Dear Bankless Nation,

Plenty of people are still kicking themselves for missing out on the $ARB airdrop, but if you missed it, focus your energy on capturing the next opportunities like those available on Starknet.

In today’s newsletter, our analyst team pulls out the 8 most-promising projects on the Starknet network.

– Bankless team

Bankless Writer: Donovan Choy

Starknet is one of the most-hyped tokenless opportunities in crypto right now.

It is one of the “Big Four” Layer-2 rollup chains in the Ethereum ecosystem. StarkWare industries is valued at an impressive $8 billion. As of today, Starknet is still in its Alpha phase; TVL sits at $11.6 million with over 17,000 ETH bridged on-chain. These numbers are a fraction of its major L2 competitors yet developer fervor points to Starknet as a promising network opportunity.

Unlike Arbitrum and Optimism, Starknet’s unique competitive advantage lies in its zero-knowledge STARK technology which promises to scale blockchains well beyond the capabilities of its optimistic rollup counterparts. For a fuller guide to Starknet, see The Bankless Guide to Starknet.

Today, we spotlight eight promising Starknet projects. The first two are available for all, but our Bankless premium subscribers have access to everything.

1. zkLend

What is it? Every chain needs a money market protocol and Starknet’s leading choice today is zkLend. zkLend does not try to reinvent the money market design that Aave and Compound pioneered. Its unique proposition is a bet on Starknet’s success, by being the first to provide an isolated pool trading market for the many to-be-airdropped Starknet-native tokens such as the L2’s own STRK token.

zkLend’s primary product is Artemis, a permissionless DeFi protocol. They are also angling for TradFi’s entry into DeFi with its to-be-released KYC service Apollo, built for market makers, VCs and hedge funds with compliance needs.

How to interact? zkLend is open to use today. Connect your Argent X or Braavos wallet and begin providing liquidity on the protocol. Borrowing and lending assets or locking in liquidity for an extended period will likely increase your chances of acquiring its future ZEND token.

2. Realms Eternum

What is it? Perhaps the most prominent game in the Starknet ecosystem is Eternum, a strategy RPG game that is being built on top of the Loot intellectual property by Dom Hoffman. The project is led by the core developer team and community at Bibliotheca DAO.

Eternum is designed to be fully-onchain, which means the entirety of the game’s assets, rules and state exist on the Starknet chain, not a centralized server or backend.

Eternum’s strategic advantage lies in its design environment, namely Starknet’s zero-knowledge-friendly modules. The team once tested its beta on Arbitrum but migrated to Starknet in favor of its ZK virtual machines that compress computation and generate proofs faster and more efficiently than the EVM, easing the higher transaction burden that games require. Starknet’s native account abstraction also introduces programmable smart contract logic into user crypto wallets, greatly improving the UX of the now rather un-user-friendly Web3 gaming experience.

How to interact? A production version of Eternum is not yet available. However, since the game’s lore is based on Dom Hoffman’s Loot NFT collection, fans can already purchase various in-game items in the form of ERC-721 tokens on open marketplaces like Opensea and Looksrare, as well as map assets (called Realms) released by the dev team. Staking these assets in Bibliotheca DAO’s contracts can also earn LORDS token emissions, the utility token of the Realmsverse.

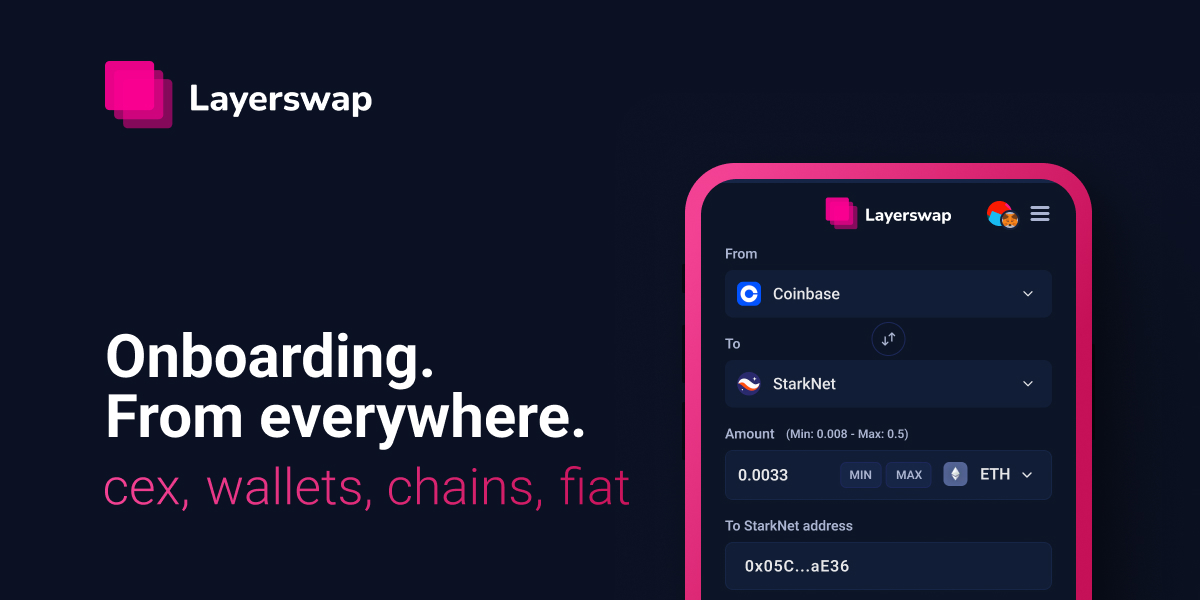

3. Layerswap

…

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Wrapped stETH

Wrapped stETH  USDS

USDS  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Polkadot

Polkadot  Monero

Monero  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Pi Network

Pi Network  Pepe

Pepe  Dai

Dai  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  Uniswap

Uniswap  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Cronos

Cronos  Gate

Gate  Aave

Aave  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic