Dear Bankless Nation,

Today, we dig into one not-so-simple question: How is Ethereum doing?

Today, we dig into Ethereum’s financial performance over Q2 2023, presenting a digestible deep dive into the metrics that matter most framing the growth of Ethereum at the protocol-level and in its various ecosystems.

– Bankless team

We’re now halfway through 2023, and Ethereum has been showing considerable resilience amid the ongoing cryptoeconomy 🐻 market compared to other alt-L1s. The below report examines top-line metrics for the second quarter of 2023 (ending June 30th) for the Ethereum network and its ecosystem as broken down into four categories:

🟦 Protocol

🟩 DeFi Ecosystem

🟥 NFT Ecosystem

🟪 Layer 2 Ecosystem

After digging into the above, we’ll then move you through our top ecosystem highlights and our forward outlook for the protocol. The full ETH Q2 2023 Report is available only to paying subscribers of Bankless. Become one!

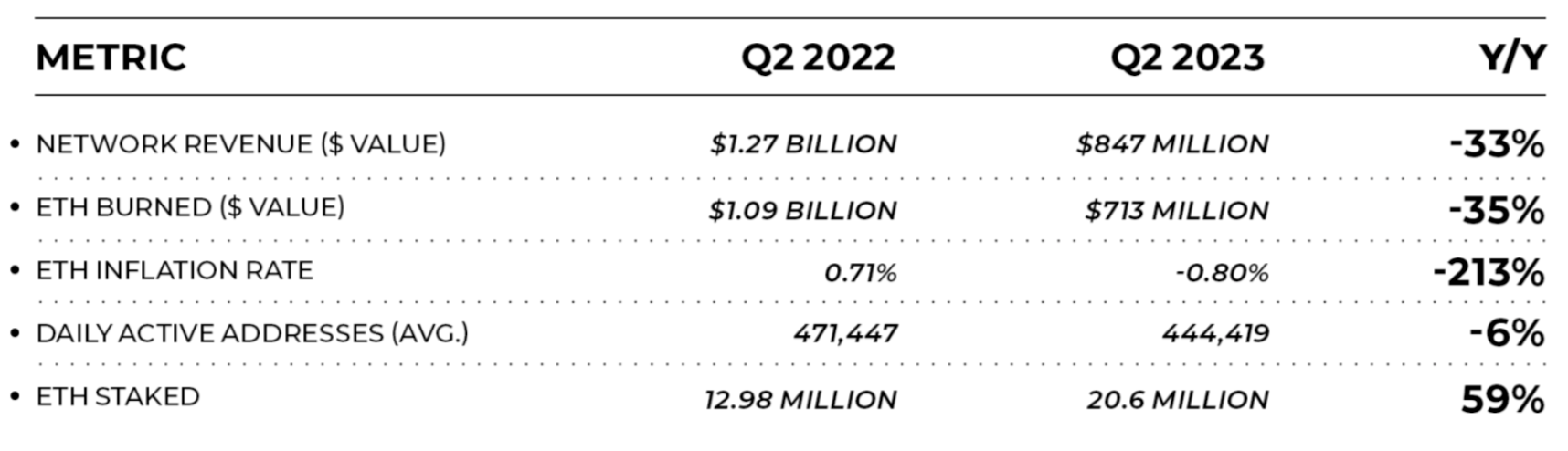

These numbers compare Ethereum’s performance in Q2 2023 against Q2 2022.

🟦 Protocol

🟦 Network revenue dropped 33.3% from $1.27B to $847M. The USD value of ETH burned fell 35% from $1.09B to $713M

Network revenue measures the total value of transaction fees paid by users to Ethereum validators, as well as the portion of said fees that is burned (i.e. removed from the circulating supply of ETH via EIP-1559 burning).

Considering the bearish conditions we’ve seen in crypto in recent months, it’s somewhat surprising that there wasn’t a larger revenue decline year-over-year. Ethereum has held up well activity-wise in this regard. That said, the decline we’ve seen here still showcases the bearish conditions lately. As demand for blockspace has dropped, so have Ethereum’s earnings and burnings for now.

🟦 ETH Inflation Rate decreased 213% from 0.71% to -0.8% on average

The ETH Inflation Rate the growth in overall supply of ETH over the course of the quarter. This growth rate turned negative as the EIP-1559 fee burning mechanism is now chugging along full steam ahead.

🟦 Average daily active addresses declined 6% — from 471,447 to 444,419

This metric tracks the average number of wallet addresses to transact on Ethereum each day over the duration of the quarter. As with network revenue, it’s fairly surprising this figure hasn’t dropped further amid the current bear market.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Sui

Sui  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  USDS

USDS  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Mantle

Mantle  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Render

Render  Monero

Monero  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Tokenize Xchange

Tokenize Xchange  Filecoin

Filecoin  Arbitrum

Arbitrum