Ethereum (ETH) co-founder Vitalik Buterin expressed his concern over the recent regulatory pressures faced by rival crypto projects, including Solana (SOL), in a June 30 tweet.

Buterin pointed out that these projects do not deserve such treatment, adding that this would not be an honorable way for Ethereum to “win” if other blockchain networks get kicked off exchanges. He added:

“…In the long term, [this] probably isn’t even a victory. This is especially true since the real competition is not other chains, it’s the rapidly expanding centralized world that is imposing itself on us as we speak.”

Buterin made this statement in response to a question about his opinion about the U.S. policy approach to crypto.

The crypto industry faces regulatory pressure in the U.S.

Recent actions from the U.S. financial regulators, such as the Securities and Exchange Commission (SEC), suggest that the country has adopted an anti-crypto stand towards the emerging industry.

Over the past month, the SEC has filed charges against major crypto exchanges, including Binance and Coinbase, alleging that they violated federal securities law.

In addition, the regulator classified more than ten digital assets, including SOL, ADA, MATIC, SAND, ALGO, MANA, and others, as securities in its lawsuits against these firms.

Meanwhile, several other crypto stakeholders, including Coinbase and Binance CEO Changpeng, ‘C.Z.‘ Zhao, and billionaire investor Mark Cuban, have previously criticized this approach to the crypto industry.

The government approach impacts the industry.

Following the SEC’s classification of certain digital assets as securities, tokens such as SOL, MATIC, and ADA experienced significant drops in their values as several major crypto platforms delisted them.

However, data shared by Julio Moreno, the head of research at CryptoQuant, suggest a potential “comeback” for these impacted assets.

Moreno pointed out that an index tracking the performance has risen by 22% since June 14, while that tracking Bitcoin and Ethereum is up by 16%.

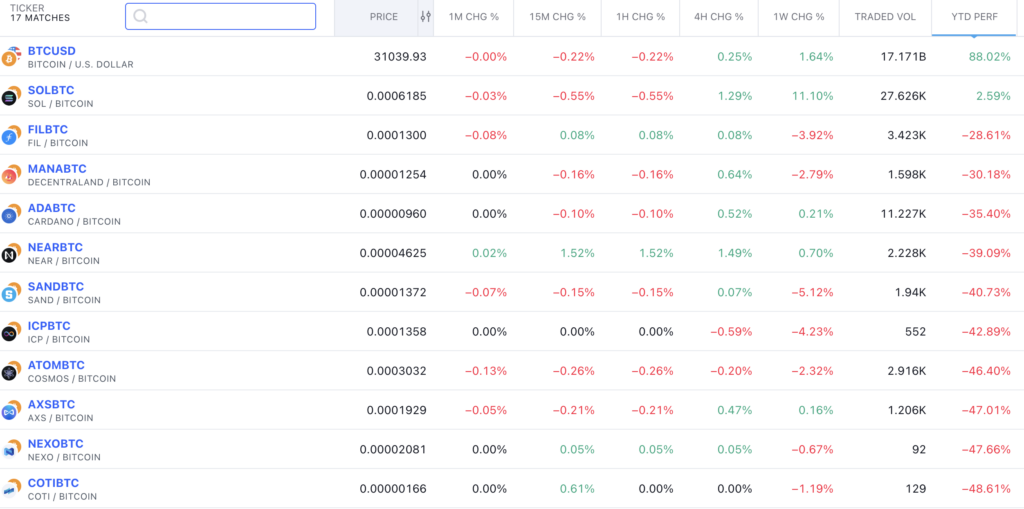

However, CryptoSlate’s TradingView screener tracking assets listed in the SEC lawsuits highlights that only Solana has a positive year-to-date return when denominated in BTC, with others experiencing over 20% declines against Bitcoin.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  USDS

USDS  Shiba Inu

Shiba Inu  Hedera

Hedera  Toncoin

Toncoin  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Polkadot

Polkadot  Monero

Monero  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  Bittensor

Bittensor  Dai

Dai  sUSDS

sUSDS  Aptos

Aptos  Uniswap

Uniswap  OKB

OKB  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Cronos

Cronos  Gate

Gate  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer