Dear Bankless Nation,

Everybody knows about DeFi on Ethereum and other smart contract platforms like Cosmos and Solana.

But did you know DeFi exists on Bitcoin?

Even though Bitcoin only supports basic transactions on the base layer, developers can build a DeFi ecosystem on top of the network while inheriting its high security guarantees.

This has been in the making for awhile.

And it’s now starting to come into fruition.

Today, we’ll explore the basics of how to use DeFi on Bitcoin.

Tomorrow, Muneeb Ali is sharing his vision for how Bitcoin scales this ecosystem to compete with smart contract platforms.

Bankless covering Bitcoin?!?!

Yup. (don’t tell Ryan & David)

Let’s get into it.

– Bankless team

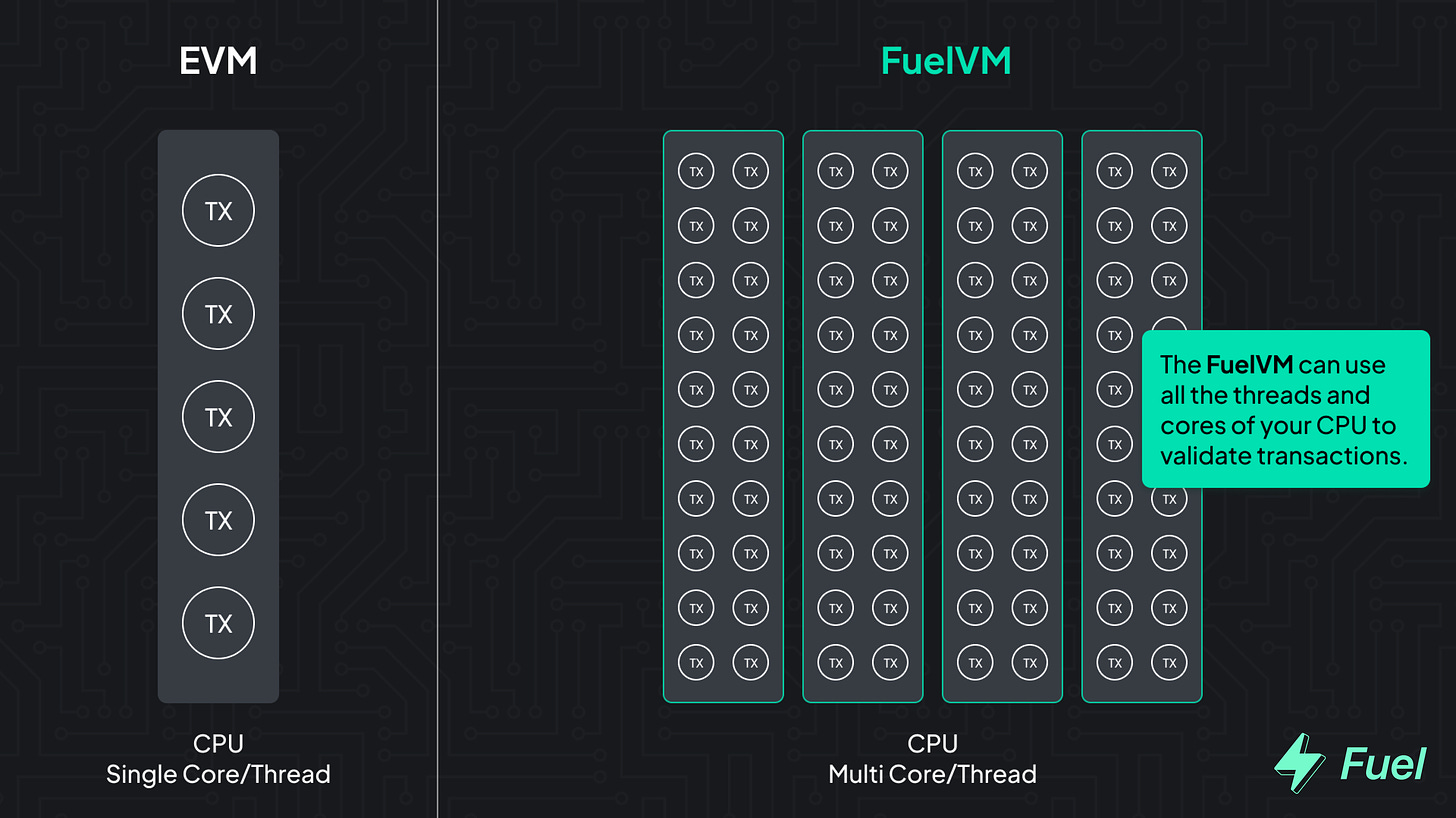

Modular blockchains are the future. L2s alone won’t solve the scaling problem; for this, we need to move toward a modular architecture. Fuel is the fastest execution layer for the modular blockchain stack, enabling maximum security and the highest flexible throughput.

Bankless Writer: William M. Peaster, Bankless contributor and Metaversal writer

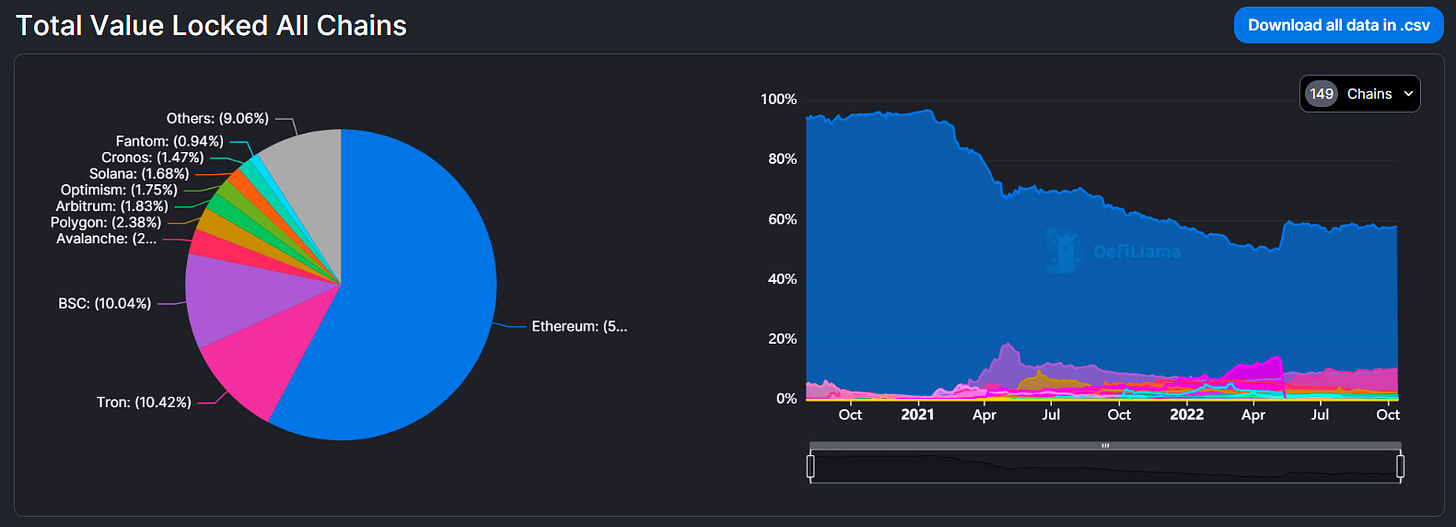

Over the past couple of years, Ethereum has been the hub for DeFi activity while spreading to Ethereum Virtual Machine (EVM) chains like BSC, Polygon, Arbitrum, Optimism, and so forth.

However, Bitcoin has its own native DeFi ecosystem that, while still much smaller than EVM-based DeFi, is steadily coming together on layers built on top of the network (we’ll talk more about this in tomorrow’s article!).

Accordingly, this Bankless tactic will show you how to explore Bitcoin DeFi as a beginner.

-

Goal: Learn how to navigate the Bitcoin DeFi ecosystem

-

Skill: Intermediate

-

Effort: A couple hours

-

ROI: Access to new DeFi frontiers, up to +8% APY via STX stacking

Back in 2017, I pressed “Random” on Reddit and landed in r/ethtrader, starting my crypto journey.

As such, I’m part of the newer wave of folks that actually came to crypto through Ethereum and not Bitcoin, the cryptoeconomy’s OG.

At the time I took the first gig I could doing crypto news writing, so I started as a generalist. In 2018, I sold the last of my BTC for ETH and have pivoted my personal focus to Ethereum ever since.

That said, that doubling down gave me front row seats to the rise of DeFi. I became an early user of Maker, borrowing the DAI stablecoin against my ETH, and have done this to finance things in my real life ever since.

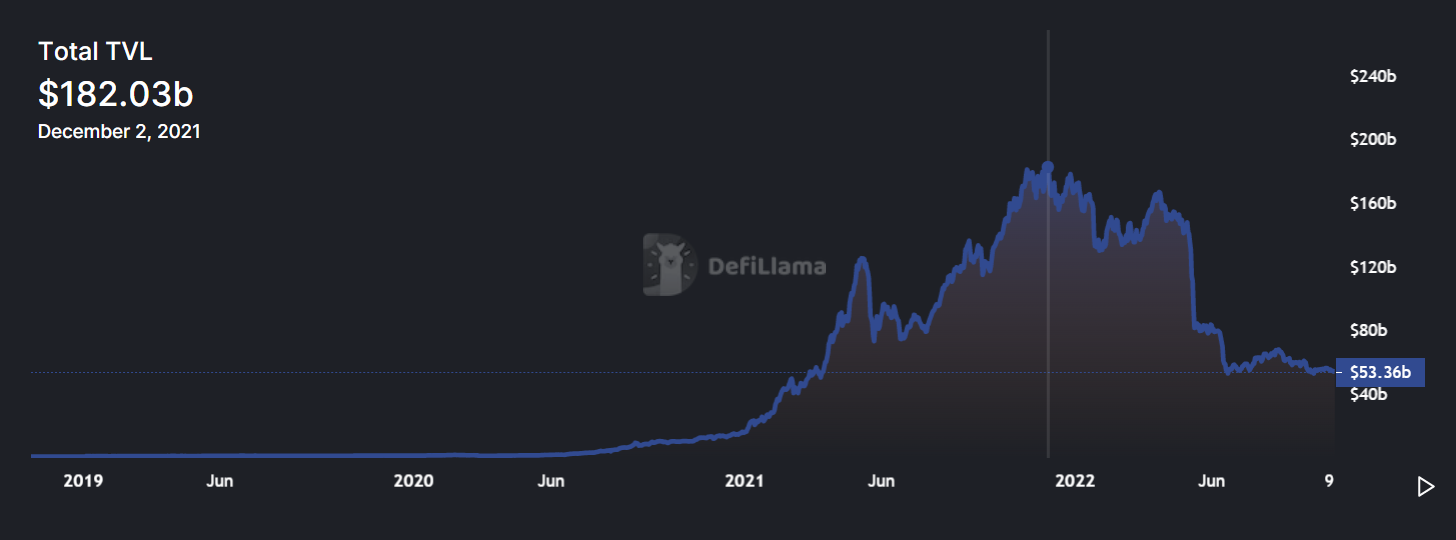

That capability made me a big DeFi believer early on, which led me to exploring as many DeFi projects as I could in recent years while the total value locked (TVL) in the ecosystem surged to new heights.

Amid this surging we saw more and more innovation and variety. You could earn trading fees by LPing on Uniswap, Curve, and Balancer, you could borrow and lend on Aave and Compound, you could trade derivatives on dYdX and Opyn, and on and on!

The world of decentralized finance was blooming.

In this same upswing came a boom of other chains — from Alt-L1s to Ethereum-centric L2s.

For the most part, the largest of these new chains have been EVM-based because of network effects, making it easier for the existing cohort to experiment with new chains.

I’ve tried most EVM chains of note so far. Lately then I’ve been exploring non-EVM DeFi projects to learn more, such as how to trade on Cosmos’s Osmosis appchain like I outlined in my tactic last week.

I feel fairly up to speed with most smart contract platforms, but I wanted a challenge.

What about Bitcoin?

Does DeFi on Bitcoin exist?

To be sure, I’ve been out of the loop on Bitcoin for years.

But now the OG blockchain does have the first makings of its own DeFi ecosystem coming together. It’s been built on systems that settle transactions on the base layer and execute all of the contract logic on-top of Bitcoin (sound familiar?).

Accordingly, I thought it’d be interesting as an EVM guy to try some of the biggest Bitcoin DeFi projects I could and then write up a post on how to use these projects.

Before getting into the action though, let’s quickly review Bitcoin’s “layers” approach to DeFi.

Allow me to explain

While DeFi can occur on Ethereum’s base layer, the Bitcoin base layer can only handle basic transactions. Smart contract logic doesn’t exist!

As a result, the Bitcoin DeFi scene occurs one level up in the protocol layer where external projects can build on, and inherit security from, Bitcoin.

Currently the largest of Bitcoin’s DeFi protocols is the Lightning Network, a Bitcoin L2 that uses payment channels to let people make extremely fast and low cost payments in decentralized fashion.

Today, there is over 5,000 BTC deposited into Lightning, equivalent to ~$96M USD right now.

Not bad! This puts Lightning as the 78th largest DeFi protocol behind the likes of Ribbon Finance and others.

However, while there are ongoing efforts to build a more expressive app layer on top of Lightning itself, the network is suited only for payments right now.

To tap into more advanced Bitcoin DeFi functionalities like borrowing, lending, and beyond, you have to go to general-purpose protocols that offer smart contract capabilities atop Bitcoin.

The two biggest examples of these sorts of protocols today are RSK and Stacks, as RSK boasted a $51M TVL and Stacks an $11M TVL at the time of this post’s writing.

Below, let’s walk through the basics of how you could try this Bitcoin DeFi trifecta of Lightning, RSK, and Stacks for yourself.

Tomorrow, one of the best experts in this area, Muneeb from BlockStacks, will publish an in-depth article on this topic. Strap in.

Decentralized payments are at the heart of DeFi, thus the Lightning Network is at the heart of Bitcoin DeFi.

If you’re a Bitcoin DeFi newcomer like me, you’re interested in using the simplest possible way to interact with Lightning to first get the hang of things.

Toward that end, a solid option to consider is Breez, a sleek non-custodial Lightning client designed for mobile devices.

You don’t need any technical know-how, just download the app to your phone, deposit some BTC from another wallet or your crypto exchange of choice, and boom!

You’re ready to use Lightning.

Here’s the step by step:

-

Download Breez through the Apple App Store or Google Play

-

Press Receive and then Receive via BTC address to generate a deposit address

-

Deposit your desired amount of BTC to your Breez address and wait for the deposit tx to be confirmed

-

Done! Now you’re ready to start sending/paying BTC on Bitcoin’s first L2

Personally, I wanted to try putting some of my newly deposited Lightning sats (short for “satoshis,” the smallest denomination of BTC) to good use, so I pulled up the Lightning address of the Human Rights Foundation via QR code and sent over around ~$50 worth of BTC.

Very easy!

Even though Breez is in beta, everything went smoothly.

Color me impressed, but that’s just basic payments.

We want to borrow, swap, and earn.

We want DeFi.

So, let’s move into more complicated Bitcoin-based DeFi possibilities by exploring RSK.

RSK is an EVM-compatible smart contract protocol that exists on Bitcoin.

This sidechain, which uses merge mining to inherit Bitcoin’s extensive security guarantees, allows users to bridge their BTC to RSK’s native RBTC 1:1 pegged token and then put RBTC to use in Ethereum-like smart contracts.

One of the largest DeFi apps on RSK right now is Sovryn.

The downside is that RSK and Sovryn requires you to have RSK’s native token, the BTC-pegged RBTC, to pay for transactions.

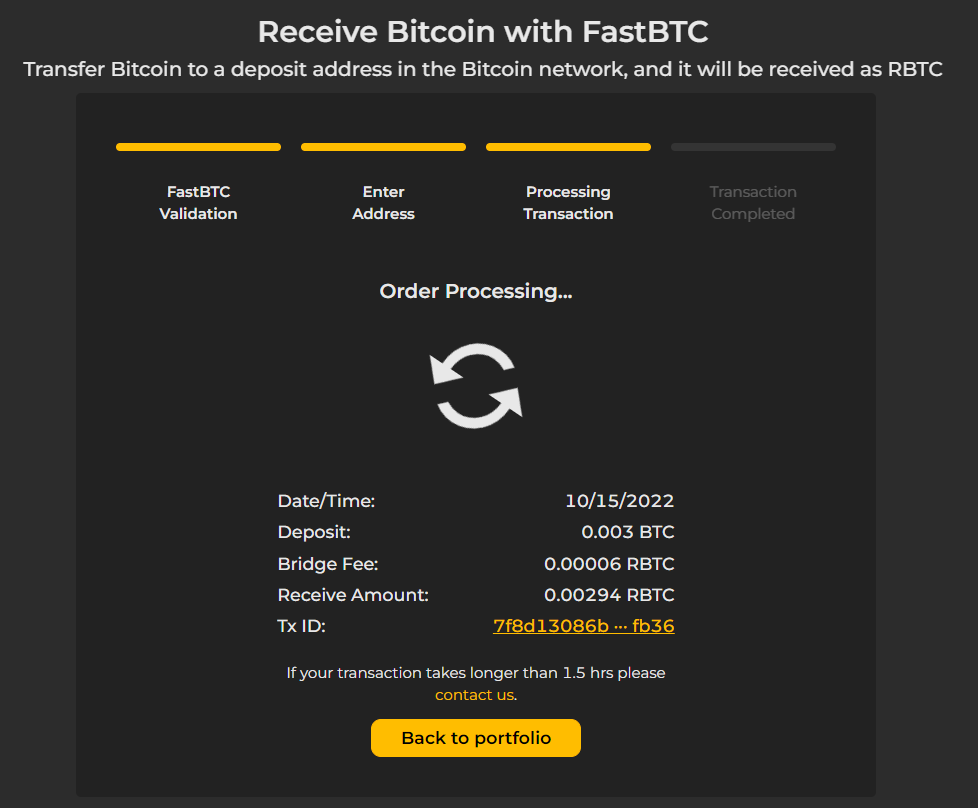

There are three ways to do this:

-

Fast: Buy some RBTC on a supporting exchange, like Bitfinex, Bisq, etc, and then transfer to your wallet/

-

Medium: Use the FastBTC transfer option using the RBTC Receive button on Sovryn to deposit BTC into RSK.

-

Slow: Convert some BTC to RBTC using the official conversion process, which can take up to one day.

Before diving into Sovryn you’ll want to add the RSK EVM chain to your wallet, e.g. your MetaMask.

To do this, you can head to chainlist.org to search for and add the chain from there.

Once your RBTC is ready on RSK, you can head to the Sovryn app and choose from DeFi activities like Borrowing, Lending, LPing, Margin Trading, Staking, and more.

If you just want to swap tokens, you can head to the Swap hub and trade into whatever you want just like you would on any EVM-based DEX.

Stacks is another smart contract protocol built on top of Bitcoin.

Unlike RSK, Stacks isn’t EVM-compatible, but if you’ve used any smart contract platforms before this protocol will feel generally familiar. The native token of the network is STX, which is needed to pay for transactions.

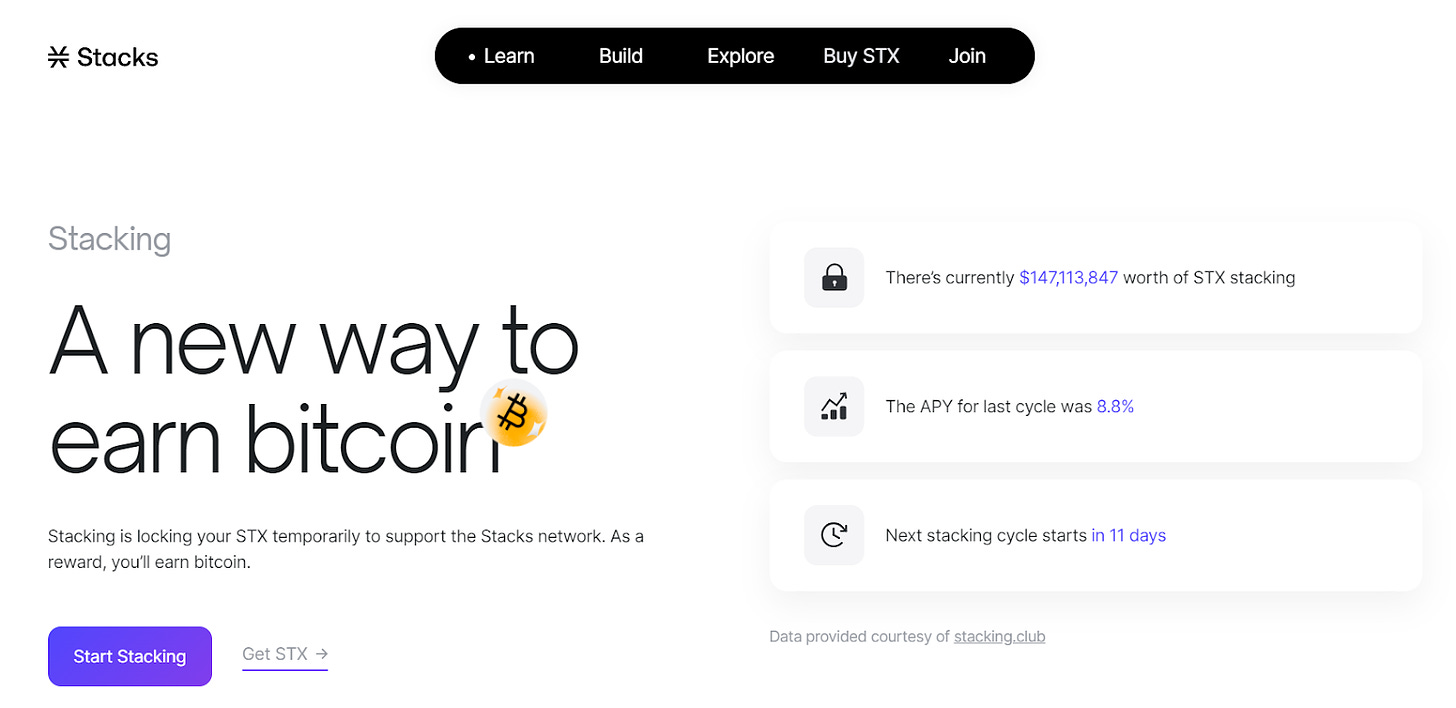

Notably, Stacks offers a Stacking program that allows users to stake their STX tokens in order to support the network and earn BTC rewards from Stacks’s participating BTC miners. You could follow these steps to join in on the campaign:

-

Download the popular Hiro Desktop Wallet for Stacks

-

Back up your wallet account for posterity

-

Acquire STX on your crypto exchange of choice and then deposit it to your new Hiro Wallet address

-

Once you’ve received your STX deposit head into your Hiro Wallet and click on the Get started button below the Stacking option, then click on the Stack in a pool option

-

Find a stacking pool address of your choice on stacks.co and then copy it into your Hiro UI

-

Input the amount of STX to lock and whether you want your deposit to be of limited or indefinite duration

-

Confirm the transaction with your wallet, and voila! Now you’ll be staking STX to stack sats, with the APY estimated to be +8% right now

The Bitcoin DeFi scene is much more primitive than Ethereum’s DeFi scene as things currently stand, but it’s certainly not non-existent.

And with Bitcoin’s block subsidy continuing to fall every four years, the OG blockchain can strongly benefit from increasingly thriving protocol and app layers bringing in more and more BTC transaction fees over time.

In this regard the rise of projects like Lightning, RSK, and Stacks are very encouraging, though they are undoubtedly still quite early on in their lifespans. Additionally, these projects are only the firsts of more to come, as there are new contenders arriving all the while, like the DeFiChain sidechain effort.

Keep your eyes on the old guard and the newcomers alike in the Bitcoin DeFi scene accordingly!

William M. Peaster is a professional writer and creator of Metaversal—a new Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Read More: newsletter.banklesshq.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Lombard Staked BTC

Lombard Staked BTC  Pi Network

Pi Network  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Stellar

Stellar  USDS

USDS  Chainlink

Chainlink  Hedera

Hedera  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Sui

Sui  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  MANTRA

MANTRA  Polkadot

Polkadot  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Bitget Token

Bitget Token  Hyperliquid

Hyperliquid  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Wrapped eETH

Wrapped eETH  sUSDS

sUSDS  Uniswap

Uniswap  Dai

Dai  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Ondo

Ondo  Gate

Gate  OKB

OKB  Mantle

Mantle  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave