Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved

-

In year one, Bitcoin ETFs attracted $115B AUM, $32B in net inflows, and now hold ~5.7% of Bitcoin’s supply.

-

BlackRock’s iShares Bitcoin ETF dominates with 540K BTC, while Grayscale’s holdings declined as investors shifted to lower-cost options.

-

Bitcoin ETFs have driven institutional adoption, redefining market structure and cementing Bitcoin’s role as a mainstream asset.

It has been just over a year since spot Bitcoin exchange-traded funds (ETFs) hit the US financial markets by storm. These vehicles have expanded Bitcoin access for retail and institutional investors, attracted billions of dollars in untapped capital, and elevated the asset class from niche to mainstream. This launch will likely be remembered as the most successful ETF debut in financial history, with over $110B in assets under management (AUM) amassed in just one year.

In this week’s issue of Coin Metrics’ State of the Network, we reflect on the remarkable success of spot Bitcoin ETFs as they mark their 1-year anniversary, revisiting their flows, standout issuers, and market-shaping impact.

After a decade of anticipation, rejected filings, and fake tweets that caught the crypto market offside, the U.S. Securities and Exchange Commission (SEC) finally approved the launch of spot bitcoin ETFs on January 10th 2024. Shortly after the approval, eleven funds entered the market vying to attract inflows. Issuers included traditional finance giants like the $11T asset manager—BlackRock, Fidelity, as well as crypto-native issuers like Bitwise.

