[ad_1]

Dear Bankless Nation,

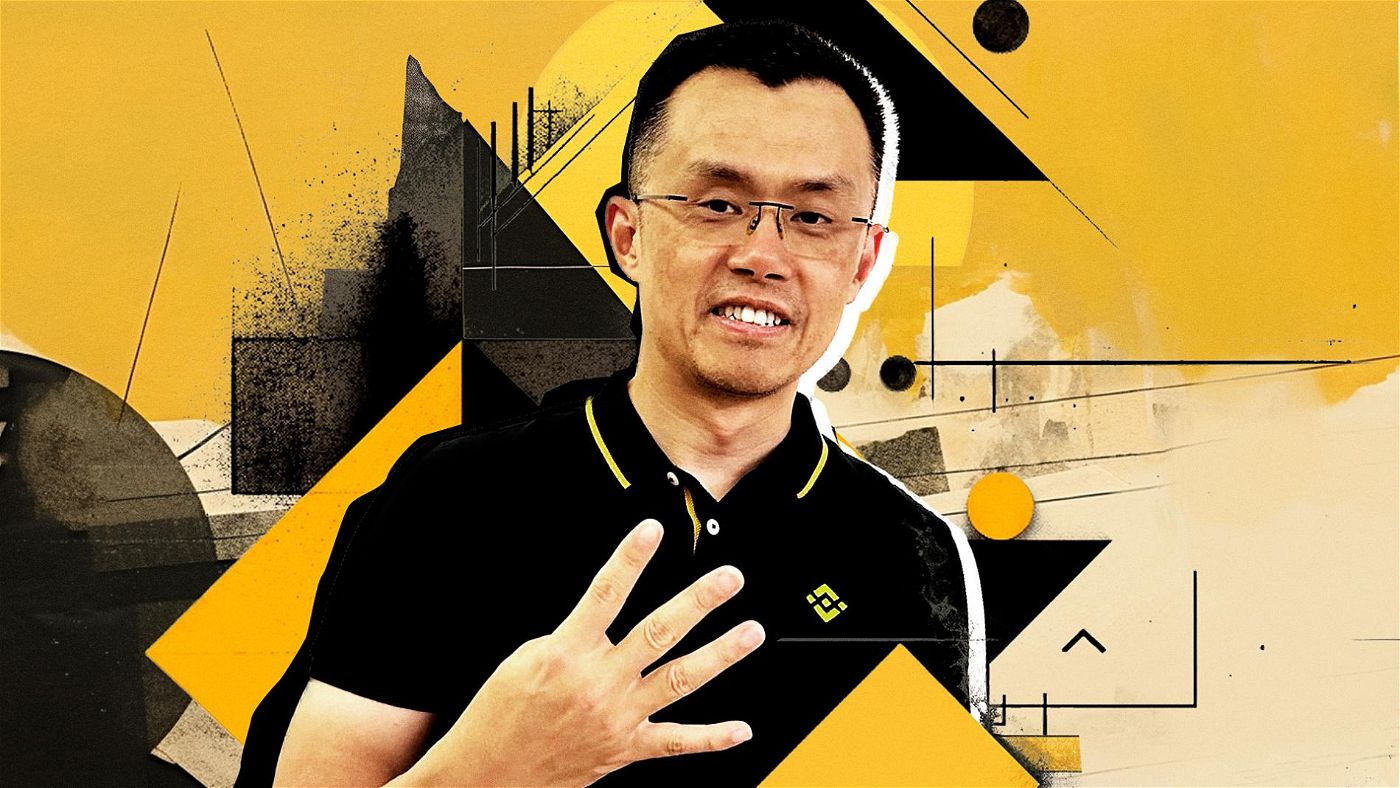

CZ has been throwing up 4’s an awful lot lately. With Binance in the crosshairs of the DOJ, which is reportedly mulling criminal charges and billions in fines against Binance, Crypto Twitter is getting a little nervous.

Today, analyst Jack digs into the situation and delivers some takeaways on the contentious saga.

-Bankless team

From Mt. Gox to FTX, crypto’s history books are littered with centralized crypto exchanges that exploded suddenly and left users in a lurch. These events have served as all-too-frequent reminders of the dangers of trusting centralized exchanges and not embracing self-custody.

As we come up on the 1-year anniversary of the FTX implosion, more and more people on Crypto Twitter seem to be voicing their concerns about the future of Binance. The question on our minds today is: how much trouble are they really in?

For years, critics have proclaimed that Binance, crypto’s largest exchange, will be the next to go bust. Yet, no matter how horrendous the dumps, the exchange has managed to surprise its doubters by continuing to fulfill withdrawals and stave off insolvency.

While Binance has weathered every test the market has thrown at it, the exchange now faces an existential threat from the nation-states and US regulators attempting to aggressively crack down on the CEX.

Today, we’re discussing how we got here and how things could go sideways

Regulatory Inquisition

Regulatory Inquisition

Binance made headlines numerous times throughout 2023 for undesirable regulatory reasons. While much of the regulatory assault against Binance has been concentrated in the US, the exchange has also experienced difficulties obtaining licenses or operating across numerous jurisdictions, including Australia, Austria, Belgium, Canada, Cyprus, Holland, and Germany.

Stateside, things aren’t looking great. Unlike the frivolous assaults against DeFi protocols and exchanges who have “failed to comply” with an unwritten set of rules, Binance has been targeted for what regulators perceive as a willful disregard of established laws.

The first sign of trouble came in February when stablecoin issuer Paxos received a Wells notice from the SEC regarding its Binance USD (BUSD) issuance. Simultaneously, New York’s NYDFS agency ordered Paxos to cease the issuance of the stablecoin. While the subtext of these orders is unknown, it was a concerning development.

In March, the CFTC filed an enforcement action against the exchange for willfully circumventing internal compliance policies to onboard prohibited persons. The CFTC’s complaint cites numerous instances where Binance’s compliance staff provided white glove service to illegally onboard “VIP” US customers to the international platform and references multiple transactions related to terror groups and illicit finance – also, not so good.

Not one to sit out an opportunity to assault crypto, the SEC followed up with its enforcement action in June, charging Binance with violating US securities laws and misusing customer funds. This set of accusations suggested that Binance diverted US user funds to CZ-owned entities and artificially inflated trading volumes. As one component of its complaint, the SEC cited $190M in customer funds transferred from Binance.US into the bank account of the CZ-controlled Sigma Chain; this account later spent $11M to finance the purchase of a yacht.

Binance CEO CZ, one of crypto’s most influential and combative figures, often shares a singular response to such accusations – 4.

Too lazy to even post 4.

Focus on building.

— CZ

Binance (@cz_binance) September 26, 2023

CZ stans have certainly been sympathetic to this response, and a history of frivolous US enforcement actions against crypto protocols from the CFTC and SEC has diminished the merit of these accusations against Binance; however, it appears that more trouble is still on the horizon.

The Department of Justice is rumored to be weighing a suit against the exchange. Still, prosecutors have so far held off on filing charges, allegedly worried that a Binance indictment could cause a catastrophic FTX-style bank run. Then, this week, the Wall Street Journal provided an update to the case, reporting that the years-long investigation could result in criminal charges and billions in fines against Binance and top executives.

Unlike civil enforcement agencies, the DOJ is responsible for criminal enforcement, meaning potential penalties under the DOJ regime are much more severe than those of other regulators and could include imprisonment.

What Could Happen?

What Could Happen?

If recent reports are to be believed, the Department of Justice has done its homework. Should the DOJ decide to throw the book at Binance as the WSJ suggests could occur, what happens?

While Semafor’s report floated the government concerns of an FTX-style bank run, Binance has always maintained its solvency, but users have to take its word for it, even with its so-called proof of reserves system, which, yes, proves a user’s assets are held within the platform but fails to provide insight into Binance’s liabilities or accounting practices.

At the very least, crypto will be in for a chaotic couple of months should Binance’s operations be impacted by the DOJ. While we don’t want to wander too deep into hypotheticals, Binance has processed 42% of spot trading volumes this month, and the CEX is the dominant source of crypto liquidity. Should this liquidity dissipate or evaporate overnight, market participants would likely rush to dump their bags into illiquid conditions, further depressing prices in their flight toward the exit.

Crypto critics would undoubtedly be proclaiming the end of the industry, but we’re not worried! Crypto is not dependent on asset prices or any single organization’s efforts to succeed. Opaque, all-powerful CEXs aren’t why crypto is here. When users realize the stakes, they often flee to more transparent platforms. After the collapse of FTX, for example, the ratio of users transacting on DEXs over their centralized counterparts surged.

Decentralized systems are resilient to collapse by design and are intended to weather any storm! We didn’t come here to recreate TradFi, so don’t allow your faith in the industry to be shaken by the bad weather around any one company

Action steps

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Aptos

Aptos  Cronos

Cronos  sUSDS

sUSDS  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic