[ad_1]

Apparently, it’s a bull market.

That’s what everyone is saying, at least. And this shouldn’t be discounted! If a critical mass of people is bullish, that sentiment becomes contagious, and the time to bid is now!

But there’s something different about this bullish sentiment from previous cycles, and it’s worth identifying and parsing out.

People are bullish because of the Spot ETFs that are imminent. The Bitcoin Spot ETF approval could happen anytime, and the Spot ETH ETF isn’t far behind. This is a moment this industry has been waiting for over a decade — the Winkelvi first filed their Bitcoin ETF in 2013! The size of the pipe that a Spot ETF builds between BTC and ETH should not be underestimated.

A TON of money can flow through these pipes. It’s a massively bullish catalyst, and there’s no other way to interpret that.

If these Spot ETF approvals triggered a bull market, it would be the first time crypto experienced an externally caused bull market.

What do I mean by this?

- The 2013 bull market was known as the Fork-and-Fair-Launch era, where people realized that Bitcoin was a primitive that could be copied. 10,000 PoW chains blossomed, and a few of them are still alive to this day.

- The 2017 bull market was the ICO mania, where people realized that you could just issue a token on Ethereum, and you wouldn’t need to have your asset be encumbered by an entire blockchain. Plus, smart contracts!

- The 2021 bull market was the NFT mania and the Alt-L1 mania, in which we figured out that our tokens didn’t have to necessarily be just financial assets, but culture, art, and community were able to realize value in DeFi. Also, we needed more blockspace, and the desire to produce an “Ethereum-killer” attracted a ton of VC funding and energy.

- The 2024 bull market currently seems poised to be the spot ETF approval bull market? Because external capital is capable of buying BTC and ETH?

Do you notice something different here? This bull market is not on our terms.

This is an exogenous bull market. It’s being caused by external forces beyond the crypto industry. There is no internal catalyst for excitement, interest, and blockspace demand.

In all previous crypto bull markets, we’ve found some new primitives that unlocked new use cases, new applications, and new demand. We excited consumers and retail with new powers and drew people in with an expanded vision of what crypto could be.

In this bull market, TradFi can purchase our two main blue-chip assets in their brokerages. These are different bull market catalysts.

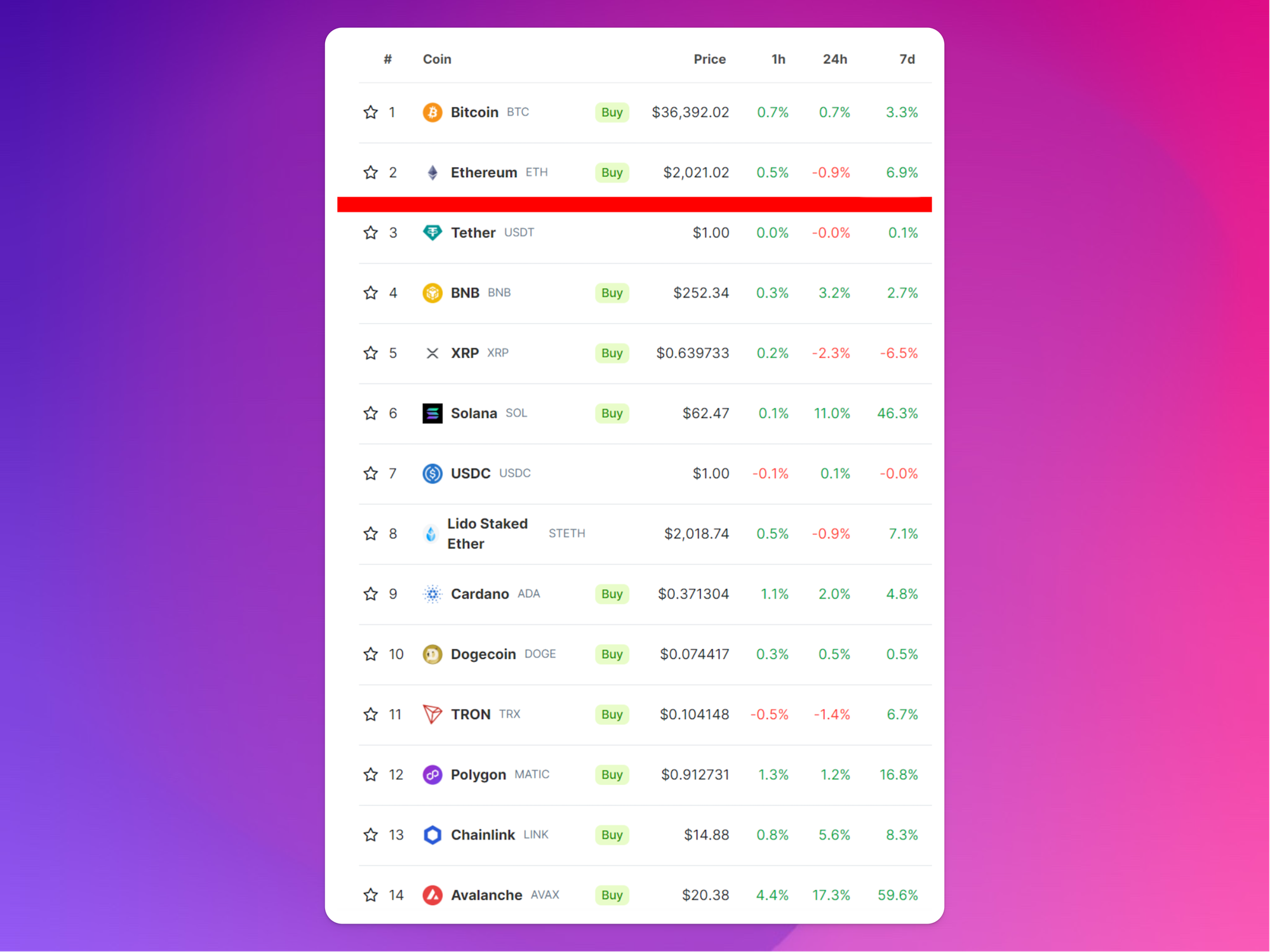

Right now, bullish sentiment has gone viral in the industry, and down-market cap assets have experienced some insane price actions, notably THORChain and Solana, two assets that also had huge pumps last bull market.

Industry veterans who stuck around all bear market are putting their chips on the table, placing their bets on what a retail speculative frenzy might look like, and are using the memory of 2021 to inform their investment decisions.

But what if this bull market isn’t like 2021? Traders and speculators are using historical activity and price action to inform what might attract users in 2024. Still, all the signals we have right now point to a different kind of bull market than one we previously had.

A Tale of Two Markets

With the incoming Spot BTC and ETH ETFs, there will be a big fat line drawn between the crypto-assets that have Spot ETF exposure and those that do not. The reason why the Spot ETFs are bullish is due to the massive amounts of exposure that create the trillions of dollars of wealth held in traditional brokerages and the rest of TradFi.

Only BTC and ETH have this exposure!

People placing their chips below this line are speculating on a bull market that matches the historical bull markets that crypto has experienced. But, without an endogenous catalyst of internal excitement, new interest, and new capital, why would the bull market proceed past this big line between BTC, ETH, and the rest of the market?

We need an Endogenous Catalyst

Bankless Nation, like you, I want a bull market. But if we’re going to have the “bull market” that we all imagine, we need a reason for new entrants to come into crypto directly via private keys and start playing in the arena below BTC and ETH.

Right now, we don’t have any new reason for people to enter crypto in a crypto-native way. We haven’t unlocked any new primitive. Retail doesn’t care that Polygon or Solana has cheap blockspace and improved execution environments.

We haven’t built any new apps!

Now, increasing asset prices is marketing in itself, and the Casino re-opening and people making money for the first time in 2 years is an incentive to re-enter the arena. But I fear that that is short-lived if there’s not some new app or primitive that people can play with, as there was in 2013, 2017, and 2021.

To have the bull market we all want, we need an endogenous catalyst.

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  sUSDS

sUSDS  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic