fA consideration of DeFi in recent times has centered on a hive of protocol development relative to Ethereum and other altcoins. ‘Bitcoin DeFi’ isn’t a phrase that’s spoken often but the gradual emergence and development of the Taro protocol might be instrumental in changing that.

What is Taro?

Taro is a protocol for issuing assets on the Bitcoin blockchain. One of the exciting aspects of the new protocol is its ability to integrate with the Lightning Network, allowing assets to be transferred over Lightning instantly, with high volume and low fees.

Taro is an abbreviation for Taproot Asset Representation Overlay. The protocol is the result of bitcoin improvement proposals (BIP) advanced by Lightning Network development firm, Lightning Labs.

This is not the first attempt to bring other digital assets to the Bitcoin blockchain. The difference between Taro and other efforts is that it relies on the functionality added via Bitcoin’s last major upgrade, Taproot.

Lightning Labs released the first version of Taro in September. This initial alpha release has gone live on testnet as a precursor to eventually going live on the Bitcoin mainnet once any bugs have been ironed out. Lightning Labs stated that integration with Lightning Network is included in the developmental roadmap for Taro and will be added in the future.

To achieve this, the Lightning Network infrastructure firm will have to merge Taproot channels into its LND lightning implementation. Work to achieve this is currently ongoing.

In the months ahead, enhanced features will be added to the Taro daemon such as ‘universe functionality’. Universes are information repositories that allow users and asset issuers to demonstrate asset provenance and supply issuance, while also making it easier to interact with Taro asset data. Think of a Taro ‘universe’ as akin to a project’s git repository where changes made to project files are tracked.

How it works

Taro assets are embedded within UTXOs — or bitcoin outputs. They can be imagined as UTXOs within a UTXO. A new Taro asset is minted by making an on-chain transaction that commits to special metadata in a Taproot output. As the asset is being minted, the Taro daemon generates witness data and assigns the asset to a private key that the minter holds. The newly created Bitcoin UTXO is then broadcast to the Bitcoin network. This UTXO output is the new asset’s genesis proof, acting as a unique identifier.

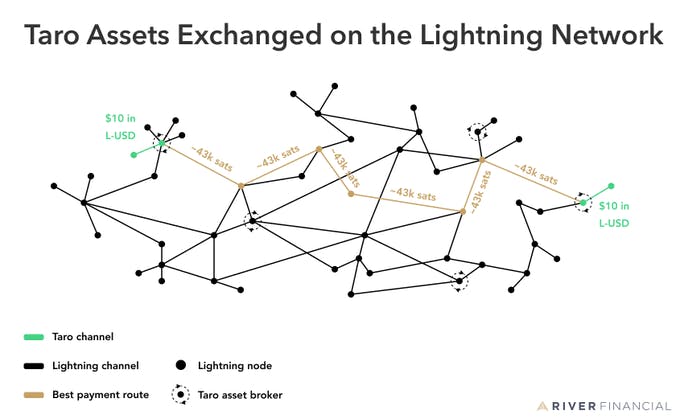

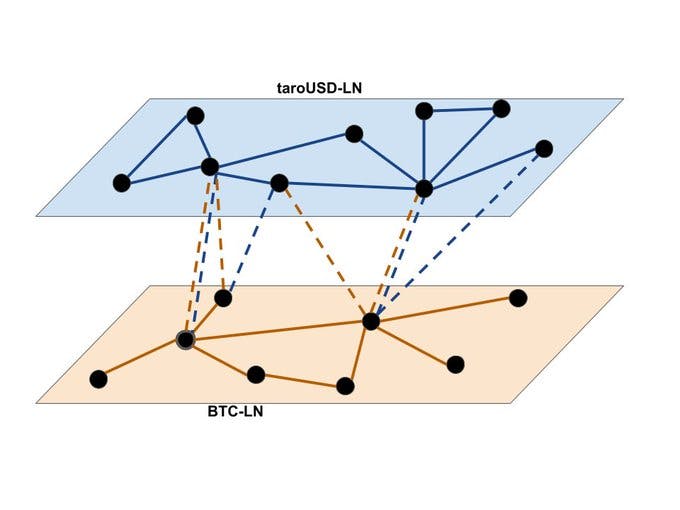

Using this mechanism, Taro has the potential to enable the Lightning Network as the underlying value transfer protocol of the internet. The Taro protocol will allow for atomic swaps between any Taro asset and BTC.

Taproot facilitates complex conditions being set for a Bitcoin UTXO. Taro harnesses Bitcoin’s proof of work (PoW) consensus mechanism by using Taproot.

In making use of Bitcoin’s UTXO model in this way, Taro has an edge on Ethereum’s ERC-20 and ERC-721 standards. It’s more secure as it avoids key reuse and more private as balance information is not revealed.

Bitcoinizing the dollar

Tether’s USDT stablecoin started out in life on the Bitcoin blockchain via the Omni Layer. It then embraced Ethereum and a number of other blockchains later on in an effort to deal with scalability. Could we see this go full circle with USDT once again hosted on Bitcoin but this time via Taro?

While Taro will facilitate all manner of digital assets, stablecoins are seen as the lowest hanging fruit in terms of immediate use case and utility. According to Michael Levin, Product Manager at Lightning Labs, people in emerging markets want exposure to US dollars. That’s a view that was reinforced by Bitcoin proponent and MicroStrategy co-founder Michael Saylor who claimed at a recent conference that people need US dollars in the short term and Bitcoin in the longer term.

Lightning Labs believes that Taro will enable start-ups like Strike, Paxful, Breez and Ibex Mercado to provide their application users with access to bitcoin and lightning-native stablecoins, particularly a USD stablecoin.

Once this functionality is fully built out, it will mean users having USD-denominated and BTC-denominated balances within the one wallet. In this way, the company believes the objective of bringing bitcoin to billions of people will be accelerated.

Other potential use cases

In the same way as the first stablecoin started out on a Bitcoin network layer, the first NFTs also emerged on the Bitcoin network. Once Ethereum came to the fore, any such development moved to its ecosystem. As well as enabling fungible currencies like stablecoins, Taro can also facilitate non-fungible unique tokens like collectibles or NFTs. It’s interesting to think that the potential at least exists through Taro for NFTs to once again feature within the Bitcoin ecosystem.

Wrapped altcoins could also feature within the Bitcoin ecosystem via Taro should anyone have the will to create them. There could be a rationale for doing so in leveraging the security of the Bitcoin network.

This initial version of Taro utilizes a level of programmability similar to that of Bitcoin Script. That provides a familiar segue for developers who are already accustomed to Bitcoin Script to build on the new protocol. However, the protocol allows the flexibility to add new opcodes and additional functionality to meet new use cases as they emerge.

What that demonstrates is that there’s more flexibility to come from Taro but we still don’t know all of the use cases that will be uncovered just yet. Some Bitcoin-centric companies have already identified the potential. River Financial, a Bitcoin technology and financial services firm, has established River Lightning Services (RLS) as a direct response to the emergence of Taro.

RLS intends to make it easier for other companies to access the new multi-asset functionality that Taro brings. By offering an application programming interface (API), RLS will allow developers to access that functionality without having to run dedicated Lightning Network infrastructure. River Financial CEO and founder Alex Leishman sees Taro as a major catalyst for Lightning Network adoption.

Meanwhile, Bitcoin-centric financial services company NYDIG has established a Lightning accelerator project called Wolf which will seek to advance development, implicating Taro. Founder of Bitcoin VC firm Stillmark, Alyse Killeen, believes that “Lightning Network and Taro are the kind of innovations that can kickstart more mainstream adoption of Bitcoin-based payments the way that broadband connections did for the internet two decades ago.”

Bitcoin DeFi vs. Ethereum-centric DeFi

This newfound flexibility that Taro brings with it was lacking back in 2013. Then, Vitalik Buterin and others founded Ethereum to pursue the building of decentralized applications that the Bitcoin blockchain didn’t have the flexibility to facilitate. What followed has been a frenzy of DeFi-related development within the Ethereum ecosystem, spilling over into many alternative blockchains.

A ‘move fast and break things’ approach has prevailed within that ecosystem, resulting in an oftentimes chaotic and imperfect hive of DeFi-related innovation replete with some spectacular hacks along the way.

By comparison, development within the Bitcoin ecosystem has been slow. Bitcoin itself has been limited in what it offers developers as Bitcoin Script limits the complexity of what can be built. Developers who have long since moved over to work on other blockchains have bemoaned this shortcoming.

Taro protocol as an extension of layered development on Bitcoin: IMG SRC

Meanwhile, those builders who have continued to focus on Bitcoin see Bitcoin’s lack of flexibility as a feature and benefit. The thinking is that the codebase behind the base layer money has to be restrictive to lessen the odds of it coming undone through a hack or exploit.

Instead the approach has been to apply software updates in a very slow, conservative and considered manner. The Taproot upgrade which has facilitated Taro went live in November 2021.

Some Bitcoin proponents have claimed that once fully developed, Taro renders all altcoins irrelevant. In June, Bitrefill CEO Sergej Kotlar claimed that Taro could “shake things up big time in how the whole crypto industry works”.

While there’s no doubt that Taro is an exciting development, there’s a body of work to be done before it in any way serves to undermine the development that has taken place within the Ethereum ecosystem and on other blockchains where DeFi protocols are concerned.

In a funding round earlier this year, Lightning Labs raised $70 million. That enables the company in its efforts to roll out further Bitcoin and Lightning-related technologies, including the further development of Taro. Keeping in touch with what developers build out on this technology going forward is highly recommended.

Read More: second-pocket-shoot-73.hashnode.dev

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Internet Computer

Internet Computer  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Ethereum Classic

Ethereum Classic