By Omkar Godbole (All times ET unless indicated otherwise)

The past 24 hours have been marked by bullish postings on social media, with notable figures voicing positive outlooks on the cryptocurrency market that have worked their way into prices.

Bitcoin has bounced to over $98,000 from $96,900, with President Donald Trump’s son Eric encouraging family-linked World Liberty Financial to invest in the largest cryptocurrency.

Cardano founder Charles Hoskinson was among those painting an optimistic picture. “To give you a sense of how big the upcoming bull market is for crypto, we just absorbed a downturn that was larger than the collapse of Luna or FTX and have already nearly recovered: 710 billion in losses and 740,000 traders liquidated in 24 hours. 2025 is Crypto’s year,” Hoskinson posted.

Cardano’s ADA token rose 4% and other major altcoins including XRP, SOL and ETH posted similar gains, CoinDesk data show.

As for ether, while the analyst community remains bearish, institutions seem to be buying it up. Data tracked by on-chain sleuth Lookonchain shows in the past two days a trading firm withdrew 62,381 coins from centralized exchanges, moving them to Coinbase Prime. Market maker Wintermute noted strong over-the-counter demand for ether early this week.

In other news, Conor Grogan, a director of Coinbase, speculated that crypto exchange Kraken may know Bitcoin creator Satoshi Nakamoto’s real identity. Nakamoto may own 1.096 million BTC, with a paper wealth exceeding Bill Gates, Grogan said. A bill has been introduced in the U.S. Senate to regulate stablecoins, which could boost demand for U.S. Treasuries and “spur financial innovation,” FxPro’s chief market analyst, Alex Kuptsikevich, said.

On the macro front, China-sensitive currencies like the Australian and New Zealand dollars are again weak against the U.S. dollar, but remain in recent ranges, indicating that markets do not expect a long, drawn-out U.S.-China trade war. Trump, however, is in no hurry to call President Xi Jinping and that could cap gains in risk assets for now.

The U.S. Treasury Secretary Scott Bessent has said that the Trump administration wants to lower the U.S. Treasury yield, which could bode well for risk assets. Even so, the 10-year rate may spike higher if Thursday’s weekly U.S. jobless claims and fourth-quarter Unit Labor Costs paint a positive picture of the economy. That could arrest BTC’s upswing. Stay alert!

What to Watch

- Crypto:

- Feb. 6: Berachain (BERA) mainnet launch, as well as initial creation and distribution of its native token. 15.75% of BERA tokens will be airdropped to community members, applications and liquidity providers.

- Feb. 6, 8:00 a.m.: Shentu Chain network upgrade (v2.14.0).

- Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

- Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will start reimbursing creditors.

- Macro

- Feb. 6, 7:00 a.m.: Bank of England (BoE) releases Monetary Policy Summary and Minutes of the Monetary Policy Committee Meeting as well as the February Monetary Policy Report. The press conference is live-streamed 30 minutes later.

- Interest Rate Decision Est. 4.5% vs. Prev. 4.75%

- Feb. 6, 8:30 a.m.: U.S. Department of Labor releases Unemployment Insurance Weekly Claims report for week ended Feb. 1.

- Initial Jobless Claims Est. 213K vs. Prev. 207K

- Nonfarm Productivity QoQ (Preliminary) Est.1.4% vs. Prev. 2.2%

- Continuing Jobless Claims (January) Est. 1870K vs. Prev. 1858K

- Jobless Claims 4-Week Average Prev. 212.5K.

- Feb. 6, 2:00 p.m.: U.S. House Financial Services Committee hearing about “Operation Choke Point 2.0“: Two of the witnesses are Paul Grewal, Coinbase’s chief legal officer, and MARA Holdings CEO Fred Thiel. Livestream Link.

- Feb. 6, 2:30 p.m.: Fed Governor Christopher J. Waller is giving a speech on Payments at the Atlantic Council in Washington. Livestream link.

- Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment Situation report.

- Non Farm Payrolls Est. 170K vs. Prev. 256K

- Unemployment Rate Est. 4.1% vs. Prev. 4.1%

- Feb. 8, 8:30 p.m.: China’s National Bureau of Statistics (NBS) releases January’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. 0%

- Inflation Rate YoY Prev. 0.1%

- PPI YoY Prev. -2.3%

- Feb. 6, 7:00 a.m.: Bank of England (BoE) releases Monetary Policy Summary and Minutes of the Monetary Policy Committee Meeting as well as the February Monetary Policy Report. The press conference is live-streamed 30 minutes later.

- Earnings

- Feb. 6: CleanSpark (CLSK), post-market, $-0.06

- Feb. 10: Canaan (CAN), pre-market, $-0.08

- Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

- Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

- Feb. 12: Hut 8 (HUT), pre-market, $0.04

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12 (TBA): Metaplanet (TYO:3350)

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase Global (COIN), post-market, $1.61

Token Events

- Governance votes & calls

- OsmosisDAO is discussing a change to the use of taker fees collected in OSMO to burn 50% of collected fees.

- Threshold DAO is discussing the creation of a bond program to address its stablecoin’s liquidity challenges.

- Bonk DAO is voting on burning 2.025 trillion BONK “celebrating the end of the BONKDragon campaign and the 2025 Lunar New Year.”

- Feb. 6: 11 a.m.: Livepeer (LPT) to host a Core Dev Call on Discord.

- Feb. 6, 2 p.m.: Arbitrum to hold an open call about using AI to empower decentralized finance applications.

- Feb. 6, 12 pm.: Moonwell to hold a governance call.

- Feb. 6: Bittensor (TAO) to vote on launching a dynamic Tao, which introduces a more decentralized approach to governance.

- Feb. 7, 1 p.m.: Sweat Economy (SWEAT) to hold a token holders briefing discussing tokenomics, product roadmap and partnerships.

- Feb. 8, 1:08 p.m.: A dYdX Foundation vote on granting the dYdX Operations subDAO signer market authority over the market map and eliminate revenue sharing for that function is on track to pass.

- Unlocks

- Feb. 9: Movement (MOVE) to unlock 2.17% of circulating supply worth $31.41 million.

- Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $68.99 million.

- Token Launches

- Feb. 6: Berachain (BERA) to be listed on Bybit, Bithumb, Bitget, BingX, MEXC, SwissBorg, Kraken, OKX, LBank, Gate.io, BitMart, Binance and KuCoin.

Conferences:

Token Talk

By Shaurya Malwa

- The Floki DAO community voted with a 99.71% approval rate to invest $125,000 from its treasury into upcoming BNB Chain-based AI Agent Bad AI.

- The investment will diversify Floki’s treasury and deepen its involvement in the blockchain and AI sectors.

- Bad AI plans to use artificial intelligence and machine learning to develop a decentralized AI ecosystem for various uses, such as online bots and AI-based applications. Over 45% of its token supply is dedicated to Floki, including airdrops to FLOKI and TokenFi users.

- Similar AI agents on other chains have valuations between $720 million and $2.8 billion.

Derivatives Positioning

- BTC and ETH perpetual funding rates have flipped positive in a sign of renewed bias for bullish bets, according to Velo Data.

- Funding rates for SUI, XLM, HBAR, TON, SHIB and ONDO remain negative.

- XMR has recorded the highest positive open interest-adjusted cumulative volume delta among majors in the past 24 hours, indicating net buying activity.

- Bullish sentiment has been in restored in the front-end BTC options on Deribit, but that’s not the case in ETH options.

- Block flows featured BTC calendar spreads, outright longs in $130K December expiry call and a bull call spread, betting on a rally to $5K in ETH.

Market Movements:

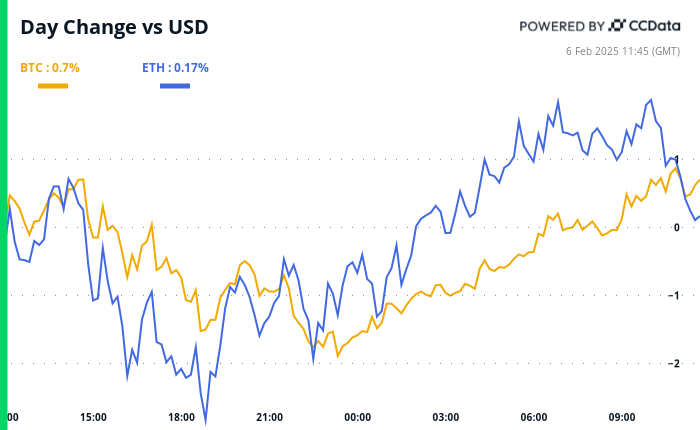

- BTC is up 1.7 % from 4 p.m. ET Wednesday to $98,0682.38 (24hrs: +0.76%)

- ETH is up 4.15% at $2,812.62 (24hrs: +0.37%)

- CoinDesk 20 is up 1.54% to 3,281.41 (24hrs: -0.60%)

- CESR Composite Staking Rate is down 9 bps to 3.09%

- BTC funding rate is at 0.0041% (4.52% annualized) on Binance

- DXY is up 0.36% at 107.96

- Gold is unchanged at $2,865.30/oz

- Silver is down 0.97% to $31.99/oz

- Nikkei 225 closed +0.61% at 39,066.53

- Hang Seng closed +1.43% at 20,891.62

- FTSE is up 1.18% at 8,724.97

- Euro Stoxx 50 is up 0.70% at 5,307.80

- DJIA closed +0.71% to 44,873.28

- S&P 500 closed +0.39% at 6,061.48

- Nasdaq closed +0.19% at 19,692.33

- S&P/TSX Composite Index closed +1.15% at 25,569.84

- S&P 40 Latin America closed -0.39% at 2,392.39

- U.S. 10-year Treasury is down 4 bps at 4.42%

- E-mini S&P 500 futures are unchanged at 6,090.25

- E-mini Nasdaq-100 futures are unchanged at 21,749.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 45,007.00

Bitcoin Stats:

- BTC Dominance: 61.45 (0.15%)

- Ethereum to bitcoin ratio: 0.02867 (-0.69%)

- Hashrate (seven-day moving average): 808 EH/s

- Hashprice (spot): $59.7

- Total Fees: 5.12 BTC / $515,226

- CME Futures Open Interest: 163,495 BTC

- BTC priced in gold: 34.0 oz

- BTC vs gold market cap: 9.65%

Technical Analysis

- The BTC/JPY pair has penetrated the bullish trendline connecting higher lows registered in October and November.

- The breakdown may embolden bears, although the pair remain locked in a sideways range.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $336.70 (-3.33%), up 1.10% at $340.40 in pre-market.

- Coinbase Global (COIN): closed at $275.14 (-1.87%), up 1.89% at $280.34 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.66 (-0.04%)

- MARA Holdings (MARA): closed at $17.03 (-3.51%), up 1.53% at $17.29 in pre-market.

- Riot Platforms (RIOT): closed at $11.74 (-4.48%), up 1.36% at $11.90 in pre-market.

- Core Scientific (CORZ): closed at $12.71 (+4.10%), up 1.18% at $12.86 in pre-market.

- CleanSpark (CLSK): closed at $10.31 (-4.89%), up 2.33% at 10.65% in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.46 (-0.49%), up 1.16% at $22.72 in pre-market.

- Semler Scientific (SMLR): closed at $51.79 (+1.07%), up 2.24% at $52.95 in pre-market.

- Exodus Movement (EXOD): closed at $51.36 (-9.53%), up 2.61% in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $66.4 million

- Cumulative net flows: $40.67 billion

- Total BTC holdings ~ 1.176 million.

Spot ETH ETFs

- Daily net flow: $18.1 million

- Cumulative net flows: $3.17 billion

- Total ETH holdings ~ 3.785 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows inflows into gold-backed tokens has surged alongside a rise in the spot price of gold.

- The yellow metal rose to a record high of $2,882 Wednesday.

While You Were Sleeping

- Trump’s Aim to Lower the 10-Year Yield Could Bode Well for Bitcoin (CoinDesk): U.S. Treasury Secretary Scott Bessent said the Trump administration aims to lower the 10-year Treasury yield by controlling inflation and reducing the budget deficit, which could help risk assets, including bitcoin.

- Berachain’s BERA Trades at $8 Ahead of 79M Token Airdrop and Mainnet Launch (CoinDesk): Layer-1 blockchain Berachain’s mainnet starts up later today. Of the total 500 million BERA tokens to be created, nearly 80 million will be airdropped to eligible users.

- Tiger21 Founder Michael Sonnenfeldt Says Ultra-Rich are Bullish on BTC (CoinDesk): Michael Sonnenfeld, founder of TIGER 21, a peer advisory group for ultra-high-net-worth investors, said BTC now serves as both a store of value and a substitute for gold.

- Bitcoin Musings Draw Scrutiny Over Czech Central Bank Governor (Bloomberg): Czech central bank governor Aleš Michl’s proposal to invest up to 5% of reserves in bitcoin may face a months-long review and be reduced to under 1%, insiders report.

- Trump’s Trade War Adds to ‘Clear Decoupling’ on Central Bank Rate Cuts (Financial Times): As the Fed holds interest rates steady amid inflation worries, Trump’s new tariffs intensify risks, prompting central banks in economies reliant on U.S. exports to cut rates to shield against slower growth.

- Surging Dollar Spurs Jump in Corporate FX Hedging (Reuters): U.S. companies earning abroad are boosting hedging to safeguard repatriated profits as confidence grows that Trump’s tariffs will keep the dollar high, threatening to erode converted earnings.

In the Ether

Read More: www.coindesk.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic