- Bitcoin price falls into a key Fibonacci level.

- Ethereum price shows the possibility of a recovery rally.

- Ripple price could be setting up for one more low within the coiling range.

The crypto market is at a crossroads. The next move will likely determine the trend for weeks to come. Key levels have been defined.

Bitcoin price at a fork in the road

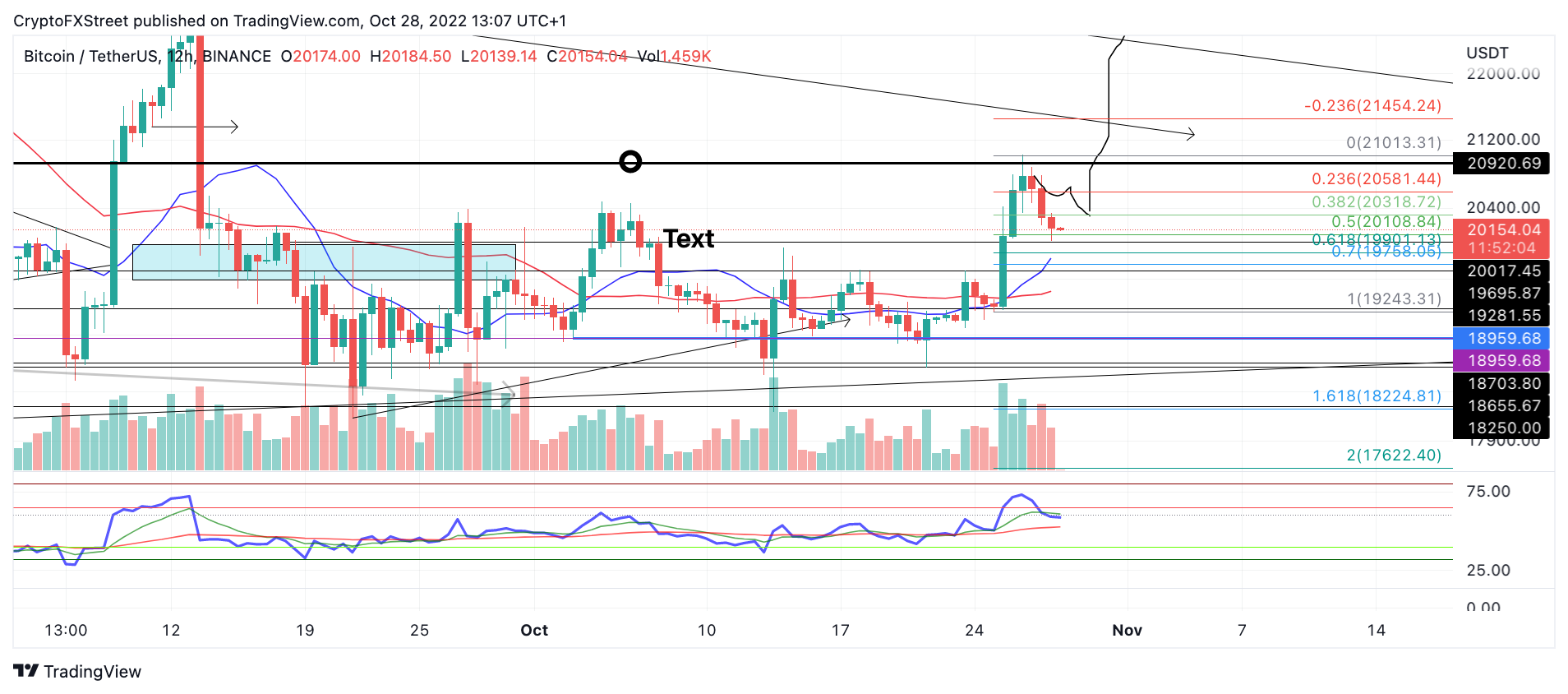

Bitcoin price currently trades at $20,503. After being rejected from the $21,000 level on Wednesday, October 26, the peer-to-peer digital currency fell 4%. As it hovers a few hundred dollars above the 2017 all-time highs at $19,600, leaving investors to wonder, what will happen next?

Bitcoin price breached overbought conditions upon the previous rally. If a bounce is to occur, a divergence between swing lows on the Relative Strength Indicator would be ideal for sidelined bulls to enter the market. Currently, the RSI does not show a divergence but is coming down to test previous resistance zones as support. If the market is genuinely bullish, $22,000 could be the next target, provided that support is established soon.

The bulls have yet to retest the 8-day exponential moving average (EMA) at $19,700 after piercing through it earlier in the week. A Fibonacci retracement tool surrounding the strongest part of this week’s rally shows the current low within the sell-off as a 61.8% retracement. The bears’ ability to head any lower would be concerning for the health of the uptrend.

The bullish thesis would be void if the swing low at $18,650 were tagged. If the bears happen to re-tag that level, a further decline toward the October 13 lows at $18,300 would likely commence. Such a move would result in an 8% dip from Bitcoin’s current market value.

BTC/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum shows strength

Ethereum price witnessed a 5% bounce during the final Friday of October. Ethereum, the decentralized smart contract token, fell into the mid $1,390 level during the overnight session and rebounded with an uptick in volume by New York’s opening bell.

Ethereum price auctions at $1,545. If the market is genuinely bullish. ETH’s price should propel toward the $1,600 level over the weekend. Traders should keep the decentralized smart-contract token that has yet to retest the ascending trend channel, which broke through earlier this week. A break below the swing low at $1,450 could trigger a sell-off into the lower half of the trend channel at $1,407.

ETH/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

XRP price could print a new low

XRP price is in a challenging situation. As the trading range coils from October’s highs at $0.54 to the lows at $0.42, most of the trading has taken place near the lower half. The digital remittance token remains submerged as low volume continues to signal a bullish lack of interest.

XRP price auctions at $0.4676. An optimistic signal is that the 8-day exponential moving average has provided support, enabling Ripple’s ongoing 3% bounce. The bad news is that the 21-day simple moving average rejected the price prior, and the volume shown does not look substantially different from Ripple’s previous attempt.

A failure to hurdle the 21-day simple moving average at $0.48 could lead to a sweep-of-the-lows-event targeting $0.41. Such a move would result in an 11% decline from the current market value.

Invalidation of the bearish idea is a breach above the October 27 swing high at $0.48. If the bulls manage to reconquer the $0.48 barrier, an additional rally targeting September highs at $0.56 could occur. Such a move would result in an 18% increase from the current XRP price.

XRP/USD 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Stellar

Stellar  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Litecoin

Litecoin  Pepe

Pepe  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Aave

Aave  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Immutable

Immutable