In Brief

Cryptocurrencies like Bitcoin and Ethereum are increasingly used in emerging Asia, Africa, and Latin America for financial inclusion, inflation hedging, and economic empowerment despite being viewed as speculative investments in the West.

While the emergence of cryptocurrencies such as Bitcoin and Ethereum has drawn attention from all across the world, emerging countries in Asia, Africa, and Latin America have seen a particularly sharp increase in their use. Digital currencies are becoming more important instruments for financial inclusion, inflation hedging, and economic empowerment in the Global South, while being frequently seen as speculative investments in the West.

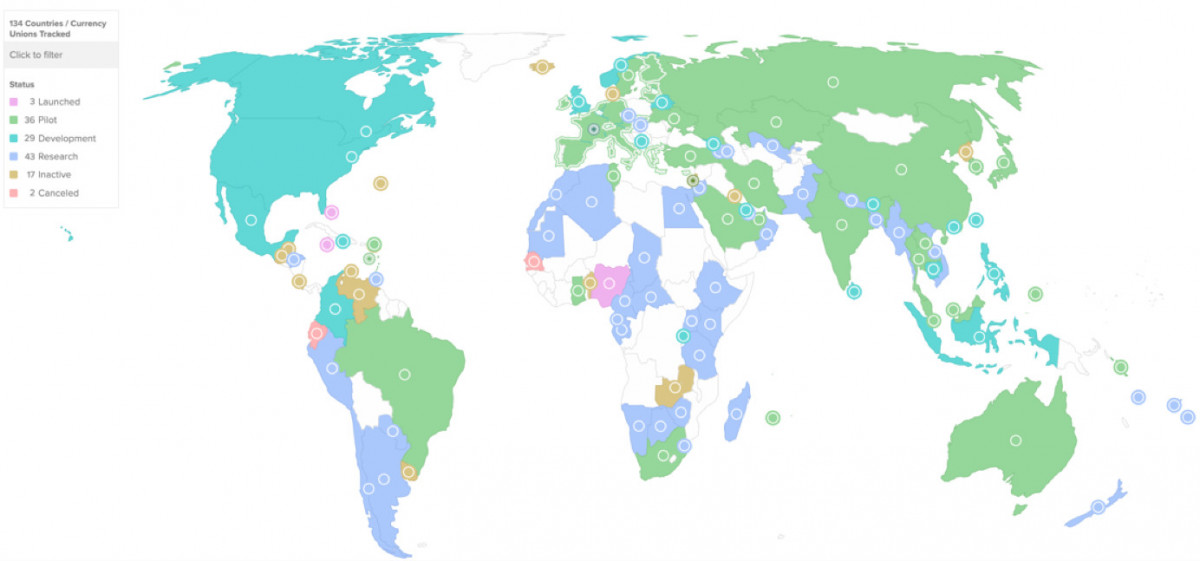

Photo: CBDCs around the world. Reuters

What Is the Situation With Digital Currencies in Different Countries?

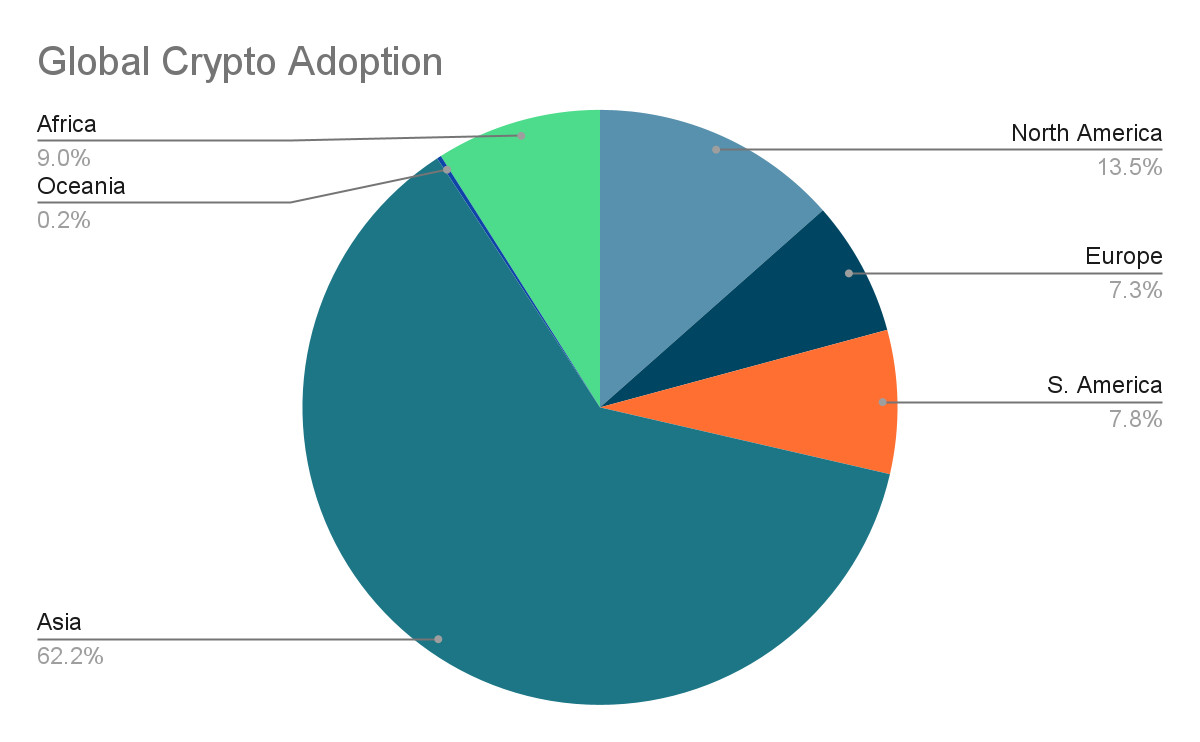

According to data, the nations with the largest percentages of cryptocurrency companies and owners include Brazil (16%), Argentina (18%), Indonesia, Nigeria, the Philippines, South Africa (19%), and Thailand (20%). These countries have a lot of unbanked people, high costs and friction for cross-border payments and remittances, and volatile national currencies, all of which contribute to the attractiveness of cryptocurrency.

Cryptocurrencies can offer a more reliable store of value and protection against inflation, eating away at life savings in nations like Venezuela, Zimbabwe, and Argentina that are beset by fast-depreciating fiat currencies. In light of the recent 40% depreciation of the Nigerian naira, many people turned to crypto as a means of protecting their cash.

Open cryptosystems just need a smartphone and internet connection to be accessible to the 1.4 billion unbanked people in the globe, many of whom are impoverished and have no access to traditional banking. Since the permissionless architecture does not impose onerous ID and KYC requirements, anybody may use digital money. Initiatives for universal basic income, such as GoodDollar, are utilizing cryptocurrency to promote financial inclusion in areas with low incomes.

Crypto Pioneers of the Nation-States

El Salvador, the first nation to make crypto legal tender in 2021, is leading the drive for state-backed cryptocurrency adoption at the sovereign level. Although adoption has been sluggish since the first Chivo wallet campaign, the government is stepping up its efforts with long-term teaching programs and the construction of cryptocurrency infrastructure.

The Sand Dollar, the world’s first central bank digital currency (CBDC), was introduced by the Bahamas in 2020, making them the early adopters. Designed for an island nation with hundreds of little population centers, the initiative provides underbanked and isolated areas with essential financial access.

The Central African Republic (CAR) followed El Salvador in enacting laws that made bitcoin legal tender and establishing the Sango Project, a national cryptocurrency center. The CAR wants to establish economic corridors and draw in global investment, despite the fact that this is debatable given its instability and relations to Russia.

Several international organizations, such as the IMF, have retreated in light of the enormous potential impact cryptocurrencies might have in developing nations, cautioning that price volatility poses threats to monetary policy goals and financial stability. However, the promise of open sound money may be too strong to deny for many emerging countries that have been adversely impacted by capital controls, inflation, and depreciated national currencies.

Gateway to Cryptocurrency’s Future of the Developing Countries

Cryptocurrencies are not only providing the Global South with a direct means of trade, but they are also creating a whole new world of decentralized finance projects. Economies in transition, such as India, are already in the forefront of utilizing cryptocurrency for lending and borrowing purposes, outpacing outdated conventional financial systems.

Photo: Coinpedia

From a business perspective, blockchain technology has the potential to transform essential industries such as agriculture and supply chain logistics in underdeveloped nations by enabling transparent asset monitoring and verification.

Numerous practical applications for cryptocurrencies are emerging, and a new generation of entrepreneurs is energizing the market with their ideas and enterprises. Decentralized applications and business models are emerging in many forms, such as peer-to-peer lending pools, crowdfunding platforms, and play-to-earn games.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  USDS

USDS  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Monero

Monero  Bitget Token

Bitget Token  Pepe

Pepe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  Dai

Dai  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Cronos

Cronos  Internet Computer

Internet Computer  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic