- The L2 protocol becomes the second sidechain to be integrated with Convex Finance

- The development would allow blockchain interplay as CVX investors shun HODLing

In the last quarter of 2022, Convex Finance [CVX] committed to integrating several sidechains on its network. So, on 9 March, the liquidity provider announced that it had launched on Polygon [MATIC] to further foster the mission.

How much are 1,10,100 CVXs worth today?

Sidechains are secondary blockchains with their own consensus protocol, allowing the parent blockchain to improve its security and privacy.

Pool in the pool— that’s the way

According to the Medium-channeled statement, the integration would improve liquidity provision on Curve Finance [CRV], and also boost token staking on the protocol.

The disclosure means that Polygon becomes the second sidechain and layer-two (L2) Ethereum [ETH] scaling solution to be involved.

In November 2022, Convex added Arbitrum to the fray. This led the former to create a cross-chain interface so users can interact with its Liquidity Pools (LPs).

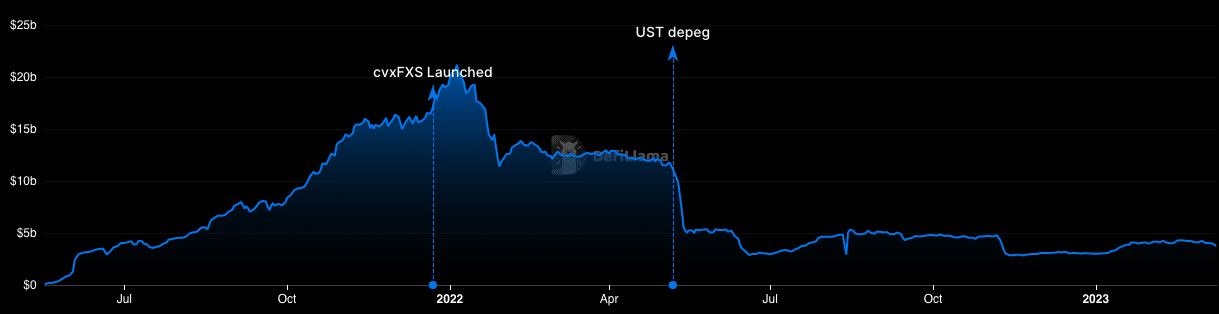

Convex confirmed that the case Polygon would be similar to the interaction with Arbitrum. However, information from DeFi Llama revealed that the Convex Finance Total Value Locked (TVL) remained still in the fifth position.

The TVL represents the number of assets deposited by liquidity providers in smart contracts into a protocol. At the time of writing, the TVL had decreased by 5.60% in the last 24 hours. An interpretation of this points to hesitation in positively impacting the DeFi sector capital and applications.

Convex added that the development would enable the single-sided staking in line with its recently-passed cvxFXS proposal. Furthermore, the blockchain yield optimizer pointed out that the current Arbitrum pools would align with the Polygon integration to aid user access. The communique mentioned,

“Convex will be migrating the current Arbitrum pools to new pools, with the aim of aligning the code base with Polygon to prevent confusion for integrators.”

Hitting the tops and bottoms

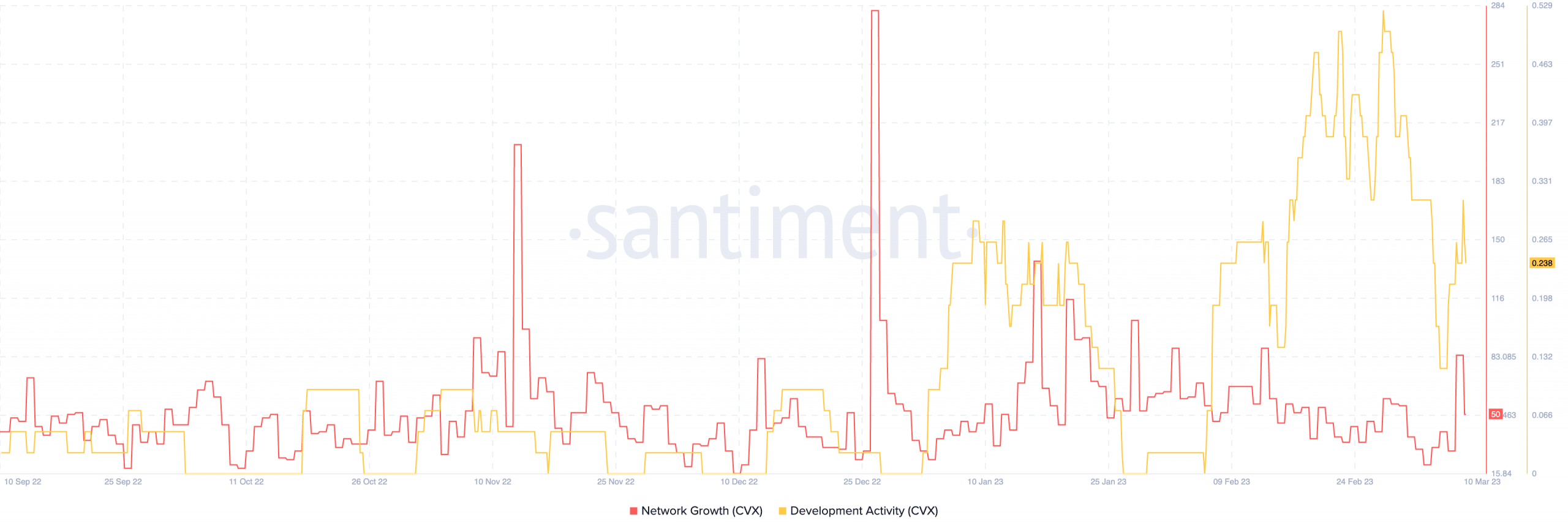

Meanwhile, the Convex development activity picked up a significant increase as a result of the update. The metric explains developers’ contribution to upgrades within an ecosystem.

Read Convex’s Finance [CVX] Price Prediction 2023-2024

As revealed by Santiment, the Convex development activity rose to 0.309 even though it dropped to 0.238 at press time. This brief jump implied an impressive dedication from the Convex Finance development team.

The network growth also posed a similar trend to the development activity. The metric illustrates the adoption of a project. So, the downturn implied that Convex only gained traction for a short while with minimal notable growth.

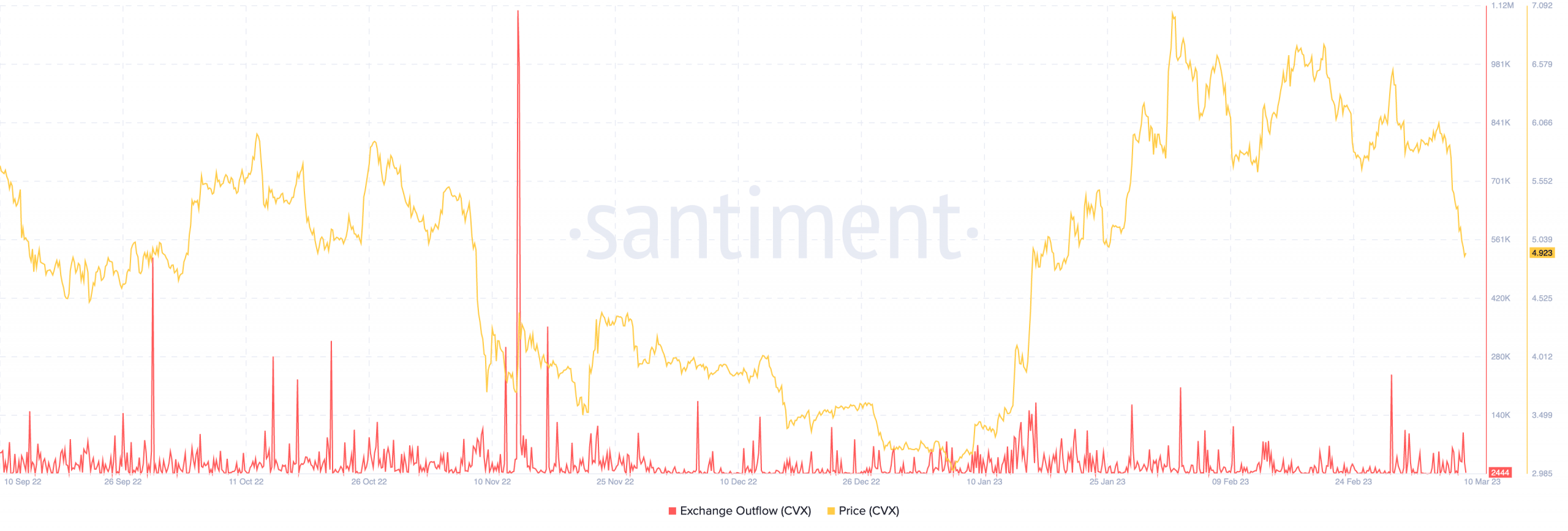

Regardless of the development, CVX investors have remained resolute in neglecting to hold the token for the short term. This was because the exchange outflow was 2444— a decrease from the 1 March high. At press time, the CVX traded at $4.92, following the wider market price collapse.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Toncoin

Toncoin  Chainlink

Chainlink  Stellar

Stellar  USDS

USDS  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Hedera

Hedera  Litecoin

Litecoin  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  WETH

WETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Hyperliquid

Hyperliquid  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Pi Network

Pi Network  Uniswap

Uniswap  Dai

Dai  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Aptos

Aptos  OKB

OKB  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Gate

Gate  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Cronos

Cronos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer