI

Freysa AI