Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH’s weak fundamentals could delay immediate price reversal.

- Short-term Ethereum holders’ profits could be cut to size.

Ethereum [ETH] dropped below its $1,600 mark after Bitcoin [BTC] lost the $23k zone. BTC sharply declined on 24 January, moving below $22.5k and pulling down ETH to $1,518.

At press time, ETH struggled to break above $1,560 as BTC hovered below the $22,800 level. Therefore, BTC’s loss of traction and velocity could force ETH into a short-term range before bulls attempted to target the green zone.

Read Ethereum’s [ETH] Price Prediction 2023-24

ETH is stuck in the $1,540 – $1,560 range: Is a break above likely?

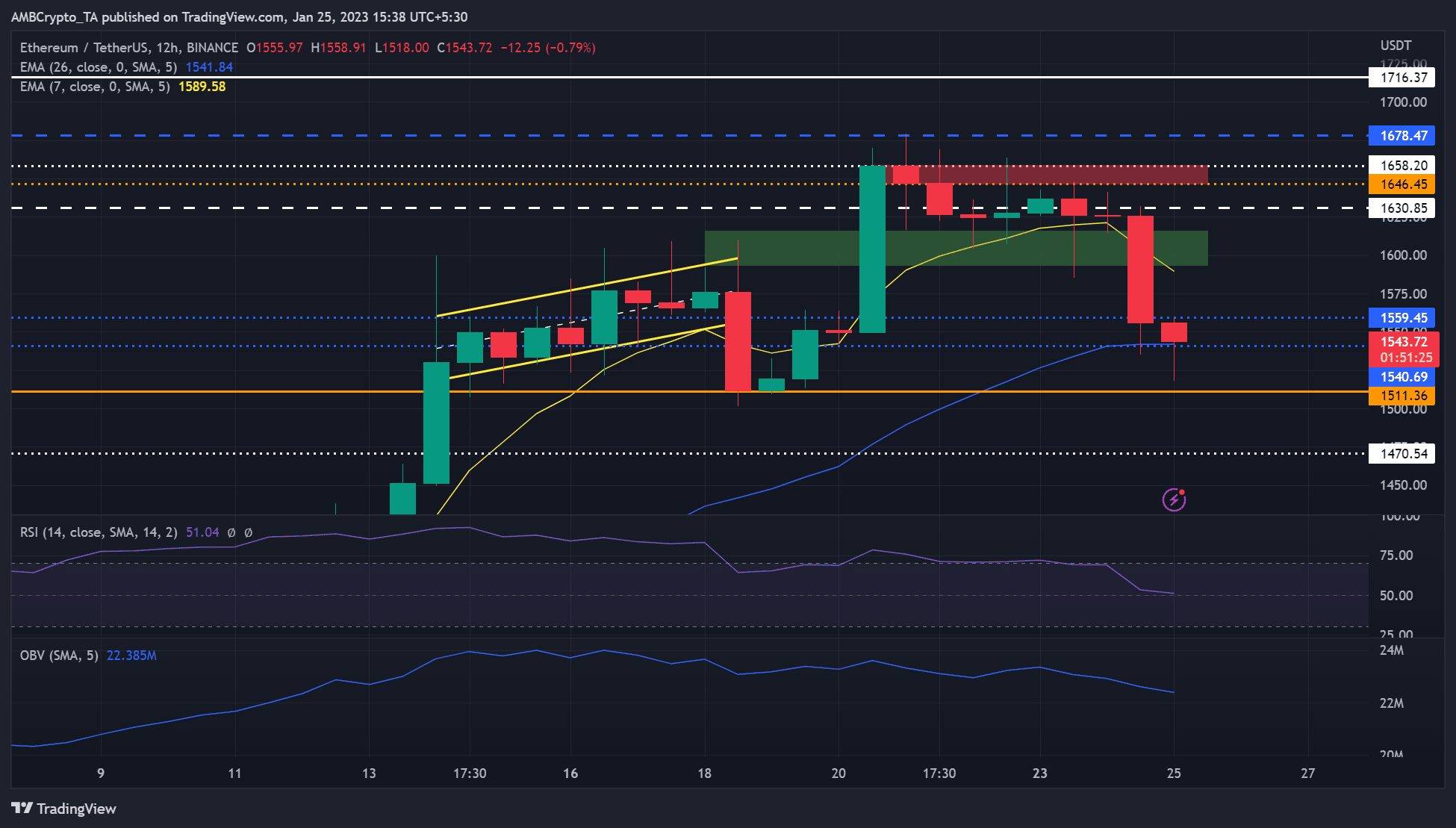

ETH fronted an extra rally around 14 January, despite signs of slowing momentum. The price action carved a rising channel (yellow) in the same period.

The altcoin broke below the channel but found steady support at $1,511. The ensuing recovery faced rejection at $1,678, followed by a slight consolidation before a major drop on Tuesday to the $1,500 region.

On the 12-hour chart, ETH’s Relative Strength Index (RSI) declined and was 52, showing a mild bullish momentum that was close to a neutral market structure. Similarly, the On-Balance Volume (OBV) declined, undermining a strong uptrend momentum for the King of the altcoin market.

Therefore, ETH could fluctuate in the $1,540 – $1,560 range in the short term before attempting a retest of the $1,600 zone in the next couple of days/weeks. In addition, a move to the $1,700 zone could be possible if BTC moves beyond $23K, especially if next week’s FOMC announcement triggers the markets positively.

However, a drop below $1,511 would invalidate the above bias. Such a plunge could see ETH settle at $1,471.

ETH saw a short-term accumulation, while gains declined by over 10%

Is your portfolio green? Check out the ETH Profit Calculator

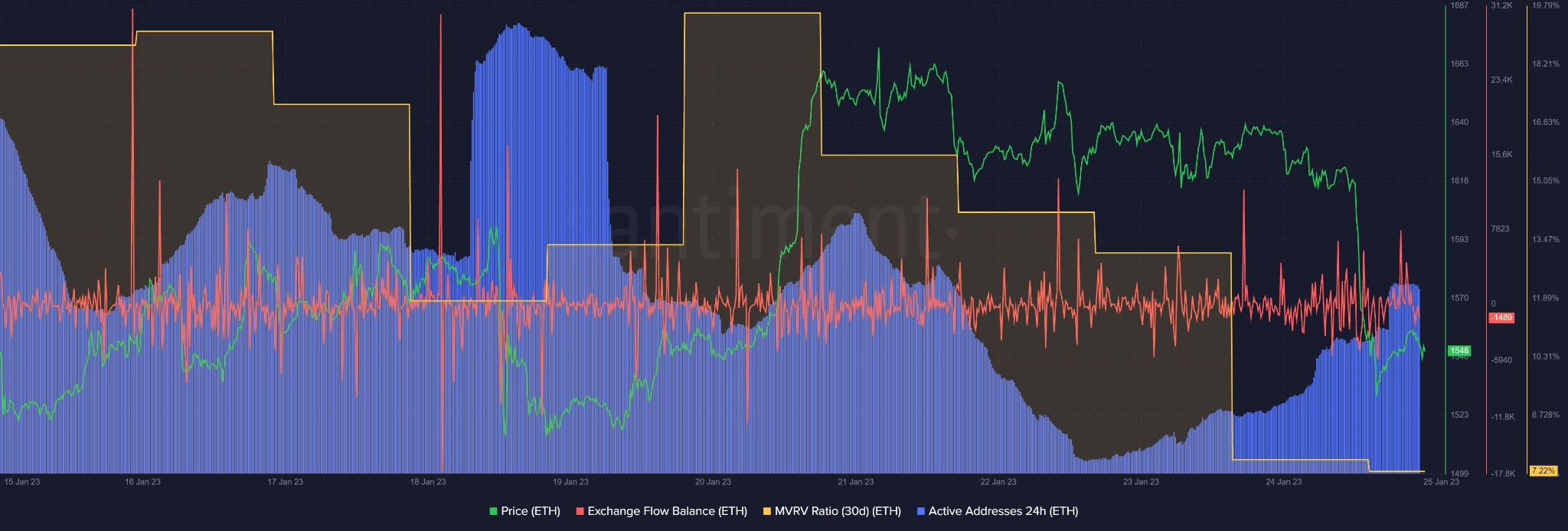

According to Santiment, ETH’s Exchange Flow Balance was negative at press time. It shows more ETH flowed out than into the exchanges, indicating that a short-term accumulation occurred at the time of publication.

However, the stagnant active addresses in the past 24 hours show that trading volume remained unchanged, undermining a strong price reversal. Therefore, short-term accumulation and stagnant trading volume could force ETH into a price consolidation within the $1,540 – $1,560 range in the next few hours.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Litecoin

Litecoin  Hedera

Hedera  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Render

Render  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Dai

Dai  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Immutable

Immutable  WhiteBIT Coin

WhiteBIT Coin  Celestia

Celestia