Macroeconomics and financial markets

In the US NY stock market on the 14th, the Dow fell by $156 (0.5%) from the previous day, falling for the first time in three business days. The Nasdaq closed higher at $68.36, or 0.57%.

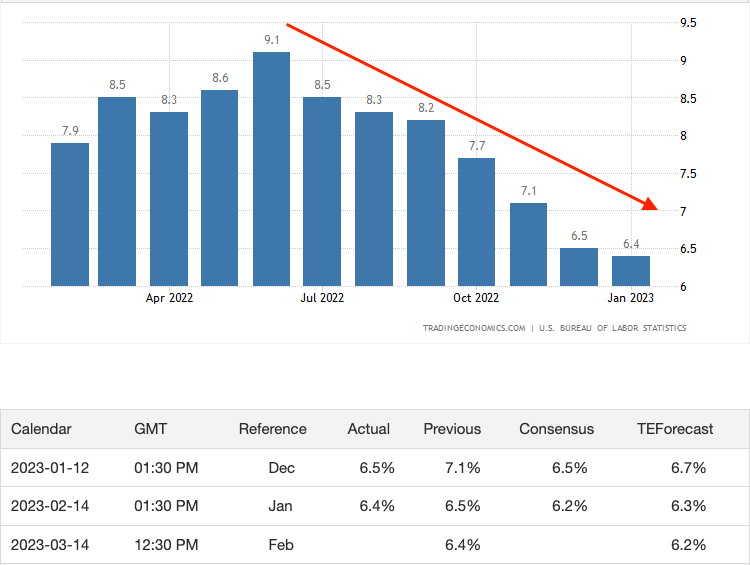

The U.S. CPI (U.S. Consumer Price Index) announced at 22:30 (Japan time) on the 14th was +6.4% compared to the same month of the previous year, exceeding the market forecast of +6.2%, confirming the strength of inflationary pressure. Market participants are of the view that further “additional interest rate hikes” will be called into question. Core CPI, excluding food and energy, increased 5.6% year-on-year.

On the other hand, the month-on-month rate of decline was 0.1%, showing a steady slowdown compared to the +9.1% in June last year.

Trading economics

The president of the U.S. Fed has made a series of hawkish remarks about the possibility of continuation of high inflation, and Fed Chairman Jerome Powell is skeptical of a premature policy change. Unless the US economy suffers a significant recession due to the effects of the US economy, most people believe that the US Federal Reserve (Fed) will not change its stance for the time being.

In the NY foreign exchange market, there was a scene where the dollar yen hit a six-week high of 133.3 yen.

connection:US CPI continues to slow down Nasdaq continues to rise, dollar soars | 15th Financial Tankan

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin rose 1.73% from the previous day to $22,100.

BTC/USD daily

There were no surprises in the CPI results either above or below, but it can be said that the development lacked a sense of direction. The BTC price was seen to plunge immediately after the CPI announcement, but then rebounded. From the previous day, Ethereum (ETH) rose 3.15% and Polygon (MATIC) rose 5.74%.

The virtual currency market had a series of negative factors before the CPI, and the price range was adjusted mainly in the alt market, so the passage of the event brought a certain sense of relief.

On the 13th, the NY State Department of Financial Services (NYDFS) ordered the issuing company Paxos to suspend the issuance of new BUSD tokens. The U.S. SEC (Securities and Exchange Commission) claims that the industry’s third-largest US dollar-linked stablecoin, Binance USD (BUSD), is an unregistered security.

connection:New York State Department of Financial Services Explains Why It Ordered the Suspension of Issuance of the BUSD Stablecoin

However, in order to prevent market turmoil, we will continue to have appropriate audits and reserve collateral backing stablecoins, and we will be ready to respond to redemptions until at least February 2024.

Major stablecoins such as USDT, USDC, and BUSD have been adopted as “key currency pairs” by major crypto asset (virtual currency) exchanges. BUSD accounted for about 35% of the total trading volume, while USDT accounted for 58%.

To update this morning’s chart, #BUSD Denominates nearly 35% of ALL trade volume on Binance. #USDT denominates 58%. #USDC pairs were de-listed in September, but charted for context.

“Other” includes fiat currencies/BTC/ETH-denominated pairs. pic.twitter.com/vAatarlCLe

—Kaiko (@KaikoData) February 13, 2023

Changpong Zhao (CZ), CEO of Binance, said at a temporary Twitter Spaces AMA on the 14th, “Due to regulatory pressure, the US dollar stablecoin market will shrink. Instead, they may be forced to move to euro-, yen- or Singapore-dollar-backed stablecoins.”

Following the collapse of the algorithmic stablecoin “UST (TerraUSD)” in May last year and the collapse of FTX, a major exchange in November last year, the US Fed took a tougher stance, causing market turmoil. The emergence of centralized country risks such as

Recently, US exchange Kraken was indicted by the SEC for “securities law violations” and was forced to stop providing staking services to US customers and pay a fine of $30 million. Widespread impacts and strong concerns have spread to staking services such as Ethereum and all staking “PoS currencies” such as Ethereum.

connection:How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking

Morgan Stanley strategists have expressed concern that “a decline in stablecoin market capitalization means a decline in cryptocurrency liquidity and leverage.”

According to DefiLlama, daily trading volume on CurveFinance, a decentralized exchange (DEX) focused on stablecoin trading, surged earlier this week to hit $1.07 billion. Demand is believed to have risen sharply following the suspension of new issuance of BUSD.

. @Curve Finance has recorded a trading volume of $1.07 billion over the past 24 hours, marking a new high for the year. Only two other days in its history have seen a higher volume, and they both occurred immediately after the collapse of FTX pic.twitter.com/esHTGaMg5L

—DefiLlama.com (@DefiLlama) February 14, 2023

Click here for a list of market reports published in the past

The post CPI Passes Without Surprise, Bitcoin Recovers to $22,000 Level appeared first on Our Bitcoin News.

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Hyperliquid

Hyperliquid  Toncoin

Toncoin  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Pi Network

Pi Network  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Dai

Dai  Aptos

Aptos  Aave

Aave  OKB

OKB  Ondo

Ondo  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange