BitDAO, a project armed with the second largest treasury in all of crypto, plans to throw its weight behind a Layer 2 network it has developed.

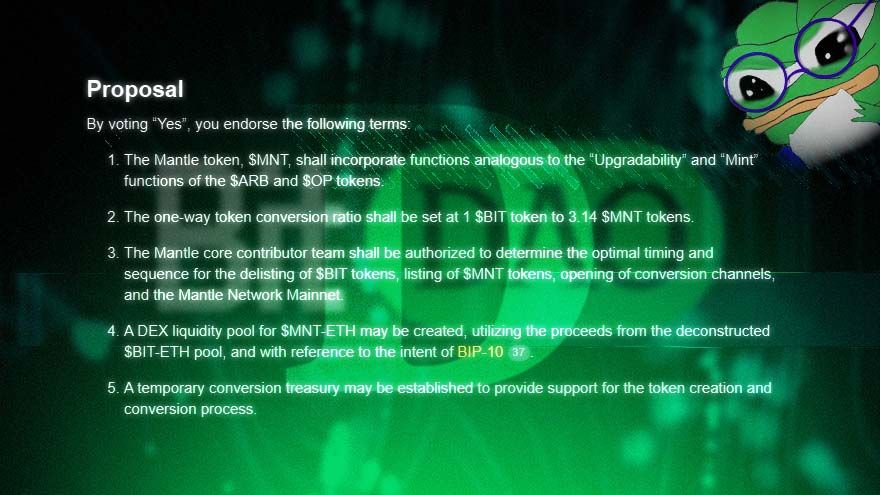

A governance vote that passed on May 19 committed to rebranding BitDAO as a Layer 2 called Mantle and also approved plans to enable one-way conversions of the project’s BIT tokens to MNT, the new network’s native token.

It’s a major move by BitDAO, a project which has a lot of resources but has operated largely out of the limelight. With BitDAO doubling down on a Layer 2, the project is signalling that it will compete in a subsector of crypto that has become both crucially important and visible in 2023 as Ethereum looks to scale. Thanks to its treasury and some key hires, Mantle may be primed to be a real player in the scaling wars.

BitDAO, which defines itself as an “open platform for proposals that are voted upon by BIT token holders,” controls a $4B treasury, according to DeFi Llama. That’s second only to the Arbitrum DAO, which launched earlier this year with the airdrop of the ARB token.

While the BitDAO treasury primarily consists of its native BIT token, it is well diversified — at $296M, it holds the largest amount of stablecoins of any DAO.

The BIT token has a market capitalization of $763M, making it a top-100 digital asset.

Despite its size, BitDAO remains a confusing project to many. That lack of clarity is part of what’s driving the rebrand to Mantle, which was previously a sub-project of BitDAO.

“There is fragmentation of communities, messaging, and mind-share between the Governance (BitDAO) and Product (Mantle) components of the existing BIT ecosystem,” reads the proposal.

With the vote, and a subsequent forum post exploring the details around the conversion of BIT to MNT, BitDAO has made a distinct choice to associate with Mantle. Earlier, the project functioned like an investment DAO, directing capital towards other projects, of which Mantle was one.

Crowded Layer 2 Sector

Now, BitDAO is taking a decided step towards aligning itself with a Layer 2 network, a sector which has been red hot this year with the Arbitrum airdrop and the launch of severalzero-knowledgerollups.

Seraphim Czecker, who works for the company behind Lido Finance, DeFi’s largest protocol, told The Defiant he’s “pretty bullish,” on Mantle. Czecker cited Mantle’s deep pockets as one reason he thinks Mantle will be a player to watch in the increasingly competitive Layer 2 space. He also said the engineering team is well-versed in the world of maximal extractable value (MEV), possibly the most technical subsector in crypto, which involves reordering pending blockchain transactions for profit.

Czecker added that BitDAO’s association with ByBit, a top 10 by volume centralized exchange whose traders are also active DeFi users, should also buoy Mantle.

ByBit Contributions

ByBit received 60% of the initial 10B BIT supply, according to BitDAO’s documentation. Of those 6B tokens, 4.5B were subject to a year-long vesting period before starting to unlock on a monthly basis.

ByBit previously contributed 2.5 basis points of its futures trading volume to the BitDAO treasury. After another proposal, BIP-20, passed on April 4, the exchange started transferring a set amount of BIT tokens to BitDAO on a monthly basis.

The overarching reason for the switch was that a predictable supply of BIT tokens will decrease the emphasis on growing BitDAO’s treasury and increase the focus on the project’s initiatives.

The proposal also said that by tying BIT contributions to trading volume, the token is more likely to legally be categorized as a “ByBit token.” The consistent transfers make BIT less of a “centralized exchange token,” according to the proposal. A well-known exchange token, FTT, played a crucial role in bringing down the FTX empire last year.

Testnet Phase

Mantle hasn’t launched yet. While the project has made some compelling claims about its modular design, a school of thought around blockchain architecture which has gained traction, it is still in the testnet phase.

Arjun Kalsy, head of ecosystem at Mantle, told The Defiant that the team is targeting mid to late July for a mainnet launch.

Mantel touts other differentiating factors like its decentralized sequencer, which contrasts with major scaling solutions like Arbitrum and Optimism, which have centralized ones. Sequencers are the specialized nodes of Layer 2s which organize and submit the scaling solutions’ transactions to a Layer 1 blockchain like Ethereum.

Piotr Szlachciak, the co-founder of L2BEAT, which compiles Layer 2 data, told The Defiant that L2BEAT doesn’t evaluate testnets. “Once [Mantle] goes live and we can see the actual code running, a serious discussion about a project can take place,” Szlachciak said, emphasizing that until the Layer 2 launches fully, he remains fully neutral on the project.

For now, details of the token swap from BIT to MNT are being hammered out on BitDAO’s forums. There’s no guarantee that the MNT token will outperform — debate still swirls over how to properly value Layer 2 tokens.

Still, with a unique connection to a major exchange like ByBit, as well as $230M raised in 2021 from major investors including Peter Thiel, investors will likely take a long look at MNT.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Pi Network

Pi Network  Hyperliquid

Hyperliquid  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  WETH

WETH  USDS

USDS  Monero

Monero  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  Aave

Aave  Ondo

Ondo  OKB

OKB  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange