The Ethereum (ETH) to Bitcoin (BTC) ratio (ETH/BTC) is a pivotal metric, offering insights into the relative strength and market dominance of the two largest cryptocurrencies. Representing the value of one Ethereum in terms of Bitcoin, the ratio serves as a critical tool for investors and analysts to gauge the comparative performance and sentiment towards these digital assets.

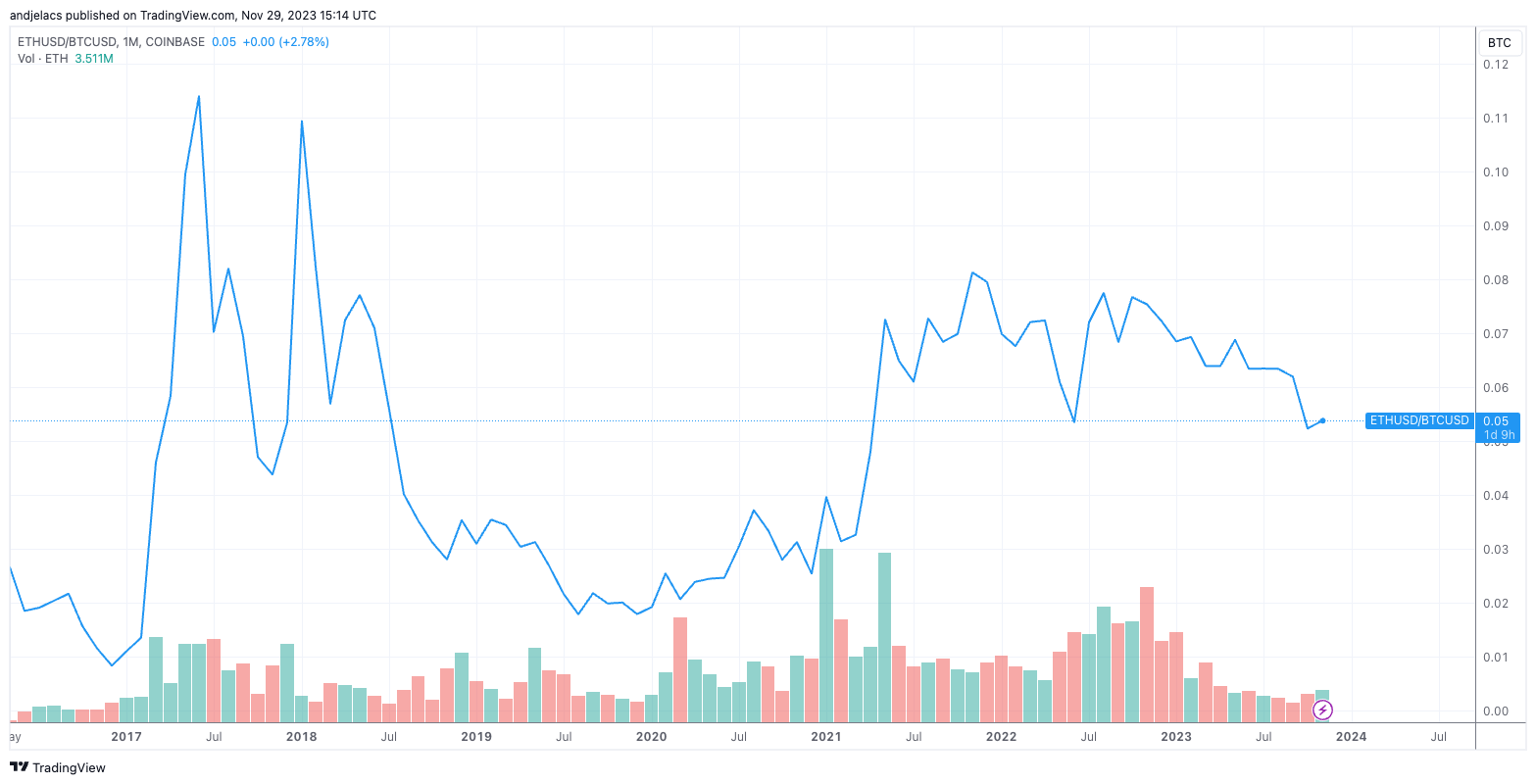

Historically, the ratio has experienced significant fluctuations. It reached its all-time high in June 2017, when Ethereum’s value significantly overshadowed Bitcoin’s. Conversely, Dec. 2016 saw the ratio reach its all-time low, reflecting a time when Ethereum’s value dropped significantly compared to Bitcoin.

However, the overall volatility of this ratio, measured by the standard deviation of its historical closing prices, is relatively moderate. This is indicative of the often parallel price movements of BTC and ETH, as they typically mirror each other’s market trends.

The synchronized movement of BTC and ETH is a defining factor in the observed stability of the ETH/BTC ratio. When both cryptocurrencies experience similar bullish or bearish trends, their ratio maintains equilibrium, underscoring the interdependence in their market movements. This phenomenon is a testament to the correlated nature of the crypto market, where major currencies often share similar market sentiments and external influences.

From Jan. 2020 to Oct. 2022, the ETH/BTC ratio saw an uptrend, attributed mainly to the anticipation surrounding the Merge — Ethereum’s transition to a Proof-of-Stake consensus mechanism. This significant upgrade in Ethereum’s blockchain was viewed as a pivotal step towards enhancing its efficiency and scalability, potentially increasing its value relative to Bitcoin.

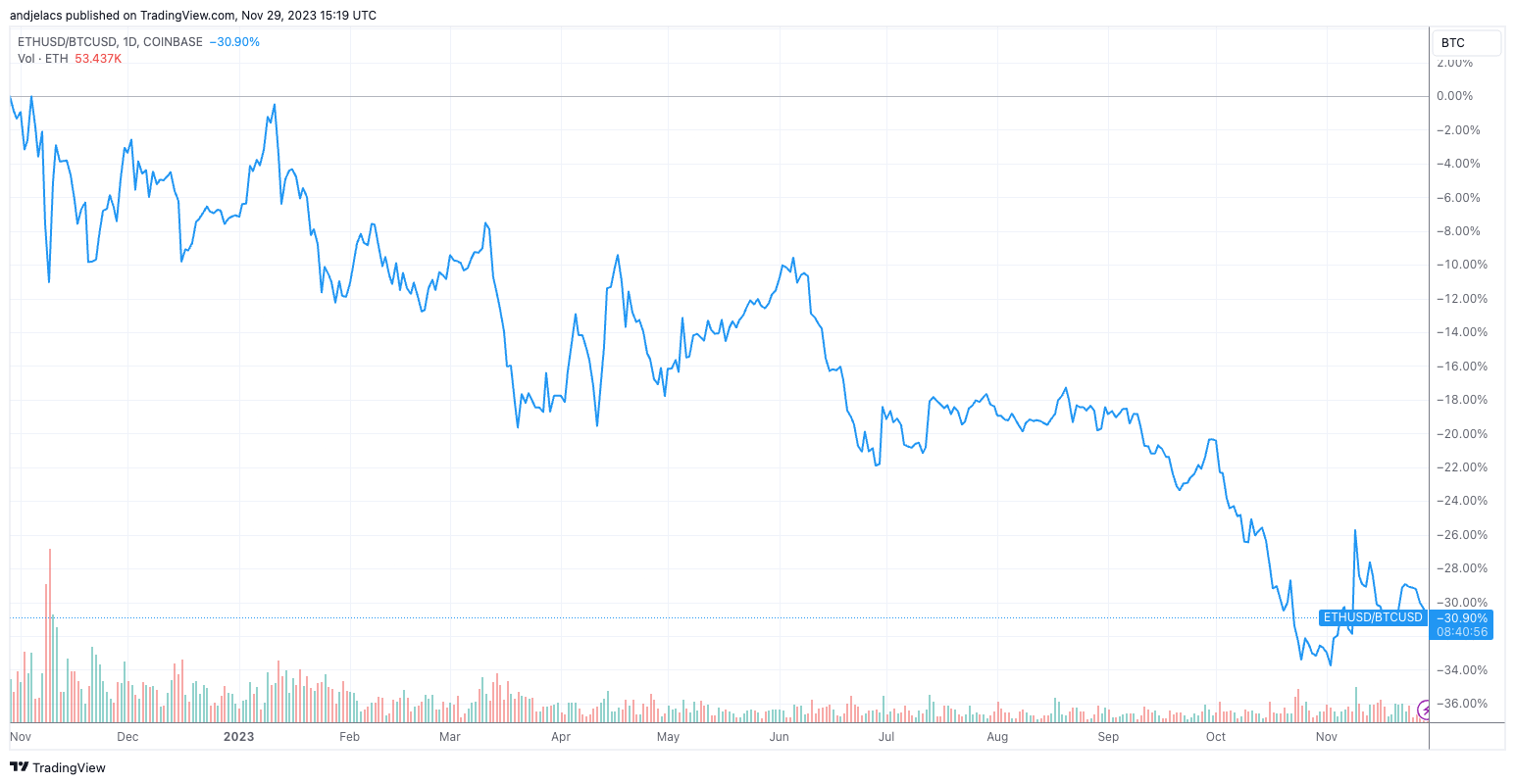

However, after Oct. 2022, the ratio exhibited a downward trend. This decline could be a market correction following the high expectations the Merge set or a reflection of broader market trends affecting both cryptocurrencies. It also shows that, during this period, Ethereum’s growth or decline in value was not as pronounced as Bitcoin’s, leading to a decrease in its relative value.

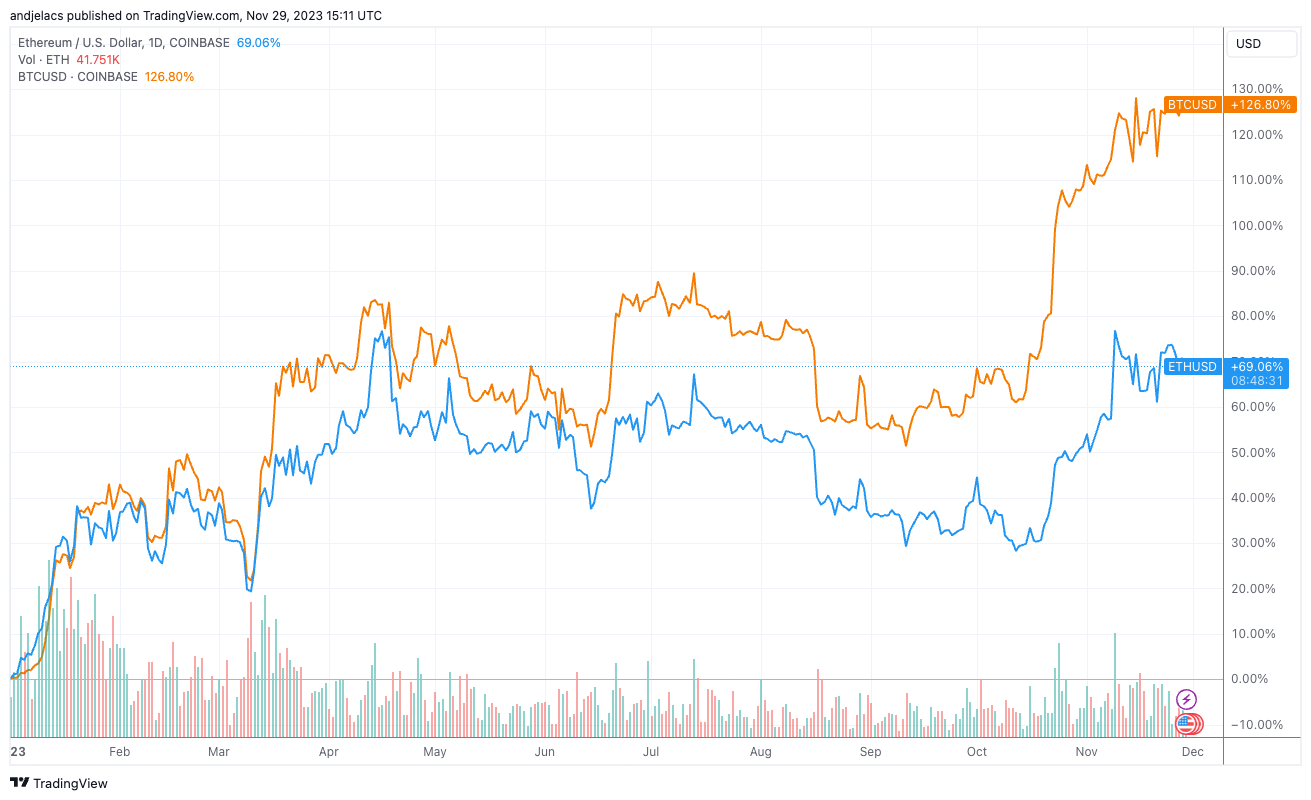

The ETH/BTC ratio offers significant insights into the market’s current dynamics. The relatively low ratio can be primarily attributed to Bitcoin’s more substantial price increase than Ethereum. YTD, Bitcoin has seen a 126% increase, while Ethereum’s growth, although notable, was relatively lower at 69%. This disparity in their growth rates has been a critical factor in keeping the ETH/BTC ratio subdued.

The differing trajectories in their prices show Bitcoin’s increasing dominance in the market. While Ethereum continues to play a significant role in the crypto ecosystem, especially as the home of DeFi, Bitcoin’s more significant price increase underscores its growing prominence and possibly greater investor confidence. This trend is reflected in the ETH/BTC ratio, serving as a barometer for Bitcoin’s strengthening position relative to Ethereum.

The ratio’s movement clearly indicates the shifting balance of power within the crypto market, with Bitcoin currently taking a more dominant role.

The post Decline in ETH/BTC ratio shows Bitcoin’s rising market dominance appeared first on CryptoSlate.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Toncoin

Toncoin  Litecoin

Litecoin  Monero

Monero  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer