JPMorgan, one of the world’s largest investment banks, has maintained its negative stance on the cryptocurrency market in a recent report

JPMorgan, one of the world’s largest investment banks, has reaffirmed its negative outlook on the cryptocurrency market in a recent report.

The bank expressed its concerns regarding the recent collapse of the $SI network, which it claims is “another setback for the crypto ecosystem.”

The comments from JPMorgan come as shares of crypto-focused companies fell after Silvergate Capital disclosed plans to wind down operations and voluntarily liquidate.

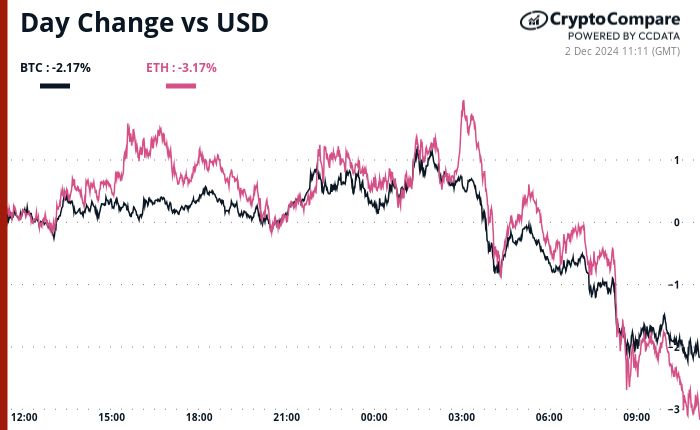

The price of Bitcoin, the world’s largest cryptocurrency, dipped to an intraday low of $20,816 on the Bitstamp exchange. Coinbase’s stock dropped by almost 1%, and both Riot Blockchain and Marathon Digital, two major crypto mining companies, saw their stock slide by 2.3% each.

JPMorgan goes on to say that replacing the instantaneous network for processing dollar deposits and withdrawals will be a difficult task. Hence, the implosion of Silvergate is a significant blow to the cryptocurrency industry, which relies heavily on fast, efficient payment processing networks.

The bank also highlights the reversal in the CME futures spread, which is indicative of a deterioration in demand. This could be interpreted as a signal that investors are less confident in the future of cryptocurrency.

As reported by U.Today, the bank predicted that Bitcoin could plunge all the way to $13,000 in November.

Read More: u.today

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Hedera

Hedera  Litecoin

Litecoin  Pepe

Pepe  LEO Token

LEO Token  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  Aave

Aave  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub  MANTRA

MANTRA  Stacks

Stacks