Ethereum (ETH) gas fees jumped to a 10-month high — prompted by a surge in meme coin mania.

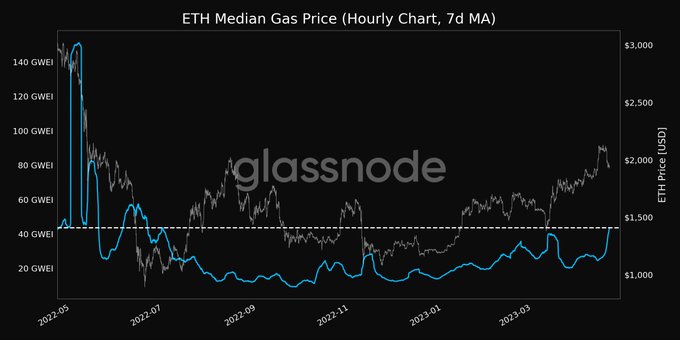

Per Glassnode, the median Ethereum gas price over a seven-day moving average (7DMA) reached 43.641 gwei — a price last seen on June 30, 2022.

Gwei is a denomination of ETH — with 1,000,000,000 gwei equaling 1 ETH, or 1 gwei equaling 0.000000001 ETH.

Over the past year, the median gas price over a 7DMA peaked at 150 gwei in May 2022 but dropped sharply by July 2022. It then gradually stabilized around the 20 gwei mark going into September 2022, when the Merge rolled out.

Ethereum gas fees

The cost of using Ethereum has been a point of contention since the “DeFi Summer” of 2020 — when the average gas price reached as high as 700 gwei.

This period saw network activity surge as yield protocols, such as Curve, Compound, and Yearn, began taking off — triggering mania from the demand to farm unreal gains.

Ethereum’s architecture is such that high gas fees come about when network traffic and the demand for transaction verification is high.

While some assumed the Merge and the switch to Proof-of-Stake (PoS) consensus would tackle this problem, it was confirmed that gas fees remain primarily driven by the demand for blocks and the network’s capacity to meet that demand — not the consensus mechanism used.

Recently, Ethereum network activity has skyrocketed with a wave of newly released meme coins — some of which netted early investors gains in the thousands of percent.

Meme coins are back

PEPE is one such meme coin, which has risen to become the sixth largest by market cap at $89.1 million in a few days.

PEPE reached a local top of $0.000000391704 on April 20 and has been trending downwards since.

The success of PEPE has spurred social media chatter on which meme coin is next to spike. For example, a tweet from @liquiditygoblin said meme season is back — tagging “$PEPE, $WOJAK, $COPE.”

The post Meme season blamed for jump in Ethereum (ETH) gas fees appeared first on CryptoSlate.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  USDS

USDS  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  WETH

WETH  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Wrapped eETH

Wrapped eETH  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Dai

Dai  OKB

OKB  Aptos

Aptos  Gate

Gate  Bittensor

Bittensor  Ondo

Ondo  NEAR Protocol

NEAR Protocol  Tokenize Xchange

Tokenize Xchange  sUSDS

sUSDS  Internet Computer

Internet Computer  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic