As the name suggests, CeFi (Centralized Finance), the transactions and trading records of the users are processed and managed in a centralized way. The platform facilitates the selling and buying of cryptocurrencies through an intermediary. This intermediary is often exchanged with an order book.

The main goal of CeFi is to create crypto investment opportunities and financial services for people. Through this, it offers high yields with lesser security concerns. CeFi platforms are user-friendly and well-refined compared to DeFi (Decentralized Finance).

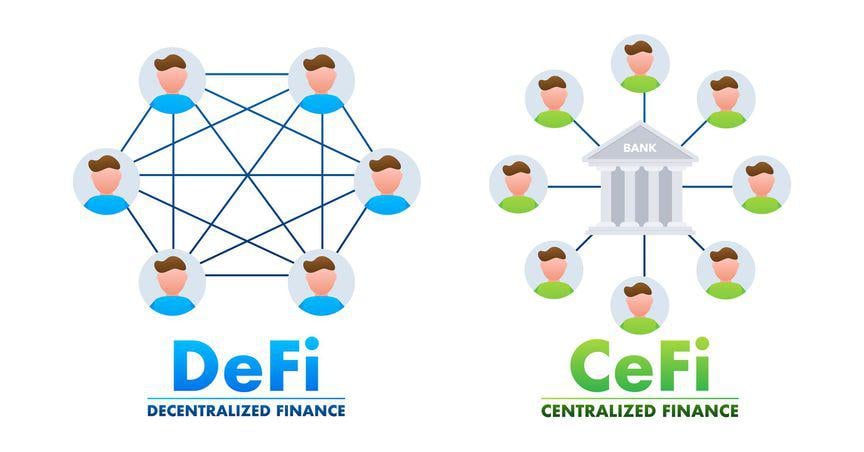

Unlike CeFi, DeFi works on implementing 100 per cent decentralization in the finance and cryptocurrency ecosystems and is open source as opposed to CeFi.

DeFi vs CeFi

One of the biggest differences between CeFi and DeFi is that the former is a regulated system compared to the latter. Some other aspects also differentiate DeFi and CeFi on various levels. Some are mentioned below:

-

Transaction costs

In DeFi, it is essential to charge transaction fees; in CeFi, the platform can offer transaction services at no cost. This is because the platform relies on the AML (anti-money laundering) verification of their clients.

-

Custody

Unlike CeFi, DeFi provides full control to the users over their assets. However, this can bring great responsibility to the users. In case of any technological hazard, the users are bound to bear the repercussions.

-

Speed

Although it depends upon the platforms individually, the speed of executing transactions is relatively high in CeFi and DeFi.

-

Cross-chain services

Many of the cryptocurrencies are often traded on CeFi. Generally, DeFi does not support such tokens due to the complexity involved in it. Also, there is a delay in the completion of the cross-chain exchange.

-

Fiat conversion flexibility

CeFi platform works on a fiat currency model that is involved in the exchange. This makes things comparatively easier for the user to trade in CeFi. Further, CeFi offers flexibility that allows the control to customers for ensuring fiat conversions.

Bottom Line

CeFi and DeFi are the two sides of the same coin. They strive to reach the same goal of making crypto trading better and more popular than traditional finance. However, the approach for each platform towards the goal is different.

CeFi offers crypto-to-fiat trades, fair trade, customer support, and more. But, to make it go smoothly, it requires trust from users towards the platforms. Once it gains trust, it will enhance the ability of the platforms to hold and manage the money effectively. DeFi, on the other hand, does not require this, but at the same time, it also does not offer some of the major functions and benefits of CeFi.

To start with your crypto investment, understand both sides and weigh them in your perspective. Be analytical and careful while choosing your service provider and platform. Before deciding to invest, be critical in your approach and do not have a colored vision towards any platform.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.

Read More: kalkinemedia.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Celestia

Celestia  Immutable

Immutable