Given the massive amount of transaction data onchain and sentiment data on social media, it’s not surprising that one of the most desired areas for synergy between crypto and artificial intelligence remains AI-assisted trading.

There are already plenty of builders shipping products that aim to provide a little extra alpha to users based on a variety of signals. The quality of these products can be extremely hit-or-miss. All of them are very early! But the idea that AI products can crawl blockchains and public networks for nuggets of information to curate for its users to make trading decisions off of is a pretty convincing sell.

While many of today’s top bots are dedicated to hunting memecoin diamonds in the rough, others are working across blue-chip assets like BTC and ETH, and even in trad markets like forex.

Today, let’s examine three projects that aim to use AI to give their users a competitive edge in the market. Let’s dive in!

Dither

Dither

Telegram trading bot Dither brings AI together with onchain historical data to analyze tokens for potential upside.

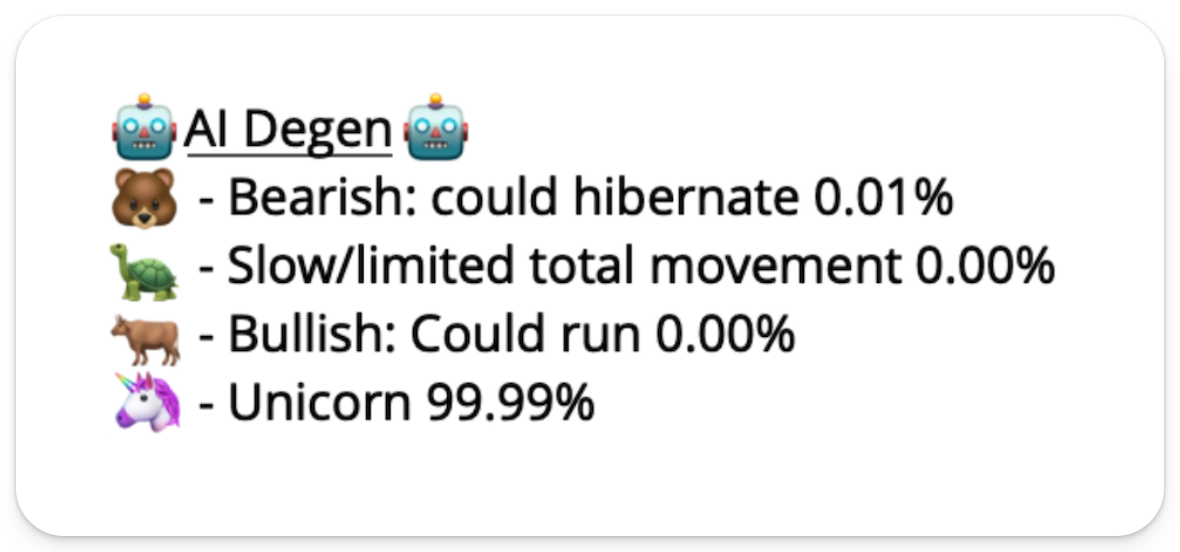

Its SeerBot uses a Time Series AI to filter for tokens matching with historically performant tokens on a number of quantitative and qualitative factors, cutting down research time for traders. The bot digs into the onchain history and ships ratings based on metrics like percent of LP locked, 24-hour volume, memeability, and holder distribution. Once the bot makes this analysis, it will assign the token an emoji-coded score with the percentage likelihood that the token will fall into each bucket.

While Dither has had some incredible wins, like finding BODEN at $233K and ALBEMARBLE at $176K, historical performance is not a guarantee of future performance, and the vast majority of its calls still end up at 0 – as most memecoins do!

↔️ Intent.Trade

The flagship product of gmAI, an “AI operating layer” on Solana, Intent.Trade applies AI to a suite of onchain activities like data analysis, automated yield farming, and, of course, memecoin trading.

Their Meme Coin Trader Agent offers tools to analyze token contract data for safety, provide chart analytics, and execute trades based on user commands via conversation with the agent. The agent provides technical analysis using data from on-chain sources to offer insights into price movement. Currently, Intent.Trade is only available to holders of a particular gmAI NFT, but they have stated the product will soon be opened up to everyone.

Someone turns 0.1 SOL into 17.2 SOL (x172 profit) using IntentTrade.

Our AI Agent spots $FLIPCAT in Solana Hot Pairs and recommends a buy signal at a 5k market cap.

Watch the magic: 5k -> 820k+ market cap (x172). pic.twitter.com/75P3ZRSd0S

— Intent.Trade (@intent_trade) June 5, 2024

Taoshi is a project operating a specialized Bittensor network subnet (SN8) that uses AI and machine learning to provide trading signals across forex, crypto, and indices.

Contributors to this network are skilled traders and trading systems that can submit one position (long, short, or flat) per trade pair at a time, moving in one direction until closed with a flat signal to profit. This structure ensures only the best traders and advanced trading systems compete, making Taoshi a highly competitive and efficient trading platform.

Taoshi’s network of signal providers creates a wealth of valuable indicators for trading a range of assets.

There are already a number of products live on Taoshi. One of the most popular is TARVIS, which provides signals via Telegram for forex and major crypto assets like Bitcoin and Ethereum. These bots operate across multiple timeframes and average into most positions across long or short orders. While they definitely have a learning curve, TARVIS currently claims an 82-2 win/loss ratio on its calls.

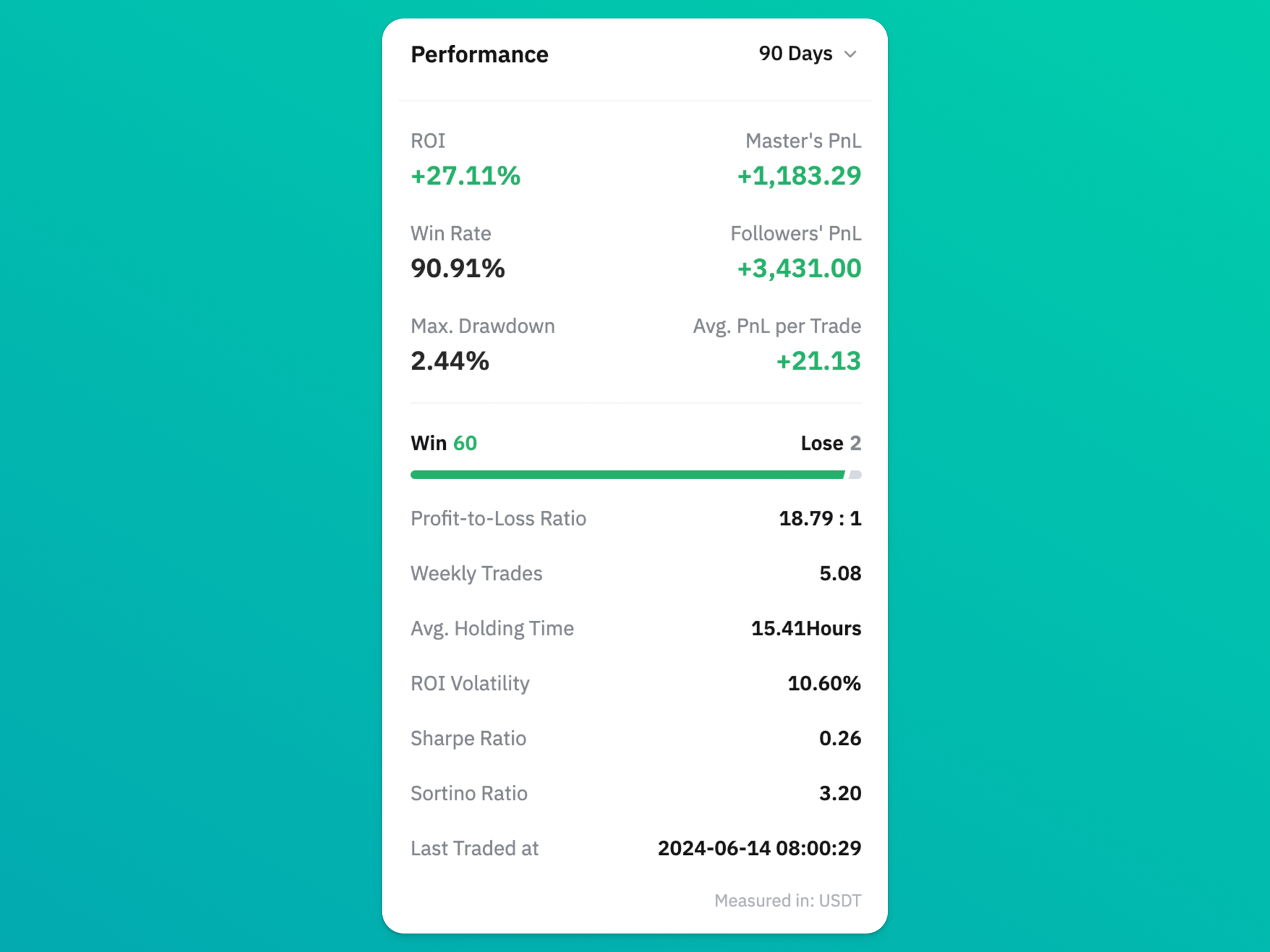

You can use AI trading bots like Dale to copy-trade TARVIS on Bybit. All of Dale’s positions, past and present, can be viewed here for you to ride.

Closing Thoughts

As crypto’s trading landscape evolves and grows more cutthroat, AI-driven tools are likely only going to prove more essential for gaining a competitive edge.

All of these tools are in their early innings but showing promising traction or a unique take on the future of AI-assisted trading. Together, they showcase the idea that AI support could soon become the default for retail traders, providing multiple approaches for traders to use to navigate and succeed in an increasingly competitive market.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  USDS

USDS  WETH

WETH  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Monero

Monero  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethena Staked USDe

Ethena Staked USDe  Ondo

Ondo  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer