- Axie Infinity has seen a decline in growth metrics in the last week.

- AXS sees increased token distribution.

Axie Infinity [AXS], the well-known play-to-earn gaming platform, has experienced a drop in crucial growth indicators in the past week, as per the latest findings from DappRadar.

According to the data provider, while the count of unique active wallets on Axie Infinity grew by a mere 0.43% in the last seven days, the total number of transactions completed by these addresses fell by 8%.

During that period, transactions completed on Axie Infinity totaled 299,720.

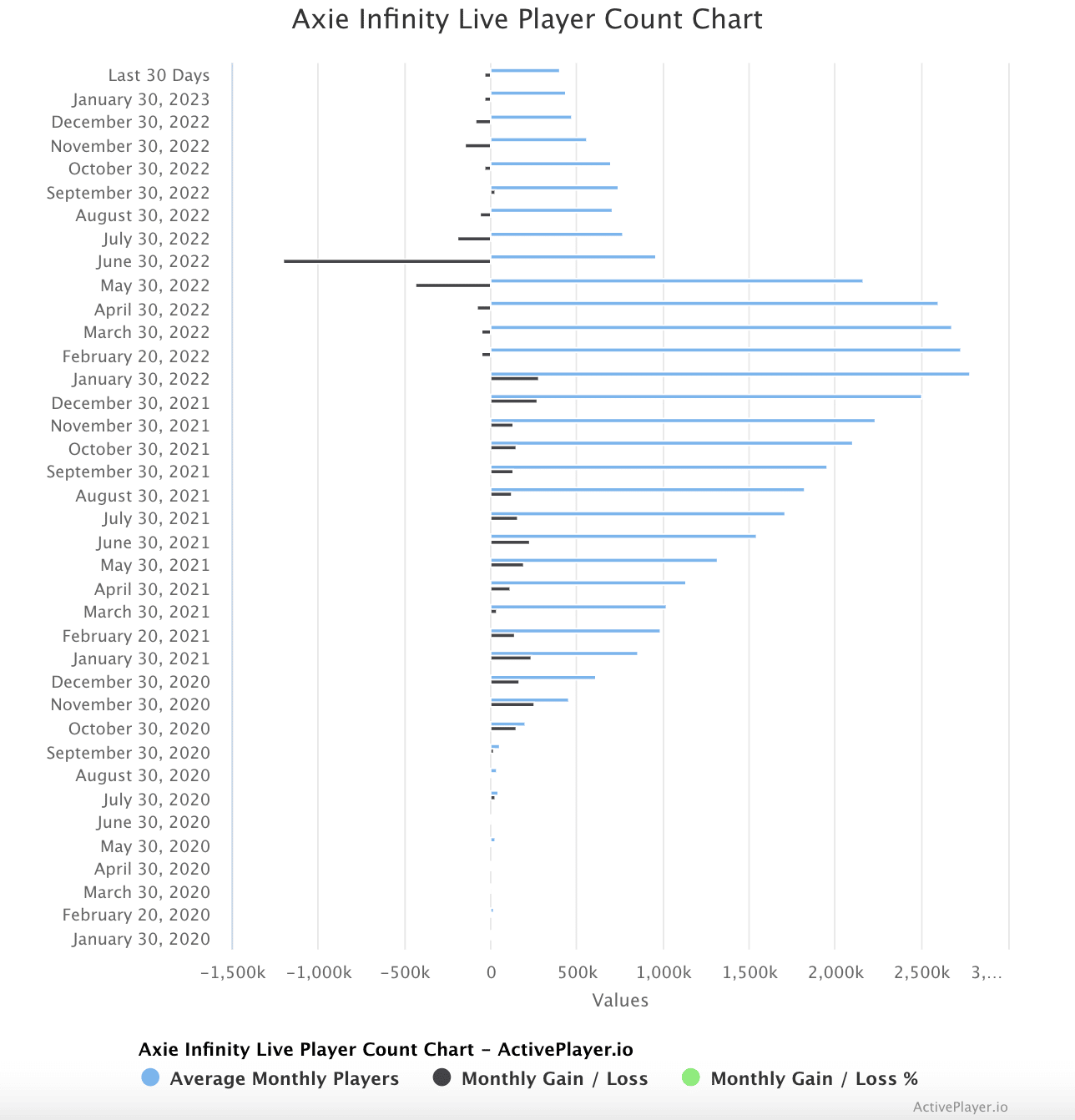

With a significant decline in user activity in play-to-earn games last year, Axie Infinity suffered a huge blow to its user base in 2022.

Despite significant growth across the broader cryptocurrency market since the start of the year, Axie Infinity has failed to follow the trend, with a decrease in the number of new players joining its platform.

Realistic or not, here’s AXS market cap in BTC’s terms

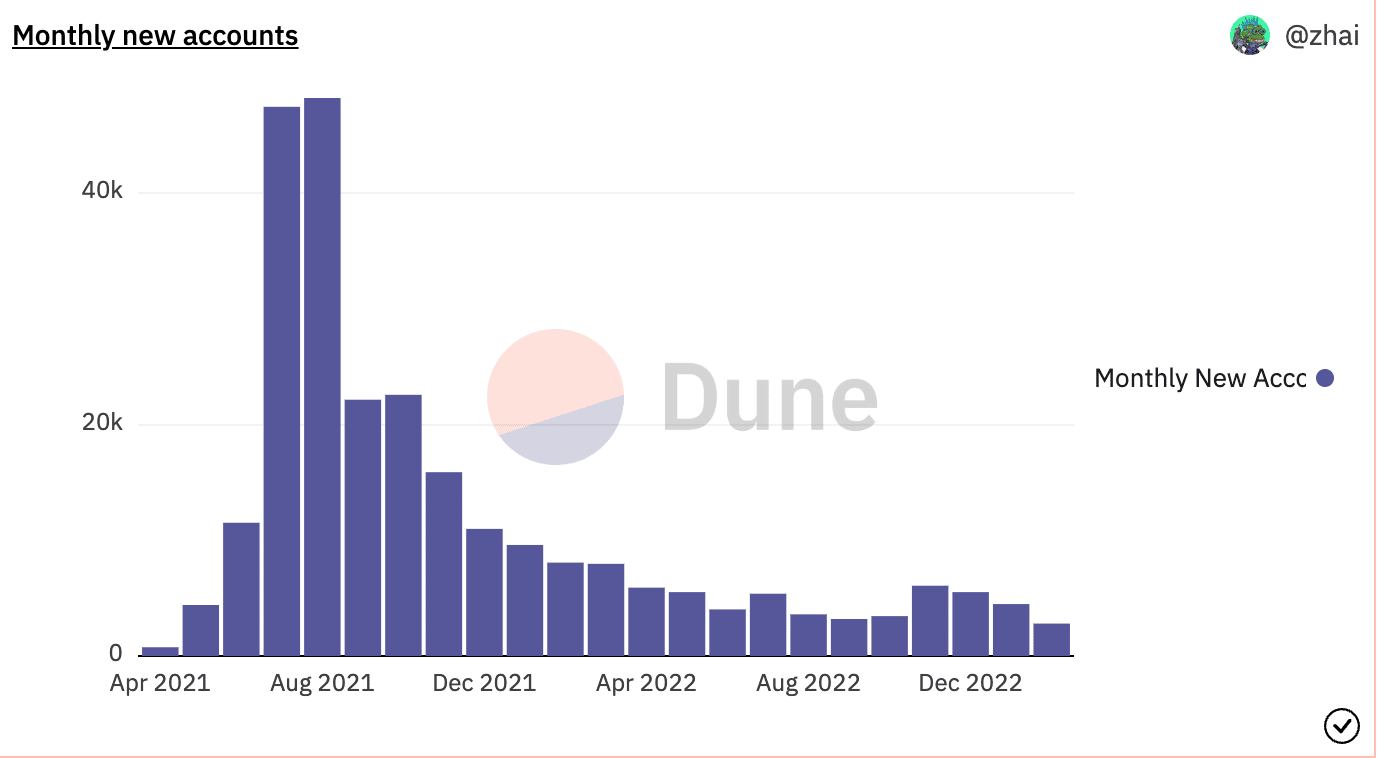

With 2807 new accounts created on Axie Infinity in February, monthly new accounts on the gaming platform have dropped by 49% since December 2022.

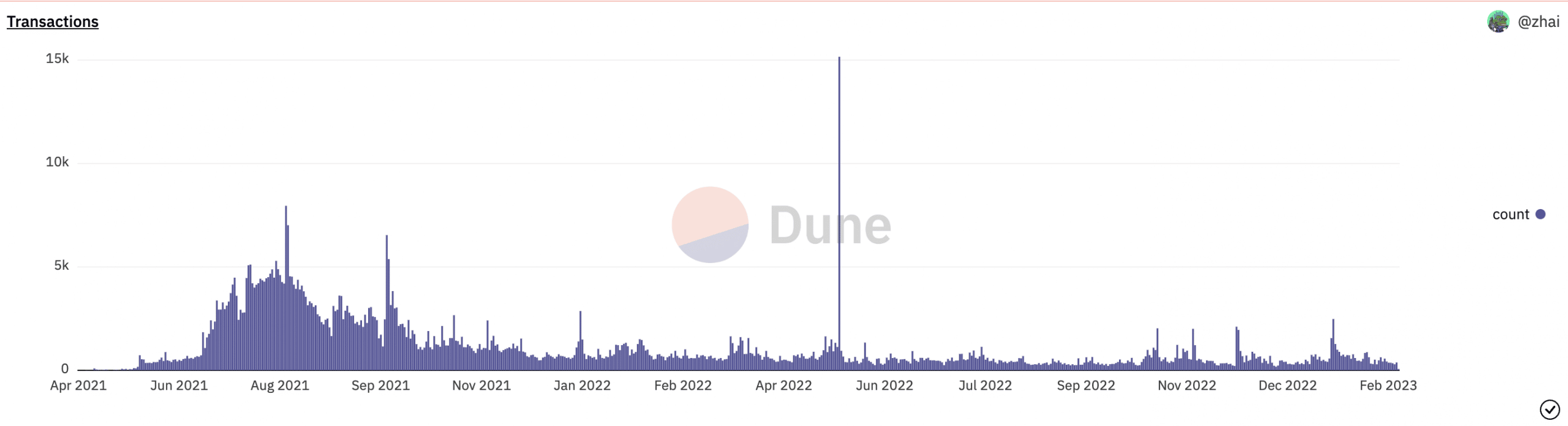

As for the count of daily transactions completed on Axie Infinity, it has seen a steady fall since the high of 2481 transactions on 22 January.

Further, due to the fall in transaction count on the game in the last week, the fiat value of these transactions plummeted as well.

According to data from DappRadar, the fiat value of transactions completed on Axie Infinity in the last seven days totaled $8.55 million, declining by 38.35%.

Not without a silver lining

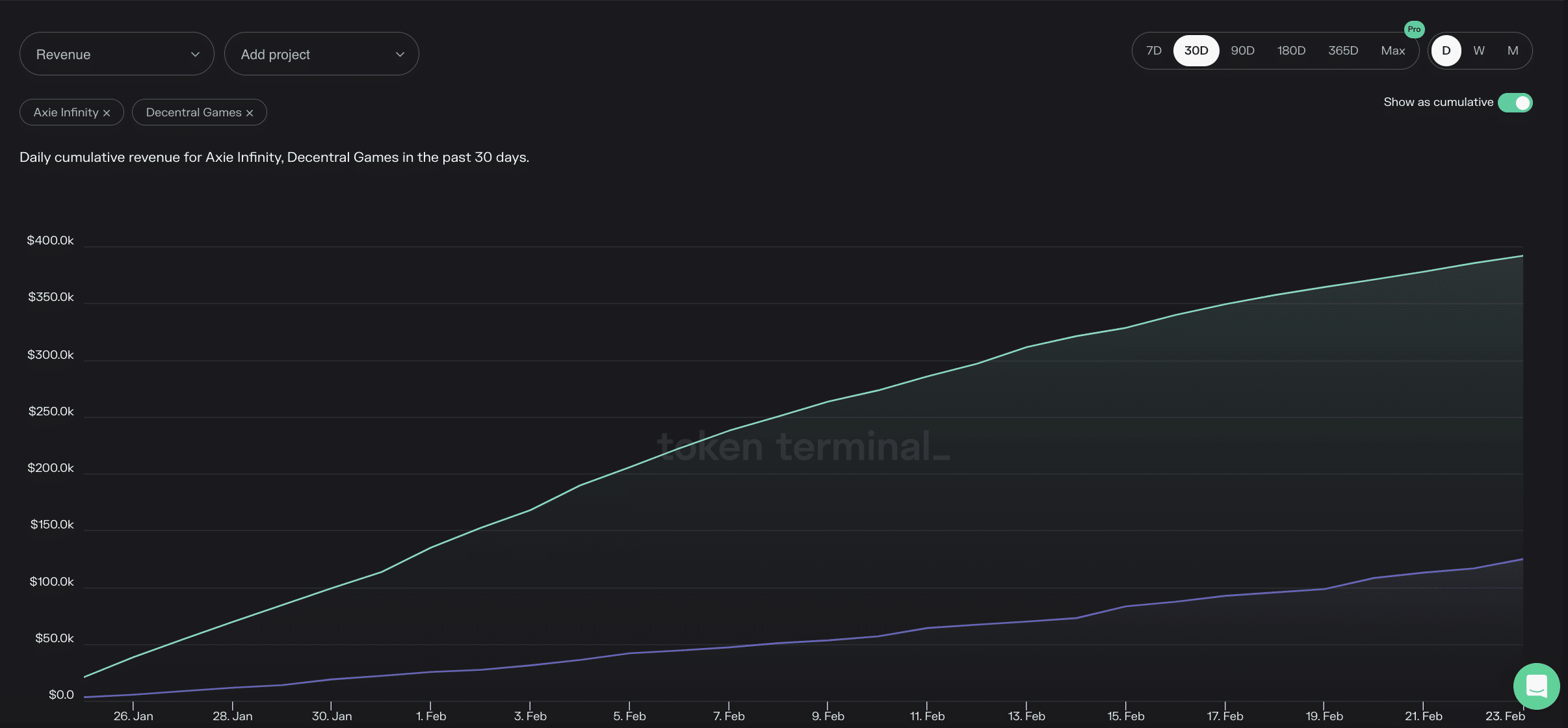

An assessment of Axie Infinity’s performance within a 30-day window period revealed a jump in revenue on the gaming platform.

According to data from Token Terminal, profit recorded by the play-to-earn game in the last month totaled $391,900, representing a 69% jump.

Its revenue jump was, however, less compared to that of Decentral Games, another blockchain-based gaming platform that saw a 3900% jump in revenue during the same window period.

Nonetheless, the 69% uptick in Axie Infinity’s revenue remains noteworthy, considering the fact that there has been a persistent fall in active gamer count in the last 30 days.

Liquidity exodus equals further price decline

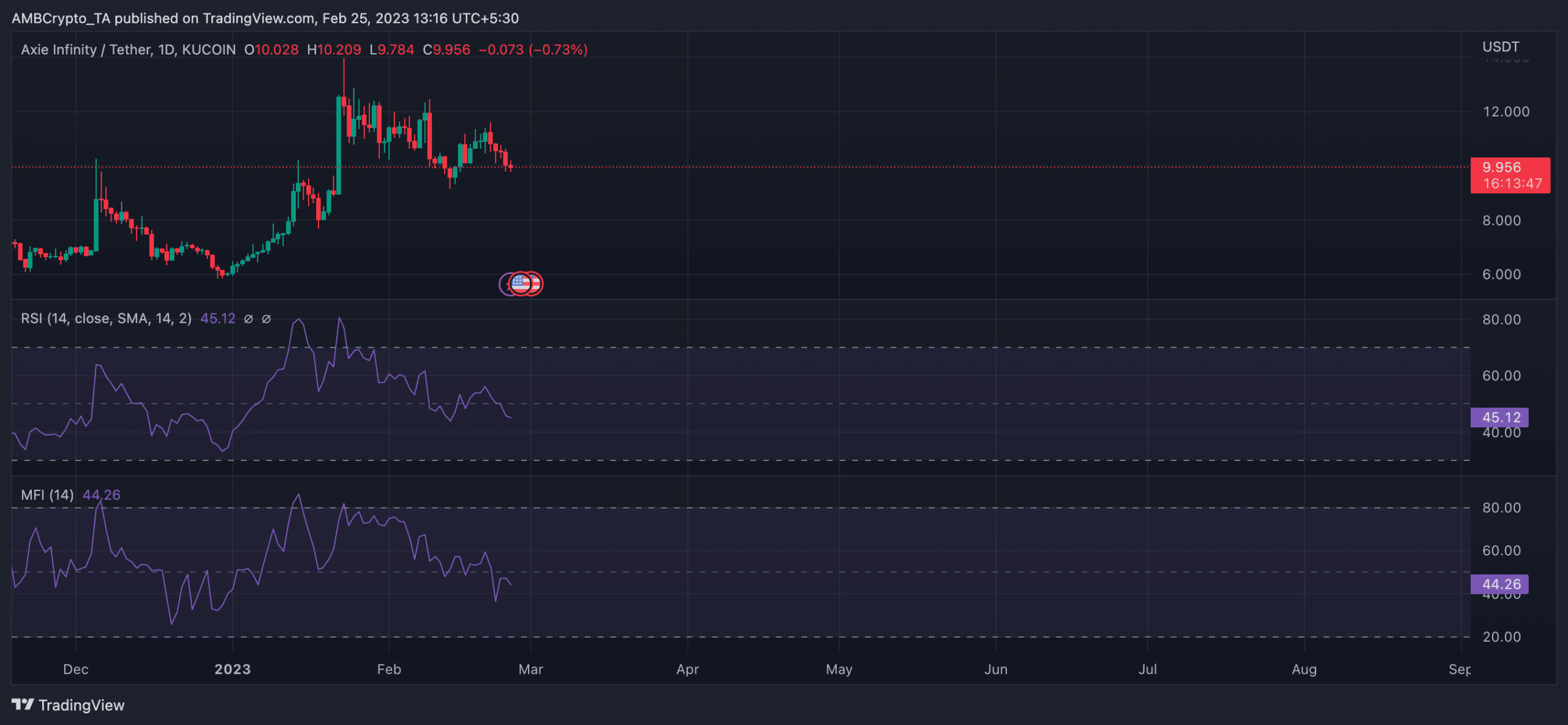

An assessment of AXS’s price movements on a daily time scale showed a drop in the token accumulation trend in the last week. During that period, AXS’s value fell by 9%, per data from CoinMarketCap.

Is your portfolio green? Check out the Axie Infinity Profit Calculator

Moreover, key momentum indicators have breached their respective neutral zones and were headed for overbought regions at press time.

AXS’s Relative Strength Index (RSI) was 45.12, while its Money Flow Index (MFI) was 44.26.

The steady decline of these indicators indicated a shortfall of liquidity in the AXS market as many traders were interested in selling and taking profits instead.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Algorand

Algorand  Dai

Dai  Bonk

Bonk  Stacks

Stacks  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub