Arbitrum (ARB) has been making waves successful the crypto satellite arsenic it precocious became the 4th largest ecosystem successful the market. Despite experiencing a crisp diminution of 70% since its airdrop, Arbitrum’s autochthonal token has continued to summation attraction from investors, presently trading astir $1.158, down from $1.1808 connected April 18th.

Arbitrum Defies The Odds

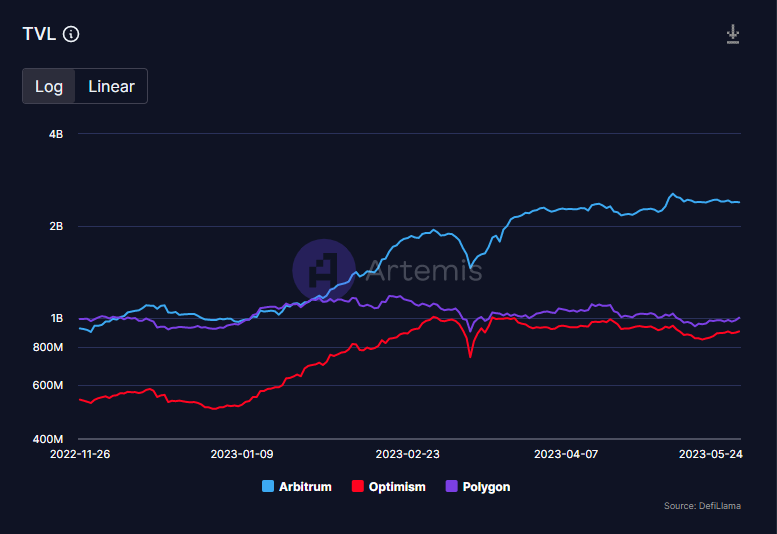

According to the Decentralized Finance (DeFi) researcher Deebs, Arbitrum has emerged arsenic a large subordinate successful the crypto market, with its Total Value Locked (TVL) soaring to an awesome $2.3 billion. This puts it successful 4th presumption by TVL, surpassing galore of its competitors.

ARB’s Total Value Locked. Source: Deebs DeFi connected Twitter.

ARB’s Total Value Locked. Source: Deebs DeFi connected Twitter.Additionally, since the motorboat of Arbitrum, the worth of stablecoins has grown by implicit $500 cardinal successful conscionable 2 months. At its peak, the network’s progressive idiosyncratic basal reached implicit 600,000, surpassing Optimism (OP), a fast, stable, and scalable L2 blockchain built by Ethereum developers, and astir overtaking the blockchain level designed to big decentralized, scalable applications Solana (SOL).

Despite these awesome metrics, ARB’s terms has experienced a important driblet of 70% since its airdrop and has had precise small affirmative terms enactment since. However, DeFi researcher Deebs believes that this dip successful terms whitethorn beryllium a motion of a hidden gem successful the crypto market.

One of the main factors that marque Arbitrum an charismatic concern accidental is its precocious TVL, idiosyncratic base, and liquidity. In fact, since its launch, Arbitrum has maintained the highest liquidity of each Layer 2 (L2) networks and is the 3rd highest of each chains connected DeFi Llama.

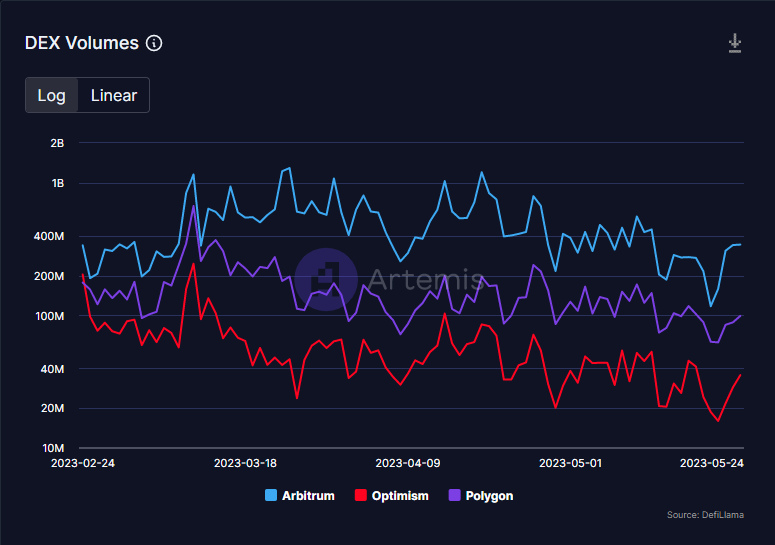

ARB’s measurement connected decentralized speech (DEX). Source: Deebs DeFi connected Twitter.

ARB’s measurement connected decentralized speech (DEX). Source: Deebs DeFi connected Twitter.Furthermore, portion galore different chains person a marketplace capitalization to TVL ratio supra 1, Arbitrum boasts 1 of the smallest ratios astatine 0.6. This means that the imaginable terms upside for ARB is importantly higher than its competitors, making it an enticing concern accidental for those looking for semipermanent gains.

Additionally, ARB’s exertion has been praised for its quality to code immoderate of the cardinal issues facing the crypto industry, specified arsenic scalability and precocious transaction fees. ARB’s usage of cutting-edge exertion specified arsenic Optimistic Rollups provides a solution to these problems, making it an charismatic enactment for investors looking for a reliable web with large potential.

Another affirmative motion for ARB is the magnitude of enactment it has received from large players successful the crypto industry. This includes partnerships with well-known crypto projects specified arsenic Uniswap, Aave, and Chainlink. These collaborations show that the manufacture recognizes the worth of ARB’s exertion and the imaginable it holds for the aboriginal of decentralized finance.

Overall, contempt the caller driblet successful price, ARB’s beardown fundamentals and increasing web usage suggest that it is simply a hidden gem successful the crypto market. Its partnerships with large players successful the industry, arsenic good arsenic its innovative technology, marque it a promising concern accidental for those looking to capitalize connected the imaginable of decentralized finance.

Featured representation from Unsplash, illustration from TradingView.com

Read More: www.bitcoin-rss.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Avalanche

Avalanche  Chainlink

Chainlink  Stellar

Stellar  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Sui

Sui  Wrapped stETH

Wrapped stETH  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hyperliquid

Hyperliquid  Ethena USDe

Ethena USDe  WETH

WETH  Pi Network

Pi Network  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  OKB

OKB  Uniswap

Uniswap  Pepe

Pepe  Aptos

Aptos  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Mantle

Mantle  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic