Solana won’t give up that easily, despite continuous price drop

Solana (SOL) is grappling with a turbulent market, and yesterday was no exception. The digital asset took a nosedive, shedding approximately 8% of its value within a single day. This unsettling drop has been attributed to FTX’s newfound authority to liquidate a substantial amount of Solana. The catch? No one knows when this liquidation might unfold.

As of the latest data, Solana is trading at around $18.2. The asset’s price has been on a roller coaster, and this recent dip adds another layer of uncertainty. But what is causing this downward spiral? FTX’s potential liquidation of Solana assets looms large, casting a shadow over the asset’s future. The exchange has been granted permission to liquidate, but the timeline remains hazy, leaving investors on edge.

The trading volume for Solana has been dwindling, which does not bode well for its short-term prospects. A lower trading volume often signals a lack of investor interest, which can exacerbate price declines. Additionally, the Relative Strength Index (RSI), a key indicator of market sentiment, is also trending downward. This suggests that the asset is losing momentum and could be entering oversold territory.

So, where does Solana go from here? The asset’s RSI shows that the current tendency on the market is fading, and a reversal upward is more than a possibility.

Shiba Inu in tough state

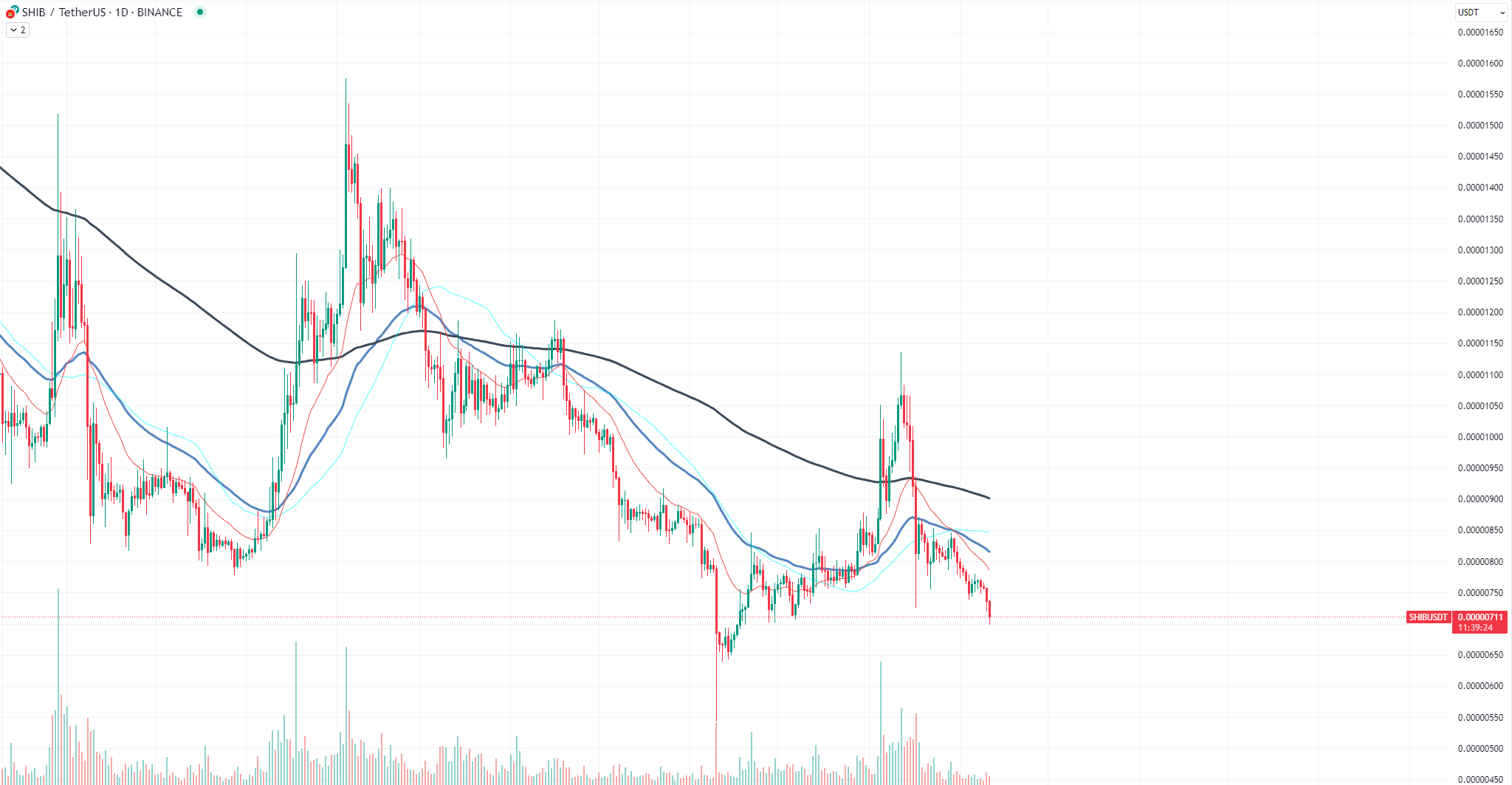

Shiba Inu seems to be drifting away from its once-attainable target of $0.000008. As of the latest data, the asset is hovering around $0.00000734. This shift in price dynamics could spell trouble for the coin’s future prospects.

A closer look at the numbers reveals that SHIB has lost its footing around the $0.00000750 mark. This is not just a random number; it is a crucial support level that has now turned into a resistance point. The asset’s failure to maintain this level could lead to a domino effect, pushing the price further down the rabbit hole.

Why does this matter? Well, support and resistance levels are like invisible floors and ceilings for asset prices. When an asset cannot break through a ceiling or falls through a floor, it usually means there is a bigger move coming. In the case of SHIB, that move does not look too promising.

The current price of Shiba Inu is $0.00000734, according to the latest data. This price point is a far cry from the $0.000008 target that many investors had set their sights on. The asset’s inability to hold its ground around the $0.00000750 level indicates that this price point has now become a local resistance level, making it even more challenging for SHIB to climb back up.

Cardano’s yearly performance disappears

Cardano’s ADA token has been on a roller coaster ride — but not the fun kind. The asset has erased all of its gains since the start of the year, plummeting back to its December 2022 levels. It is like a time machine, but only for your portfolio, and it is not taking you where you want to go.

Price analysis reveals a disheartening trend. Starting from December 2022, ADA was priced at $0.32. It saw some ups and downs, peaking at $0.44 in April 2023. However, the asset has been on a downward spiral since then, currently sitting at $0.25, as of Sept. 3, 2023. That is a significant drop, and it has got investors scratching their heads and clutching their wallets.

The trading volume has been as erratic as a cat on a hot tin roof, but the general trend is not encouraging. The asset’s price has been in free fall, and the trading volume has not been robust enough to cushion the impact. It is like watching a feather in a windstorm; you know it is going to hit the ground, but you are not sure where.

Read More: u.today

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Dai

Dai  Stacks

Stacks  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub  Immutable

Immutable