By Omkar Godbole (All times ET unless indicated otherwise)

The wait is over. Bitcoin has surged past $100,000, driven by a number of factors, including President-elect Donald Trump’s appointment of supposedly crypto-friendly Paul Atkins to lead the SEC.

Most analysts are bullish, anticipating further gains toward $120,000 and higher, and it’s not hard to see why. As Newton’s first law states, an object in motion maintains its speed and direction unless acted on by an outside force.

The wider market is poised to benefit from bitcoin’s milestone, especially as the six-digit price may be too steep for many retail investors, prompting them to consider alternative cryptocurrencies.

Ether, in particular, is likely to benefit because the spread between the Ethereum staking yield and the yield on the U.S. 10-year Treasury has narrowed recently, with the Treasury’s return dropping to 4.2% from 4.5% in the past two weeks. Note, however, that a whale address moved 11,753 ETH to exchanges in the past 24 hours, raising price volatility risks.

Additionally, the Bitcoin layer-2 network Stacks’ STX token is gaining considerable attention on social media, with one observer referring to the SEC-compliant token as a “de facto BTC staking provider.” STX has surged 56% this quarter, though at $2.80 it remains well below its record $3.84. Keep an eye on this one.

In traditional markets, BTC’s rise has lifted spirts of crypto-related equities, with self-described bitcoin development company MicroStrategy up over 6% in pre-market trading. Copycat Semler Scientific has gained over 7% and MARA Holdings more than 6%.

Still, there are several external forces that may stall BTC’s momentum.

“Risks are centered around escalating conflicts in Ukraine and the Middle East, along with dramatic shifts in interest rate expectations from the Fed,” trading firm Zerocap’s CIO Jonathan de Wet told CoinDesk, adding that the Fed’s potential hawkish turn next year may take the wind out of BTC’s sails.

Sergei Gorev, head of risk at YouHodler, said risks could emerge from an “overheated” S&P 500.

“While the price increase may continue, it likely won’t be significant,” he said. Many” technical indicators suggest a potential correction, prompting algorithmic traders to seek entry points for short positions to address divergences on the charts.”

Valentin Fournier, an analyst at BRN, and several others say the crypto market itself looks overheated and is at risk of correction.

“The Fear and Greed Index has climbed above 80, signaling extreme greed among investors. Smaller-cap assets are seeing explosive gains, drawing in retail participants eager to capitalize on the bull run. While this strategy could be lucrative, it carries significant risks in such unpredictable conditions,” Fournier told CoinDesk.

So, stay alert out there!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 5, 2 p.m.: French President Emmanuel Macron will deliver a televised speech from the Élysée Palace following the collapse of Prime Minister Michel Barnier’s government.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

- Unemployment Rate Est. 4.1% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Prev. 4%.

- Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

- Core Inflation Rate YoY Prev. 3.3%.

- Inflation Rate YoY Prev. 2.6%

- Dec. 11, 9:45 a.m.: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Prev. 3.75%.

Token Events

- Governance votes & calls

- Mars Protocol to hold community call at 9 a.m. to discuss launch of a perpetual trading product.

- Stellar to upgrade its mainnet to protocol version 22 following validator vote, time unspecified.

- Unlocks

- Solana’s Jito to release 105% of JTO circulating supply on Dec. 7 at 10 a.m., worth nearly $500 million at current prices.

- Token Launches

- StrawberryAI is to launch mainnet on Dec. 5, time unspecified.

Conferences:

Token Talk

By Shaurya Malwa

“Hailey is lying and will likely have to ‘talk tuah’ judge about this,” reads a widely shared community note on X today.

Copy and pasting:

Hawkanomics:

Team hasn’t sold one token and not 1 KOL was given 1 free token

We tried to stop snipers as best we could through high fee’s in the start of launch on @MeteoraAG

Fee’s have now been dropped pic.twitter.com/E7xN9VmCrx

— Haliey Welch (@HalieyWelchX) December 4, 2024

Viral sensation Haliey Welch launched a token on Solana late Wednesday. The token, backed by a management team, a foundation in the Cayman Islands, and a SAFT agreement with private investors who all claimed to ensure the longevity of HAWK — a token themed after Welch’s popular “hawk tuah” catchphrase.

The token initially saw its market cap soar to $490 million before dramatically crashing to less than $40 million with 20 minutes.

INFLUENCER RUG PULL

Haliey Welch, also known as “Hawk Tuah” girl, launched a token earlier today

Minutes later, it got rugged with a 93% dropdown

90% of the supply was held in one cluster + insiders earned millions by snipping the token launch and dumping it on retail pic.twitter.com/hd9khELT4e

— De.Fi Antivirus Web3

(@De_FiSecurity) December 5, 2024

The wild price action drew parallels to a classic “rug pull,” or a token that benefits early buyers by pumping several multiples after issuance only to drop more than 90% in the hours or days afterward.

On-chain sleuths such as Bubblemaps allege over 96% of HAWK tokens were held in a single cluster — or a collection of related wallets — that sold tokens when prices rose.

Welch and her team have responded to some of these allegations, denying that insiders sold tokens at launch and claiming that the initial high trading fees were implemented to prevent snipers — or bots that purchase large amounts of a token after issuances to corner supply.

Several messages sent to Welch’s team to shed light on the allegations were unanswered in Asian hours.

Derivatives Positioning

- The market looks overheated and faces pullback risks, with BTC’s perpetual funding rates more expensive than those of speculative tokens such as DOGE.

- Traders are increasingly focusing on ETH, as evidenced by the new high of 6.86 million ETH in ether futures and perpetual futures open interest. BTC’s OI is yet to confirm the new spot-price high.

- BTC calls, however, are more expensive than ETH on Deribit, according to 24-delta risk reversals sourced from Amberdata. Long dealer gamma at the $105,000 strike options suggests potential for range play.

- BTC, ETH options flows mostly leaned bullish, but a large block trade saw an ETH trader sell the December expiry straddle at $3,800, collecting over $2 million in premium. Selling straddle represents expectations for price consolidation and volatility drop.

Market Movements:

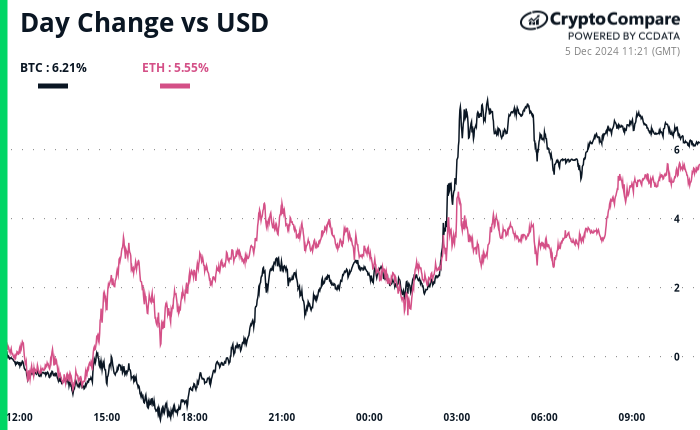

- BTC is up 4.83% from 4 p.m. ET Wednesday to $102,565.99 (24hrs: +6.22%)

- ETH is up 2.36% at $3,935.20 (24hrs: +5.24%)

- CoinDesk 20 is up 1.4% to 3,956.08 (24hrs: +0.21%)

- Ether staking yield is down 19 bps to 3.27%

- BTC funding rate is at 0.045% (49.3% annualized) on Binance

- DXY is down 0.11% at 106.21

- Gold is up 0.69% at $2672.20/oz

- Silver is up 1.14% to $31.86/oz

- Nikkei 225 closed +0.3% at 39,395.60

- Hang Seng closed -0.92% at 19,560.44

- FTSE is unchanged at 8339.32

- Euro Stoxx 50 is up 0.54% at 4,945.57

- DJIA closed on Wednesday +0.69% to 45,014.04

- S&P 500 closed +0.61% at 6086.49

- Nasdaq closed +1.3% at 19,735.12

- S&P/TSX Composite Index closed unchanged at 25,641.2

- S&P 40 Latin America closed +0.38% at 2,336.15

- U.S. 10-year Treasury was unchanged at 4.205%

- E-mini S&P 500 futures are unchanged at 6094.50

- E-mini Nasdaq-100 futures are down 0.14% to 21,505.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 45,069.

Bitcoin Stats:

- BTC Dominance: 56.60% (-0.61%)

- Ethereum to bitcoin ratio: 0.03800 (1.78%)

- Hashrate (seven-day moving average): 741 EH/s

- Hashprice (spot): $61.12

- Total Fees: 14.8 BTC/ $1.4 million

- CME Futures Open Interest: 188,135 BTC

- BTC priced in gold: 39.0 oz

- BTC vs gold market cap: 11.12%

- Bitcoin sitting in over-the-counter desk balances: 423,913

Basket Performance

Technical Analysis

- The chart shows bitcoin’s Mayer multiple, which measures the difference between an asset’s going market value and its 200-day simple moving average (SMA).

- As of writing, the Mayer multiple stands well below the 2.4 threshold that has marked previous bull market tops.

TradFi Assets

- MicroStrategy (MSTR): closed on Wednesday at $406 (+8.72%), up 6.38% at $431.90 in pre-market.

- Coinbase Global (COIN): closed at $330.94 (+6.98%), up 3.04% at $341.01 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.71 (+6.2+5%)

- MARA Holdings (MARA): closed at $25.96 (+3.3%), up 5.51% at $27.39 in pre-market.

- Riot Platforms (RIOT): closed at $12.95 (+6.67%), up 4.72% at $13.56 in pre-market.

- Core Scientific (CORZ): closed at $17.47 (+6.39%), up 2.63% at $17.93 in pre-market.

- CleanSpark (CLSK): closed at $14.68 (+5.23%), up 3.47% at $15.19 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.52 (+7.11%), up 3.15% at $30.45 in pre-market.

- Semler Scientific (SMLR): closed at $63.40 (-0.36%), up 7.37% at $68.07 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $556.8 million

- Cumulative net inflows: $32.26 billion

- Total BTC holdings ~ 1.086 million.

Spot ETH ETFs

- Daily net inflow: $167.7 million

- Cumulative net inflows: $901.3 million

- Total ETH holdings ~ 3.113 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the top 20 chains of the past month in terms of the net volume of assets received using a crypto bridge.

- Coinbase’s layer-2 scaling product BASE and programmable blockchain Solana are the highest recipients. Ethereum is the worst performer.

- The data supports the bull case in SOL and layer 2 tokens.

While You Were Sleeping

- Traders See Even More Bitcoin Buying Pressure as BTC Sets New Record at $103K (CoinDesk): Bitcoin crossed $100,000 for the first time on Thursday, reaching $103,670 before easing to $102,500. The 50 percent monthly gain reflects higher institutional interest, record ETF inflows, growing acceptance from traditional finance and optimism about Donald Trump’s presidency, which is expected to create a more favorable environment for bitcoin in the United States.

- Euro’s Outlook Gets Even Murkier After French Government Falls (Bloomberg): The euro faces pressure after Prime Minister Michel Barnier’s government was ousted in a no-confidence vote, increasing fears of political instability and fiscal uncertainty in France. Rising borrowing costs, a widening deficit, and uncertainty over the budget are compounding risks for the single currency, which has fallen 2.7% against the dollar since June.

- South Korea President Replaces Defence Minister and Battles Impeachment (Financial Times): South Korean President Yoon Suk Yeol accepted Defense Minister Kim Yong-hyun’s resignation on Thursday amid backlash over the failed attempt to impose martial law. With public protests growing and 70 percent of South Koreans supporting impeachment, opposition lawmakers are pushing for a Saturday vote while Yoon’s party works to block the motion.

- Binance’s BNB Hits Fresh Record, Breaks Out of 3-Year Range as Altcoin Rotation Accelerates (CoinDesk): BNB, the native token of the BNB Chain, climbed to an all-time high of $793 on Wednesday, driven by growing interest in altcoins and hopes for Trump’s pro-crypto agenda. The rally was also supported by reduced regulatory pressure on Binance, token supply cuts through burns, and rising activity on the BNB Chain.

- Dovish BOJ Member Strikes Cautious Tone on Inflation, Wages (The Wall Street Journal): Bank of Japan board member Toyoaki Nakamura downplayed expectations for an imminent rate hike, citing doubts about reaching the 2 percent inflation target. His comments weakened the yen to 150.70 per dollar. Economists are divided on whether the BOJ will act at its Dec. 18-19 meeting or wait because of U.S. leadership changes.

- Ethereum’s Justin Drake Sees No Threat From Solana, Says Its ‘Golden Era’ Will End (CoinDesk): In a CoinDesk interview, Ethereum developer Justin Drake said that his recent Beam Chain proposal focuses on enhancing the long-term security of Ethereum’s layer-1, not competing with Solana. He suggested that Ethereum’s layer-2 solutions, such as Arbitrum and Optimism, are designed to handle performance demands like those Solana targets.

In the Ether

Read More: www.coindesk.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Hyperliquid

Hyperliquid  Toncoin

Toncoin  Pi Network

Pi Network  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  Aave

Aave  OKB

OKB  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange