[ad_1]

Web3 has a steep learning curve. MetaMask Learn is a free-to-use education platform available in 10 languages to help you get started with basic Web3 topics and concepts.

Dear Bankless nation,

Gas fees pumped yesterday as claimers rushed to get their hands on the highly anticipated airdrop from NFT marketplace Blur.

Now that BLUR is out, what other tricks do they have up their sleeves? What’s it going to take for Blur to outcompete OpenSea? Let’s explore further today.

– Bankless team

Bankless Writer: William Peaster

$BLUR has finally arrived.

This, of course, is the new governance token of NFT marketplace Blur that was airdropped to the platform’s users yesterday.

The anticipation for this airdrop, which was tallied across three gamified phases that rewarded traders, listers, and bidders respectively, has done much to raise Blur’s profile and help it become a bona fide competitor to longtime NFT marketplace titan OpenSea.

However, an airdrop alone does not an OpenSea competitor make. The buzz and momentum that comes with an airdrop is temporary and only goes so far.

Consider NFT marketplaces LooksRare and X2Y2, which both launched incentives with the LOOKS and X2Y2 tokens early last year. As you can see from the price comparison chart directly below, both tokens pumped initially when launch excitement was fresh and have seen big price drops ever since. Both have failed to claw significant market share from OpenSea over time. Of course, their stories are still being told, so to speak, but obviously right now they’re not as exciting or enticing as they once were.

So Blur’s launch of $BLUR is a strategy to achieve decentralized governance coordination, and it’s a tactic to gain market share from OpenSea and other rivals. Again though, the bulk of this latter tactical effect is likely to be temporary and front-loaded to around the time of $BLUR’s launch, at least if other early NFT marketplace tokens are any indication.

The good news for Blur, then? It does have compelling fundamental UX offerings that do make it a legit challenger to OpenSea beyond tokenomics and buzz.

For example, Blur aggregates NFT listings from across all the main NFT marketplaces, including from OpenSea’s Seaport Protocol such that Blur is no longer constricted by OpenSea’s marketplace blocklist. In contrast, presently OpenSea only aggregates listings from projects built atop Seaport, like ENS Vision and Sound.

Additionally, Blur has doubled down on speed since day one to make itself stick out from the competition via real-time listings and instant NFT metadata reveals. According to Blur, its marketplace is in the ballpark of being 10x faster and nearly 20% more gas-efficient than Gem, which is OpenSea’s NFT aggregator for veteran traders.

Expansive choice, impressive speed, and slick UX — these are the pillars that Blur aims to stand its ground upon and gain more market share through. The thing is, though, will these pillars combined with the $BLUR launch be enough to actually edge out OpenSea over time?

That’s the trillion gwei question, and the simple answer right now is no.

To be sure, more will need to be done if Blur is to decisively pull ahead with OpenSea already positioned so dominantly.

Having launched in Dec. 2017, the visionary OpenSea has a head start of years and has become the NFT ecosystem’s juggernaut, enjoying an unparalleled depth of experience and resources accrued over its remarkable ascension.

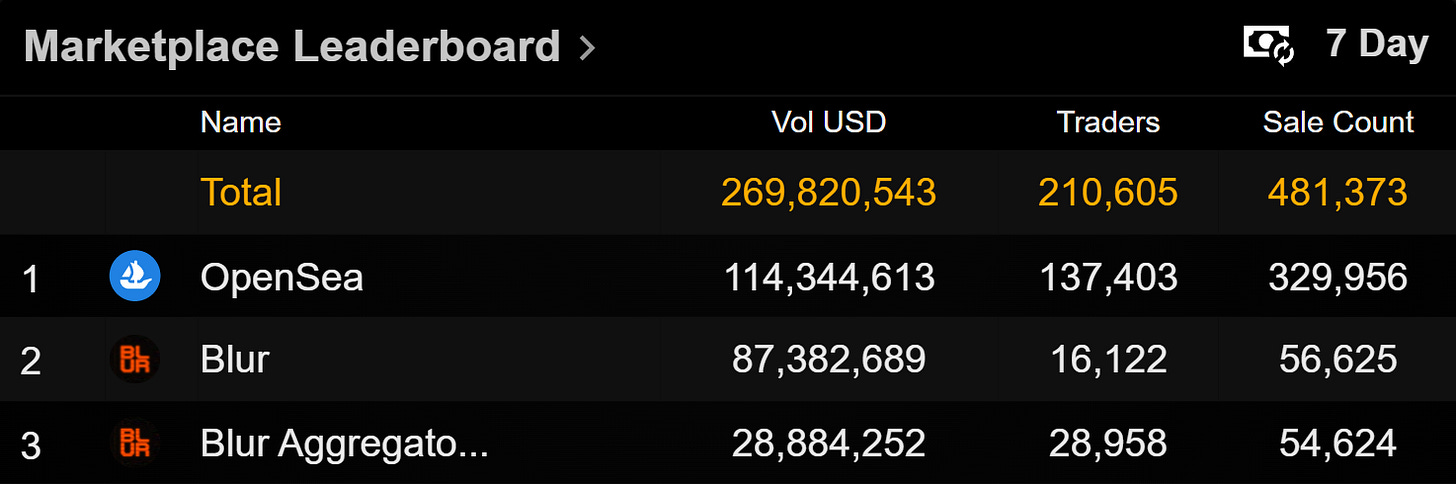

Where OpenSea is paralleled currently is in NFT trading volume levels, as Blur has been neck and neck here with the incumbent giant for weeks now.

This evenness is very impressive considering OpenSea’s aforementioned dominance, but it’s also been largely buoyed by the anticipation and farming of $BLUR, the tactical effect of which we’ve already noted will ultimately be temporary.

If Blur is to actually go on and win the NFT marketplace wars, it will need to continue meaningfully advancing and building upon its UX pillars and the $BLUR launch. This is easier said than done, right, so what should the up-and-comer do?

In my opinion, here are five things Blur needs in order to emerge as the next NFT marketplace champion.

Across is the bridge you deserve: fast speeds, low fees, great support, no hacks, and we love our users. Try it once and you’ll understand why Across users love us back and have bridged $billions with it.

Yield farmers will also find attractive yields for providing bridge liquidity!

Blur’s speed advantage is real, its gas efficiency is significant, its gas-less bidding system is slick. These, of course, are the moats that Blur’s unique selling position springs forth from right now.

Yet these moats will only remain moats as long as they’re unique to Blur. If the rest of the competition catches up on these fronts, which is possible, then Blur’s profile will start to blend into the crowd.

Blur needs to stay faster, stay more efficient, and stay slicker if it’s to win. Again, this is all easier said than done and there aren’t necessarily instant answers here, though regardless: the moats must be defended.

That said, some 65% of Blur’s early users have come from OpenSea and Gem, so if Blur can keep its moats firmed up then these users might just switch over for good. As an admirer of Gem myself, I can say right now I find the UX of Blur and Gem fairly evenly matched — there are some things I like about Blur more, and some things I like about Gem more, and both I really enjoy. Winning over power users in these tight matchups is, indeed, the name of the game.

… flowing, that is.

Blur’s gamified airdrop was an impactful tactic that has until now helped the marketplace pull neck and neck with OpenSea in NFT trading volume levels.

Call that a tactical victory, then, but Blur will need to keep stringing in more tactical victories to succeed, even if the effects are just temporary each time. It looks like Blur has taken this lesson to heart. Since post-airdrop they’ve introduced “Season 2” $BLUR rewards that will double all bidding and listing points on the marketplace for the next month. The seasonal approach makes a lot of sense here.

Blur must keep evolving and innovating if it’s to keep advancing. Stagnation for whatever reason in the face of the reigning champion, OpenSea, would undoubtedly cost Blur its window of opportunity.

As a contributor to Bankless and JPG I’ve seen for myself how talented NFT teams work behind the scenes, so I can safely assume that the Blur team has its own roadmap of new ideas, new integrations, and new rollouts that it’s lining up and working on week-in and week-out.

For example, perhaps Blur may eventually try to outmaneuver OpenSea by focusing optimized pro trading UX across all of the top L2 chains. We’ll see. But ultimately it’s up to the Blur team to prioritize what they think is best, and execute on and innovate around those plans in a skillful fashion.

Make no mistake, Blur is the underdog in this matchup. OpenSea’s abilities, resources, and active users are immense.

If the Blur team lets the odds against them get to their heads, they won’t beat out OpenSea. Sometimes underdogs win, and sometimes it’s the indomitable fighting spirit, the “we will win” hunger, that makes the difference against an entrenched incumbent over time.

Every time I’ve ever won a chess match against a significantly better rated player, it’s because I went into it thinking I was going to fight like hell and with great focus across every square on the board. If the Blur team can maintain a similar hunger, they might just be able to pull off the David vs. Goliath.

Or pray for no $SEA token, rather.

What I’m suggesting is that half of any battle is what the opposing side does. Put another way, Blur can keep its $BLUR rewards flowing and keep rolling out cool features one after the other only to still eventually be bowled over by OpenSea.

Indeed, many people consider it a foregone conclusion that OpenSea will never launch its own token. That may very well be the case. But imagine if they did airdrop $SEA to past users? It’d be a monumental move that’d likely further entrench OpenSea’s dominance for years to come.

Afterall, isn’t one way for OpenSea to defeat Blur is to do the inverse or reflection of the four main points outlined above? To eat into Blur’s UX moats, to launch its own rewards, to advance its own plans and fighting spirit? And even still, OpenSea may not ultimately need a $SEA token to beat out Blur over time.

Accordingly, for the Blur team it might not just be about doing everything right. It might also be, like in chess, about capably executing their plans while also hoping that OpenSea makes misjudgments or outright blunders of its own!

-

Track the Blur vs. OpenSea battle: review the NFT Market Overview dashboard to see how the two marketplaces stack up against each other at any given time

-

Check for the airdrop: if you haven’t already see if you have BLUR to claim

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

[ad_2]

Read More: newsletter.banklesshq.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  USDS

USDS  Avalanche

Avalanche  WhiteBIT Coin

WhiteBIT Coin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pi Network

Pi Network  Pepe

Pepe  Dai

Dai  Aave

Aave  OKB

OKB  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  sUSDS

sUSDS  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic