Fearless speculators have forked over more than $7M worth of ETH to Ben.eth, a pseudonymous memecoin creator who has quickly risen to prominence over the past two weeks.

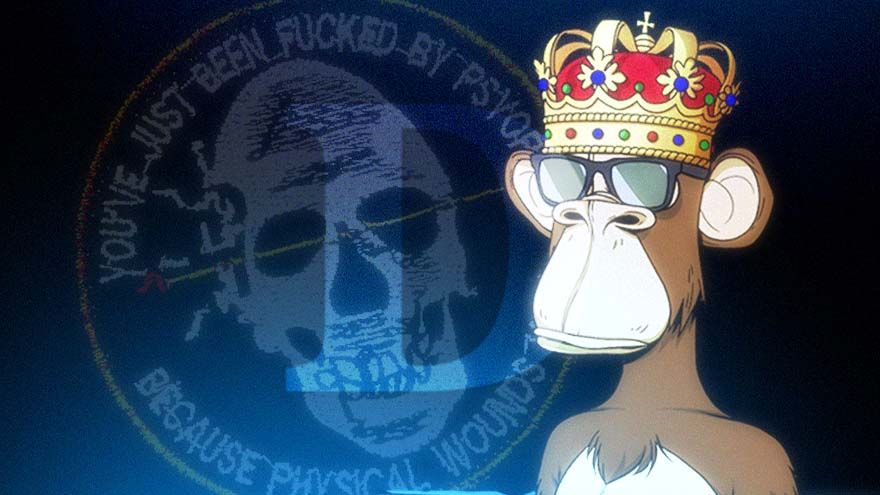

Following the success of the BEN token, which peaked at a $72M market cap four days after its May 6 launch, Ben.eth announced a presale for his next memecoin PSYOP on May 12, telling investors to send ETH to his wallet to secure an allocation.

Ethereum users have since sent 3,843 ETH to Ben.eth despite the risk of PSYOP’s founder opting to abscond with the funds. Ben.eth has already postponed the token’s launch several times.

The speculative fervor surrounding memecoins has some pundits wondering whether a renewed crypto bull season may be just around the corner. Early PEPE investors recently made fortunes after the token, which offers little utility beyond a tribute to a cartoon frog, rocketed to a $1.8B market capitalization in early May.

But other analysts warn that greedy investors could fall victim to their own FOMO, as underhanded developers could use tokens as trojan horses to execute rug-pulls, exploits, or to deploy other malicious code.

Ben.eth

Ben.eth was active on Twitter as an NFT collector before quickly rising to memecoin celebrity status after launching BEN on May 6. The token was linked to the ‘Ben DAO’ Telegram group, which described itself as a collective of crypto traders named Ben.

The token took off after Ben Armstrong, the controversial crypto influencer, began promoting the token to his 1M followers two days later, precipitating a 500% rally in the price of BEN over 24 hours.

Armstrong later took over the project following an undisclosed deal between the pair. Recent tweets suggest Ben.eth agreed to transfer his BEN liquidity provider tokens to Armstrong.

Developer Sounds Alarm

On Friday, Vydamo, a former FTX and Ethereum engineer, went public with screenshots purporting to show that Ben.eth may not have his community’s best interests at heart.

The images suggest that the smart contract includes a function allowing PSYOP to be transferred from any whitelisted wallet holding the token to another wallet. The contract also imposes varying fees on PSYOP sales depending on what other NFTs are held in the wallet, with Milady holders reportedly facing a 30% fee on sales — 10 times higher than other collections.

“I have never worked with someone more unprofessional or deranged, and due to this I left the team before payment,” Vydamo said. “I have credible evidence that Ben does not intend for this to be a fair launch or even project.”

Vydamo claims they decided they were not comfortable contributing to the project and walked away from $1M worth of PSYOP tokens to blow the whistle on the project. Ben.eth shared Vydamo’s thread and dismissed the allegations as FUD.

However, not all of Vydamo’s posts paint a damning picture of PSYOP.

On May 17, Vydamo posted an analysis of PSYOP’s presale distribution he conducted in partnership with Ctlarp or TRM Labs, a blockchain intelligence firm.

Vydamo concluded that the token’s distribution “looks pretty standard” for a token sale, concluding the allocations appear “very similar” to PEPE’s.

The researcher noted that the account values of many of PSYOP’s largest contributors are up big in the past month, concluding many “cashed up” memecoin investors are betting on the token.

He also identified high levels of engagement with Ben.eth’s posts from major NFT communities. Borovik.eth, an NFT collector, also compiled data showing notable presale contributions from NFT communities.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Monero

Monero  Toncoin

Toncoin  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  USDS

USDS  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aave

Aave  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer