By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market is looking to maintain the bullish momentum ignited by Wednesday’s U.S. CPI report, which matched estimates and cleared the path for another Federal Reserve rate cut next week.

BTC has retaken $100,000 and ether is again eyeing $4,000. A number of tokens, including AAVE and LINK, are trading 10% higher on the back of accumulation by wallets tied to World Liberty Financial, the project supported by President-elect Donald Trump’s family.

The key question now is whether BTC’s rally will be long-lasting. It could be, thanks to bitcoin’s consistent price premium on Coinbase compared with global exchanges and healthier leverage levels in the broader market. The upside may be capped, however, if the producer price index shows hotter inflation in the pipeline.

“Any upside surprise — and what it means for next Friday’s release of the core PCE deflator — could prove a minor dollar positive,” ING said.

For cues on whether $100K is a major top, my advice is simple: when in doubt, zoom out.

At $100,000, the annualized three-month BTC futures basis on major exchanges hovers around 15%, way below the 30%-plus witnessed at the height of 2021’s bull market. That’s a sign the gain is driven by genuine buying in the spot market, which is longer-lasting than speculative leverage-led bull runs.

Zooming out also brings the second half of 2021 into the frame. That’s when college kids in their late teens from extended suburban Mumbai traded tokens like DOT, SOL, ETH and other tokens without any know-how of their use case.

It’s also when the bull market topped.

Fast forward to now, and main street is silent on crypto. Remember what Leonardo Di Caprio said in The Wolf of Wall Street: “by the time you read about it in The Wall Street Journal, it’s already too late.”

If that’s not enough, the $100,000 milestone is also marked by a rise in institutional participation and active lobbying by crypto community for favorable regulatory environment.

Speaking of bull market continuation, ether looks primed to move above $5,000 as booming on-chain activity burns more of the token, reducing supply in the market, according to CryptoQuant.

“According to ETH’s realized price—the average price at which holders purchased their ETH—the current upper limit for ETH’s price stands around $5.2k,” the firm told CoinDesk.

The bullish outlook for ether is generally seen as good news for other altcoins too, although, according to Delphi Digital, the token supply is “too damn high,” thanks to projects like pump.fun. The resulting demand-supply imbalance makes finding the alpha that much more challenging in the altcoin sector. Stay alert!

What to Watch

- Crypto:

- Dec. 13: Nasdaq announces its annual changes to the Nasdaq-100 index. MicroStrategy (MSTR), the world’s largest corporate holder of bitcoin, is widely expected to be added.

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its monetary policy decision (three key interest rates), followed by a press conference at 8:45 a.m.

- Deposit facility interest rate Est. 3.0% vs Prev. 3.25%.

- Main refinancing operations interest rate Est. 3.15% vs Prev. 3.4%.

- Marginal lending facility interest rate Prev. 3.65%.

- Dec. 12, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Dec. 7. Initial Jobless Claims Est. 220K vs Prev. 224K.

- Dec. 16, 9:45 a.m.: December’s S&P Global Flash US PMI data is released. Composite PMI Prev. 54.9.

- Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its monetary policy decision (three key interest rates), followed by a press conference at 8:45 a.m.

Token Events

- Governance votes & calls

- EigenLayer to deploy Rewards v2 upgrade on Holesky testnet following governance vote. Stakers and operators can collect multiple rewards at once, saving on transaction costs.

- Moonriver’s MR64 proposal meets quorum and would upgrade tokenomics by redirecting 80% of token inflation to the treasury to fund ecosystem growth and operations.

- Synapse puts up SIP-41 for voting, and proposes a $3.5 million buyback of SYN tokens over three months. Voting is currently live.

- Unlocks

- Axie Infinity to unlock 815,000 AXS, worth $6 million at current prices, at 8:10 a.m.

Conferences:

Token Talk

By Shaurya Malwa

An AI agent token fashioned after venture fund a16z has flipped sector leader goat (GOAT) to become the most valued in its category.

Ai16z, a fund based on AI-based trading signals, has crossed an $850 million market capitalization to flip GOAT, which kickstarted the AI agents sector in October. Holders of AI16Z tokens pitch ideas to “AI Marc,” an AI agent modeled after Andreessen Horowitz (a16z) partner Marc Andreessen, to influence and suggest investment decisions.

The fund holds upward of $10 million from 30,000 unique “partners,” a feat it has achieved in a little over a month since going live.

The AI16Z price has surged 77% in the past seven days and more than tripled in the past 14 days, CoinGecko data shows. That’s more than GOAT and other AI agent tokens that function solely as memes or online chatbots.

The action shows the market’s evolving preferences for projects offering entertainment value and tangible utility — where technical projects masquerading as memes may continue to attract more demand in the coming months.

“$ai16z flipping $goat is a huge signal for the AI agent sector,” crypto trader @Defi0xJeff wrote in an X post. “It shows how the new generation of agents is progressing at a much faster pace than the old guard. This is bullish not just for $ai16z but for the entire ecosystem.”

Derivatives Positioning

- BTC and ETH implied volatility term structures have steepened alongside price rises.

- Calls have become pricier than puts as BTC’s move back above $100,000 has reduced fears of a protracted pullback.

- A market participant bought a large calendar spread by buying the $110K strike call expiring Jan. 3 while selling the $100K call expiring Dec. 27. The strategy aims to profit from the price decay in the Jan. 27 expiry while being protected from an upside volatility explosion.

- In ETH, the notable trade was a bull call spread at $4,300 and $4,500 strikes.

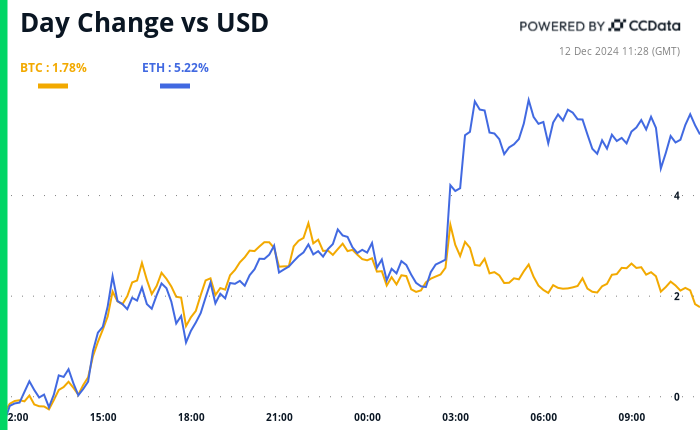

Market Movements:

- BTC is up 3.64% from 4 p.m. ET Wednesday to $100,599 (24hrs: +2.05%)

- ETH is up 6.9% at $3,921.91 (24hrs: +5.41%)

- CoinDesk 20 is up 2.14% to 3,905.81 (24hrs: +5.52%)

- Ether staking yield is down 30 bps to 3.17%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is unchanged at 106.63

- Gold is up 0.49% at $2,747.10/oz

- Silver is up 1.47% to $33.04/oz

- Nikkei 225 closed +1.21% at 39,849.14

- Hang Seng closed +1.2% at 20,397.05

- FTSE is up 0.25% at 8,322.22

- Euro Stoxx 50 is unchanged at 4,962.71

- DJIA closed on Wednesday -0.22% at 44,148.56

- S&P 500 closed +0.82% at 6,084.19

- Nasdaq closed +1.77% at 20,034.89

- S&P/TSX Composite Index closed +0.6% at 25,657.70

- S&P 40 Latin America closed +1.55% at 2,398.16

- U.S. 10-year Treasury is unchanged at 4.3%

- E-mini S&P 500 futures are down 0.16% to 6,082.75

- E-mini Nasdaq-100 futures are down 0.24% to 21,741.50

- E-mini Dow Jones Industrial Average Index futures are down 0.19% at 44,139.00

Bitcoin Stats:

- BTC Dominance: 56.18% (24hrs: -1.20%)

- Ethereum to bitcoin ratio: 0.03878 (24hrs: -0.83%)

- Hashrate (seven-day moving average): 770 EH/s

- Hashprice (spot): $61.8

- Total Fees: 18.9 BTC/ $1.9M

- CME Futures Open Interest: 194,740 BTC

- BTC priced in gold: 37.2 oz

- BTC vs gold market cap: 10.60%

- Bitcoin sitting in over-the-counter desk balances: 431,000 BTC

Basket Performance

Technical Analysis

- The ETH/BTC ratio has already scaled the 50-day SMA and is now looking to establish a foothold above the 100-day average.

- That would give traders more confidence that the pair has bottomed out and open the door for a test of the 200-day average at 0.044.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $411.4 (+9.03%), down 0.75% at $408.11 in pre-market.

- Coinbase Global (COIN): closed at $313.81 (+3.77%), up 0.63% at $315.80 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.29 (+5.04%)

- MARA Holdings (MARA): closed at $23.27 (+2.02%), up 0.13% at $23.30 in pre-market.

- Riot Platforms (RIOT): closed at $11.77 (+6.04%), down 0.59% at $11.70 in pre-market.

- Core Scientific (CORZ): closed at $15.86 (+0.51%), up 0.19% at $15.89 in pre-market.

- CleanSpark (CLSK): closed at $12.83 (-0.85%), up 0.39% at $12.88 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.89 (+2.8%), up 3.08% at $28.75 in pre-market.

- Semler Scientific (SMLR): closed at $64.53 (+7.86%), down 0.22% at $64.39 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $223.1 million

- Cumulative net inflows: $34.55 billion

- Total BTC holdings ~ 1.119 million.

Spot ETH ETFs

- Daily net inflow: $102 million

- Cumulative net inflows: $1.97 billion

- Total ETH holdings ~ 3.417 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The number of daily transactions on Aptos, a layer-1 blockchain focused on safety and scalability, has almost tripled to 3.1 million in three months.

- The increased network usage supports the bull case in the APT token, which has increased 46% this year.

While You Were Sleeping

- Dollar’s Surge Sparks Biggest Fall in Emerging Market Currencies in 2 Years (Financial Times): The U.S. dollar’s surge, driven by expectations of President-elect Donald Trump’s policies, and economic struggles in emerging markets, has sparked the largest sell-off in their currencies since Sept. 2022.

- Less than 1% of Microsoft Shareholders Voted for BTC Proposal (CoinDesk): Only 0.55% of Microsoft shareholders backed a proposal, advocated by the National Center for Public Policy Research, to include bitcoin in the company’s balance sheet.

- Vancouver City Council Passes Pro-Bitcoin Motion Citing Fiat Challenges (CoinDesk): Vancouver’s city council approved a mayoral motion to explore using bitcoin as a treasury asset and for paying fees and taxes.

- LINK, AAVE Rocket 30% as Trump’s World Liberty Financial Buys $2M Tokens (CoinDesk): Crypto wallets associated with the Trump-supported World Liberty Financial project reportedly purchased millions in ETH, AAVE, and LINK tokens on Thursday, driving up their prices significantly.

- South Korean President Yoon Vows to ‘Fight to the End’ (Reuters): South Korean President Yoon Suk Yeol, facing a second impeachment vote on Saturday, defended his Dec. 3 martial law declaration as an attempt to save democracy.

- Inflation Is Stuck. Can Trump Unstick It? (The Wall Street Journal): Despite some easing, the U.S. year-over-year inflation rate stands at 2.7%, with economists warning that President-elect Donald Trump’s planned tariffs and immigration restrictions could further drive up prices.

In the Ether

Read More: www.coindesk.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Toncoin

Toncoin  Litecoin

Litecoin  Monero

Monero  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer