Disclaimer: The datasets shared in the following article have been compiled from a set of online resources and do not reflect AMBCrypto’s own research on the subject.

At press time, the price of Ethereum (ETH) was at $1,552, down 5% from yesterday and 6% from one week ago. The fall coincided with a market-wide selloff brought on by Kraken’s agreement to stop providing any staking services to US-based clients and its payment of a $30 million settlement to the SEC.

Read Price Prediction for Ethereum [ETH] 2023-24

Despite this setback for the market, Ethereum is still a promising investment due to the altcoin’s daily trading volume of $7,433,845,302 and market cap of $185,903,721,394. There are several grounds to believe that ETH will once again increase in value, including Visa’s recent announcement that it is testing stablecoin payments on the Ethereum network.

Parithosh Jayanthi, a developer for the Ethereum Foundation, declared that the “Zhejiang” public testnet will debut on 1 February. In order for validators to prepare for the anticipated modifications for the Shanghai hard fork, the implementation will permit staked Ether withdrawal in a test environment.

According to Diogo Mónica, co-founder and president of Anchorage Digital, a cryptocurrency bank with a market cap of over $3 billion, the Merge’s success transformed Ethereum from “a smart contract platform lagging behind” into “something that was doing things properly.” This is accurate: After the Merge, institutional interest in ETH staking rose, according to Matt Hougan, CIO at Bitwise Asset Management.

As ETH dominance has increased compared to other cryptocurrencies over the past few years, Ether’s bullish setup vs Bitcoin is apparent. Both Bitcoin and Ethereum have consolidated over the week as the broader crypto market continues to enjoy a bullish spell.

The price of Ethereum has lately undergone a significant correction, yet the whales have been purchasing at every decline. The fifth-largest accumulation day in a year was recorded last week as ETH whale activity reached a new level. As the FTX problem developed over this month of November, Ethereum whales have been building up. According to a Santiment report,

“Ethereum’s large key addresses have been growing in number since the #FTX debacle in early November. Pictured are the key moments where shark & whale addresses have accumulated & dumped. The number of 100 to 100k $ETH addresses is at a 20-month high.”

It almost reached the lows during the FTX collapse-driven meltdown of the cryptocurrency market, but it rapidly bounced back and was able to maintain above those levels as well. This strengthens the argument since Ethereum has typically outperformed Bitcoin.

Given everything, buying Ethereum must be a sound investment in the long term, right? Most experts have positive predictions for ETH. Furthermore, the bulk of long-term Ethereum price projections are upbeat.

Why are projections important?

Since Ethereum has seen phenomenal growth in recent years, it is not surprising that investors are placing significant bets on this cryptocurrency. Ethereum gained traction after the price of Bitcoin dropped in 2020, following a protracted period of stagnation in 2018 and 2019.

Interestingly, much of the altcoin market remained idle even after the halving. One of the few that picked up the momentum quickly is Ethereum. Ethereum had increased by 200% from its 2017 highs by the end of 2021.

Ethereum may experience such a spike thanks to several crucial factors. One of these is an upgrade to the Ethereum network, specifically a move to Ethereum 2.0. Another reason is the Ethereum tokenomics debate. With the switch to Ethereum 2.0, ether tokenomics will become even more deflationary. As a result, there won’t be as many tokens on the market to meet increasing demand. The outcome might increase Ethereum’s rising momentum in the future.

In this article, we’ll take a quick look at the cryptocurrency market’s recent performance, paying particular attention to market cap and volume. The most well-known analysts’ and platforms’ predictions will be summarized at the end, along with a look at the Fear & Greed Index to gauge market sentiment.

Ethereum’s price, volume, and everything in between

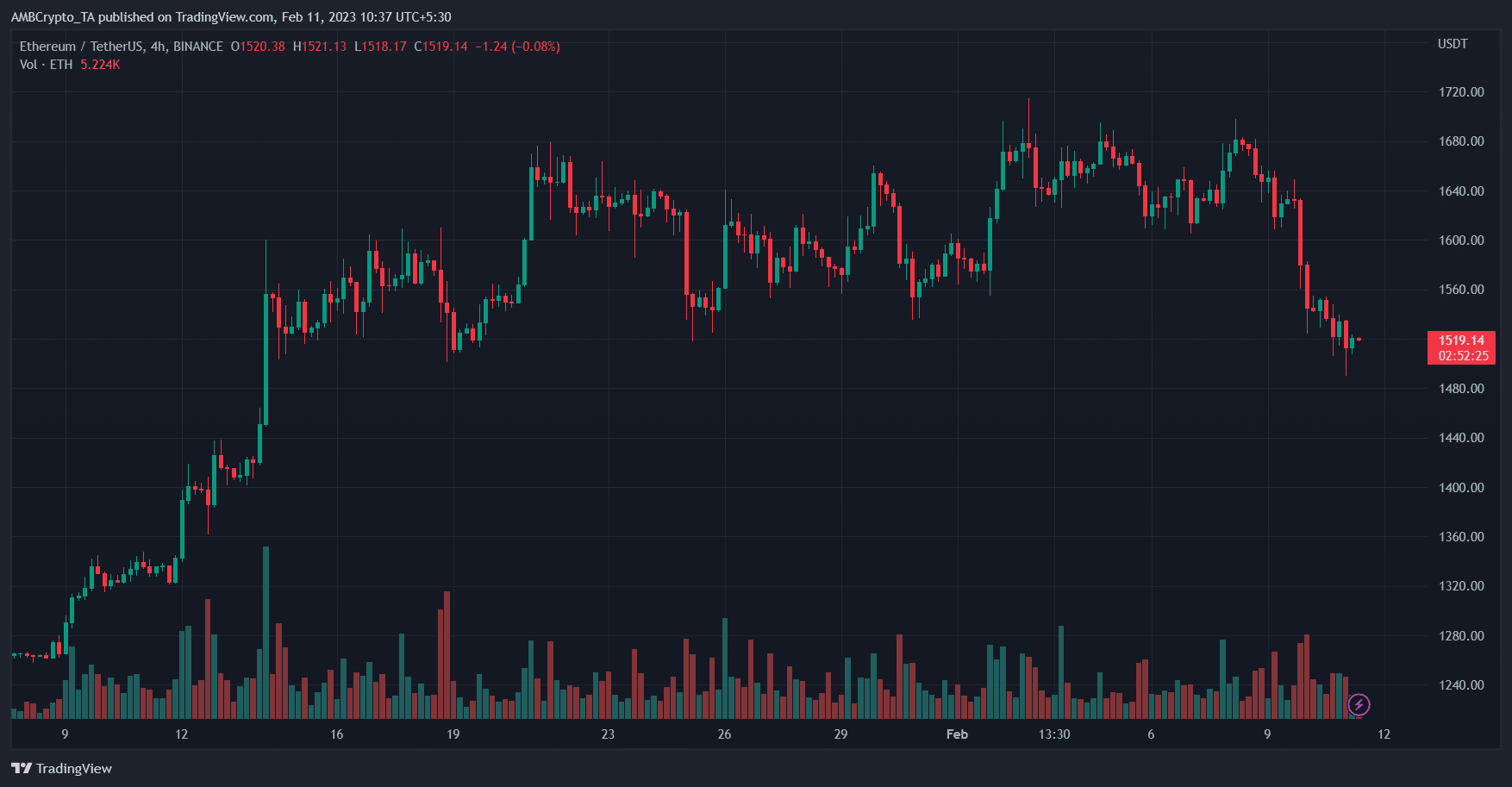

The initial cost of Ethereum in 2022 was $3,722.59. Ethereum, at the time of writing, was trading at $1,519.14.

Ether’s spot market activity has also increased, with the cryptocurrency surpassing Bitcoin as the most traded coin on Coinbase a while back.

Even though it’s difficult to forecast the price of a volatile cryptocurrency, most experts concur that ETH may once again cross the $4,000 barrier in 2022. And, according to a recent forecast by Bloomberg intelligence analyst Mike McGlone, the price of Ethereum will conclude the year between $4,000 and $4,500.

Additionally, according to a report by Kaiko on 1 August, ETH’s market share of trading volume will reach 50% parity with Bitcoin’s for the first time in 2022.

According to Kaiko, ETH outpaced Bitcoin in July as a result of significant inflows into the spot and derivative markets. Most exchanges have seen this surge, which can be an indication of returning investors. Additionally, a rise in average trade size is the exact reverse of what has been seen so far in 2022’s downturn.

On 2 August, Open Interest (OI) of Deribit Ether Options priced at $5.6 billion exceeded the OI of Bitcoin valued at $4.6 billion by 32%. This was the first time in history that ETH surpassed BTC in the Options market.

In fact, a majority of cryptocurrency influencers are bullish on Ethereum and anticipate it to reach incredible highs.

Given the anticipation around the merge, Ethereum has become the talk of the town. The second-largest crypto has beaten the king of crypto to become the most in-demand crypto. A quick division of volume by market capitalization of both cryptos will reveal Ethereum’s relative volume is in fact greater than that of Bitcoin.

While the broader Ethereum community is looking forward to the environment-friendly PoS update, a faction has emerged in favor of a fork that will retain the energy-intensive PoW model.

The faction is mostly made up of miners who risk losing their investment in expensive mining equipment since the update would render their business model useless. Prominent Chinese miner Chandler Guo stated on Twitter last month that an ETHPoW is “coming soon”.

Binance has clarified that in the event of a fork which creates a new token, the ETH ticker will be reserved for the Ethereum PoS chain, adding that “withdrawals for the forked token will be supported”. Stablecoin projects Tether and Circle have both reiterated their exclusive support for the Ethereum PoS chain after the merge.

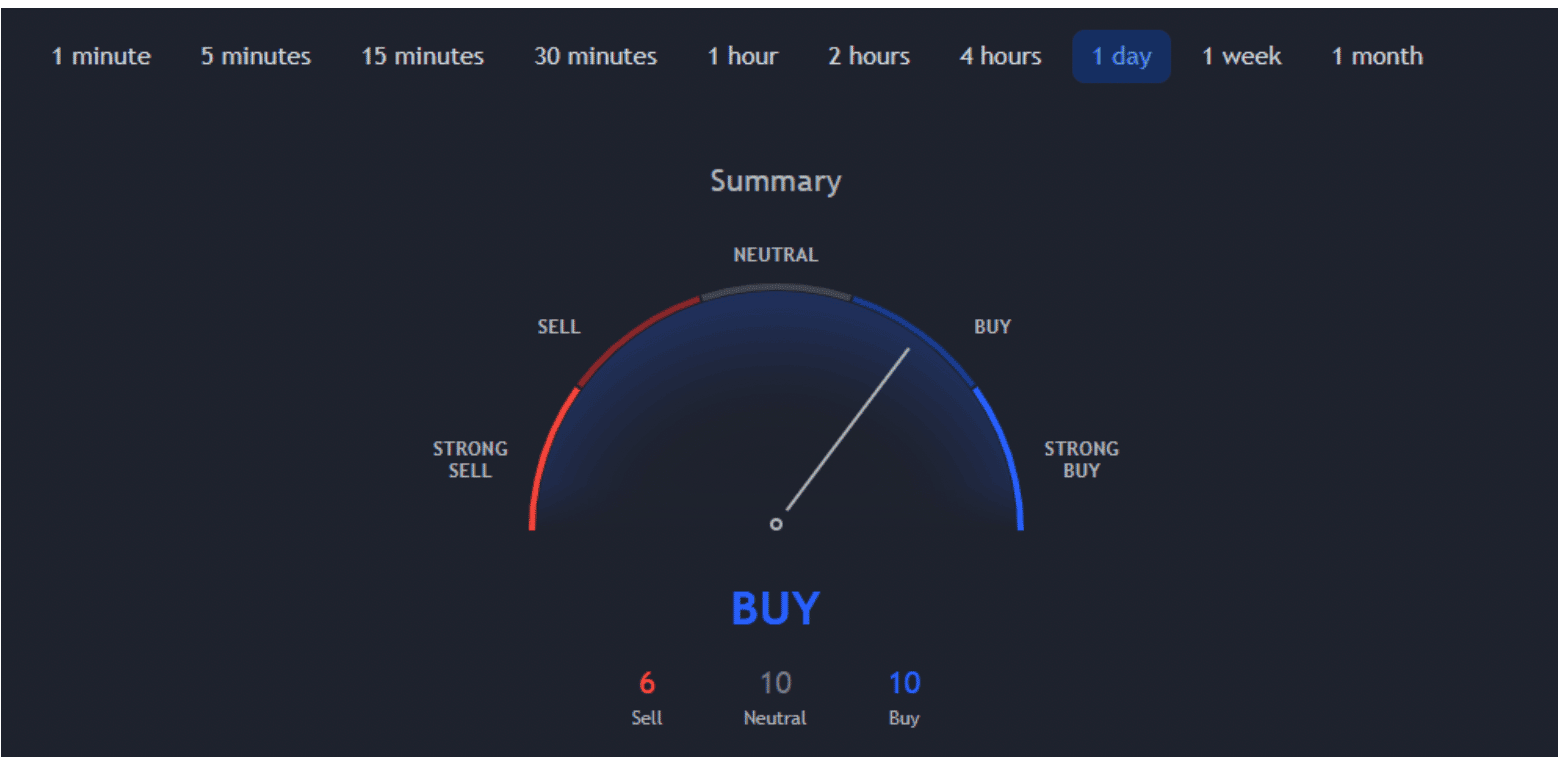

TradingView expressed the same opinion at the time this article was written, and their technical analysis of the Ethereum price indicated that it was a “Buy” signal for ETH.

In fact, PwC’s Crypto-head Henri Arslanian claimed in an edition of First Mover that “Ethereum is the only show in town.” However, investors will need to witness increased demand and functioning for Ether’s price to keep climbing.

According to Mudrex’s Edul Patel,

“The Merge will complete Ethereum’s transition to PoS, making it extremely energy efficient and convenient to make payments. That will only aid Ethereum’s massive use cases, ultimately driving demand higher for the ETH token.”

Kenneth Worthington, analyst at JPMorgan Chase, has expressed his confidence in the Merge’s ability to benefit stakeholders like Coinbase. Worthington believes that Coinbase has positioned itself to capitalize on the Merge by “maximizing the value of Eth staking for its clients”

Prominent venture capitalist Fred Wilson published a blog on 15 August outlining the imminent changes that will follow the Merge. Wilson explained that along with a reduced carbon footprint which will make Ethereum more environment friendly, the Merge will alter the supply and demand balance of ether. This change was demonstrated by Bankless in their blogpost where they projected a structural inflow of $0.3 million per day, in contrast to the current structural outflow of $18 million per day.

According to investor and creator of the cryptocurrency research and media organization Token Metrics Ian Balina, “I think Ethereum can go to $8,000.”

ETH Whale Activity

Data from blockchain analytics firm Santiment shows ETH supply held by the top addresses on crypto exchanges has been on the rise since early June. On the other hand, ETH supply held by the top non-exchange addresses i.e. ETH held in hardware wallets, digital wallets etc. has been declining since early June. But why June? Because it was around that time that a tentative timeline for the Merge was disclosed to the community.

Santiment had tweeted last week that over the past 3 months, whales had beefed up their exchange holdings by 78%

So what does this mean? It means that Ethereum whales are moving their ETH onto exchanges. Top ETH hodlers are taking their supply out of cold storage and moving it to exchanges, most likely to facilitate a quick transaction if needed.

In the run up to the merge, a number of exchanges like Coinbase and Binance announced that they will be suspending all ETH and ERC-20 token deposits and withdrawals, in order to ensure a seamless transition.

It is possible that the whales moved their holdings onto exchanges to either preemptively dump their holdings in anticipation of a price slump after the Merge. The other possibility is them waiting till well after the Merge to act on ETH’s price action.

Let’s now look at what well-known platforms and analysts have to say about where they believe Ethereum will be in 2025 and 2030.

Ethereum Price Prediction 2025

According to Changelly, the least expected price of ETH in 2025 is $7,336.62, while the maximum possible price is $8,984.84. The trading expense will be around $7,606.30.

CoinDCX also predicts ETH could have a relatively successful year in 2025 because there may not be much of an adverse impact on the asset. There is little doubt that the bulls could be well-positioned and retain a significant upturn throughout the year. The asset is anticipated to reach $11,317 by the end of the first half of 2025, notwithstanding possible brief pullbacks.

However, you have to remember that the year is 2025, and a lot of these projections are based on Ethereum 2.0 launching and performing successfully. And by that, it means Ethereum has to solve its high-cost gas fees issues as well. Also, global regulatory and legislative frameworks have not yet consistently backed cryptocurrencies.

However, even though newer and more environmentally friendly technologies have been developed, analysts frequently claim that Ethereum’s “first mover advantage” has positioned it for long-term success, despite new competition. The price predictions seem conceivable because, in addition to its projected update, Ethereum is anticipated to be used more frequently than ever before in the development of DApps.

How many ETHs can you buy for $1?

Ethereum Price Prediction 2030

Changelly also argued that the price of ETH in 2030 has been estimated by cryptocurrency specialists after years of price monitoring. It will be traded for a minimum of $48,357.62 and a maximum of $57,877.63. So, on average, you can anticipate that in 2030, the price of ETH will be roughly $49,740.33.

Long-term Ethereum price estimates can be a useful tool for analyzing the market and learning how key platforms anticipate that future developments like the Ethereum 2.0 upgrade will affect pricing.

Crypto-Rating, for instance, predicts that by 2030, Ethereum’s value will likely exceed $100,000.

Both Pantera Capital CEO Dan Morehead and deVEre Group founder Nigel Green also predict that during the next ten years, the price of ETH will hit $100,000.

Sounds like too much? Well, the functional capabilities of the network, such as interoperability, security, and transaction speed, will radically change as a result of Ethereum 2.0. Should these and other related reforms be successfully implemented, opinion on ETH will change from being slightly favorable to strongly bullish. This will provide Ethereum the chance to entirely rewrite the rules of the cryptocurrency game.

Conclusion

The platform’s increasing involvement by Visa could help it maintain its hegemonic status within the Bitcoin industry. In fact, some analysts, most notably Bloomberg’s Mike McGlone, predict that ETH will exceed Bitcoin this year.

While some of these investors have invested in rival tokens in order to profit, others are doing it out of precaution in order to hedge their portfolios. This has been corroborated by the volatility witnessed in metrics like daily active users and price action of so-called Ethereum killers like Avalanche, Solana, Cardano etc. in the run up to the merge event which is less than a month away.

The majority of investors anticipated that Ethereum would bottom out at $3500 early this year, but the currency moved lower to show them incorrect. In fact, ETH briefly fell below the terrifying $1000 threshold.

However, the coin has always rebounded when it appeared that it was poised to strike the target once more, restoring confidence in its future. This includes the incident in November 2022 when an FTX hacker allegedly dumped over 30,000 ETH. Hope is offered by the token’s persistence in the wake of the FTX bankruptcy and the protracted crypto cold.

Only yesterday, the Federal Reserve released the minutes of the Federal Open Market Committee (FOMC) meeting. It suggested that the central bank may make smaller interest rate increases going forward. Following this news, ETH’s price ticked up and reached $1,181.51 today.

Ethereum may begin a new slump if it is unable to rise over the $1,300 resistance. Near $1,225 is the first point of support on the downside.

There is broad hope that the first smart contract blockchain will survive this period of trials, despite Ethereum’s rivalries and other factors contributing to its continuous instability.

As far as the Merge is concerned, it is being hailed as a major success story by the Ethereum community. Buterin cited a research study by an Ethereum researcher, Justin Drake, that suggests that the “merge will reduce worldwide electricity consumption by 0.2%.”

“The merge will reduce worldwide electricity consumption by 0.2%” – @drakefjustin

— vitalik.eth (@VitalikButerin) September 15, 2022

It also reduces the time to mine one block of ETH from 13 seconds to 12 seconds. The Merge marks 55% completion of Ethereum’s journey toward greater scalability and sustainability.

The likelihood that Ether will experience a price surge of 50% in the future is increased by its superior interim fundamentals to those of Bitcoin. To begin with, Ether’s annual supply rate plummeted in October, in part because of a fee-burning mechanism known as EIP-1559 that takes a certain amount of ETH out of perpetual circulation anytime an on-chain transaction takes place.

Concerns about censorship on the Ethereum ecosystem have also emerged post the Merge. Around half of the Ethereum blocks are Office of Foreign Assets Control (OFAC)-compliant as MEV-Boost got implemented. As Ethereum has upgraded to a PoS consensus, MEV-Boost has been enabled to a more representative distribution of block proposers, rather than a small group of miners under PoW. This development raises a concern about censorship under the force of OFAC.

It is interesting to note that while many eagerly waited for Ethereum’s Merge and beefed up their holdings in anticipation of a price surge, there was a group of investors who weren’t confident in the Merge’s successful rollout. These investors were betting on a glitch in the rollout process, hoping that the update runs into trouble. While some of these investors have started investing in rival tokens in order to profit, others are doing it out of precaution in order to hedge their portfolios. This was corroborated by the volatility witnessed in metrics like daily active users and price action of so-called Ethereum killers like Avalanche, Solana, Cardano etc. in the run up to the Merge.

The majority of Ethereum price forecasts indicate that ETH can anticipate tremendous growth over the ensuing years.

As per Santiment, Ethereum’s active addresses have sunk to 4-month lows with weak hands continuing to drop post-Merge, and disinterest at a high as prices have stagnated. 17 October was the first day that there were less than 400,000 addresses on the network since 26 June.

😲 #Ethereum‘s active addresses have sunk to 4-month lows with weak hands continuing to drop post-#merge, and disinterest at a high as prices have stagnated. Monday was the first day that there were less than 400k addresses on the network since June 26th. https://t.co/FKXHhg6Z5g pic.twitter.com/1Ekj3bpT0A

— Santiment (@santimentfeed) October 20, 2022

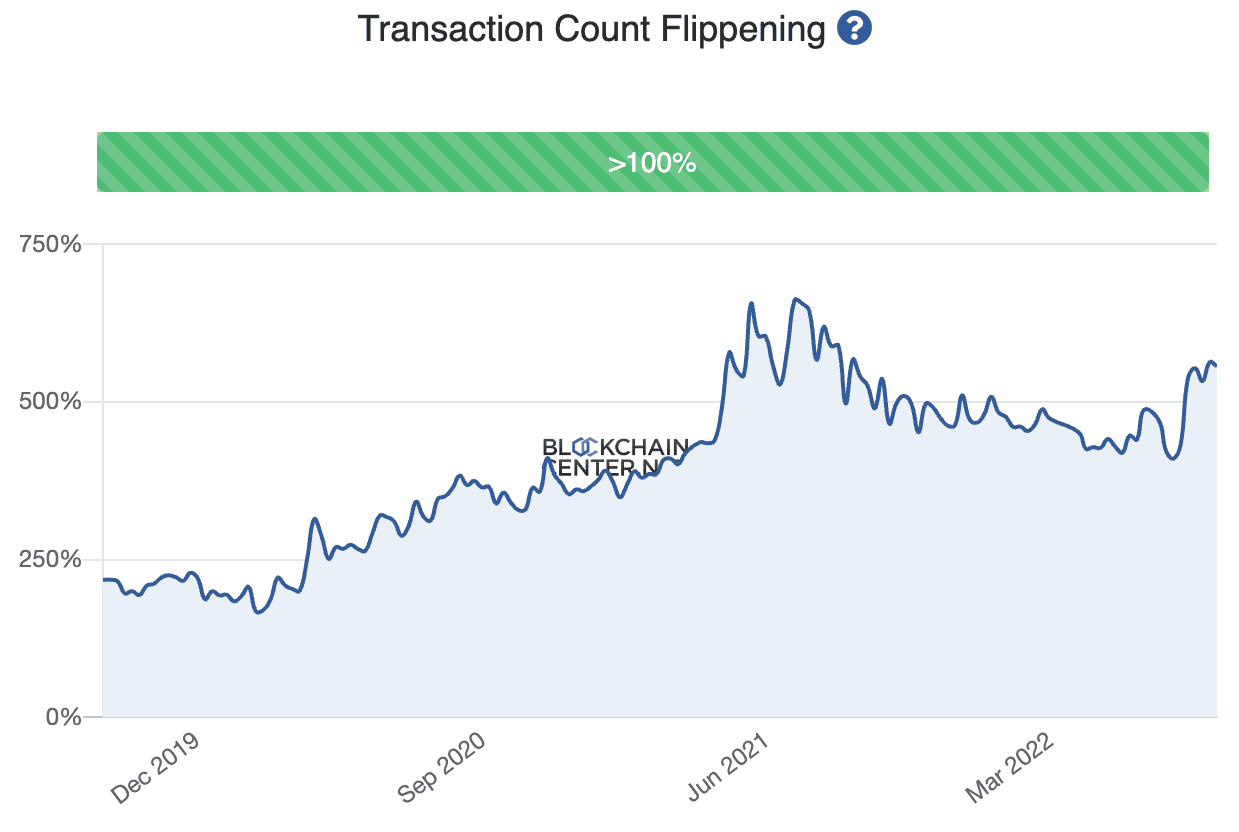

What about the flippening then? Is it possible that the altcoin might pass Bitcoin on the charts in the future? Well, that is possible. In fact, according to BlockchainCenter, ETH has already surpassed BTC on a few key metrics.

Consider Transaction Counts and Total Transaction Fees, for instance. On both counts, ETH is ahead of BTC.

Source: BlockchainCenter

On the contrary, the traditional definition of a ‘flippening’ relates to the market cap of cryptos flipping.

However, remember that a lot can change over these years, especially in a highly volatile market like cryptocurrency. Leading analysts’ projections may vary, but even the most conservative ones might cause respectable profits for anyone choosing to invest in Ethereum. As far as the F&G Index is concerned, ETH shows ‘neutral’ market sentiment for the moment.

The bankruptcy of the FTX exchange increased the likelihood of harsher regulation and has disappointed cryptocurrency investors, so the odds are currently stacked against holders of Ether.

One of the greatest stories of the year in the cryptocurrency markets was Ethereum’s historic switch to a proof-of-stake network last year, dubbed “the Merge.”

Now, all eyes are on Ethereum’s upcoming “Shanghai hard fork,” which would enable users of the network to access ether (ETH) they had staked on the blockchain but have been unable to access for months. This huge update is anticipated to occur in March.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Arbitrum

Arbitrum  Filecoin

Filecoin  Algorand

Algorand  Bonk

Bonk  Celestia

Celestia  Stacks

Stacks  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub