- TRON’s Galaxy Score looked optimistic

- TRX’s Relative Strength Index (RSI) was oversold, which was bullish

According to a report by LunarCrush, TRON [TRX] had made it on the list of cryptos that had the highest Galaxy score. This was optimistic for TRX, as it indicated a price pump in the coming days.

Top 10 coins by 1-week Galaxy Score™$btc #bitcoin$eth #ethereum$xrp #xrp$ltc #litecoin$bch #bitcoincash$bnb #binancecoin$usdt #tether$xlm #stellar$ada #cardano$trx #tronhttps://t.co/Gjsp6UpP6J

— Cuopnuiok (@cuopnuiok) November 21, 2022

Read TRON’s [TRX] Price Prediction 2023-2024

Though this development did not have any effect on TRX’s chart, it was interesting to see what might be ahead for TRX in the last weeks of 2022. At the time of writing, TRX had registered a negative 1.6% growth in the last 24 hours and was trading at $0.05065 with a market capitalization of more than $4.6 billion.

Interestingly, TRON also updated its weekly statistics, which had some notable information about its ecosystem. For instance, the platform recently successfully completed its ‘Hacker House’ event at Harvard University and finished its project submission for TRON Hackathon 2022 season 3.

While these developments looked pretty promising for TRX, let’s have a look at TRON’s on-chain metrics to better understand the current market.

Is a TRX revival possible?

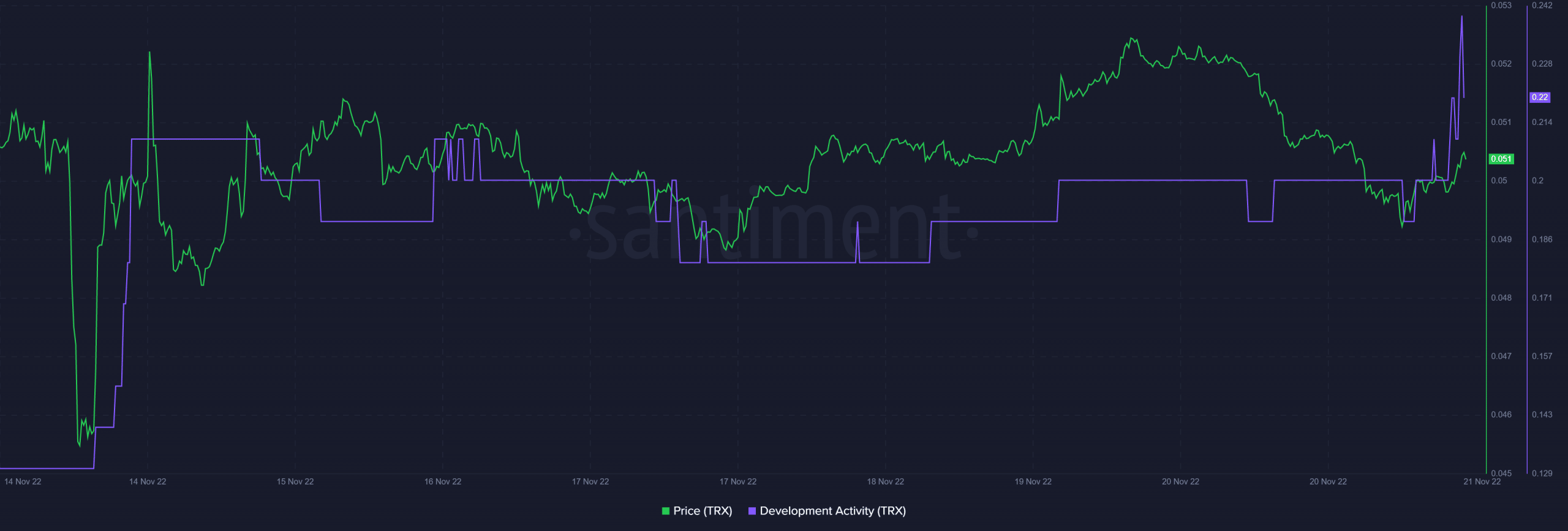

CryptoQuant’s data revealed that TRX’s Relative Strength Index (RSI) was in an oversold position, which looked bullish. This painted a positive image for TRX as it indicated a trend reversal in the near future. Moreover, TRON’s development activity also went up over the last week, which was by itself a positive signal for the blockchain.

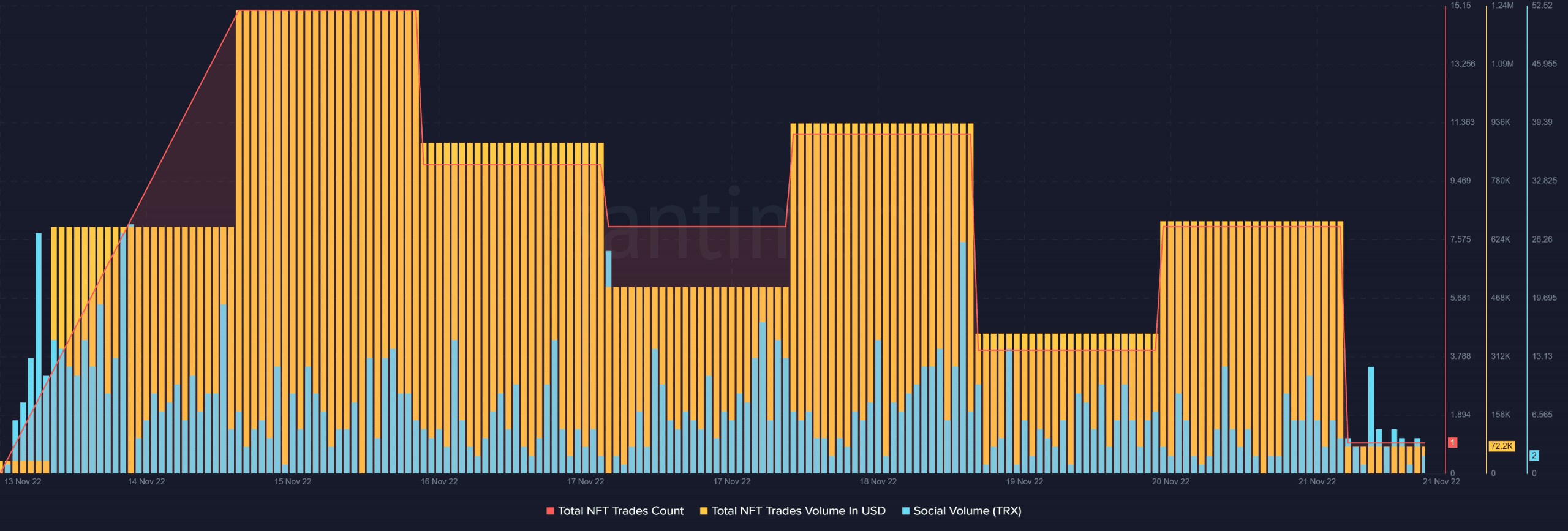

Nonetheless, the rest of the metrics were against a price surge. TRON’s NFT ecosystem witnessed a decline over the last week as its total NFT trade count and trade volume in USD, after spiking, registered a decline.

Furthermore, TRX also failed to maintain its popularity in the crypto community as its social volume decreased over the last few days.

Proceed with caution!

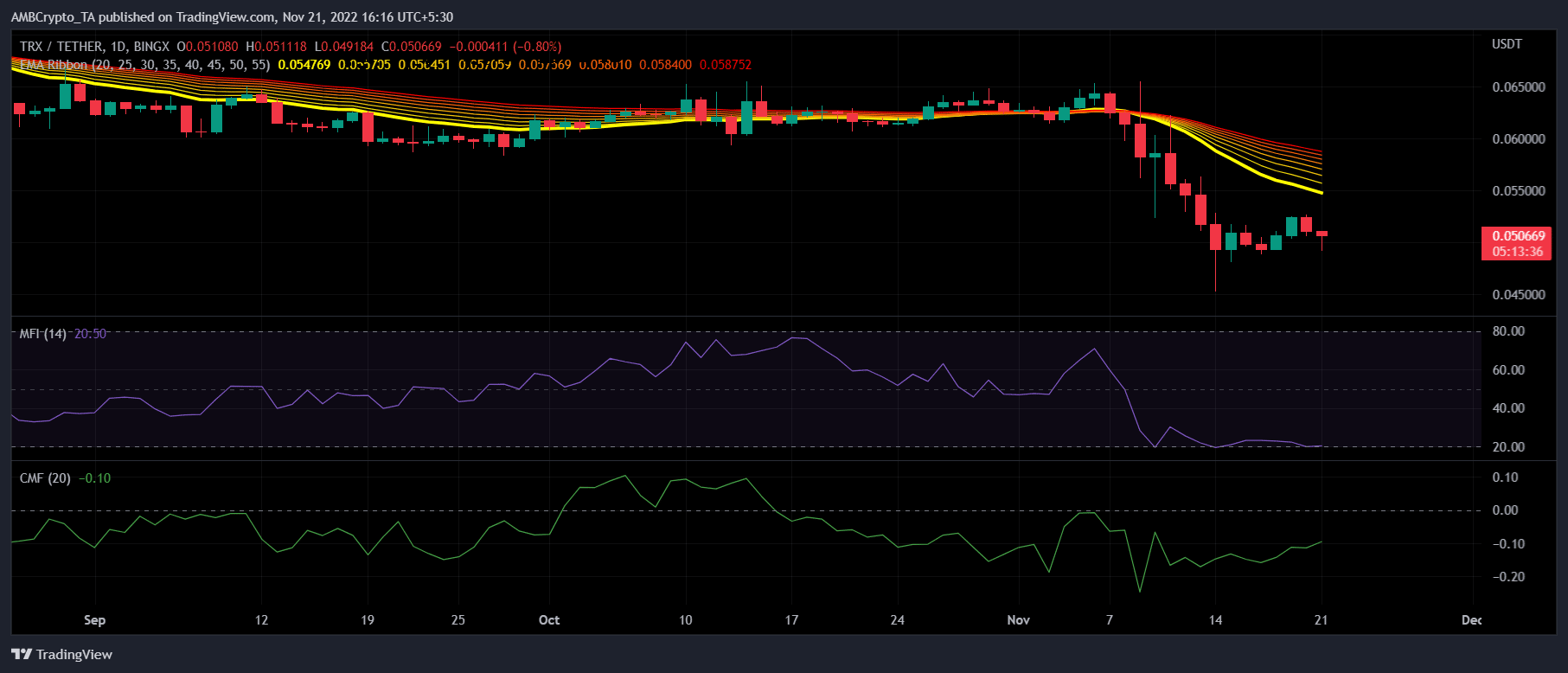

TRX’s market indicators showed a sign of revival, but caution was still suggested as the readings flashed mixed signals. The Exponential Moving Average (EMA) Ribbon revealed that the bears had an edge.

On the contrary, the Money Flow Index (MFI) was resting just below the oversold zone, thus increasing the chances of a northbound price movement. The Chaikin Money Flow (CMF) also registered an uptick, which looked promising for TRX.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub  Stacks

Stacks  MANTRA

MANTRA  OKB

OKB