Source: Coin Metrics Labs

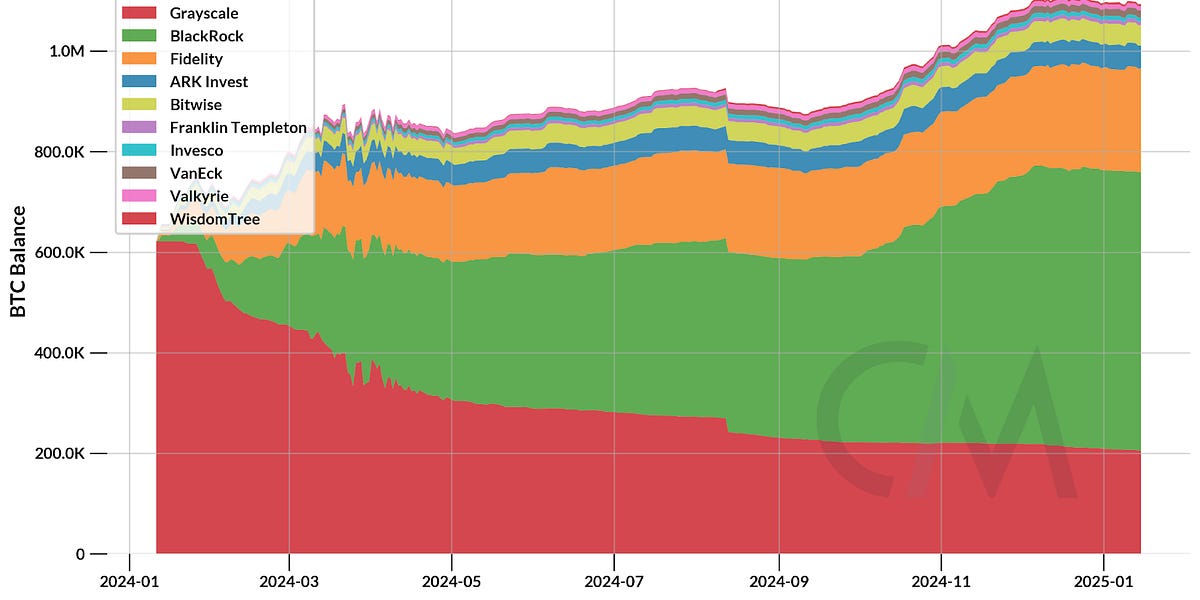

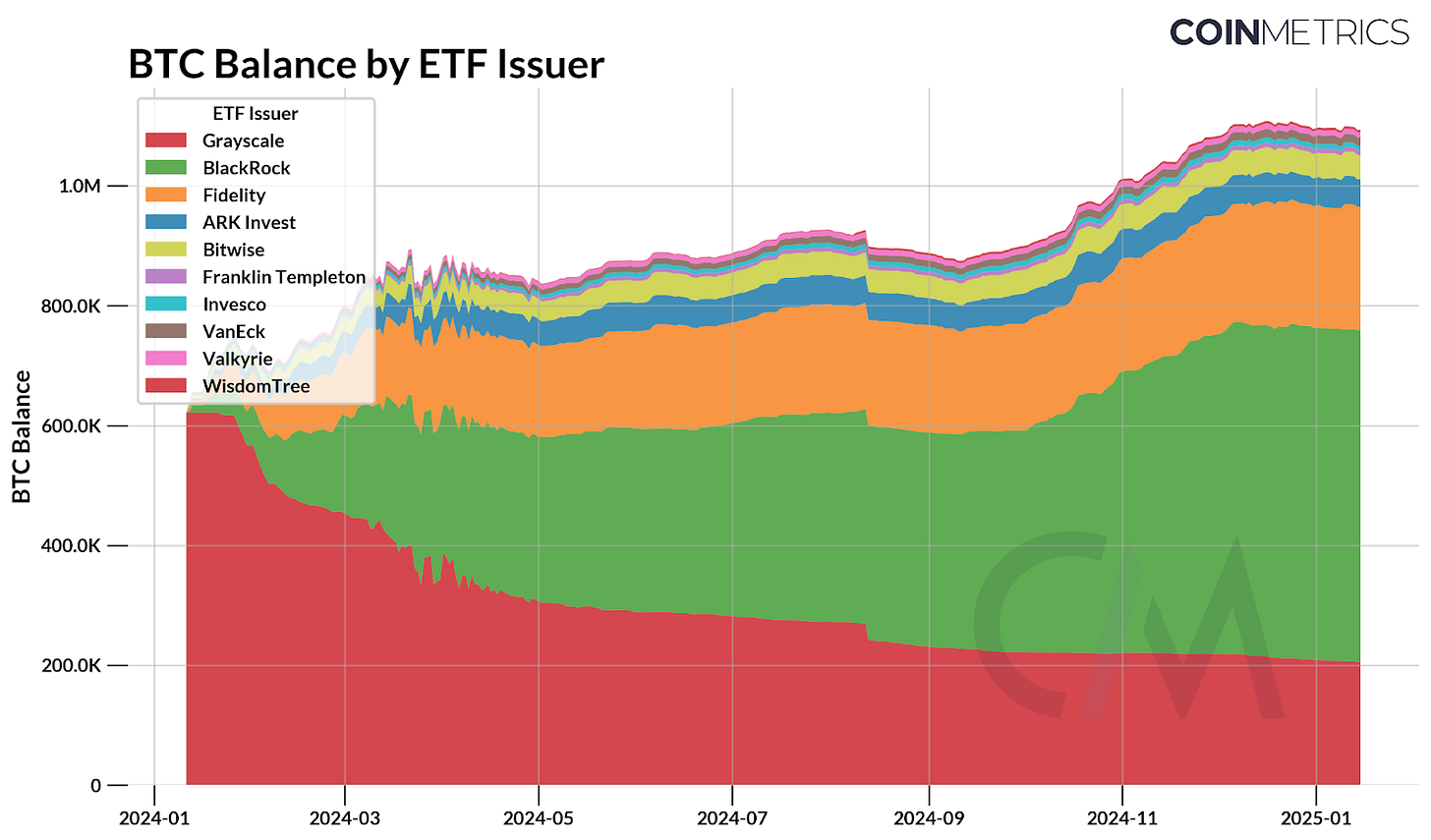

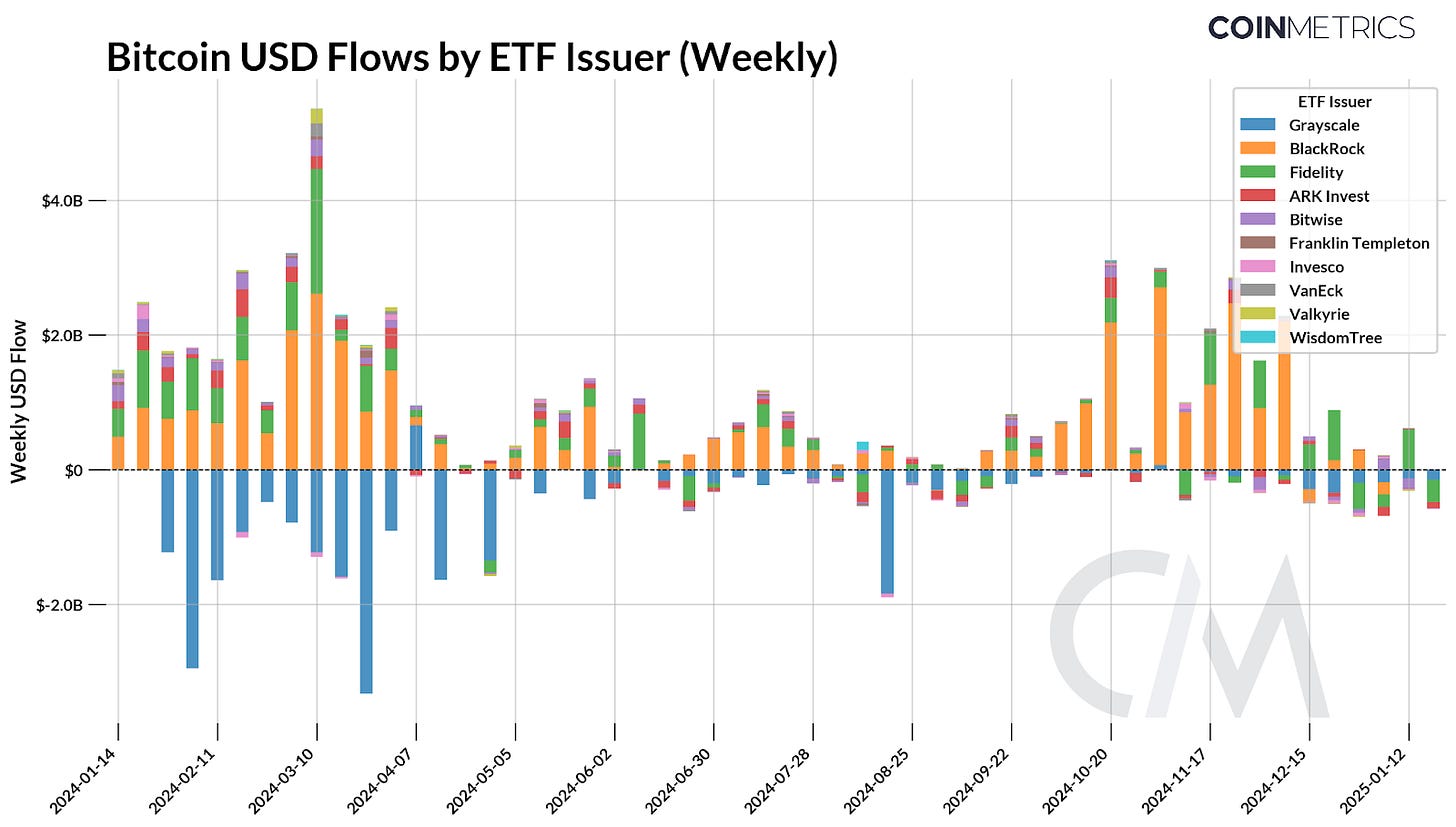

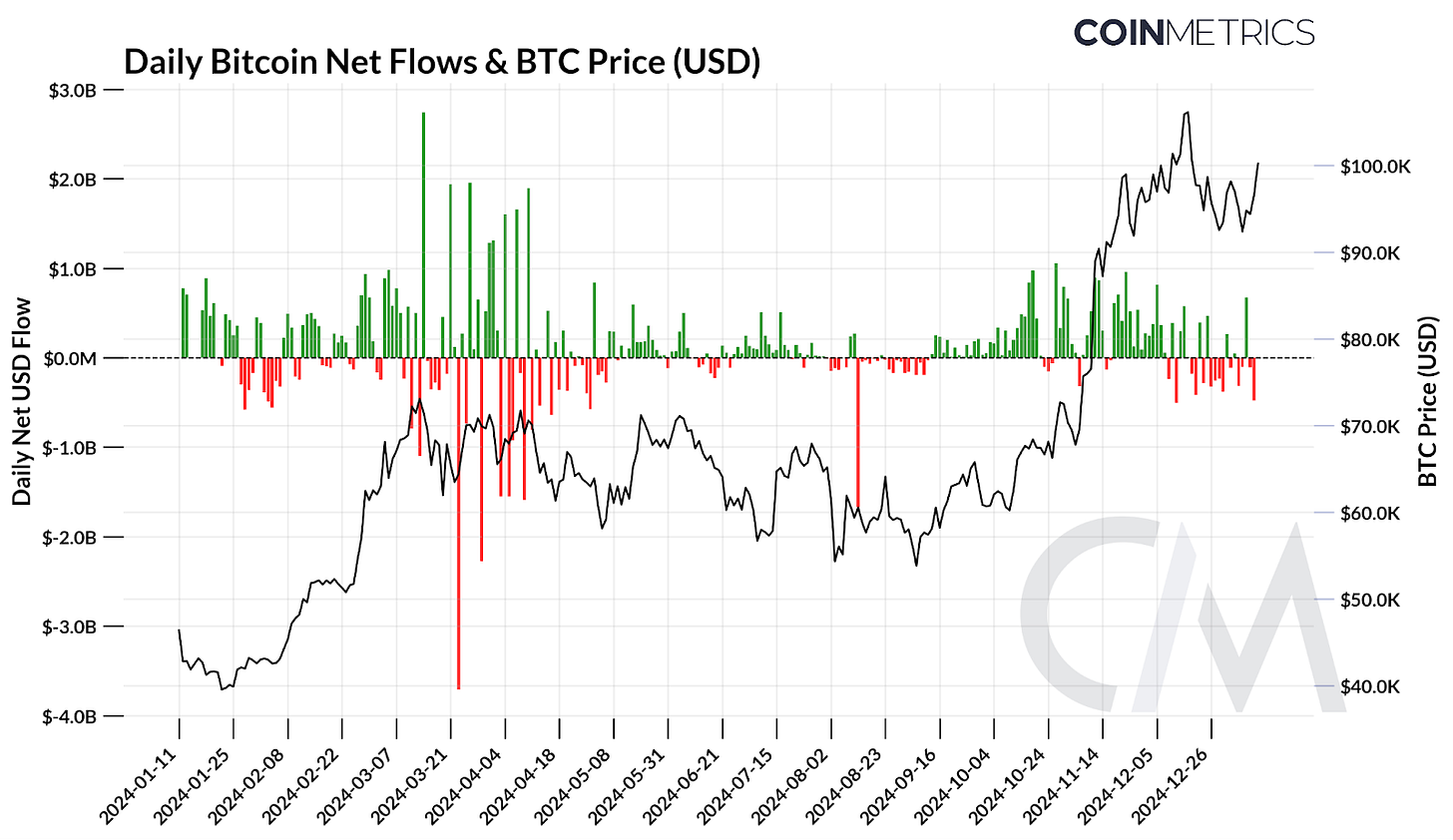

Inflows started ramping up as the year progressed, bringing the aggregate bitcoin holdings of the ETF issuers to over ~800,000 BTC by March. This acceleration of inflows coincided with a period of strong market sentiment, which translated into strength across various sectors of the crypto ecosystem. While the summer brought a period of consolidation, Donald Trump’s victory in the U.S. presidential elections in November lifted optimism once again, buoying ETF inflows and the rest of the market higher.

Currently, spot Bitcoin ETFs have recorded ~$32B in net inflows, collectively holding over 1.1M BTC—equivalent to $115B in assets under management. These holdings now represent ~5.7% of Bitcoin’s circulating supply. To put this in perspective, this is ~1% of the total AUM of all ETFs globally, underscoring the immense growth potential ahead.

Source: Coin Metrics Labs

These Bitcoin ETFs cater towards 3 broad investor bases—individual investors, wealth advisors and institutions. 13F filings have revealed the buyers behind the ETFs, consisting largely of retail and cohorts of professional investors including hedge funds and major financial institutions such as Goldman Sachs and Millennium Management. This reflects a combination of growing interest in incorporating Bitcoin into investment portfolios and the appeal of a regulated ETF structure, which acts as a bridge between traditional finance and the crypto world.

As we revealed in our 2025 Outlook Report, we expect capital inflows to accelerate into 2025, potentially doubling AUM across these ETFs as easing regulatory conditions bring broader participation from channels like pension funds, family offices and endowments.

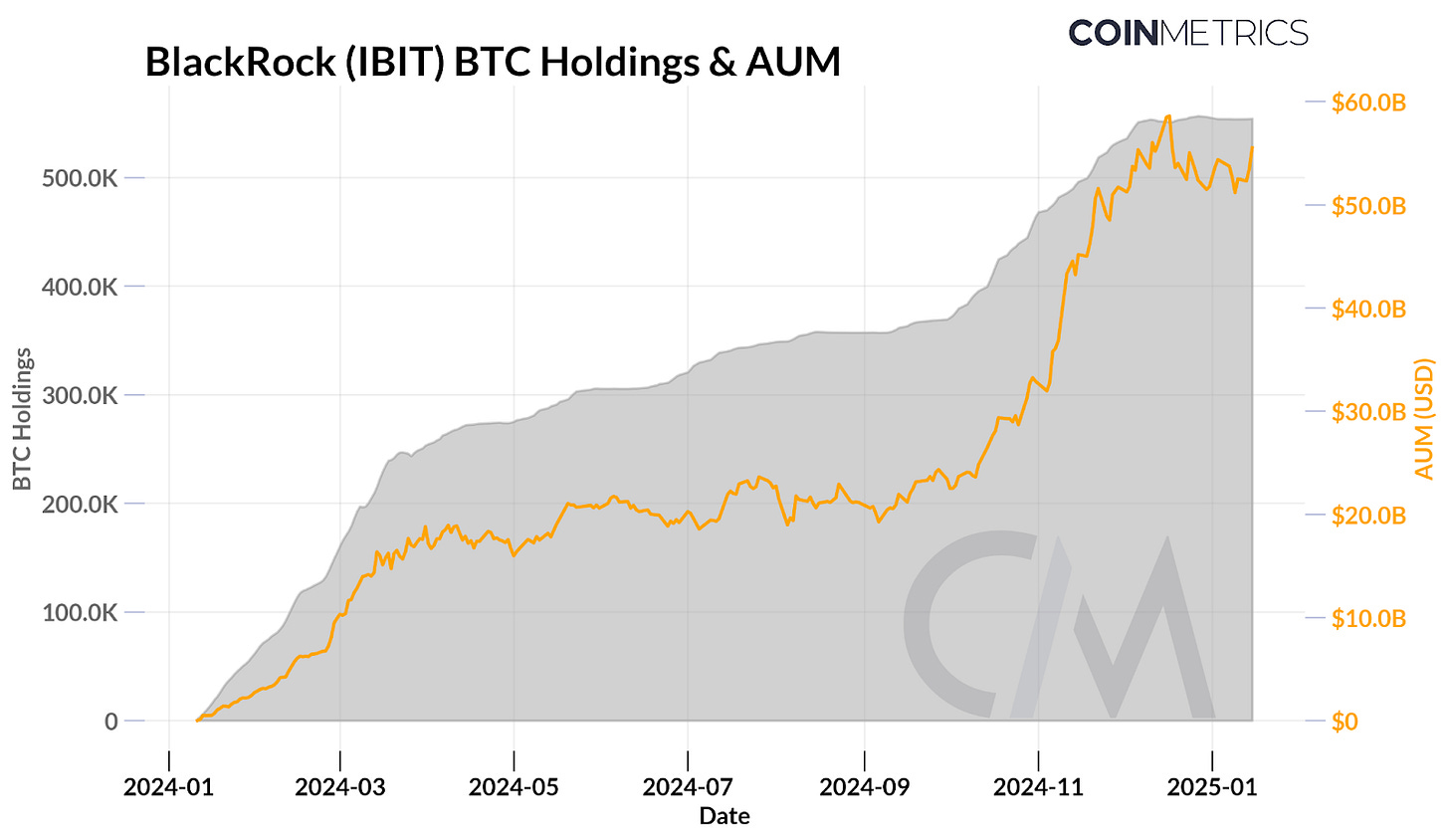

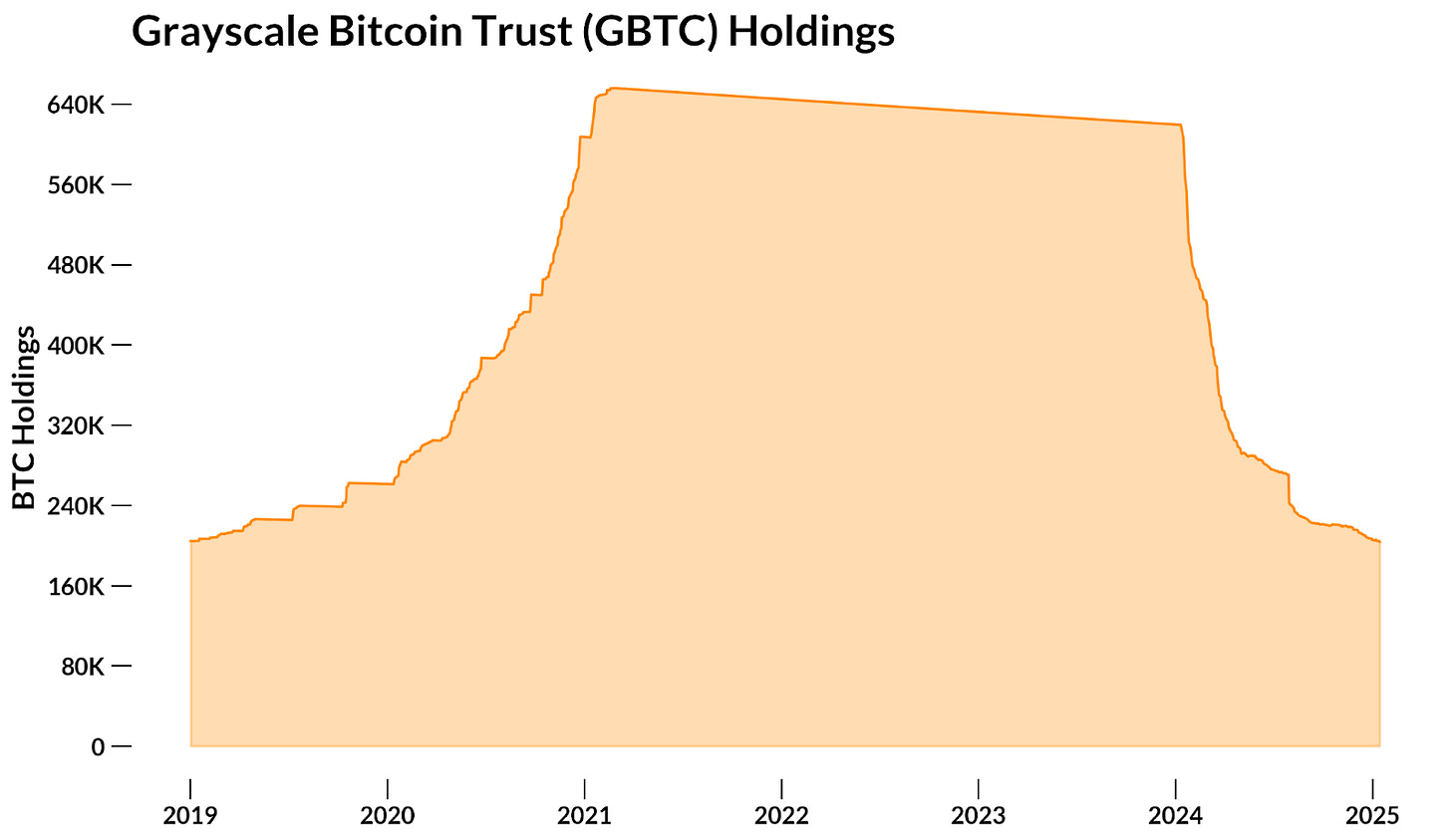

When viewed from the perspective of individual issuers, not all have performed the same. While BlackRock’s iShares Bitcoin ETF (IBIT) has accumulated ~540,000 BTC, representing half of all BTC accumulated by the ETFs, Grayscale’s GBTC has seen its holdings reduce from over 600K to 200K, dragging net flows lower.

Source: Coin Metrics Labs

As of January 19th , BlackRock’s IBIT sits at an AUM of $59B, surpassing the BlackRock iShares Gold ETF (IAU) in assets, bolstering Bitcoin’s recognition as “digital gold”. According to Bloomberg ETF analyst Eric Balchunas, IBIT reached the $50 billion of assets under management milestone in just 227 trading days, breaking the previous record of 1,323 days set by iShares Core MSCI Emerging Markets ETF.

Source: Coin Metrics Institution Metrics, Grayscale

On the other hand, the Grayscale Bitcoin Trust (GBTC), once the primary vehicle for gaining indirect Bitcoin exposure, faced challenges upon its conversion to an ETF. Investors sought newly launched Bitcoin ETFs offering lower expense ratios compared to Grayscale’s 1.5% fee. Additionally, some of GBTC’s assets were spun off into the Grayscale Bitcoin Mini Trust (BTC), a lower-cost alternative to its predecessor.

With 12 months of data to analyze, we can begin to understand the interplay between spot Bitcoin ETF net flows and BTC price. As a large, consistent source of structural demand for BTC, spot ETFs have had a measurable influence on price movements, albeit with variations over time. The chart below illustrates that significant inflows or outflows have coincided with major price movements. However, this relationship has not been consistent, as broader market conditions and investor sentiment also play a role, in addition to factors like MicroStrategy’s market impact.

Source: Coin Metrics Reference Rates & Labs

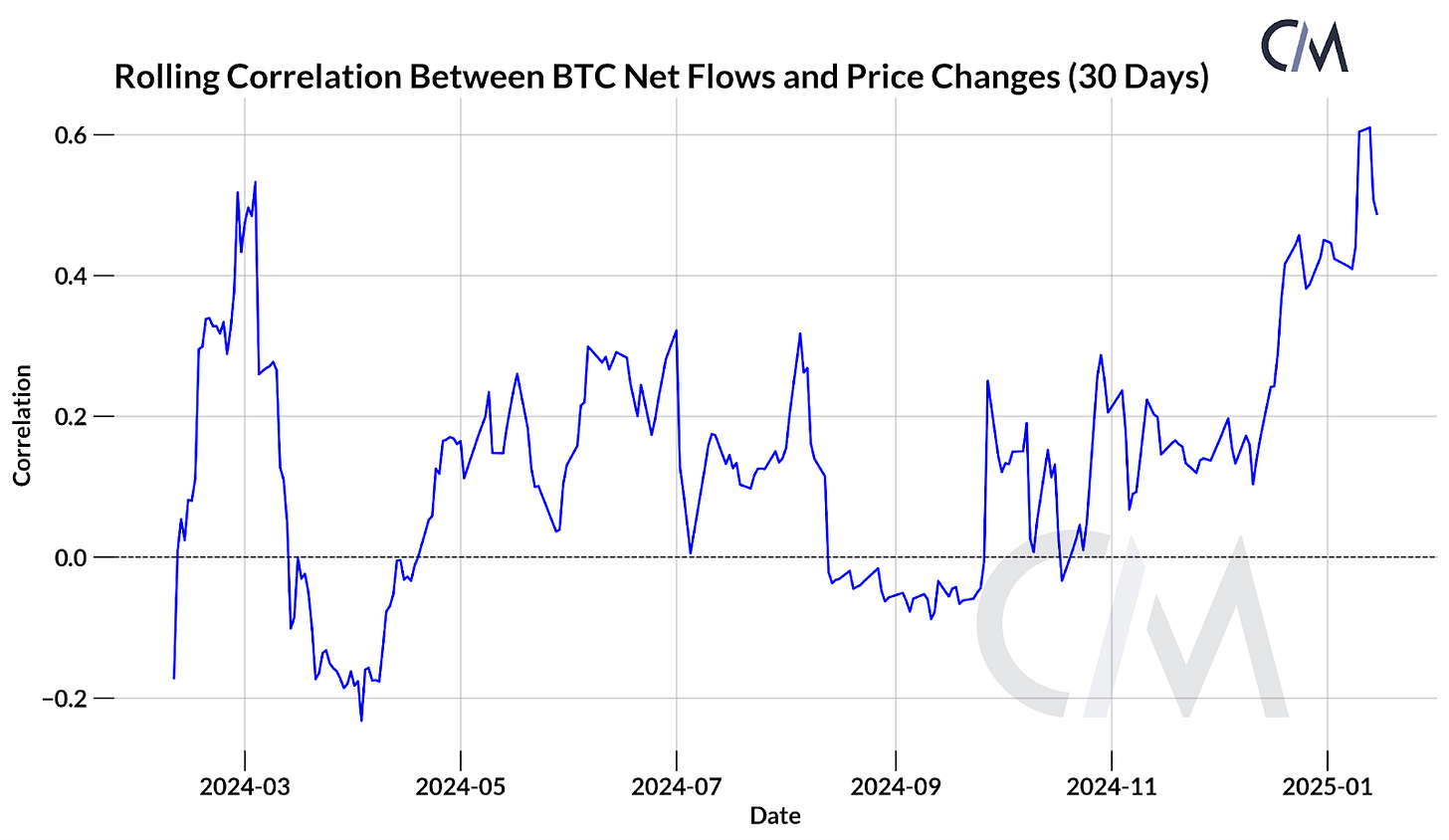

The rolling correlation chart highlights the evolving relationship between ETF net flows and BTC price changes. During periods of strong market momentum or significant inflow weeks, the correlation tends to strengthen, suggesting that ETF inflows can act as a structural driver of BTC price increases as issuers accumulate BTC to meet demand. Conversely, rising BTC prices can attract more inflows, as retail and institutional investors allocate capital to ETFs, creating a reinforcing feedback loop.

Source: Coin Metrics Reference Rates & Labs

Another dynamic to consider is the role of basis arbitrage. This involves buying spot ETFs while simultaneously shorting futures on venues like the CME to capture yield. Such trades can offset the upward price pressure from ETF inflows. Supporting this, Bitcoin futures open interest on the CME rose from $6.2B at the time of the ETF launch to $22.7B in December, highlighting the influence of such mechanisms on market structure.

Spot Bitcoin ETFs have reshaped the crypto investment landscape, attracting institutional and retail capital while driving structural demand for BTC. Over the past year, they’ve proven their potential to legitimize and expand access to digital assets. Ethereum ETFs, while off to a slower start, have begun gaining momentum, reflecting a growing appetite for such products. As the market matures, new opportunities—such as staked ETH and SOL ETFs or multi-asset ETFs for other crypto assets—could further enhance accessibility and cement the role of ETFs in bridging traditional finance with digital assets. The next wave of ETF inflows could unlock greater growth, driving momentum for crypto adoption.

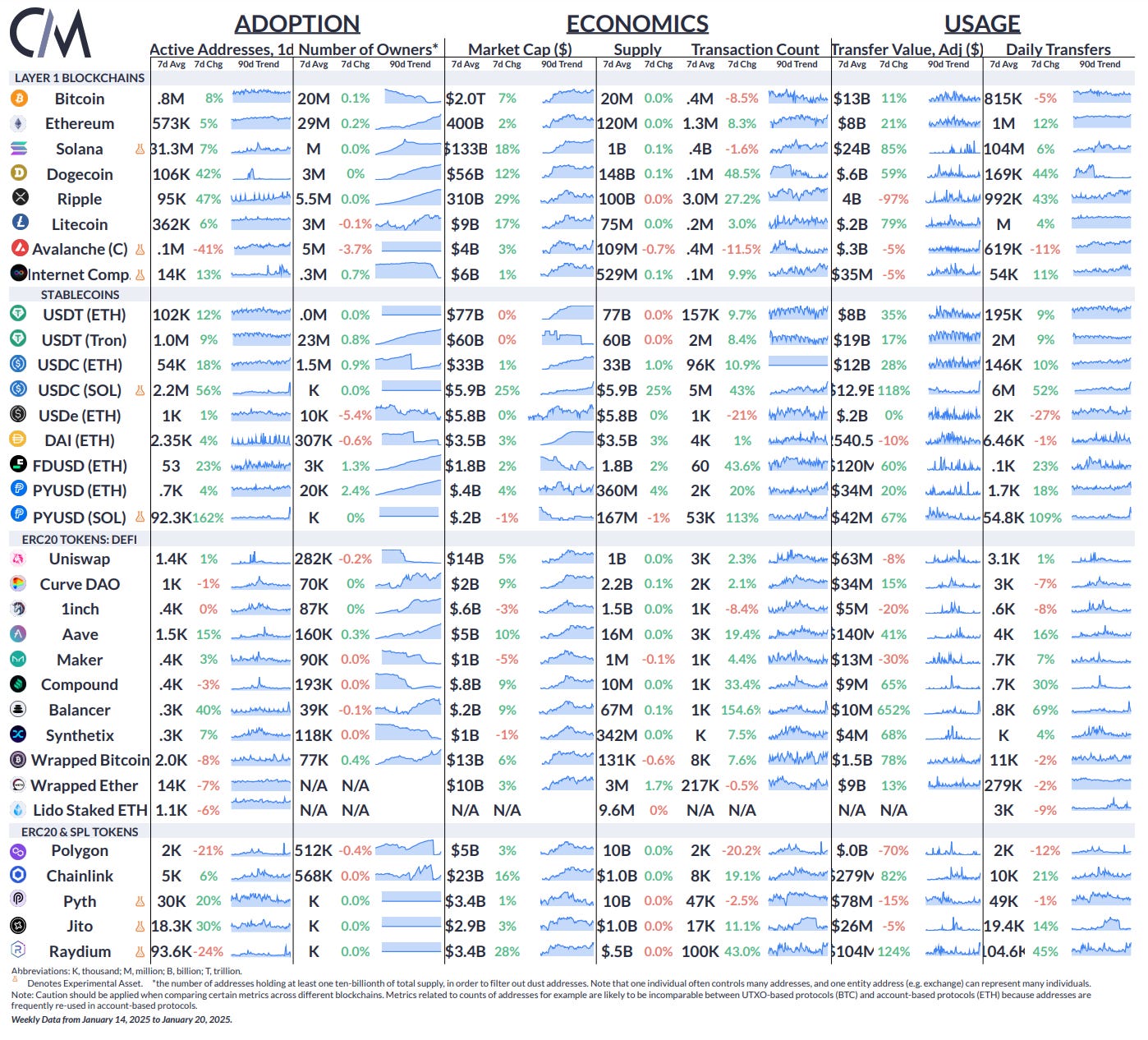

Source: Coin Metrics Network Data Pro

Active Bitcoin addresses rose 8% this week, averaging 800K daily. In the stablecoin ecosystem, USDC on Solana saw a 56% increase in active addresses and a 25% market cap growth to $5.9B. PYUSD on Solana surged 162% in daily active addresses, driven by heightened activity from the TRUMP coin launch ahead of Donald Trump’s inauguration.

-

For a deeper dive into the trends and outlooks shaping the crypto industry in the year ahead, be sure to check out our 2025 Outlook Report

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  OKB

OKB  Ethena Staked USDe

Ethena Staked USDe  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer