[ad_1]

- Zcash has rallied by 12% in 24 hours, amid a surge in buying activity.

- Zcash could hit a $1 billion market cap by year-end as bullish signals align.

Zcash [ZEC] stood among the top market gainers at press time after a 12% gain in 24 hours to trade at $54.40. The altcoin’s market capitalization had also reached $886 million and was fast approaching the crucial $1 billion milestone.

In the last 30 days, ZEC has risen by 48%, mirroring the November gains recorded by Bitcoin [BTC] and most altcoins. However, with the broader market showing signs of retracing, will Zcash extend its gains or succumb to the bearish sentiment?

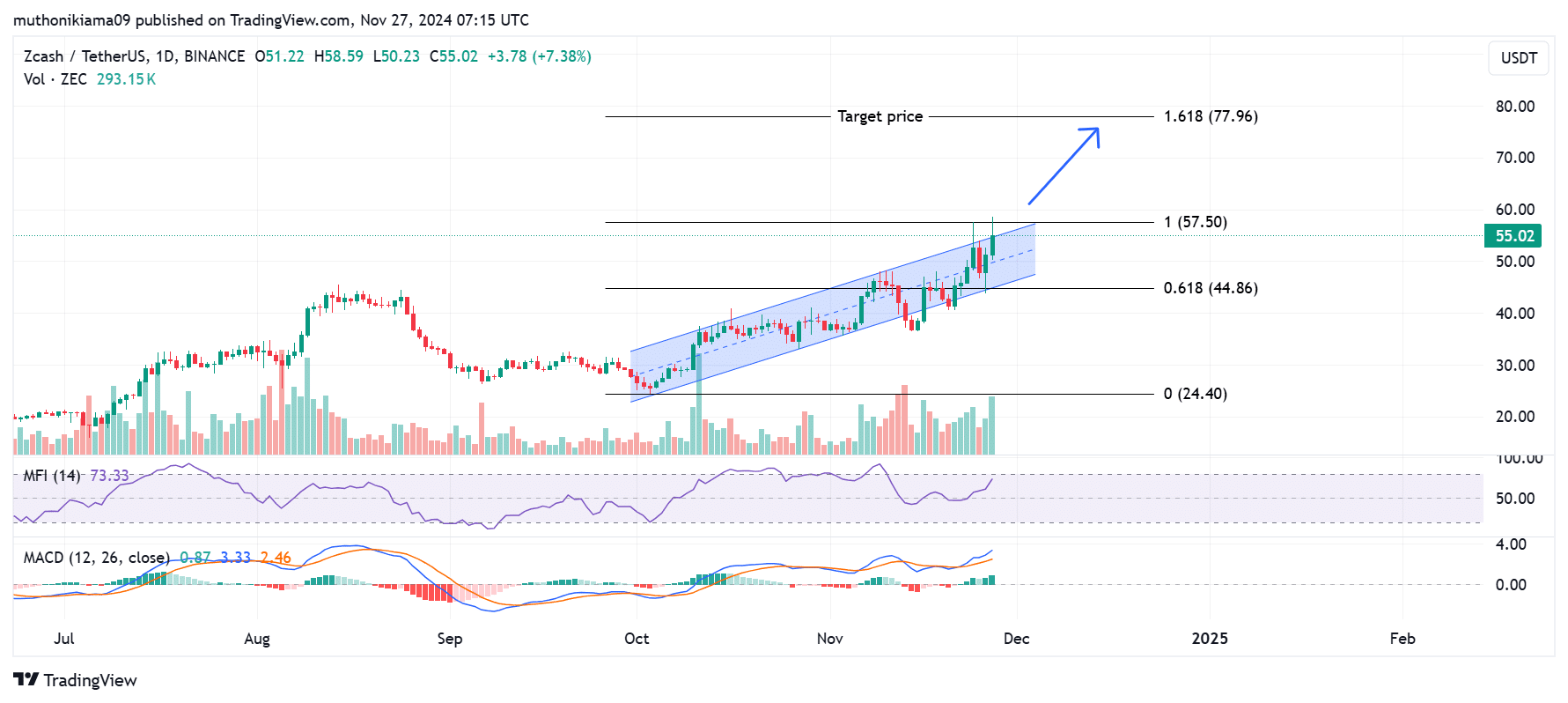

Analyzing ZEC’s parallel ascending channel

Zcash, on its one-day chart, has attempted another breakout from an ascending parallel channel. The token is facing strong resistance at the upper boundary of this channel, but a rise in trading volumes, as depicted in the volume histogram bars, could sustain the uptrend.

The Money Flow Index (MFI) with a value of 73 confirms this bullish thesis. It indicates that buying pressure is strong and driving ZEC’s uptrend. Moreover, despite being on an upward slope, the MFI has not reached overbought levels suggesting there is room for more gains.

A bullish MFI and a breakout from the ascending parallel channel could see traders hold or add to their positions.

More bullish trends can also be seen in the Moving Average Convergence Divergence (MACD) indicator as the MACD line continues to trend above the signal line. The positive MACD histogram bars further confirm the uptrend.

With these bullish signs aligning, the next target price for Zcash is the 1.618 Fibonacci level ($77). There is also a strong support level at $44, and if ZEC fails to break resistance at the upper boundary of the ascending channel, the price could drop to test this support.

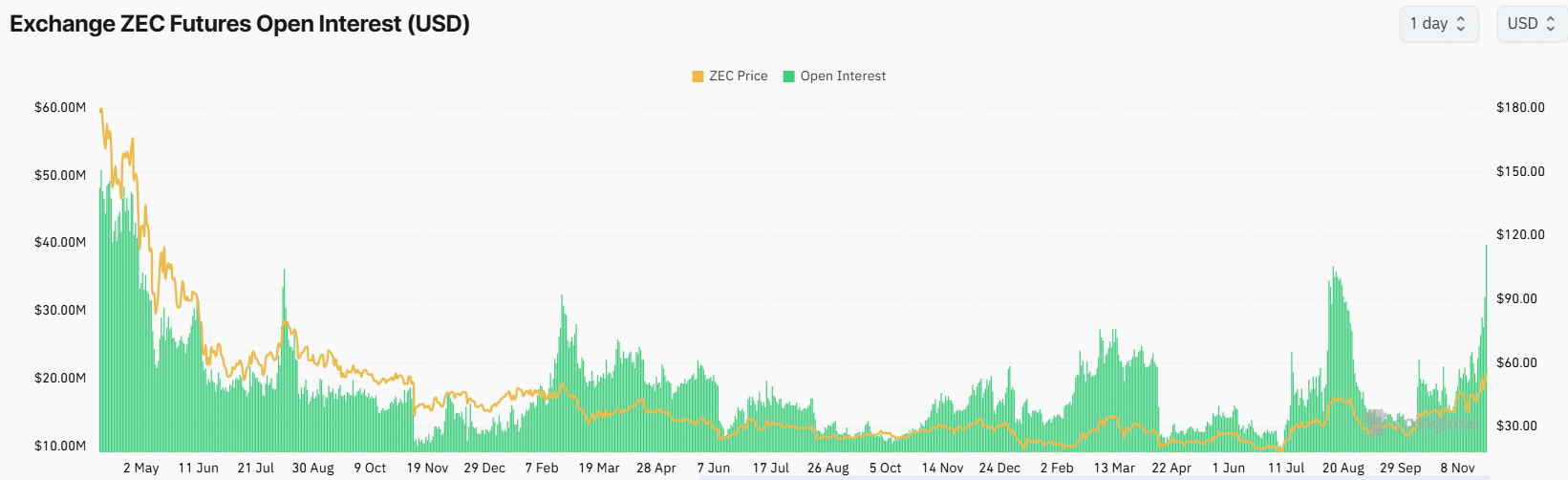

Zcash open interest hits record highs

Zcash’s recent gains have spurred interest in the token from derivative traders as seen in the rising open interest. In 24 hours, ZEC’s open interest has risen by 47% to $39 million at press time, its highest level since April 2022.

Rising open interest shows more traders are opening new positions on Zcash. This is bullish as it aligns with the gains in price.

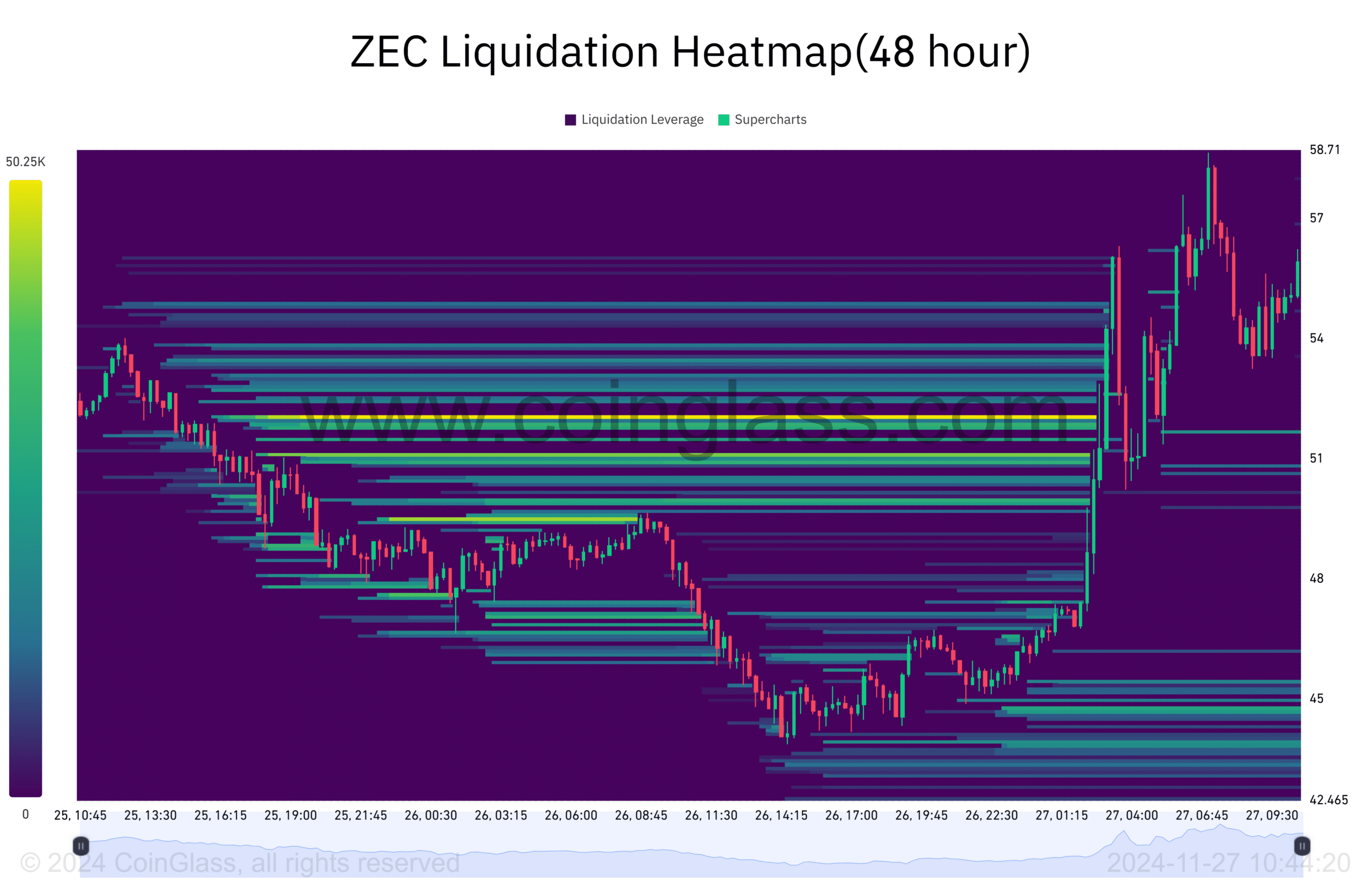

Liquidation heatmap shows THIS

Zcash’s liquidation heatmap shows a buildup of liquidations as the price increased. The forced closure of leveraged short positions accelerated buying activity, which fuelled the uptrend.

After these short positions were wiped out, the closest liquidation zone has moved to below the current price at $51. If ZEC drops to this zone, it could trigger further dips due to forced selling from long liquidations.

However, if more buyers step in before ZEC drops to this level and defend this support zone, it could lead to a sustained uptrend.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Aptos

Aptos  sUSDS

sUSDS  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic