- Litecoin Network recently processed its 135,000,000th transaction

- LTC’s market indicators favored a bullish stance for the alt

Litecoin [LTC] recently achieved a milestone by flipping Solana [SOL] to become the 15th largest cryptocurrency in terms of market capitalization. As per CoinMarketCap, at press time, LTC was trading at $60.71 with a market cap of more than $4.37 billion.

LTC’s weekly performance also looked pretty promising, as its price increased over 8% in the last seven days. However, can this new achievement stand as a consequence of Solana’s downfall, or was something actually working in favor of Litecoin? A look at LTC’s on-chain metrics gave a clearer picture of the entire situation.

Read Litecoin’s [LTC] Price Prediction 2023-2024

Good days to follow LTC?

According to the Litecoin Foundation’s latest tweet, the Litecoin Network just processed its 135,000,000th transaction. This, too, was a remarkable milestone, as it represented the reliability of the network, that had been live for over a decade now.

The Litecoin Network just processed its 135,000,000th transaction.

Over 11 years of continuous immutable, uncensorable, flawless uptime. pic.twitter.com/bMbcp7ecHg

— Litecoin Foundation ⚡️ (@LTCFoundation) November 20, 2022

Since all these developments looked optimistic for LTC, let’s dive into the altcoin’s metrics to understand whether the recent price pump was sustainable.

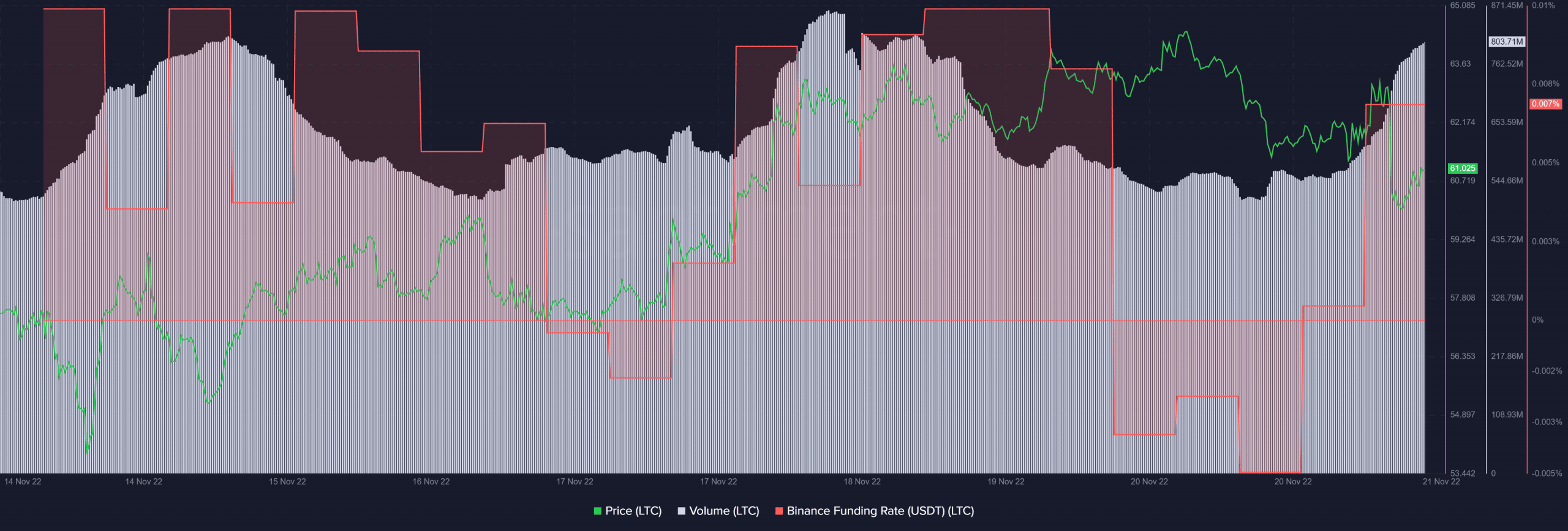

Litecoin’s volume registered an uptick lately, which was good news for the network. Not only that, but LTC’s Binance funding rate also went up, reflecting higher interest from the derivatives market.

Nonetheless, not everything was working in LTC’s favor. This was because a few metrics revealed the possibility of a downtrend. At press time, LTC had already registered over 4% negative daily gains, further increasing the chances of a bearish takeover.

Furthermore, LTC’s Market Value to Realized Value (MVRV) Ratio also registered a slight downtick recently. This could be taken as a bearish signal. Moreover, the coin‘s weighted sentiment also followed the same path and marked a decline, reflecting less popularity for the coin in the crypto community.

Things could get interesting for LTC because…

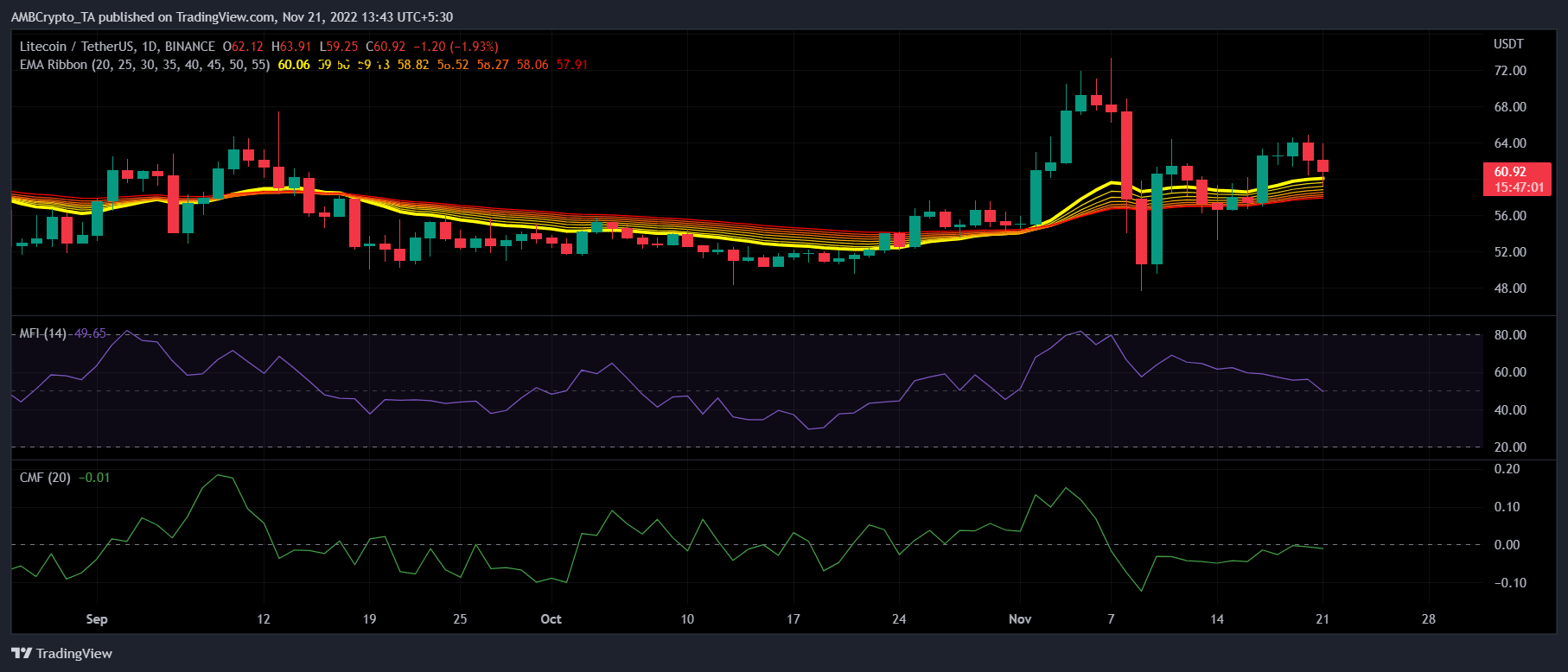

Interestingly, though a few of the metrics were unsupportive of LTC, market indicators provided much-needed relief. The Chaikin Money Flow (CMF) was resting just at the neutral mark, opening up the possibility of an uptrend. Moreover, the Exponential Moving Average (EMA) Ribbon revealed that the bulls were leading the market as the 20-day EMA was above the 55-day EMA.

Read More: ambcrypto.com

![Litecoin [LTC] achieves a new milestone: Did SOL help its rally?](https://ambcrypto.com/wp-content/uploads/2022/11/LTC-1-1000x600.png)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub  Stacks

Stacks  MANTRA

MANTRA  OKB

OKB