[ad_1]

In Brief

2024 was a turbulent year for the NFT market, with significant swings in trading volumes and sales, marking one of the worst NFT performance years since 2020.

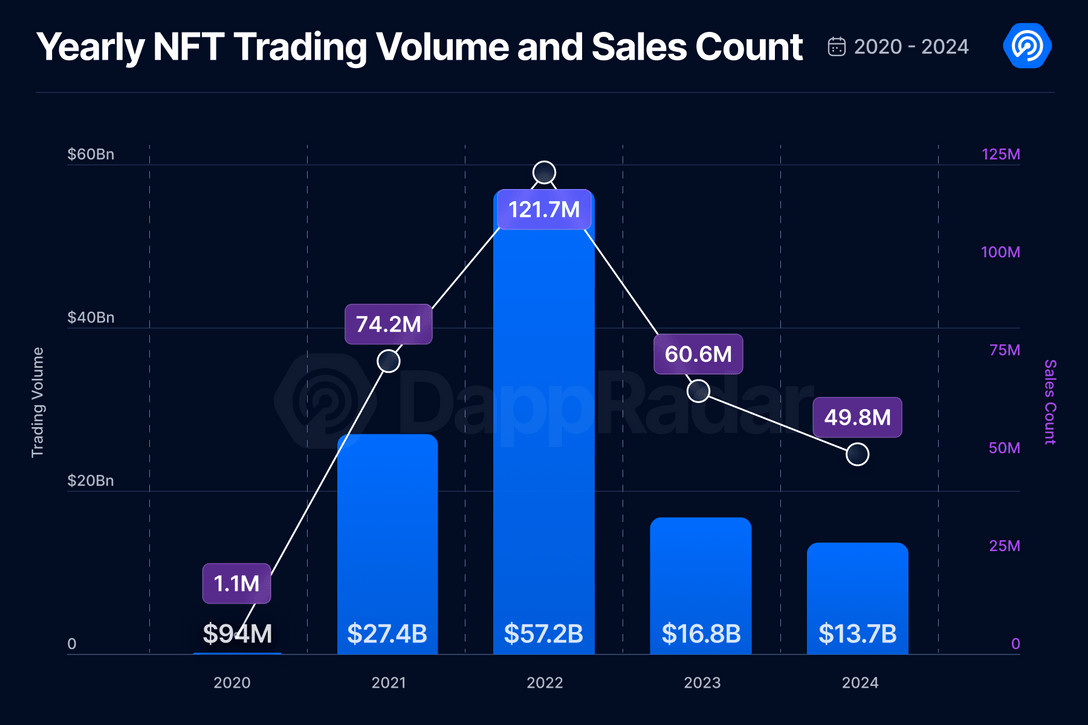

With notable swings in trading volumes and sales counts, 2024 was one of the most turbulent years for the NFT market, according to DappRadar. Although the year started off positively, the market had difficulties as the months went by, which led to one of the worst NFT performance years since 2020. Overall, NFT performance mirrored the wider volatility of the digital asset field despite some encouraging advances and growing use in specific industries.

Early Optimism: A Good Start for 2024

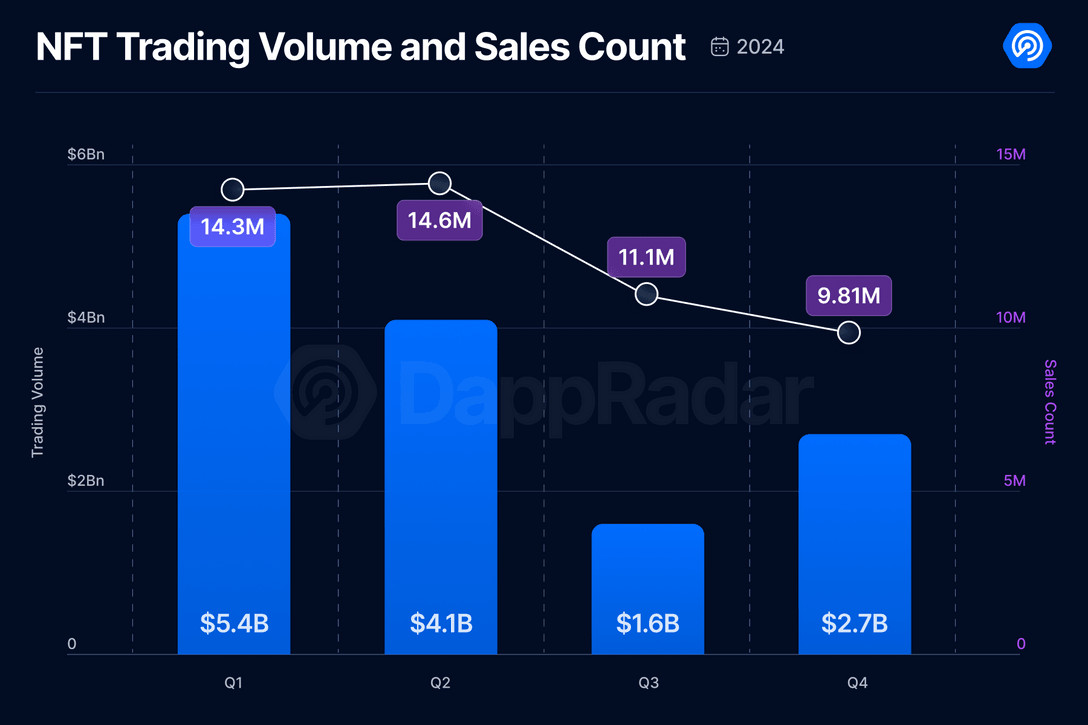

With trade volumes soaring in the first quarter, the year got off to a positive start. Compared to the same time in 2023, the NFT trading volume increased by 4% to almost $5.3 billion in Q1. A number of things contributed to this early momentum, including the rising demand for digital collectibles and the expanding application of blockchain technology in a variety of sectors. After declines in prior years, NFTs appeared to be poised for a robust resurgence in the first few months of 2024.

The Mid-Year Downturn: Q2 and Q3 Difficulties

As the year went on, the optimism soon faded. NFT trading volumes fell precipitously to barely $1.5 billion by the third quarter of 2024. The market had lost a lot of its initial impetus, as seen by this steep decline in volume. This downturn was caused by a number of causes, including shifting investor mood, regulatory uncertainty, and broader economic pressures.

While trading volume remained low during Q3, there was a slight rebound in Q4, with volumes rising to $2.6 billion. Yet, this recovery was not enough to offset the significant losses seen earlier in the year. The general trend for 2024 pointed to a market in decline, with trading activity failing to maintain the highs of previous years.

Photo: DappRadar

NFT Collections: Shifting Dominance and New Collaborations

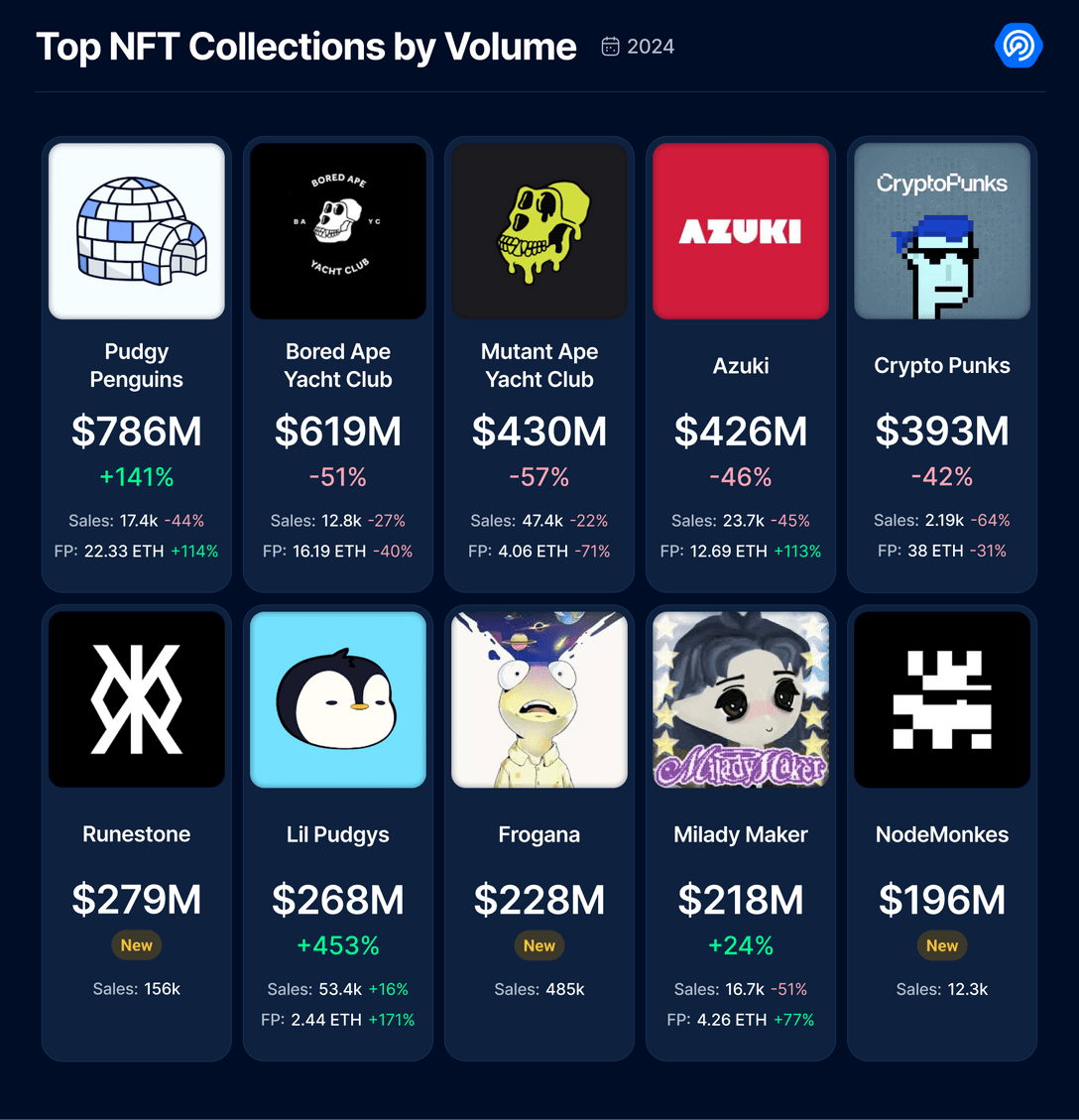

In 2024, there were notable shifts in the top NFT collections. The Pudgy Penguins’ performance was among the most noteworthy instances. Despite being one of the best collections in terms of trading volume, Pudgy Penguins had a 44% decline in sales over the prior year. In spite of this drop, Pudgy Penguins’ floor price increased by 114%, indicating a tendency toward fewer, higher-value transactions.

Photo: DappRadar

Pudgy Penguins’ 2024 success may be ascribed to their calculated attempts to diversify outside of the internet sphere. The collection helped boost real-world prominence by introducing plush toys to well-known stores, including Walmart, Walgreens, Target, Selfridges, and Argos in the United Kingdom.

In May 2024, Pudgy Penguins and Mythical Games also collaborated to create a smartphone game that uses blockchain. The goal of this partnership was to include their well-known penguin characters in a top-notch gaming experience, supporting the expanding trend of NFTs with practical applications. When Pudgy Penguins partnered with Spanish football side CD Castellón in September 2024, they became the first profile picture (PFP) NFT collection to appear on a professional football team’s kit.

On the other hand, Yuga Labs, which has historically controlled the NFT market, experienced a drop in floor pricing and trading volumes in 2024. Although its general dominance was diminished, Yuga Labs was still one of the most traded collections despite these difficulties.

With plans for its immersive metaverse platform, Otherside, and a possible new project in partnership with PP Man scheduled to premiere in 2025, the company’s dedication to innovation has not wavered. Yuga Labs is not giving up on its market position, as seen by its attempts to broaden its product offerings and investigate new prospects in the metaverse.

Photo: DappRadar

The Gaming Industry: Fueling NFTs’ Future

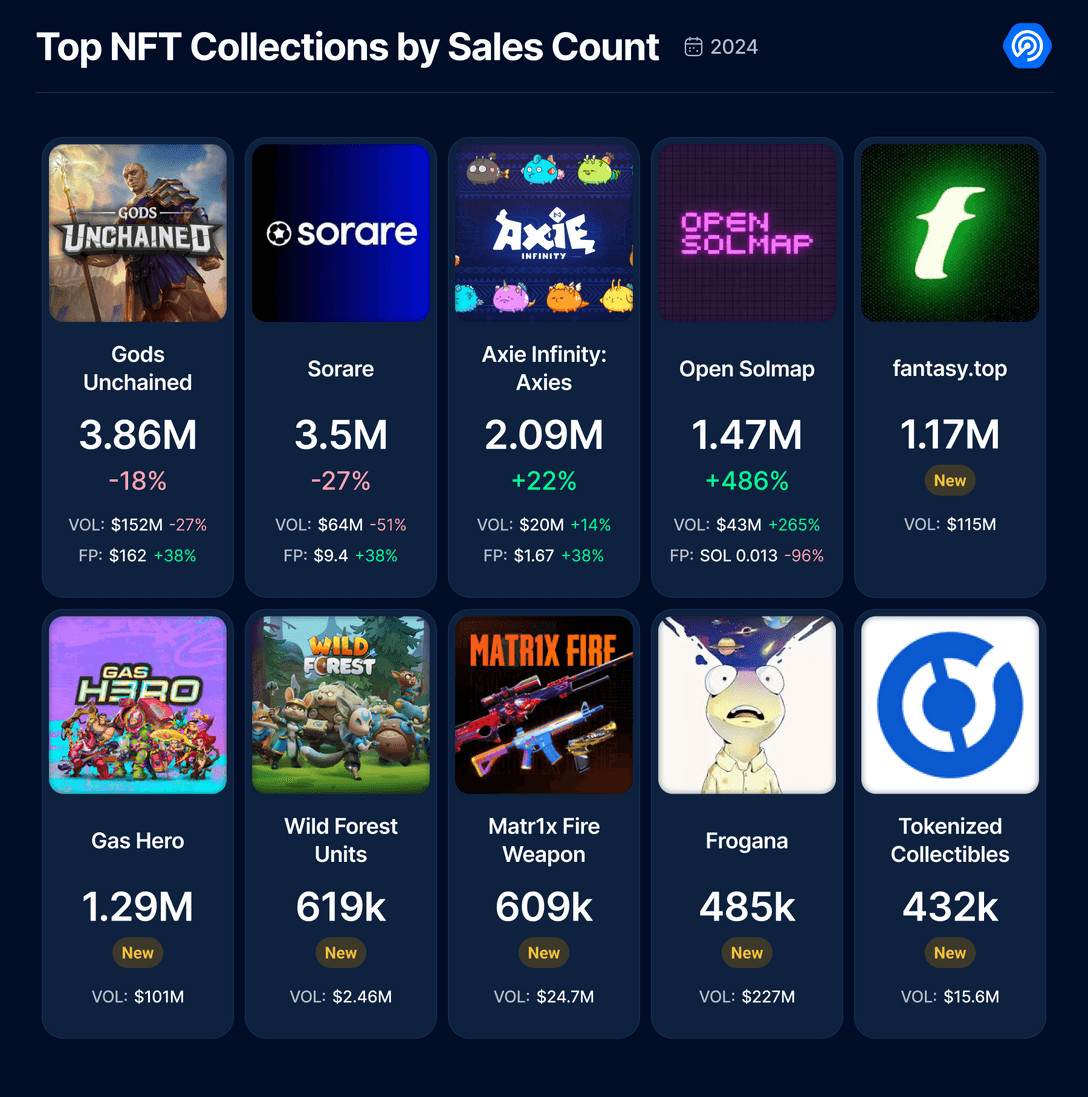

In 2024, the gaming industry was one that saw steady expansion. Since these digital collectibles gave players the opportunity to really own their in-game goods and take part in player-driven economies, NFTs connected to gaming and in-game assets were gaining popularity. NFTs with useful, in-game functions were in high demand, as seen by the dominance of gaming-related NFTs in sales figures. This pattern was indicative of a more general change in the market, as NFTs were becoming valued assets in virtual worlds and gaming platforms as well as collectors.

In the upcoming years, it is anticipated that the gaming industry’s use of NFTs would further increase. Blockchain technology’s use into gaming opens up new possibilities for both gamers and developers, improving the player experience and generating new revenue streams. NFTs in gaming will probably grow in importance as this trend develops, and further advancements are anticipated to influence the direction of digital assets in the future.

Photo: DappRadar

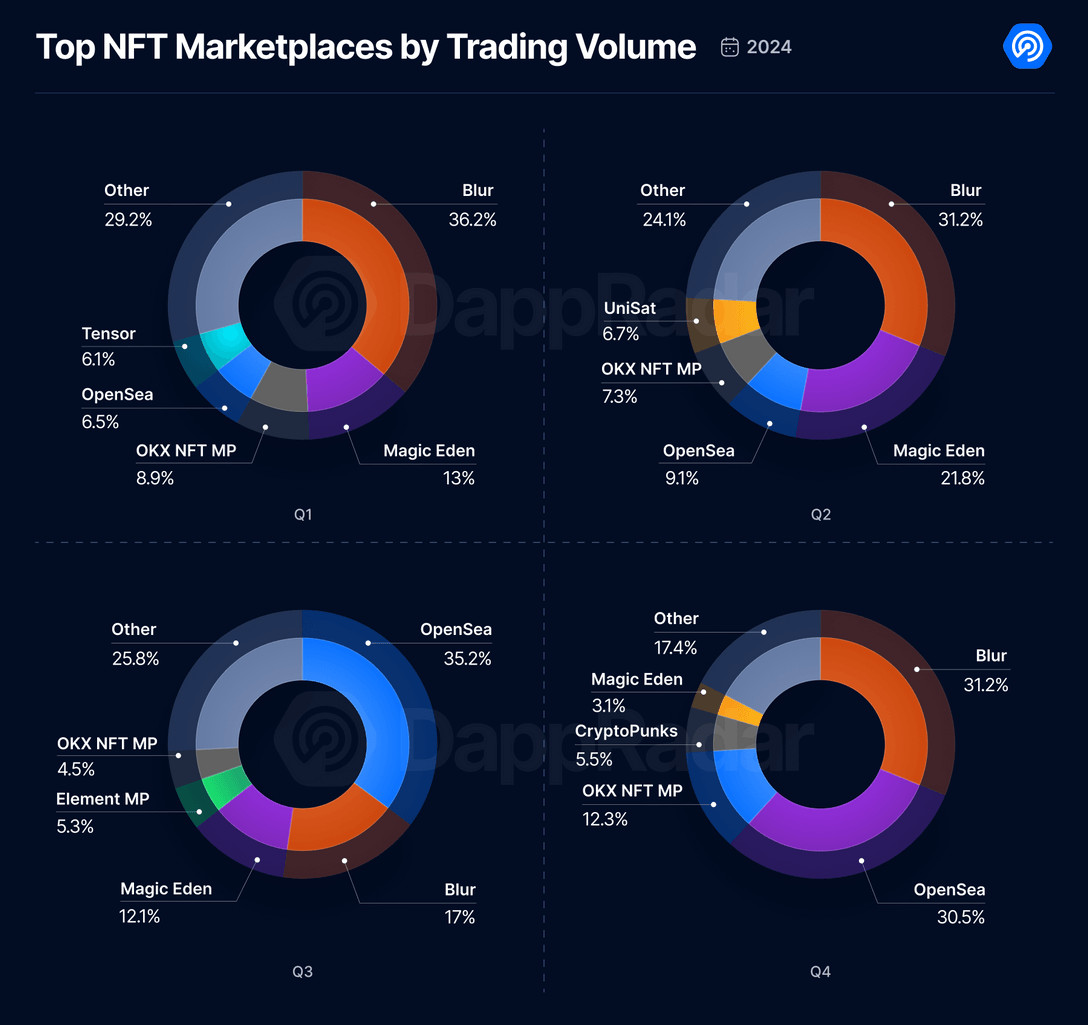

OpenSea vs. Blur, The Conflict of Marketplaces

Blur established its supremacy in NFT markets in 2024, holding the top spot for most of the year. Blur’s zero-fee trading strategy, which drew traders trying to cut expenses, was a major factor in its success. Additionally, the company started a number of airdrop efforts to expand its user base and awareness.

Yet, it was a difficult year for OpenSea, the established leader in the NFT business. The U.S. Securities and Exchange Commission (SEC) sent OpenSea a Wells Notice in August 2024 for unregistered securities. A weakening market, intense competition, and regulatory pressure caused OpenSea to announce large layoffs in November, cutting its personnel by 56%. In an attempt to recover market share, OpenSea declared intentions to relaunch with a new platform version, called “OpenSea 2.0,” despite these obstacles. Additionally, the platform is hinting at the possible release of a coin that would open up new doors for its ecosystem’s producers and collectors.

Photo: DappRadar

In 2024, however, Magic Eden—a platform that first concentrated on Solana—performed better than OpenSea. In addition to Bitcoin, Ethereum, and Polygon, Magic Eden also offers more recent networks like Base and Arbitrum. In order to fortify its ecosystem, Magic Eden introduced its native ME coin in December 2024, along with a $700 million airdrop. With this growth and calculated decision to broaden its product line, Magic Eden established itself as a major force in the market competition and may have changed the balance of power in the NFT sector.

In 2024, the NFT ecosystem kept developing beyond individual collections and marketplaces. The diversification of NFT use cases was one of the major developments. NFTs discovered new uses in industries including gaming, music, real estate, and ticketing, even if digital art and collectibles continued to be a primary emphasis. The growing use of NFTs in various industries showed that they may provide practical benefits outside of the digital sphere.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Victoria d’Este

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

[ad_2]

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Aptos

Aptos  sUSDS

sUSDS  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic