The dust may not have quite settled post Fed FOMC meeting gloom, but at least Bitcoin seems to have for now. Meanwhile tokens representing Polygon, Arweave and Fantom have been surging.

Bitcoin and Ethereum both seem to be holding up okay at present, actually. Although the US Dollar Index (DXY) looks to be threatening to make another move up as we speak. De-correlation narrative, anyone?

Looking at a few options here in which markets continue to correct (as $DXY shows strength).

In that case I’d be looking at $19.6K-20K area for longs on this one.

Buy the dip season on #altcoins, then. pic.twitter.com/TwZFlYtQAa

— Michaël van de Poppe (@CryptoMichNL) November 3, 2022

It was almost as if the #FederalReserve saw the market rallying on the initial statement (change in language) and then had #JeromePowell come out and push the markets lower. Fed wants asset prices to stay down. If markets rally, inflation will be harder to get under control.

— Gareth Soloway (@GarethSoloway) November 3, 2022

Onto some crypto market price action…

Top 10 overview

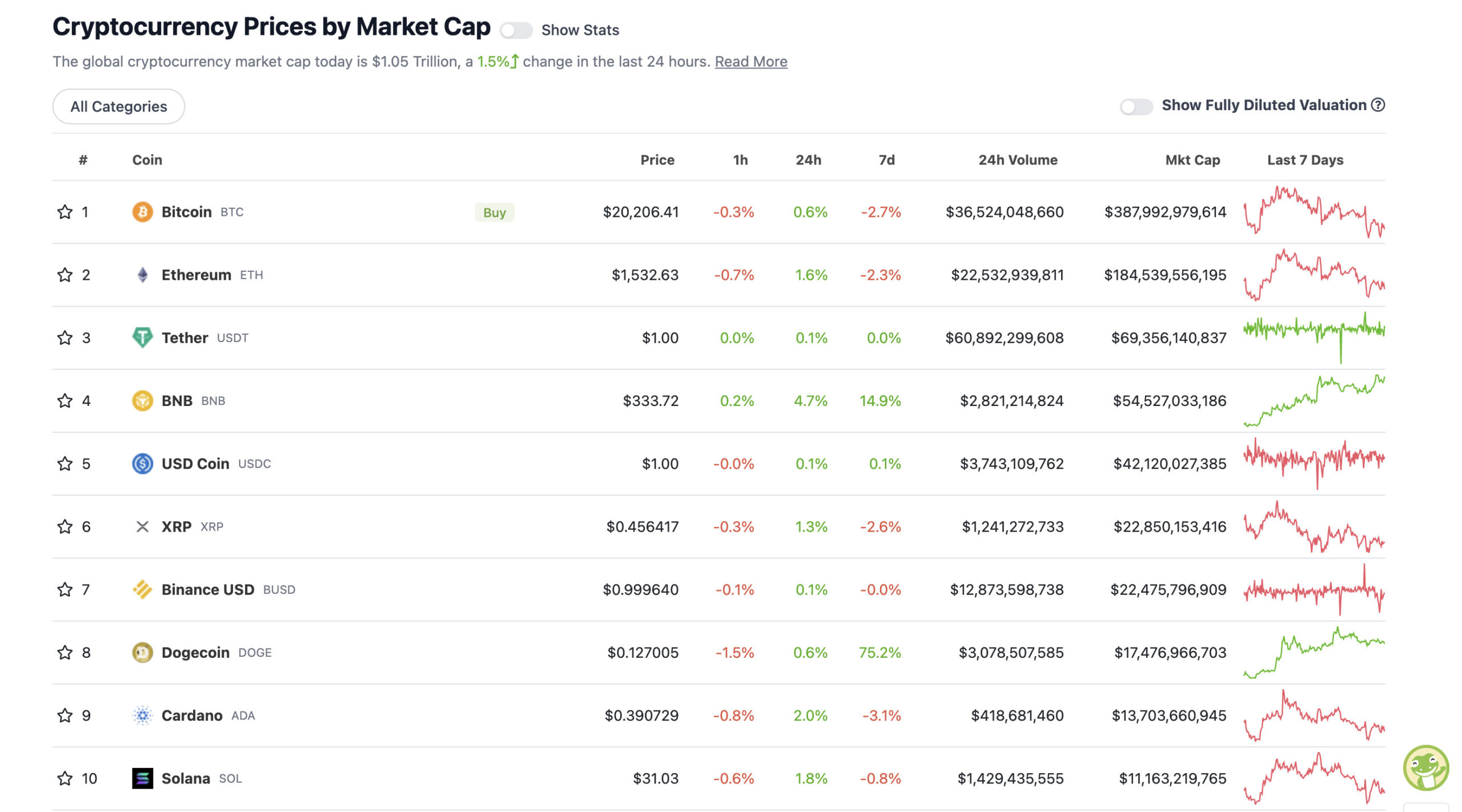

With the overall crypto market cap at US$1.05 trillion, up about 1.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

DOGE continues its pullback today after recent exuberance – probably not hugely surprising. Still one to watch, though, as that Twitter-owning “Dogefather” billionaire bloke has a way of spurring unpredictable price movements.

As for bull goose crypto Bitcoin, it might have surprised the odd bearish trader post Fed meeting by maintaining a stronghold above US$20k. That said, best not to get too complacent on that.

Popular Twitter-dwelling trader Crypto Tony did predict more consolidation – along with another big dip (US$14k seems to be a popular BTC drawdown-prediction target)… and then, erm, a bull run.

My main bias has not changed as i expect more consolidation and one more drop to produce a spring like motion to kick start the bull run pic.twitter.com/n0FYKxvtge

— Crypto Tony (@CryptoTony__) November 3, 2022

Sunshine, rainbows and pots of digital gold for all Bitcoin and altcoin holders coming up after some more market pain? Not calling it. Staying alert, though.

It would be ironic if markets rallied after Powell’s attempt to squash any hope at Wednesday’s #FOMC.

I’m not ruling it out. And tbh I’m eyeing a few areas during this pullback in case we get it.

“Markets can stay irrational longer than you can stay solvent.” – Keynes

— Justin Bennett (@JustinBennettFX) November 3, 2022

Ethereum (ETH) meanwhile has also shown that virtual sticks and stones can’t break its bones and Jerome Powell’s latest words didn’t hurt it. (Much.)

It’s holding on to its own level of seemingly crucial support for now, too, which is the US$1,500 zone.

And here’s something for ETH fans. Bloomberg Intelligence’s senior commodity strategist Mike McGlone seems to be becoming more and more of a Bitcoin bull these days, but he also clearly digs Ethereum’s future, too.

In a LinkedIn post overnight (AEDT)… the analyst posited that US$1,000 could well have marked ETH’s bottom, adding, more generally about crypto:

“Cryptos, the asset class that went up the most in the unprecedented 2020-21 period of global liquidity, appear to have completed the bulk of their drawdown as the Federal Reserve focuses on other assets such as stocks in its bid to stem inflation.

“It’s a question of whether this nascent market has earned an outlook for continued growth, adoption and price appreciation, notably vs. traditional equities, bonds and commodities. Our view is that it has, particularly considering the potential risks of falling behind.”

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.56 billion to about US$413 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Arweave (AR), (market cap: US$722 billion) +38%

• OKB (OKB), (mc: US$5 billion) +24%

• Fantom (FTM), (mc: US$648 billion) +16%

• Polygon (MATIC), (mc: US$8.41 billion) +10%

• Filecoin (FIL), (mc: US$1.79 billion) +10%

• Flow (FLOW), (mc: US$1.82 billion) +10%

Let’s talk about some of these 24-hour double-digit gainers.

What’s going on with Arweave? This:

📣 Major announcement: @Meta is now using Arweave to permanently store digital collectables from @Instagram.

Instagram users are now able to issue digital collectables for their posts, stored on Arweave.

Some thoughts 👇 pic.twitter.com/Y0xjhDwHid

— 🐘🔗 sam.arweave.dev (@samecwilliams) November 2, 2022

And that ties in with the Polygon (MATIC) Meta-based NFT news we covered late yesterday, actually.

Also jacking MATIC’s price, though, is this – Mega multinational investment bank JPMorgan has reportedly made its first ever DeFi trade (involving AAVE) on a public blockchain. And that blockchain happens to be Polygon.

Quite a day for DeFi innovation🔥

1. JPMorgan executes 1st trade on a public blockchain (Polygon) using a modified version of Aave & tokenized deposits + bonds & verifiable credentials

2. BIS announces a project investigating the use of AMMs for cross-border FX of wholesale CBDCs— Patrick Hansen (@paddi_hansen) November 2, 2022

And how about this for bullish goals from Polygon co-founder Sandeep Nailwal?

.. its not a promise of a future zkEVM, its not fake zkEVM mainnets to lure in new investors, but actually FULLY BUILT, source code available, verifiable proofs, fully functional and decently efficient production grade mainnet. See you soon on #zkEVM

— Sandeep | Polygon 💜🔝3️⃣ (@sandeepnailwal) November 3, 2022

Talking lower-cap layer 1 protocol Fantom for just a sec, too. The reason it’s having a long-missed surge can be put down to one man – Andre Cronje.

The renowned crypto developer and founder of prominent DeFi projects including yearn.finance (YFI) was pivotal in the development of the Fantom ecosystem.

The influential DeFi identity is pretty much a crypto developer’s god but due to some disillusionment, swore off the space, and Crypto Twitter, almost a year and a half ago.

Anyway, the news is, he’s back – and calling himself Fantom’s “Vice President of Meme”. Fantom fans are excited.

💥 BREAKING: Andre Cronje is BACK@AndreCronjeTech is officially back as the Vice President of Meme of @FantomFDN 🎉$FTM immediately reacted to the news with the skyrocket to $0.29 🚀#Fantom is now back in the game! LFG! 💪 pic.twitter.com/UvTiHckfnK

— Fantom Daily (@fantom_daily) November 3, 2022

DAILY SLUMPERS

• WhiteBIT Token (WBT), (market cap: US$1.08 billion) -6%

• Radix (XRD), (mc: US$511 million) -4%

• FTX (FTT), (mc: US$3.24 billion) -3%

• Klaytn (KLAY), (mc: US$719 billion) -2%

• Uniswap (UNI), (mc: US$5.2 billion) -2%

Lower-cap wrap

There’s a lot of chaff the further you delve down the market cap list. Occasional grains of wheat, too, though. Remember to DYOR.

• Band (BAND), (market cap: US$103 million) +120%

• Gitcoin (GTC), (mc: US$44 million) 64%

• NKN (NKN), (mc: US$92 million) +61%

• Ocean Protocol (OCEAN), (mc: US$98 million) +32%

• Mask Network (MASK), (mc: US$244 million) +23%

DAILY SLUMPERS

• Xen Crypto (XEN), (market cap: US$8 million) -32%

• Gala (GALA), (mc: US$243 million) -16%

• PIVX (PIVX), (mc: US$23 million) -9%

• DogeChain (DC), (mc: US$24 million) -5%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Soft landing

Softish landing

Not so soft landing

But we have tools— Sven Henrich (@NorthmanTrader) November 3, 2022

GM fam. ☕️$BTC is closing in on those long liquidations at $19,900. So we likely see a run on those liqs before any short-term bounce, IMO.

But Friday is non-farm payrolls (NFP), so don’t discount the potential for a flush into $19,600 ahead of the weekend. #Bitcoin pic.twitter.com/TuzXnrFbWK

— Justin Bennett (@JustinBennettFX) November 3, 2022

Fidelity’s Bitcoin trading will be available in the same app as stocks – effectively giving 40m customers direct access to buy Bitcoin.

This is HUGE!

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) November 3, 2022

Phenomenal work by @0xPolygon on securing partners with massive consumer reach. @Reddit, @instagram, @jpmorgan, @Starbucks, @stripe, @Disney, and @DraftKings will onboard millions+ and benefit all Polygon builders. Happy with our decision to build on Polygon back in 2019.

— Miles (@0xMiles) November 3, 2022

Earlier today, JPMorgan executed their first live DeFi trade when they swapped tokenized SGD for JPY, using a modified version of Aave on Polygon.

The future is here, it’s just not evenly distributed. pic.twitter.com/axuibvwXGX

— Jacob Robinson (@JacobRobinsonJD) November 2, 2022

.@krakenfx is bringing what they do best – secure, low cost, robust trading – to all crypto assets. @KrakenNFT public beta is now live! https://t.co/Ou90ED0Euu

— Jonathon Miller (@jdesmondmiller) November 3, 2022

Gm everyone – I’ve been receiving a lot of questions about how Airdrop 2 for @blur_io works..

So this is a thread breaking it down 🧵👇 pic.twitter.com/LoyTC2V7Vp

— Zeneca (🔮,🔥) (@Zeneca_33) November 3, 2022

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Dai

Dai  Stacks

Stacks  Bonk

Bonk  Algorand

Algorand  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub