Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

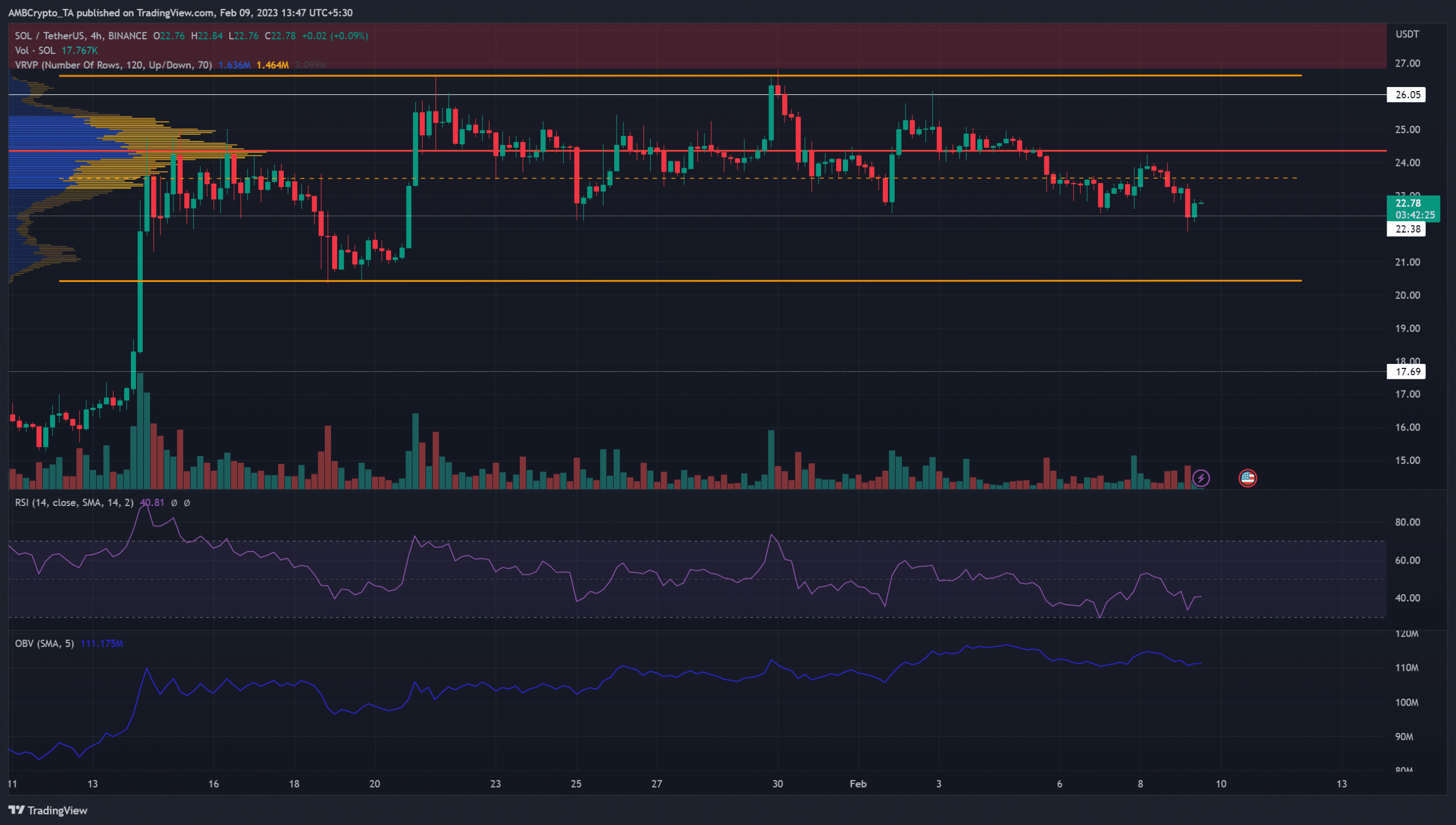

- Solana faced a sharp rejection at the range highs.

- A fall beneath $23.5 signified that another fall of 12% could follow.

Solana [SOL] performed extremely well in January when it recovered from $8 to reach $24 within weeks. In February, this bullish momentum stalled beneath a higher timeframe area of resistance at $27.

Is your portfolio green? Check the Solana Profit Calculator

SOL could not break out past $26 in the past two weeks. Bitcoin [BTC] also slid beneath the $23k level but found some buyers at the $22.4k mark. If BTC falls beneath $22.3k, it could drag many altcoins to lower prices.

A high-volume node and the mid-range present resistance to SOL

The Visible Range Volume Profile showed that the Point of Control (red) lay at $24.3. The price was trading beneath this point, which meant that SOL bulls could face significant resistance at this point in the coming days.

The mid-point of Solana’s range from mid-January also lay at $23.53, close to the high-volume node. Therefore, the inference was that the entire zone from $23.5-$24.3 presented stern resistance to the buyers.

A good risk-to-reward trade would be to buy SOL on a bullish reaction at the range lows at $20.47. A bullish engulfing pattern, or a bullish market structure break on the four-hour chart, could tip buyers of a shift in momentum.

How much are 1,10,100 SOL worth today?

Open Interest supported the idea of bearish sentiment

Source: Coinalyze

On 2 February, Solana retested the $26 level as resistance and saw a sharp rejection. The one-hour OI chart on 1 February showed a gradual move upward on the OI. This was followed by a sharp downward turn on 2 February.

In the past few days, one-hour trading sessions saw many more long positions (red) liquidated than short positions. Earlier on the day of writing, close to $1 million worth of long SOL positions were liquidated as the price fell below the $23 mark. Combined with the falling OI, the inference was discouraged longs and rising bearish sentiment.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  LEO Token

LEO Token  USDS

USDS  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  Monero

Monero  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Pi Network

Pi Network  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Dai

Dai  OKB

OKB  Ondo

Ondo  Aave

Aave  sUSDS

sUSDS  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Official Trump

Official Trump