- Solana’s high TPS might have attracted more users as its active addresses increased.

- SOL’s price action remained bullish as it increased by 20% last week.

Solana [SOL] has created quite some buzz in the crypto space, not just for its price but also for its network stats. In fact, the blockchain has outperformed other top players like Polygon [MATIC] on a key front.

Solana tops the table

The latest data from CoinGecko revealed that Solana ranked number one on the list of blockchains by transactions per second (TPS).

This achievement showed the efficiency and dependability of the blockchain as it processed the maximum number of transactions in a set timeframe.

Apart from SOL, Sui, Binance Smart Chain, and Polygon also made it to the top four on the same list. However, it was interesting to note that while Polygon’s TPS stood at 190, Solana had a major lead as its TPS was 1053. Ethereum was lower down on the list with a TPS of just 22.

AMBCryto’s look at Solana Explorer revealed that, at press time, SOL’s TPS was 2303.

AMBCrypto then checked Artemis’ data to see whether Solana’s high TPS had any impact on its network activity. We found that SOL’s daily active addresses have increased over the past three months. The number spiked in mid-March as it exceeded 2.4 million.

However, despite an increase in daily active addresses, the blockchain’s daily transaction count remained somewhat similar to that at the beginning of February.

Notably, SOL’s daily transactions did witness a major uptick on the 11th of April, but the trend didn’t last.

Things in terms of captured value also didn’t look good for the blockchain. SOL’s fees registered a massive drop after spiking on the 18th of March.

Thanks to the drop in fees, the blockchain’s revenue also followed a similar declining trend over the last several weeks. Nonetheless, SOL’s performance on the DeFi front remained on par as its TVL continued to grow.

Solana investors are rejoicing

In the meantime, SOL’s price action gained bullish momentum. According to CoinMaerketCap, SOL was up by more than 20% in the last seven days.

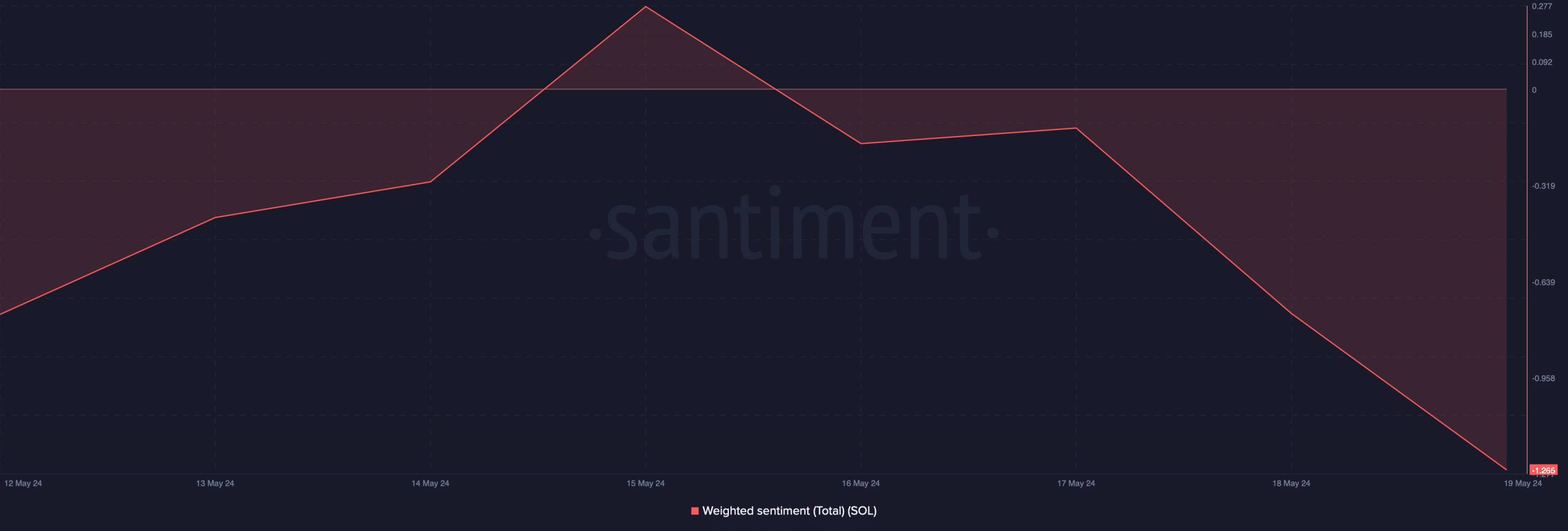

At press time, it was trading at $178.08 with a market capitalization of over $79.9 billion. Surprisingly, the price uptick didn’t help stir up bullish sentiment in the market, as its weighted sentiment remained in the negative zone.

Is your portfolio green? Check out the SOL Profit Calculator

Bearish sentiment around SOL might not be enough to stop the bulls. AMBCrypto’s analysis of SOL’s daily chart revealed that its Relative Strength Index (RSI) registered a massive uptick.

Its Chaikin Money Flow (CMF) also looked bullish, as it had a value of 0.15 at press time. The concerning indicator was the Money Flow Index (MFI), as it indicated that SOL’s price might witness a correction.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Official Trump

Official Trump  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos