The biggest news in the cryptoverse for Oct. 26 includes the theft of over $1M worth of Ethereum by a phishing attack, Vitalik Buterin’s tweet deeming ZKPs “necessary” for Ethereum and Binance overtaking Huobi in crypto derivatives trading.

CryptoSlate Top Stories

Over $1M worth of ETH, NFTs stolen in phishing attack

A scammer, “Monkey Drainer,” stole 700 Ethereum (ETH) through a phishing attack over the past 24 hours. The total amount equates to nearly $1.05 million, and the attack was revealed by the on-chain sleuth ZachXBT.

1/ Over the past 24 hrs ~700 ETH ($1m) has been stolen by the phishing scammer known as Monkey Drainer.

They recently surpassed 7300 transactions from their drainer wallet after being around for only a few months. pic.twitter.com/6vAYBiqCxQ

— ZachXBT (@zachxbt) October 25, 2022

The attacker created fake websites that appear as legitimate crypto businesses to access the victims’ wallet address keys and login credentials.

Vitalik says making ZK proofs ‘understandable’ is necessary for Ethereum

Ethereum co-founder Vitalik Buterin Tweeted and said that making Zero-Knowledge Proofs (ZKP) is necessary to keep the Ethereum ecosystem “open and welcoming” to people who don’t understand math.

Referring to ZKPs as a “moon bath,” Buterin tweeted:

“I’m so happy that Ethereum has such a strong culture of trying hard to make all our moon math as understandable and accessible to people as possible.”

Binance overshadows Huobi in crypto derivatives trading

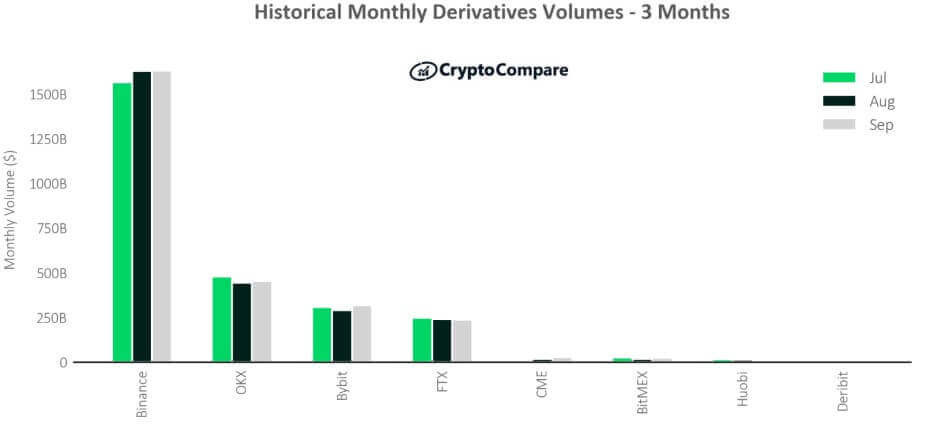

Crypto derivatives trading increased by 1.54% month over month to reach $2.71 trillion, which compensated for 63.4% of all transactions in September.

Crypto exchange giant Binance was responsible for 60.1% of the derivatives trading in September, while OKX followed as a second with 16.8%.

ByBit came third by controlling 11.7% of the whole derivatives market. Huobi, on the other hand, was placed sixth in dominance. This is a great fall since it was the biggest trading platform for derivatives in early 2020.

Australia confirms crypto transactions will be subject to capital gains tax

The Australian government confirmed that cryptocurrency transactions would be taxed soon.

The government’s budget papers for 2022-23 were released, and they considered cryptocurrencies as an asset instead of a foreign currency, which subjected them to taxation.

The lawmakers are currently working on a taxation framework. While Australia didn’t disclose the percentage, it said that the tax legislation will be backdated to income years until July 1, 2021.

Is China about to catalyze the crypto bull market through Hong Kong?

Former BitMex CEO Arthur Hayes examined the relationship between China and Hong Kong in an article he posted on his medium account and implied that China might utilize Hong Kong as a “window to the world.”

He wrote:

“Hong Kong (a deepwater port at the mouth of the Pearl River Delta) has always been China’s window to the world. Whether it was shipping, capital, or narcotics supplied by the biggest drug dealer in human history (the British Crown,) Hong Kong has historically been where China and the West met.”

Monetary Authority of Singapore proposes new measures to regulate crypto, stablecoins

Two consultation papers were published by the Monetary Authority of Singapore (MAS) on Oct. 26, which summarized the regulatory frameworks for digital payment token services and stablecoin users.

The papers accept that crypto assets are “inherently speculative and highly risky “ and aim to limit the activities of digital payment token services.

Hong Kong Monetary Authority announces success and key findings from CBDC project, mBridge

Hong Kong Monetary Authority (HKMA) published its Central Bank Digital Currency (CBDC) project mBridge’s highlights and success on Oct. 26.

The report stated that the mBridge’s six-week pilot program ran between Aug. 15 and Sept. 23. The project facilitated over 160 payment and foreign exchange transactions that were collectively worth around $22 million.

US lawmakers express concern over crypto firms hiring former government officials

A group of five U.S. Democratic lawmakers led by Senator Elizabeth Warren reached out to several financial regulators in the U.S. to ask about the “revolving door” between the U.S. government agencies and the crypto industry.

The group initially said that U.S. citizens should be confident that government policies weren’t created to “cater to the crypto industry’s desire to ‘avoid the sort of regulatory crackdown it has faced in China and elsewhere.’”

Moldova bans crypto mining amid energy crisis

Moldova announced banning crypto mining activities on Oct. 26 and pointed at the growing energy crisis as a reason.

Moldova’s Commission for Emergency Situations (CES) released a report to announce the ban, which also disclosed that Moldovan President Maia Sandu ordered government agencies to save electricity. As a result, the CES moved forward with the crypto mining ban.

CryptoSlate Exclusive

Op-Ed: Is Ethereum now under U.S. control? 99% of latest relay blocks are censoring the network

After The Office of Foreign Assets Control (OFAC) sanctions Tornado Cash, Ethereum co-founder Vitalik Buterin called validators and asked for validators to be slashed if the sanctions were implied at the protocol level.

However, the number of blocks compliant with the OFAC sanctions increased over the past months. Swat Bitcoin’s Editor in Chief, Tomer Strolight, tweeted about the situation showing that around 63% of all Ethereum blocks were OFAC compliant to draw attention.

Why is nobody talking about this? pic.twitter.com/Nlng6kgHxr

— Tomer Strolight (@TomerStrolight) October 26, 2022

Research Highlight

About 61% of BTC holders are underwater as market stagnation persists

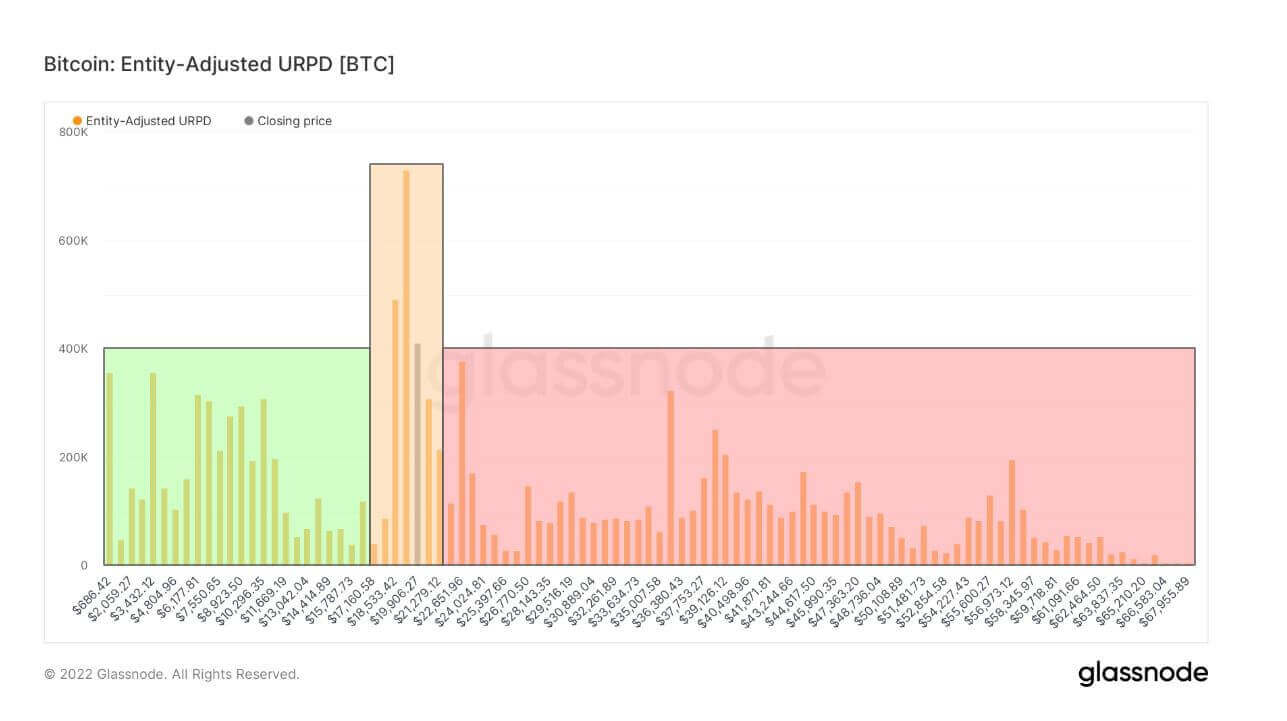

Bitcoin (BTC) recorded its lowest of the bear market at $17,600 on June 22. even though it bounced back to recover to $25,300 and has been lingering at a fairly stable range between $18,100 and $20,500 recently, on-chain data indicates that the majority of Bitcoin investors are still underwater.

The UTXO Realized Price Distribution (URPD) chart demonstrates the existing Bitcoins that last moved within their respective price buckets.

According to the chart, investors who bought Bitcoin at $17,600 or below consist of only 25% of all token holders. On the other hand, 61% of token holders were underwater when Bitcoin sunk to its lowest.

News from around the Cryptoverse

Andreessen Horowitz’s crypto fund sinks by 40%

Venture Capital firm Andreessen Horowitz established a $4.5 billion crypto fund in May 2022. The bear market started soon after, and Horowitz’s fund lost 40% of its market value, as it is reported by Wall Street Journal.

BitMex CEO quits

Crypto exchange platform BitMEX’s CEO Alexander Höptner resigned from his role, according to Bloomberg. BitMex’s CFO Stephan Lutz was named as the interim CEO, while Höptner didn’t specify a reason for leaving his role.

Binance launches Binance Oracle

According to an announcement post on BNB Chain’s website, Binance launches an Oracle Network to enable smart contracts to run on real-world data. The BNB Chain will be the first blockchain that’ll use the Binance Oracle.

Crypto Market

In the last 24 hours, Bitcoin (BTC) increased by +2.47% to trade at $20,753, while Ethereum (ETH) also spiked by +4.84% to trade at $1,562.

Biggest Gainers (24h)

Biggest Losers (24h)

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Shiba Inu

Shiba Inu  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  Litecoin

Litecoin  Hedera

Hedera  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Dai

Dai  Celestia

Celestia  Immutable

Immutable  Bonk

Bonk