- Magic Eden displayed continued dominance among NFT marketplaces

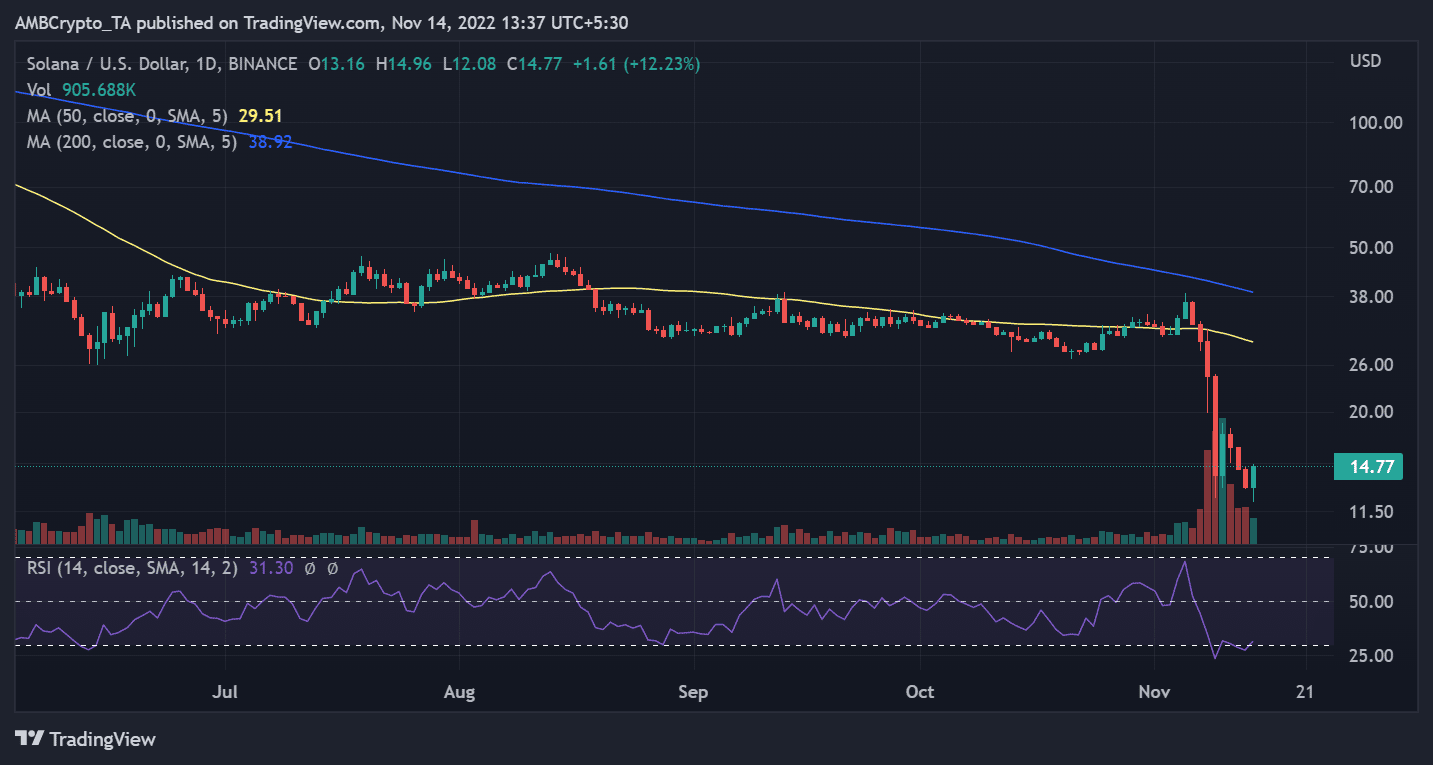

- Solana showing positive signs as the price shows a 10% recovery

Solana [SOL] had been mired in a number of controversies over the past few weeks, including FTX‘s collapse and the token unlock news. All of this news could have thus, contributed to the decline of the SOL token.

Still, new data from Messari suggested that the Solana Non-Fungible Token (NFT) space might have been able to weather the storm. This was despite all the simmering concerns.

Magic Eden leads the pack

According to a tweet by Messari on 13 November, Magic Eden had been the dominant NFT marketplace on the Solana chain. This was because it controlled over 75% of trade volume in the past month. A few other related marketplaces also witnessed some growth in terms of volume.

.@MagicEden still dominates @Solana NFT trading volume, gaining close to ~78% market share.@hadeswap has climbed to third place out of the “best of the rest” Solana marketplaces, signaling that bonding curve pricing marketplaces may be fit for low-fee chains. pic.twitter.com/cPM12GrQC2

— Messari (@MessariCrypto) November 13, 2022

DappRadar data showed that Magic Eden’s market dominance went much beyond the Solana ecosystem. The Solana NFT marketplace was second in the rankings of markets in terms of transaction volume in the seven-day interval, only behind OpenSea.

Analyzing the same data over a 30-day period showed that Magic Eden was still trailing Opensea in total trade volume. Although OpenSea still has a larger daily trading volume by millions of dollars, this statistic could be considered as a testimony to the continued rise of Magic Eden.

Although Solana as a whole seems to be receiving unfavorable press at the moment, Magic Eden’s success may provide the network with much-needed relief. One plausible explanation for the Solana NFT marketplace’s predominance could be that the platform opted for optional royalties.

This action was taken in reaction to the royalty dispute that swept the NFT industry, in which certain platforms enforced royalties and others left that decision up to the user. Magic Eden was among the latter.

Also, the platform was built on Solana, which meant that the fees for minting NFTs were going to be lower than they were on OpenSea, which is based on Ethereum. Additionally, the network’s speed makes the platform a favorite of NFT developers and traders. But how does this reflect on the overall Solana NFT metrics?

Is the magic spreading to Solana?

Considering the aggregate NFT trading volume of Solana on Santiment, the network witnessed a respectable volume. A closer check of the data revealed that the volume had dropped. However, it the sales in the millions of dollars over the past few days still gave the ecosystem some standing. There was a noticeable increase on the graph on September 28 of $5.6 million.

More FTX drama, but SOL forging ahead

It seemed that the FTX scandal was still weighing Solana down even as the company made efforts to recover. Recently released information indicated that the FTX breach had also affected Serum, a liquidity hub in Solana. According to a statement made by Magic Eden, the company temporarily suspended SFT listings and trade on the platform for security reasons.

🧵/ Due to reports of FTX’s compromised security, we did an audit to see how we could protect our users

– Your NFTs are safe & secure

– @ProjectSerum, a program we use for SFT trading, may have been affected. To be safe, we temporarily disabled SFT listings & sales on @MagicEden https://t.co/Dcbs1SB8i6— Magic Eden 🪄 (@MagicEden) November 13, 2022

Solana’s co-founder Anatoly Yakovenko also updated the community, and said that the developers who relied on serum were forking the application.

Afaik, the devs that depend on serum are forking the program because the upgrade key to the current one is compromised. This has nothing to do with SRM or even Jump. A ton of protocols depend on serum markets for liquidity and liquidations.

— toly 🇺🇸 (@aeyakovenko) November 12, 2022

According to TradingView, SOL was trading slightly above $14 at the time of this writing in a daily timeframe. Notably, the price of SOL had increased by over 10% within the last 24-hour period.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Polkadot

Polkadot  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  WETH

WETH  Sui

Sui  Litecoin

Litecoin  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Pepe

Pepe  LEO Token

LEO Token  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  USDS

USDS  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Filecoin

Filecoin  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Render

Render  Eigenlayer

Eigenlayer  Algorand

Algorand  Hyperliquid

Hyperliquid  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Aave

Aave  Celestia

Celestia